Altcoin

Solana: What are the two main factors causing the price of SOL to rise?

Credit : ambcrypto.com

- Solana has continued to rise and create new help ranges.

- DEX quantity continues to see report spikes.

Solanas [SOL] blockchain is buzzing with exercise, recording a pointy improve in decentralized alternate (DEX) volumes and token burns.

This has meant a surge in person exercise and community engagement, which has caught the eye of the crypto neighborhood.

As the value of SOL continues to rise, questions come up about whether or not this momentum will be sustained or if a pullback is within the offing.

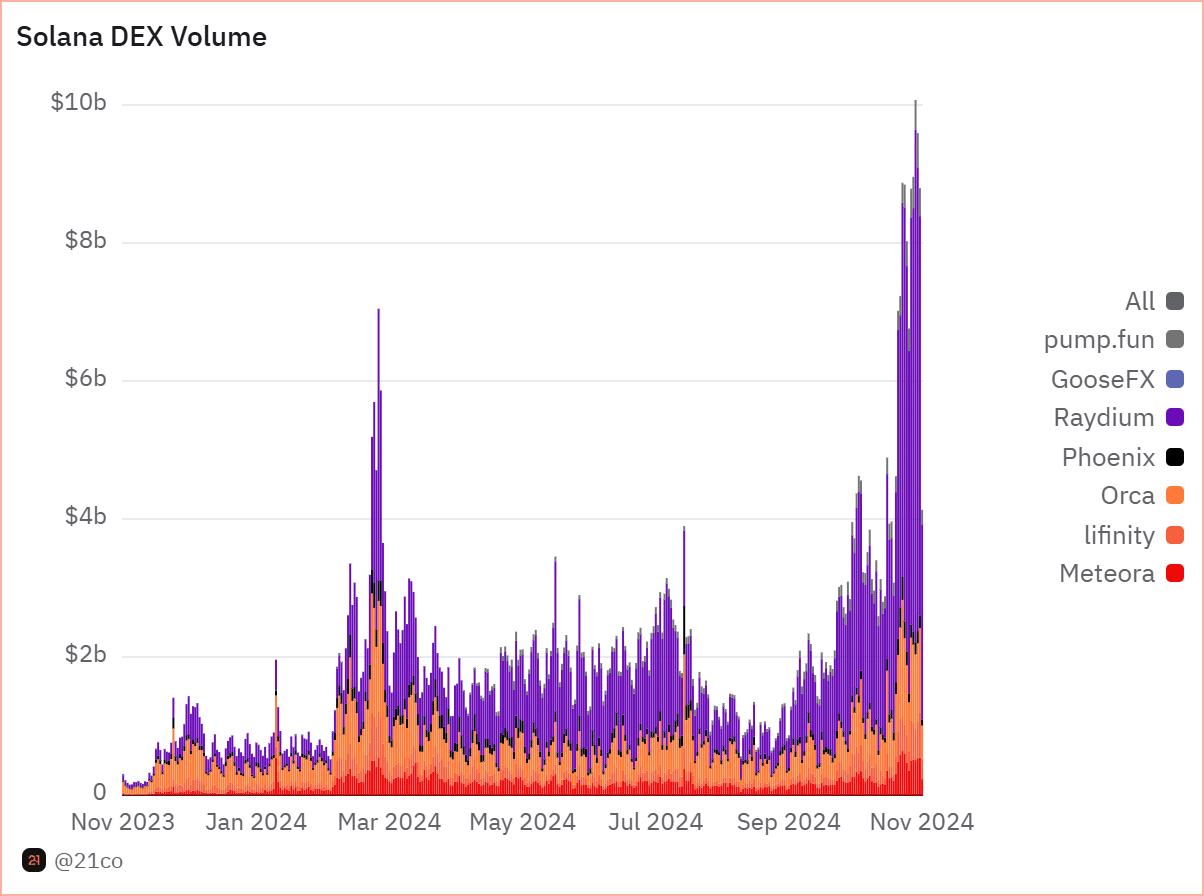

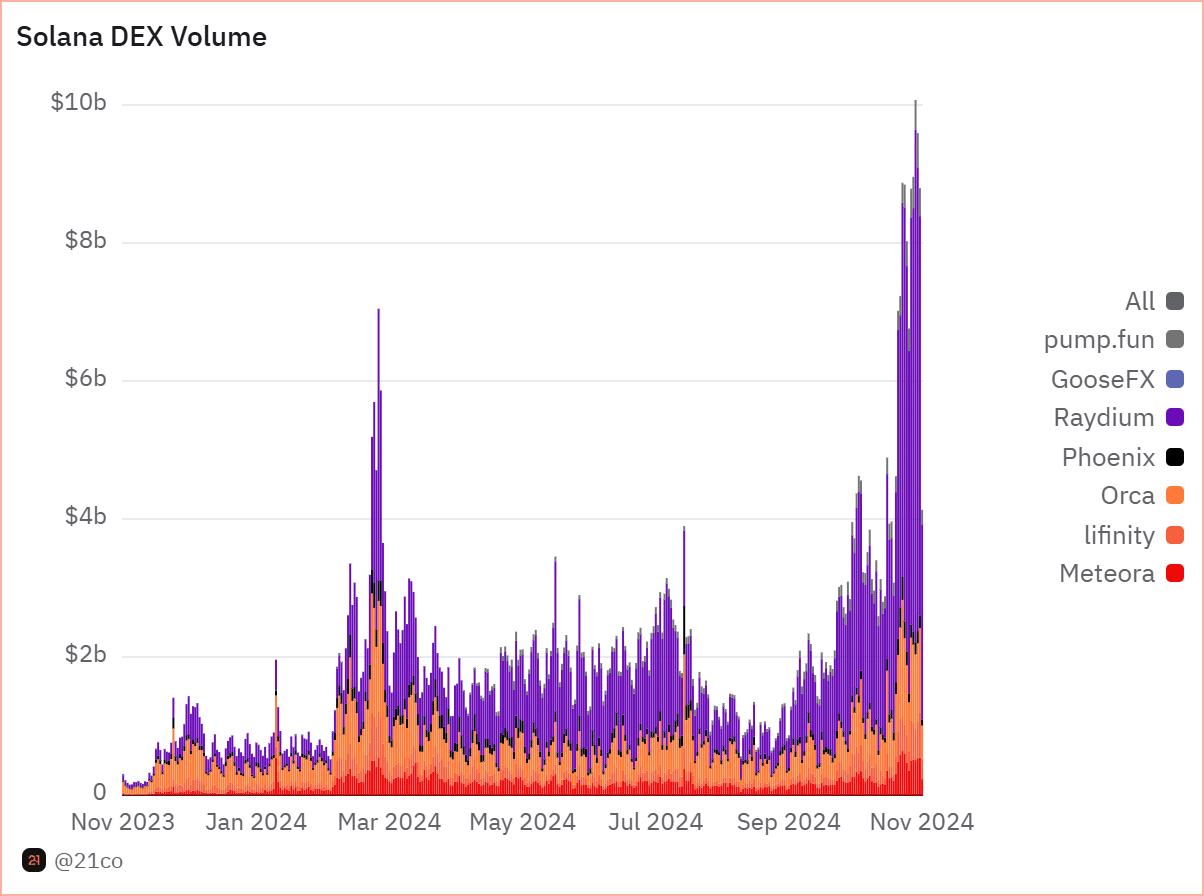

Solana DEX quantity will increase

In latest weeks, Solana’s DEX volumes have skyrocketed, with platforms like Raydium [RAY] and Phoenix leads the cost.

TComplete quantity not too long ago exceeded $10 billion per knowledge Dune analysismarking one of many community’s busiest intervals in latest historical past.

This uptick mirrored a marked improve in demand for Solana-based decentralized finance (DeFi) functions.

