Altcoin

Solana: Why THIS price level could be crucial for SOL’s upcoming rally

Credit : ambcrypto.com

- The current worth motion prompt the bulls had been gaining management, however sturdy resistance at $162 may forestall an instantaneous rally.

- Merchants ought to preserve an in depth eye on the resistance at $162 as a break above this stage may sign a stronger restoration.

Solana [SOL] had lately skilled a decline after witnessing a basic ascending channel collapse and falling beneath the vital assist ranges as bearish momentum took over. The query is whether or not the bulls can regain management or whether or not extra draw back is on the best way.

Solana bulls got here onto the market once more

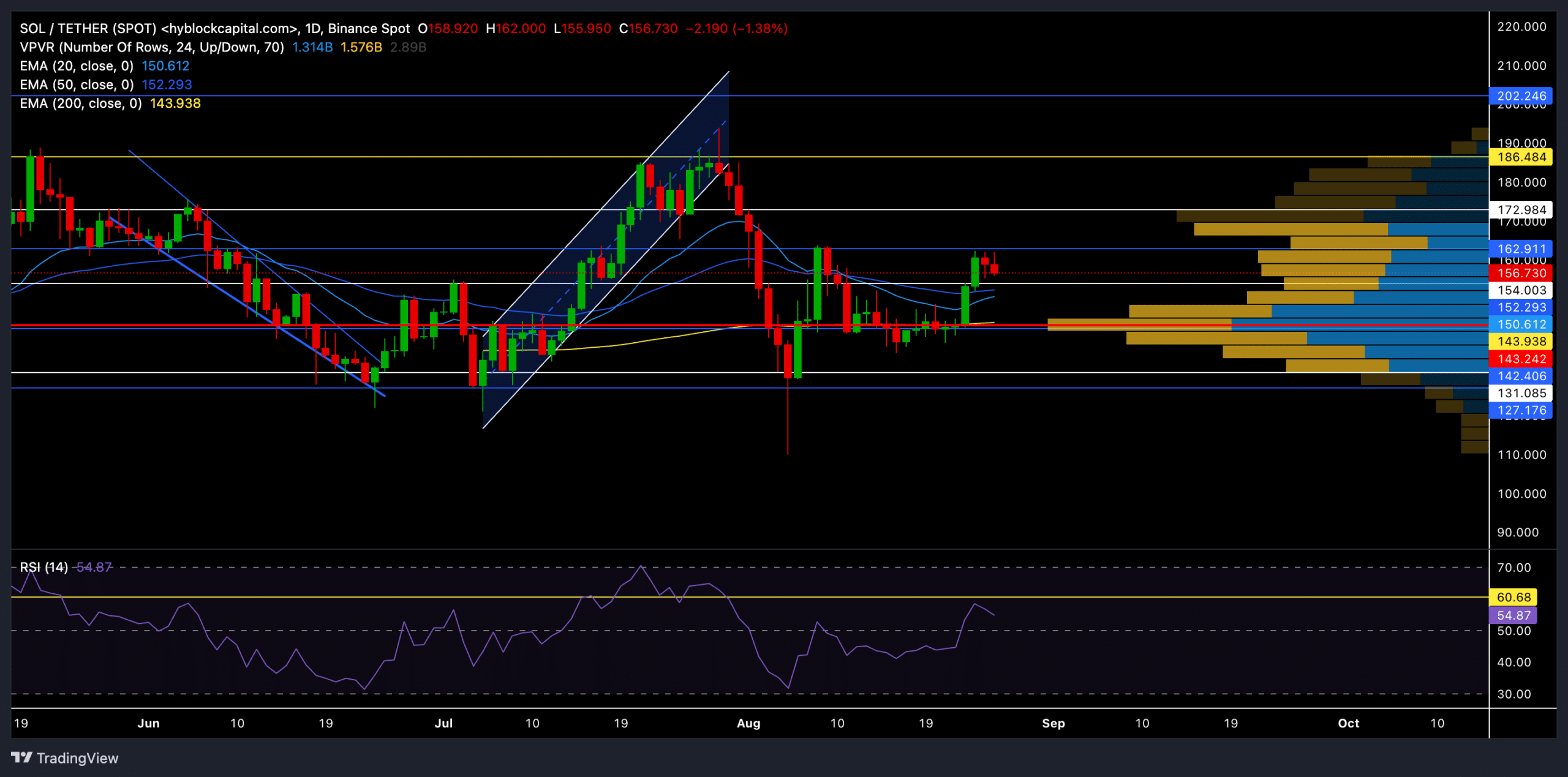

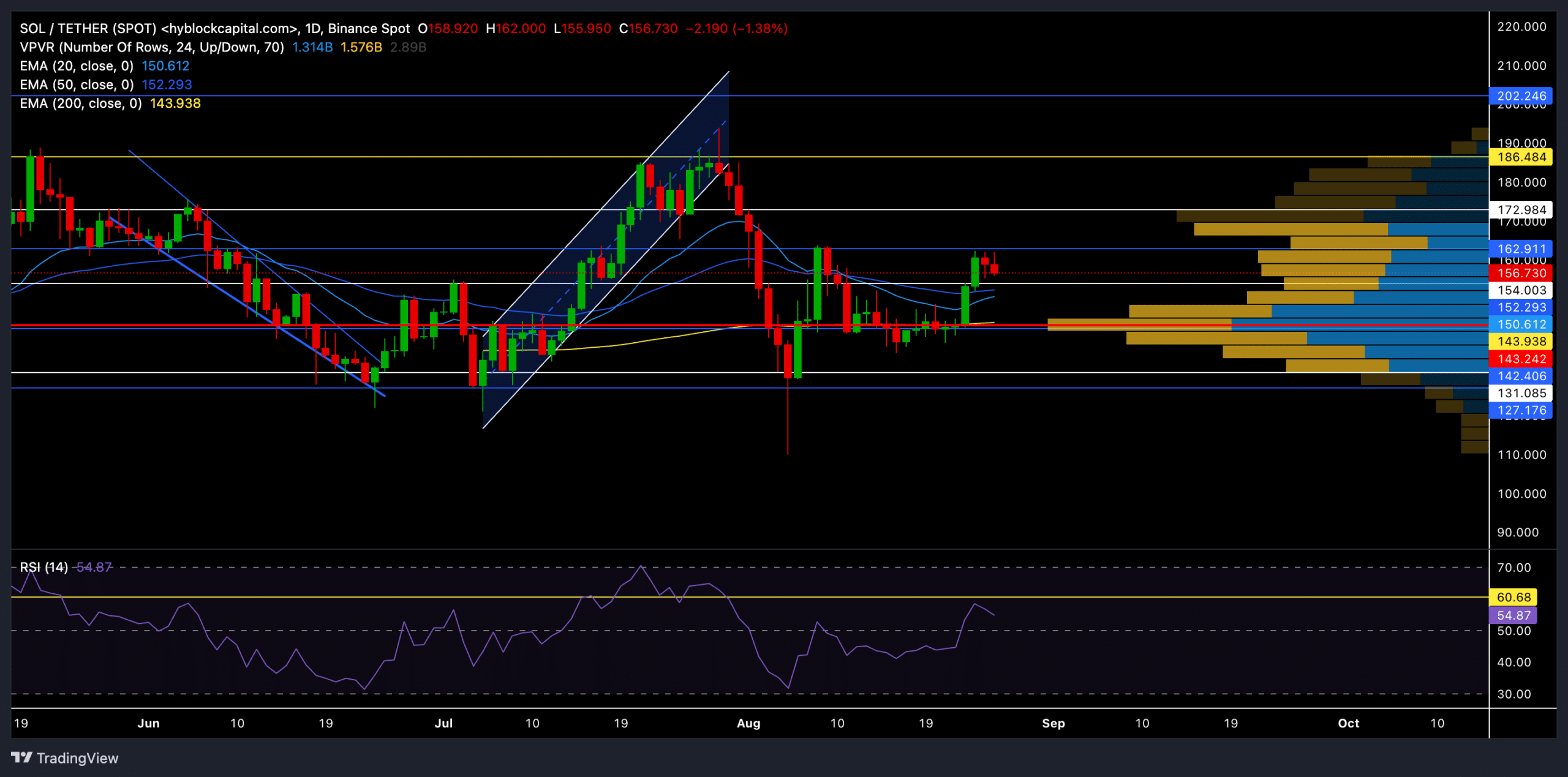

Supply: TradingView, SOL/USDT

SOL was underneath bearish stress in early August after failing to carry above the essential $172 stage. At present buying and selling round $156.7, SOL is down nearly 1.26% within the final 24 hours.

After recovering from the $142.15 assist stage on August 6, SOL managed to submit a 20% achieve in simply over three weeks. Nevertheless, this bullish momentum was short-lived as the value encountered resistance at $162, a stage that was tough for the bulls to beat this month.

However, the value regained some essential assist ranges and was hovering above the 20, 50 and 200 day EMA on the time of writing.

It’s price noting that there was a slight bearish stress because the altcoin reversed from the $162 resistance, and the value hovered in a zone that would see extra volatility.

The RSI was above 50 on the time of writing, indicating a barely bullish edge. Nevertheless, consumers ought to search for a possible shut above the RSI resistance level at 60 to gauge the possibilities of a rally within the coming days.

Vital ranges to observe

The quick assist stage to observe is close to $150 (20-day EMA). If SOL can maintain above this stage, it may try to retest the USD 172 resistance zone within the coming days.

Nevertheless, if the bears proceed to use stress and the SOL falls beneath $150, the checkpoint (pink) of the VPVR indicator close to the $143 stage might be retested.

