Altcoin

Solana’s $ 13 million liquidation puzzle – Will this change things into Sol’s favor?

Credit : ambcrypto.com

- Solana consumers and sellers on the derivatives market have recorded the identical quantity of loss, which signifies exhaustion.

- Actions out there are tailor-made to a bullish story and the chance that the subsequent motion might be of Solana Bullish.

Latest developments with Solana [SOL] Losses, registered within the derivatives market, have a splits sentiment. Sol had even risen by 14.56% throughout the week and 6.50% within the month.

Ambcrypto noticed, nevertheless, that indicators nonetheless most popular consumers, which means that the subsequent decisive swing may tilt up.

Sol stalls with $ 13 million in liquidations

Within the final 24 hours, liquidations within the Derivatenmarkt noticed an equal distribution between lengthy and quick positions, per coinglass.

Each events every misplaced $ 6.5 million, signaling of exhaustion of merchants and indecision. After all, this tug of conflict typically leads to muted worth motion, and that’s precisely what occurred.

The every day revenue of SOL was solely 0.7% throughout the identical interval.

When liquidations are tuned evenly, the market tends to falter, unsure in regards to the subsequent step. Nonetheless, the evaluation of Ambcrypto urged that Bulls nonetheless had a slight lead.

Actually, the value may nonetheless break to their benefit – if the momentum comes.

