Altcoin

Solana’s TVL down with 30% – Can Network recover after weighing scandal?

Credit : ambcrypto.com

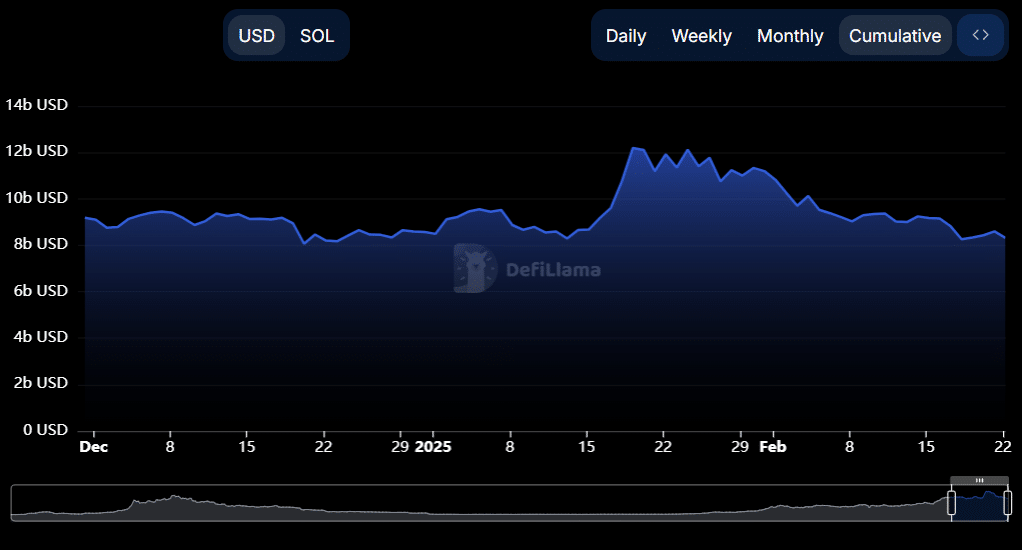

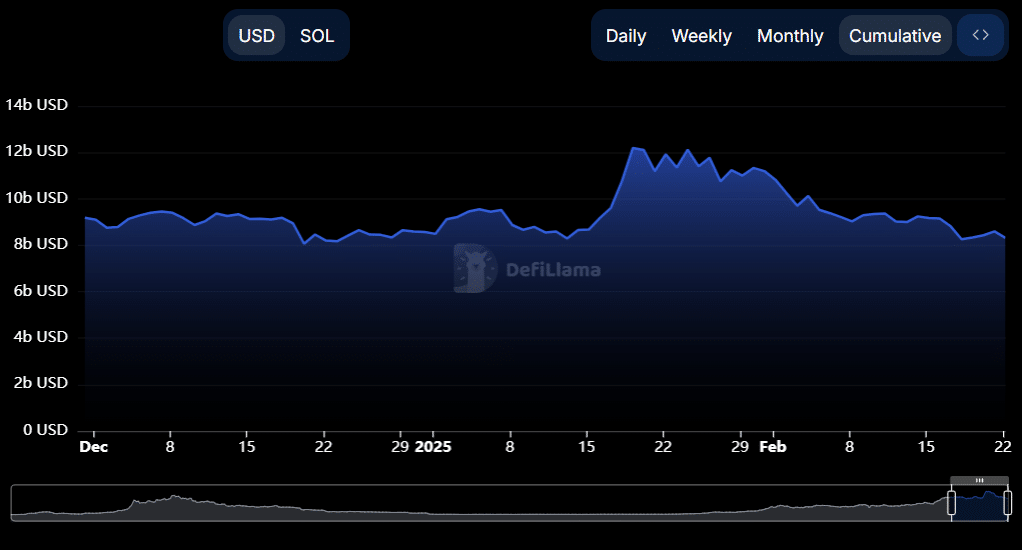

- Solana’s TVL fell beneath $ 10 billion as a result of scales and liquidity outings

- Restoration to $ 10.3 billion nonetheless emphasised a lower of virtually 30% since mid -January

Solana’s [SOL] The full worth locked was just lately a brand new low of $ 9.90 billion, which marked an unlucky milestone for the community. This assault of depreciation, largely attributed to the autumn -out of the scales, led concern concerning the stability of the Defi Ecosystem of Solana.

Though the identical has been considerably restored to achieve $ 10.3 billion, this nonetheless represents a lower of virtually 30% since mid -January. For sure, this has led to the lengthy -term well being and progress of the community.

With Solana, who faces these challenges, all eyes are centered on how this may affect the worth of SOL and a wider market sentiment.

Solana’s TVL touches new lows

Solana’s TVL took a pointy decline on the charts, with the newest drop that it pushed below $ 10 billion for the primary time since November 2024. This lower follows a broader pattern of fluctuating liquidity inside Solana’s Defi Ecosystem, a sample that was seen through the previous Downturns triggered by protocol Exploits and market -wide contractions.

Traditionally, necessary TVL descendants in Solana have merged with massive sale within the worth of SOL. Particularly because the belief of traders is reducing in response to ecosystem instability. Current knowledge even emphasised a steep fall in the long run of January 2025, a largely attributed to the aftermath of the scales.