Supply: DuneAnalytics

The surge in exercise underscored the rising liquidity and participation inside Solana’s ecosystem.

These elements are important for long-term community progress and underline the community’s standing as a formidable competitor to Ethereum [ETH] and different Layer-1 blockchains.

With liquidity flowing into Solana’s DEXes, the implications for SOL’s demand – and, by extension, its value – are vital.

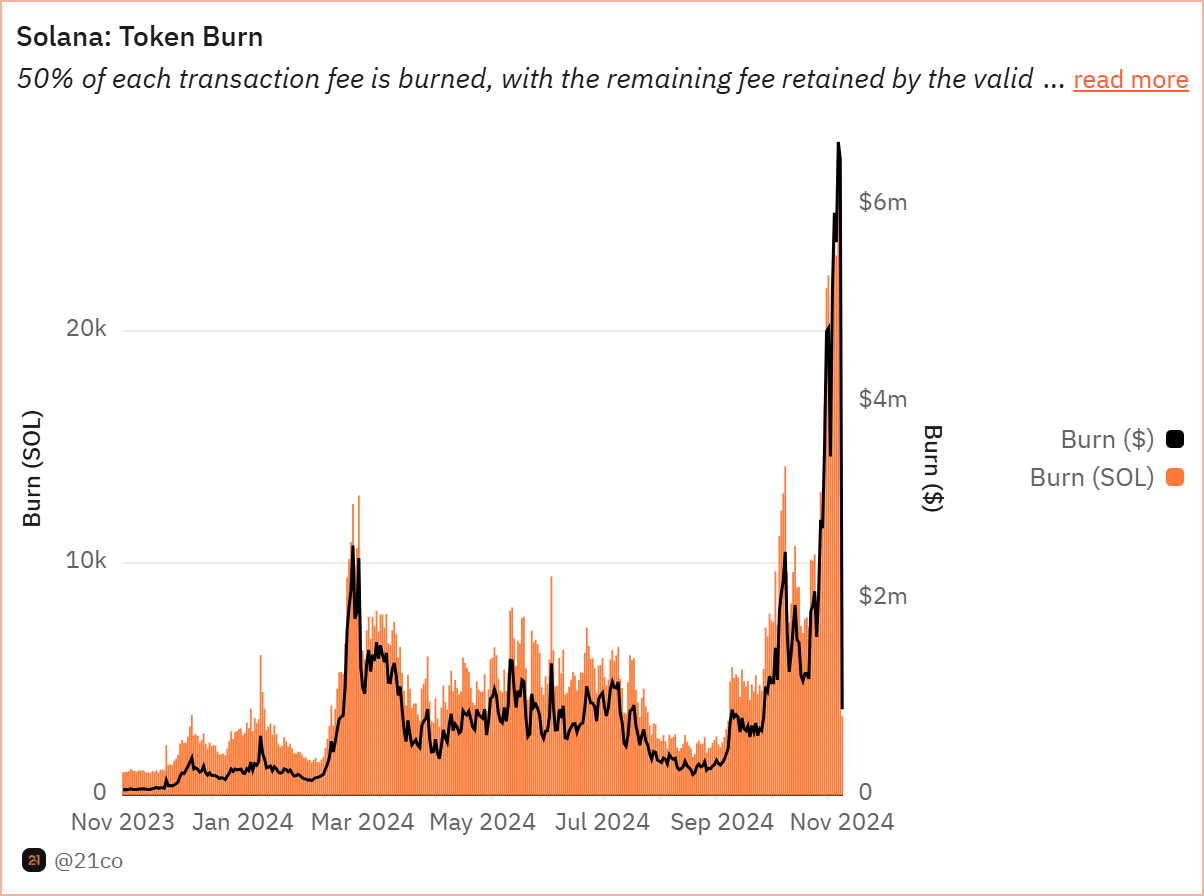

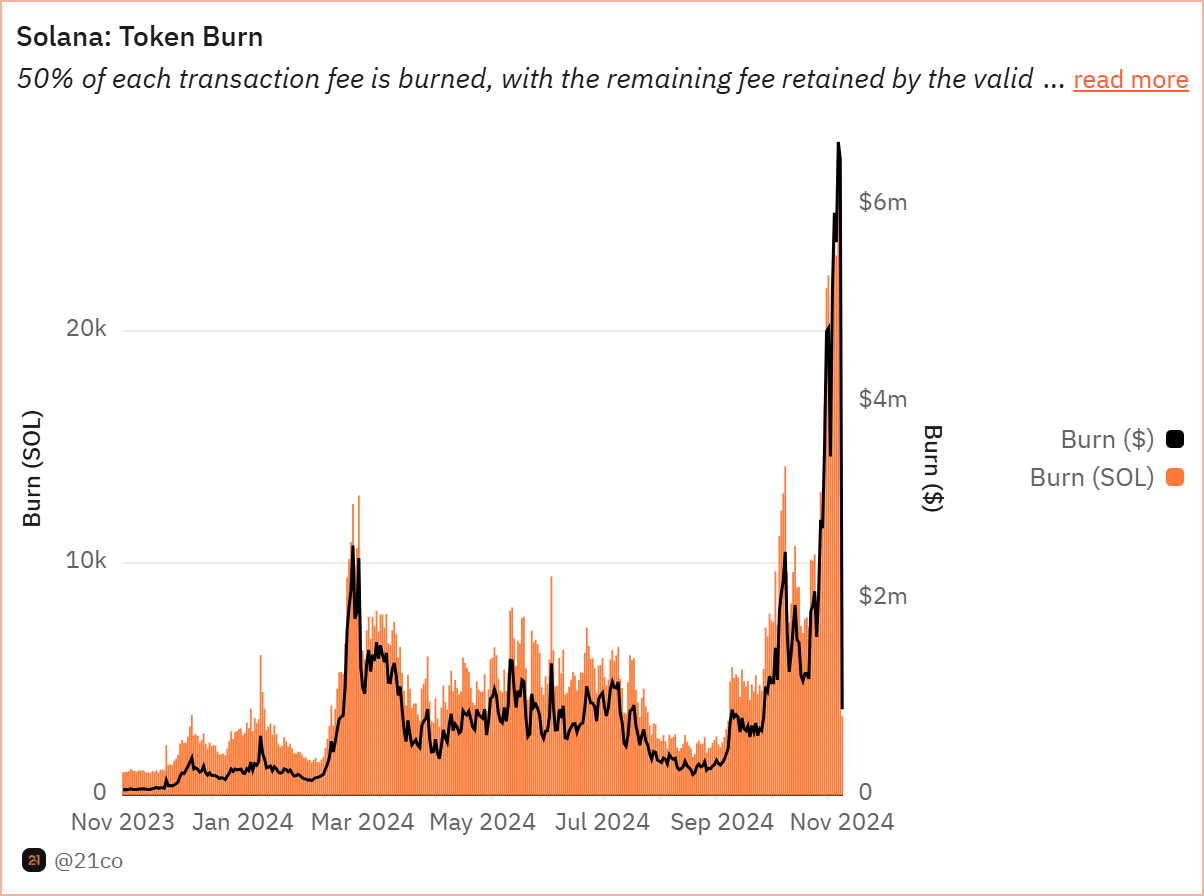

Token Burns: Strengthen Solana

Along with DEX volumes, Solana’s token burn mechanism performs a vital function within the community’s financial mannequin.

With 50% of transaction charges being burned, SOL’s provide continues to shrink, creating shortage out there.

Latest knowledge exhibits that Solana has burned greater than $6 million in transaction charges, a record-breaking milestone that demonstrates the community’s vibrant exercise.

Supply: DuneAnalytics

This combustion mechanism not solely limits provide but in addition will increase the perceived worth of SOL. As exercise will increase, so do the variety of burns, reinforcing a deflationary development that advantages long-term holders.

