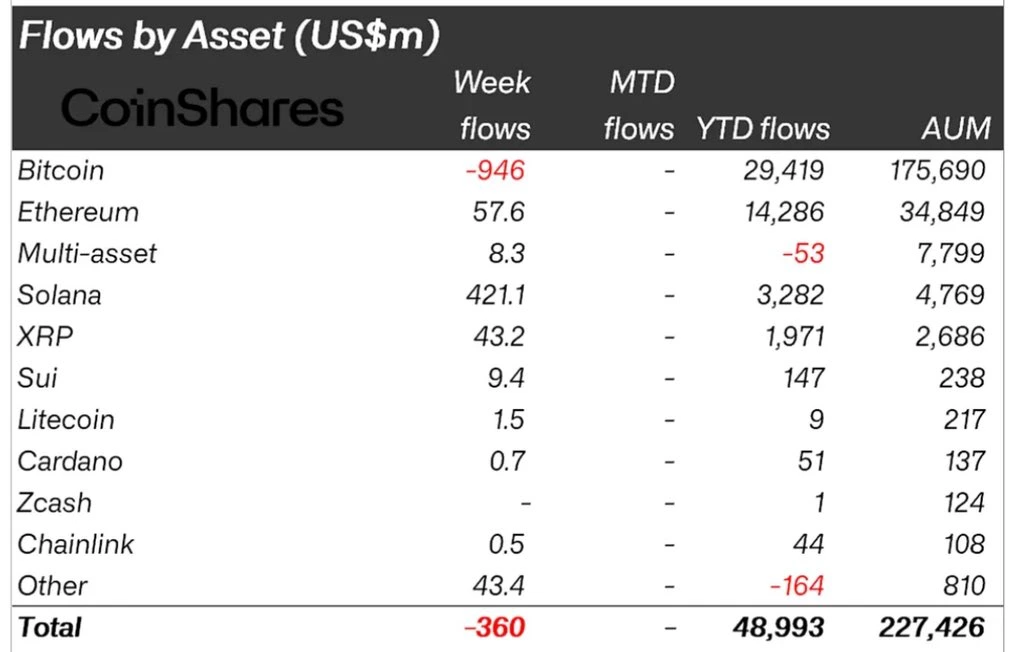

Solana (SOL) whales have been piling up aggressively over the previous week, amid medium-term bearish sentiment. In response to a weekly report from CoinShares, Solana led the remainder of the crypto asset funding merchandise, with internet money inflows of roughly $421 million.

As such, money inflows from Solana’s funding merchandise this 12 months are roughly $3.2 billion, bringing whole belongings beneath administration to roughly $4.76 billion. Remarkably, Solana surpassed Ethereum (ETH) and XRP, which recorded internet money inflows of roughly $57.6 million and $43.2 million, respectively.

Supply: Coin shares

It’s value noting that Bitcoin’s funding product recorded a internet money outflow of roughly $946 million final week, placing stress on bullish sentiment.

Why Are Traders Shopping for Solana Amid Bearish Sentiment?

Spot SOL ETF Hype Will increase market demand throughout the anticipated 2025 season

Natural demand for Solana is closely influenced by the spot SOL ETF hype in america. The current itemizing of the Bitwise Solana Staking ETF has elevated the chance of extra related merchandise coming to market amid the continued US authorities shutdown.

Capital rotation from Bitcoin to SOL will happen nearly seamlessly by means of the ETF market, particularly throughout the anticipated 2025 alternate season. Moreover, the 2025 alternate season is predicted to be triggered by the beginning of the Fed’s quantitative easing in December.

Ecosystem progress and community resilience

The Solana ecosystem has grown in parallel with the mainstream adoption of digital belongings. In response to market knowledge evaluation of DeFiLlamaSolana’s whole worth has grown to over $10 billion, with a Stablecoin market cap of roughly $14.5 billion.

The Solana ecosystem has grown considerably in current instances, fueled by the resilience of the community. Over the previous twelve months, the Solana community has not skilled any outages regardless of mainstream adoption.

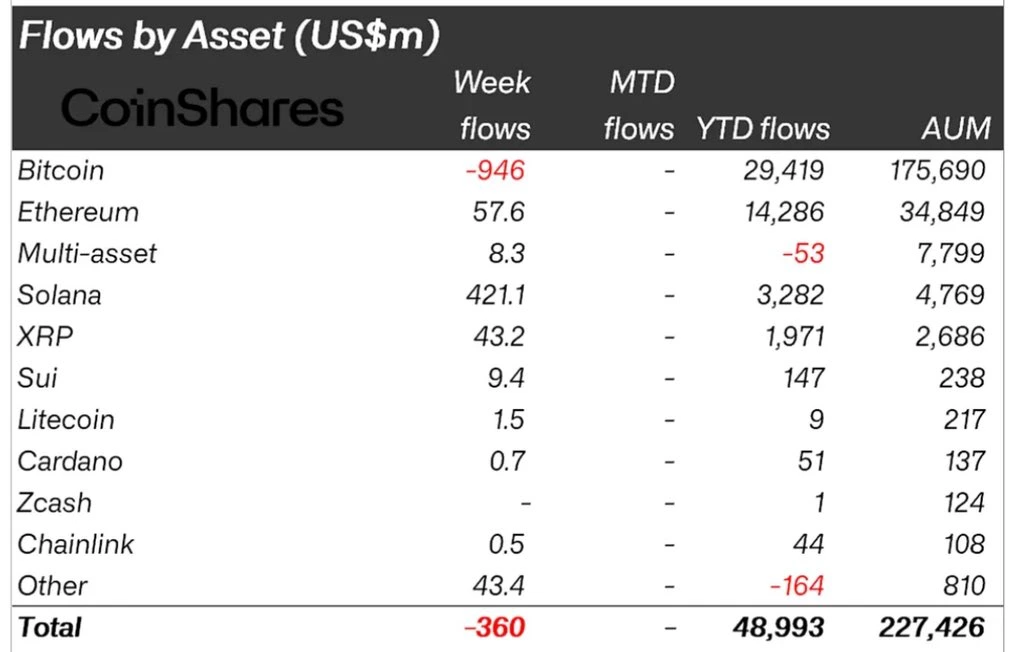

What’s subsequent for the SOL Prize?

From a technical evaluation perspective, the SOL/USD pair is approaching the highest of a multi-year ascending triangle sample.

Supply: X

A constant shut above the earlier all-time excessive will trigger additional upward motion for the SOL worth within the following months.