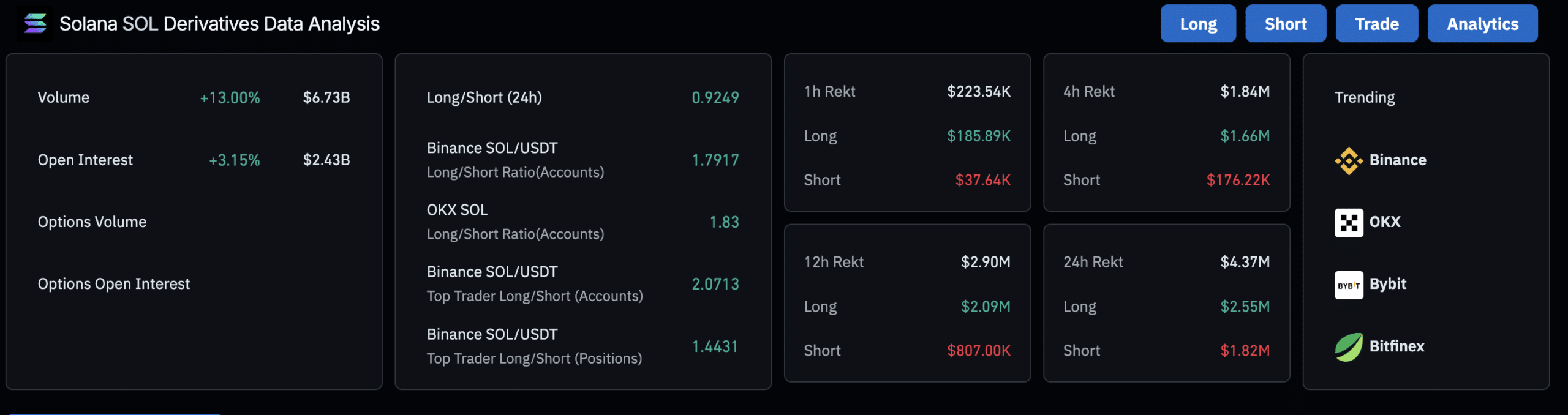

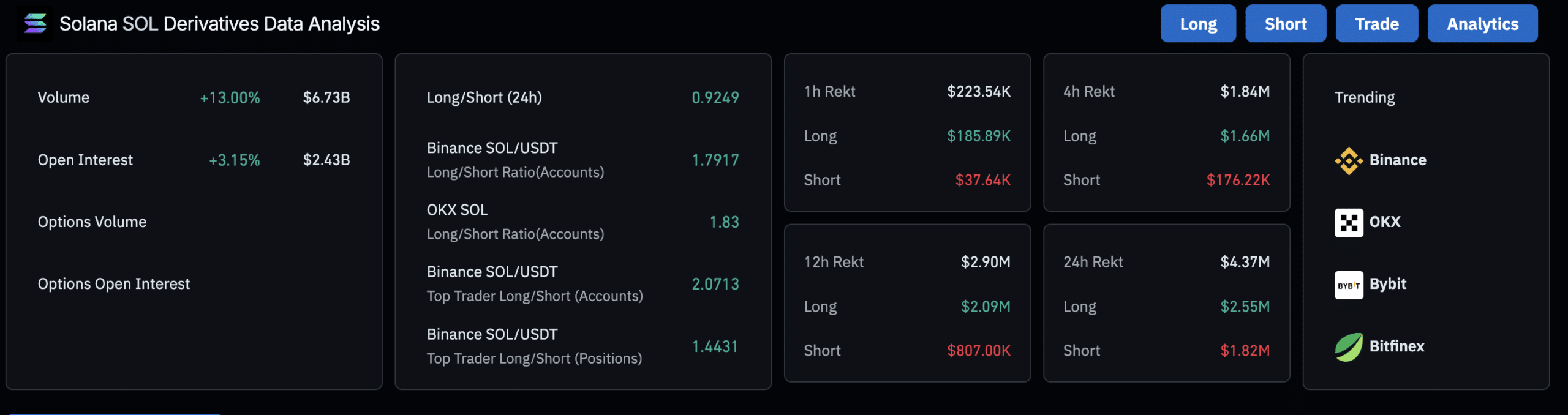

Whereas whole quantity rose 13% to $6.73 billion over the day, open curiosity rose 3.15% to $2.43 billion. This prompt that merchants had been nonetheless actively collaborating, however sentiment was leaning in the direction of the bearish aspect.

Supply: Coinglass

The lengthy/brief ratio over the past 24 hours was 0.9249, indicating barely bearish sentiment amongst merchants.

Is your portfolio inexperienced? View the Solana Revenue Calculator

Nevertheless, on Binance, the SOL/USDT lengthy/brief ratio was bullish at 1.7917, displaying that a good portion of merchants had been nonetheless bullish.

Consumers must also regulate Bitcoin sentiment and different macroeconomic components that would affect SOL’s worth motion within the coming weeks.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now