Essential actions desire the bulls

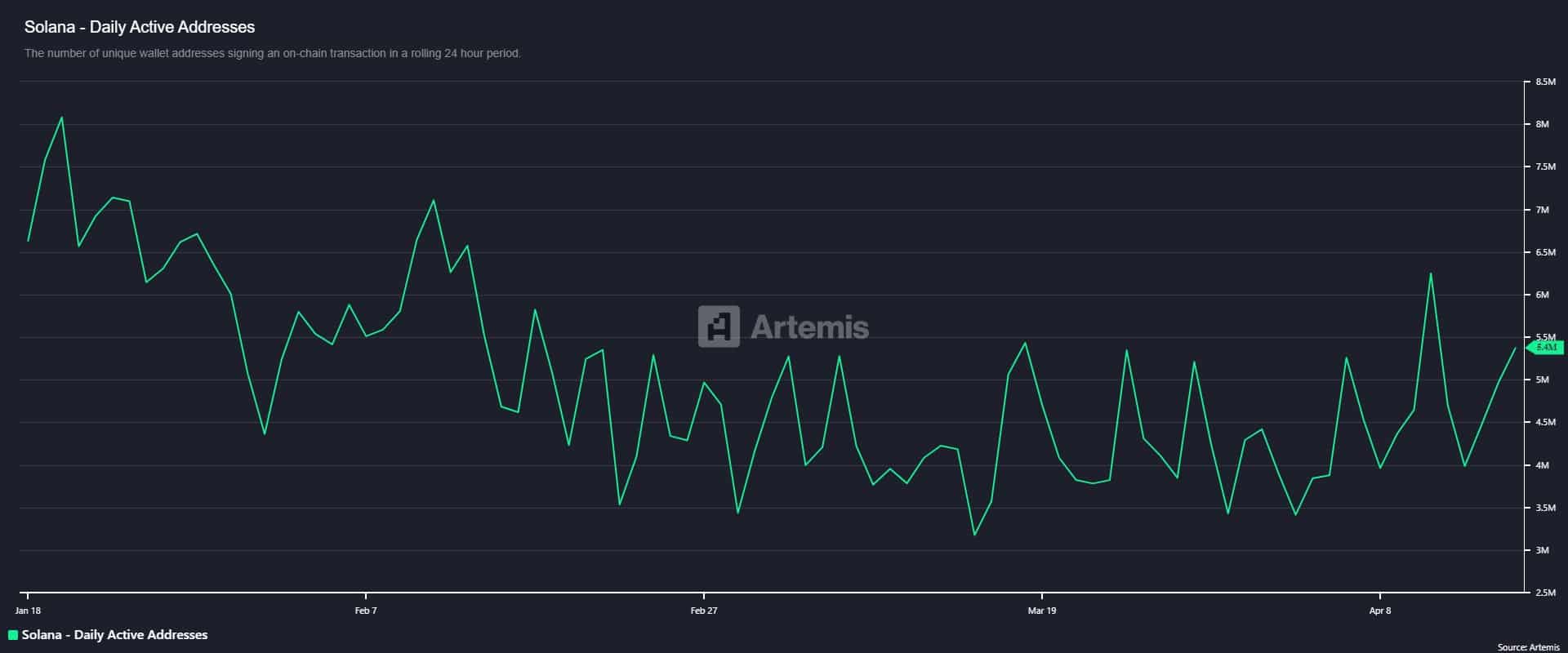

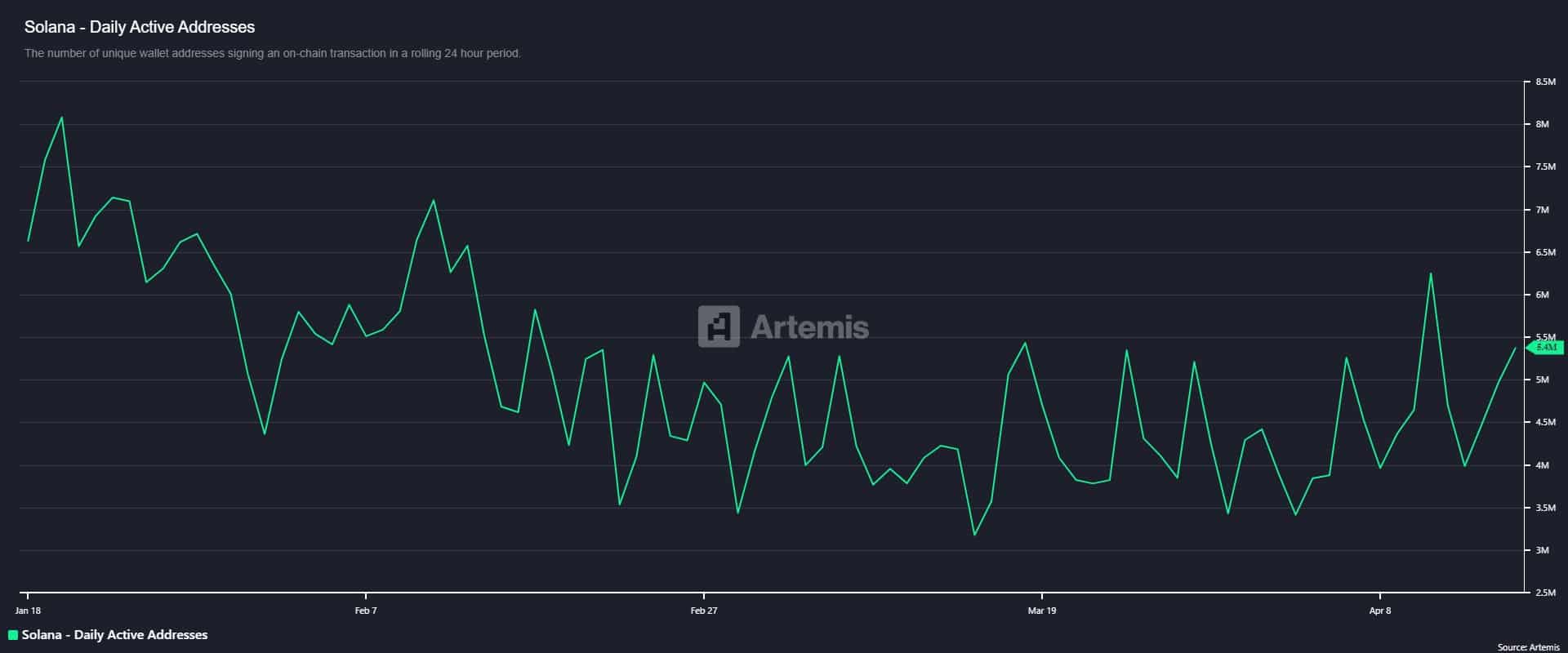

Furthermore, the exercise on the chain strengthened that opinion. Distinctive energetic addresses have risen 31% inside 24 hours and reached 5.4 million, in line with Artemis.

That peak implied new shopping for or receiving from SOL, intensifying bullish expectations.

Supply: Artemis

This corresponds to the rising commerce quantity on decentralized exchanges (Dexes), which noticed a rise of 15.35% final week, reached $ 16.2 billion – Solana the chain with the very best DEX commerce quantity.

The bullish story can also be current within the Futures market.

The variety of stressed contracts continued to develop, along with the acquisition quantity on the derivatives market.

Open curiosity, which data the quantity of stressed spinoff contracts, has however risen. These contracts embody each lengthy and quick positions.

The long-to-korter ratio, which successfully compares the shopping for and promoting quantity within the derivatives market, offers measurements above 1 to help a bullish and below 1 to counsel the vendor’s dominance.

On the time of the press, the lengthy -destructive ratio learn 1,0087, which signifies extra buy quantity. This most likely implied that the rising open curiosity was dominated by lengthy merchants, which will increase the possibility of a worth rally.

Supply: Defillama

Within the final 24 hours, the belief of buyers continued to develop because the liquidity in Solana flowed by round $ 72 million in Solana, in order that the entire worth is locked (TVL) to $ 7,144 billion.

When TVL climbs, because of this extra buyers lock their Sol-the long-term obligation in the long run lock-into-protocols to make varied actions attainable, together with the liquidity provide.

If the market continues to mirror a number of bullish alerts, it’ll most likely shine in favor of the bulls, with Sol Rallying.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024