This decreased provide momentum creates a robust tailwind for a token that’s already gaining momentum.

Can SOL break by means of the resistance?

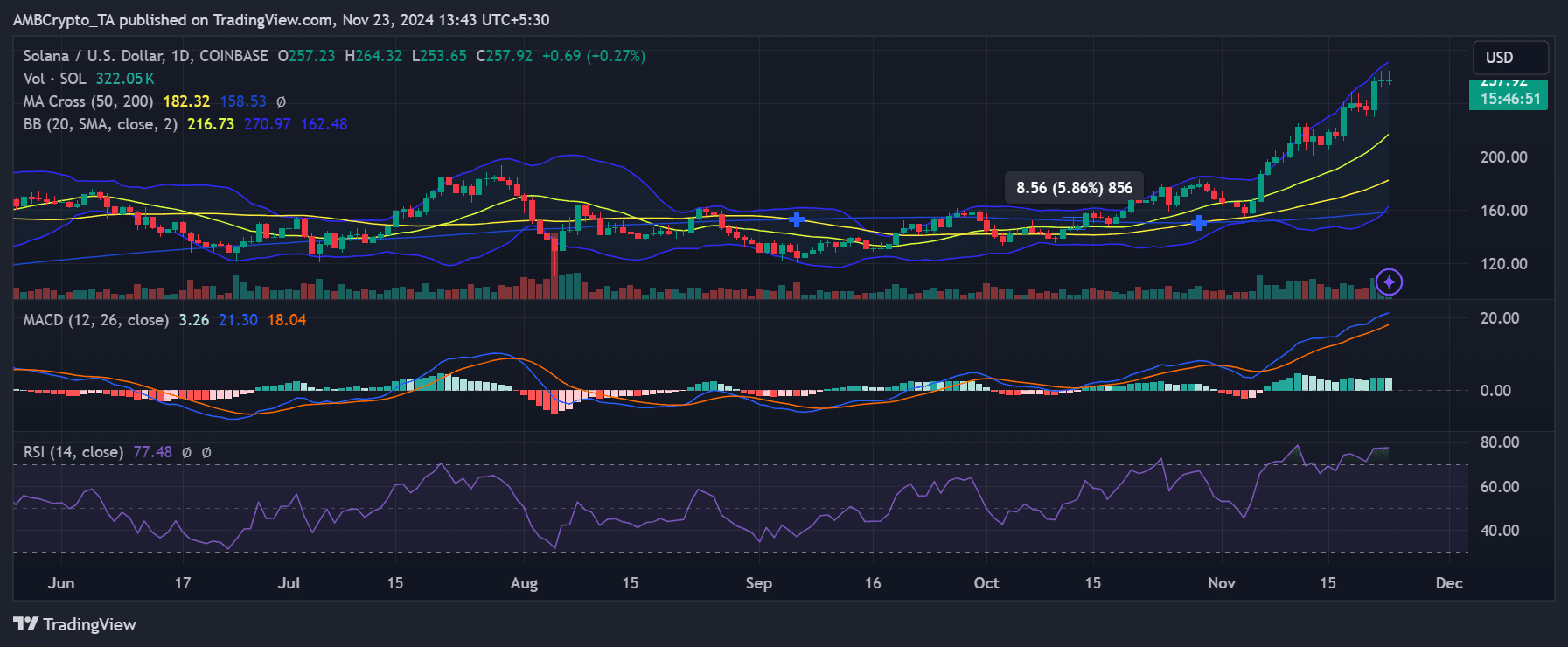

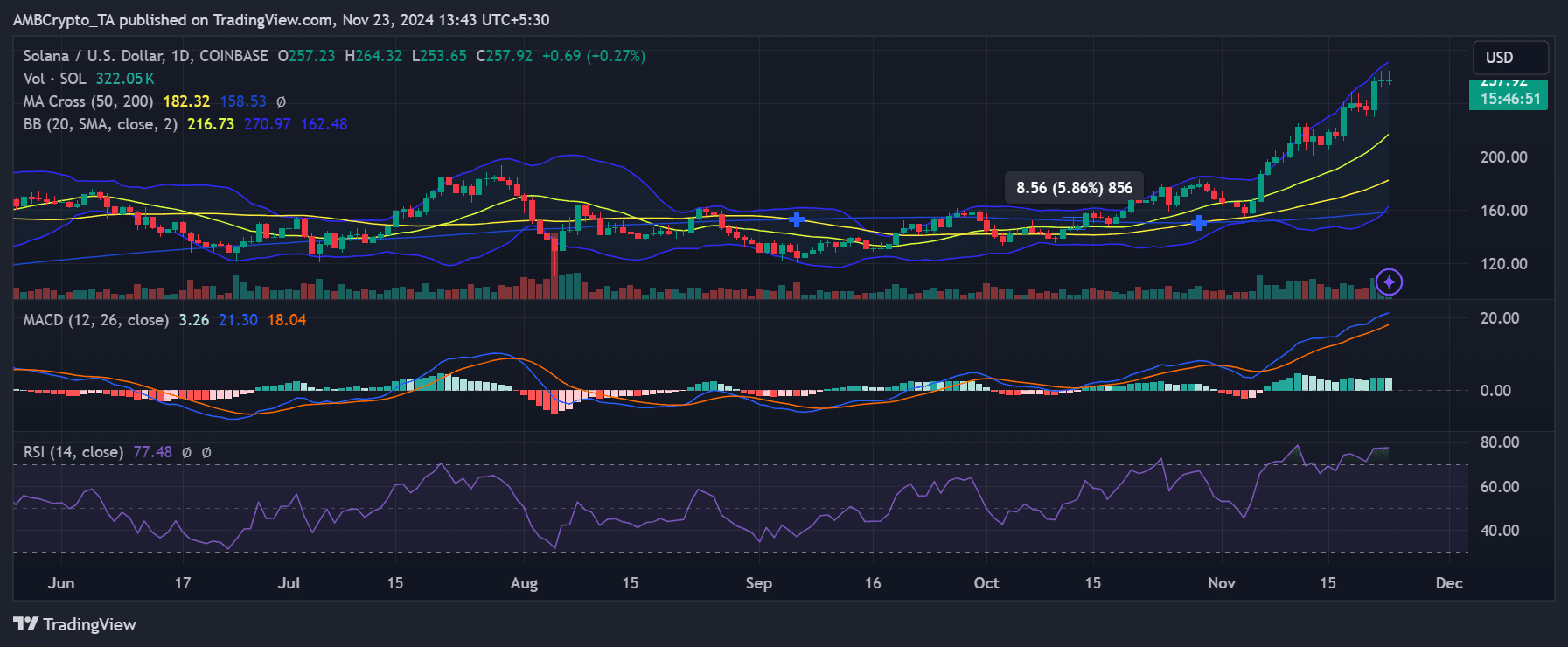

SOL’s value has been on a tear, not too long ago buying and selling above $250, and is near testing its yearly highs. AMBCrypto’s evaluation revealed a mixture of alerts.

Notably, the RSI indicated overbought situations, indicating a attainable consolidation interval, whereas the MACD maintained a bullish stance, indicating additional upside potential.

Supply: TradingView

The following main resistance degree is at $275 – some extent that would set off a breakout or act as a barrier.

A continued surge in on-chain exercise, coupled with regular DEX volumes and token burns, may present the momentum wanted to interrupt by means of this resistance.

Nevertheless, if this degree isn’t reached, the SOL may return to key help close to $230.

Is your portfolio inexperienced? View the SOL Revenue Calculator

Rising DEX volumes and escalating token burns replicate sturdy adoption and exercise.

Whereas SOL’s value trajectory depends upon market sentiment and broader crypto traits, the basics point out a bullish outlook. Whether or not the community can keep this momentum stays to be seen.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now