Whereas the Solana TVLa beforehand floated almost $ 12 billion, the discharge of virtually 30% inside a month is a grim reminiscence of the vulnerability of the Defi sector of Solana. Additionally it is a remark about his steady battle to retain closed capital.

Safety issues live on within the midst of Libra Fallout

Regardless of the deterioration, nevertheless, Solana’s TVL returned barely to $ 10.3 billion, indicating {that a} degree of capital flows.

Nevertheless, the Libra-Vlugkling has induced everlasting harm, which exists worrying about safety and investor confidence on Solana-based Defi tasks. The sudden collapse of scales left the liquidity from a number of protocols, activating pressured liquidations and the additional damping of participation.

Supply: Defillama

Whereas TVL rose briefly initially of February, it struggled to retain any momentum, indicating that the belief of traders stays shaky.

These wider implications prolong additional than the Defi sector of Solana. The Sol worth promotion can stay risky as a result of market individuals re -assess the danger of the ecosystem. If Solana fails to revive confidence in its defi-security and governance, the latest restoration might be of quick period, making the community weak to the additional capital flight.

Solana’s worth views

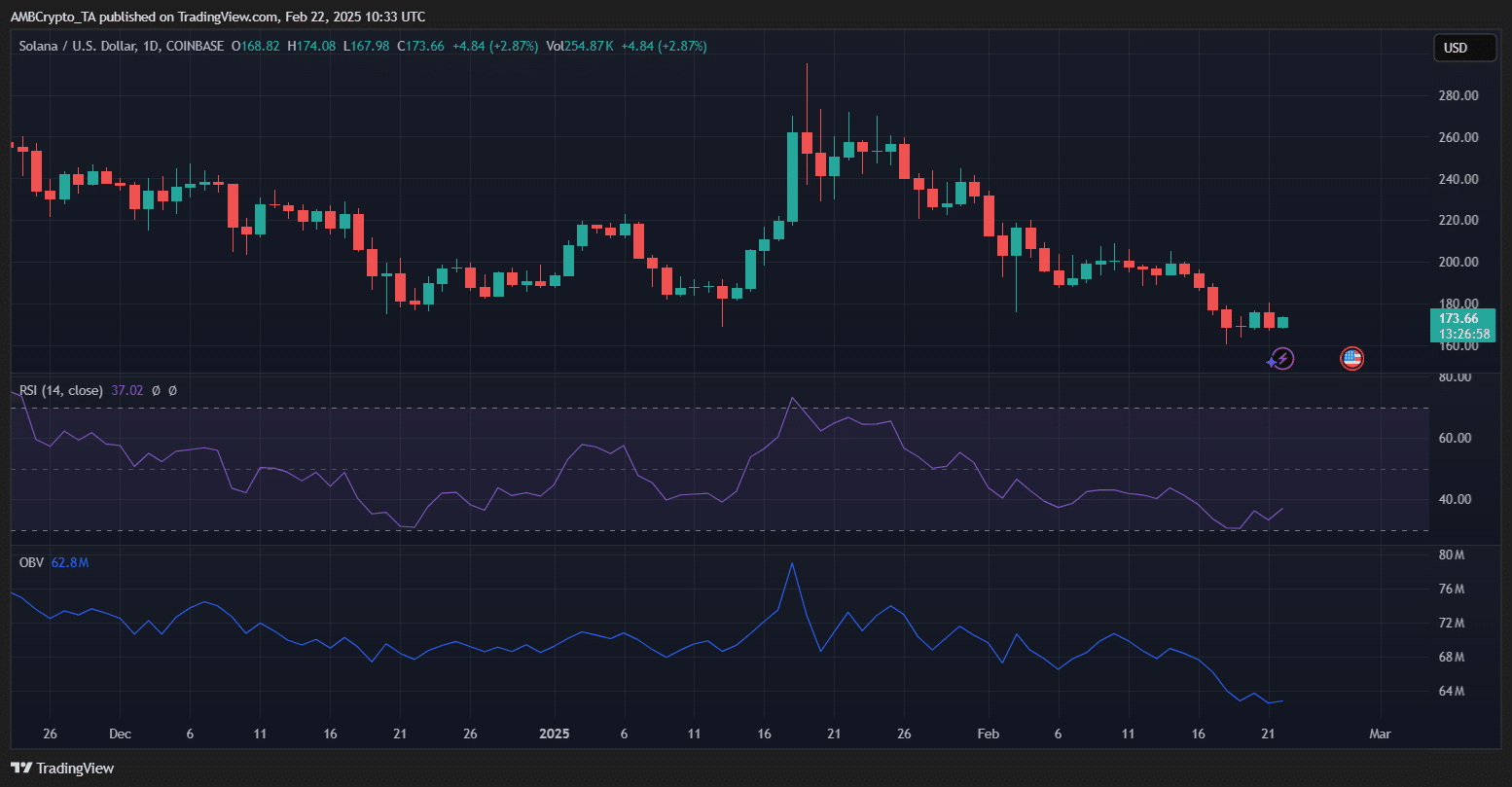

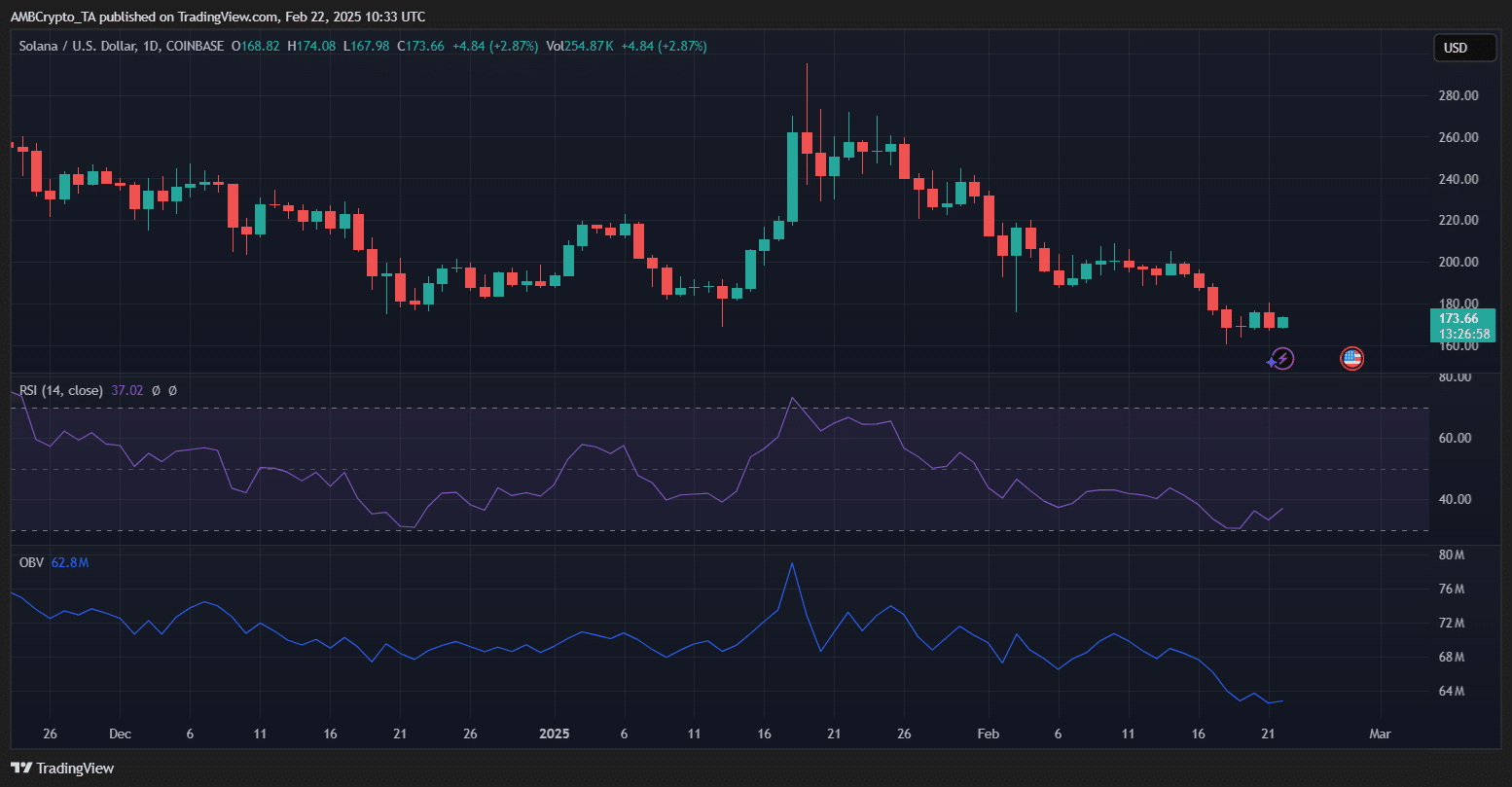

The autumn within the Solana TVL appears to have contributed to the newest Bearish Development from Sol. The value diagram unveiled SOL -trade on $ 173.66 on the time of press, after intraday winsts of two.87%.

Nevertheless, the broader pattern stays within the south. Since he peaks above $ 260 earlier this 12 months, Sol has steadily fallen, which implies that the liquidity shops of his Defi Ecosystem are mirrored. The RSI at 37.02 urged that the gross sales strain has been dominant in latest weeks.

As well as, the BBV adjusted a decline at 62.8 m – an indication of diminished shopping for momentum.

Supply: TradingView

The affect of the scales-scale fiasco on TVL in all probability led to a wave of funding uncertainty, which led to ongoing sale.

Traditionally, the worth of Sol has responded negatively to liquidity contractions in its ecosystem, and this time is not any completely different. Whereas the latest RSI Uptick hinted on a potential rebound within the quick time period, SOL stays at risk except the belief of Defi is restored.

If TVL continues to stagnate, Solana might battle to reclaim the $ 200 resistance degree within the quick time period.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now