Altcoin

Solana’s way to $195 – SOL’s price should remain above THIS level!

Credit : ambcrypto.com

- Merchants gave the impression to be over-indebted, with $156.7 on the backside and $166.5 on the high

- SOL’s on-chain metrics with technical evaluation prompt bulls dominated the asset

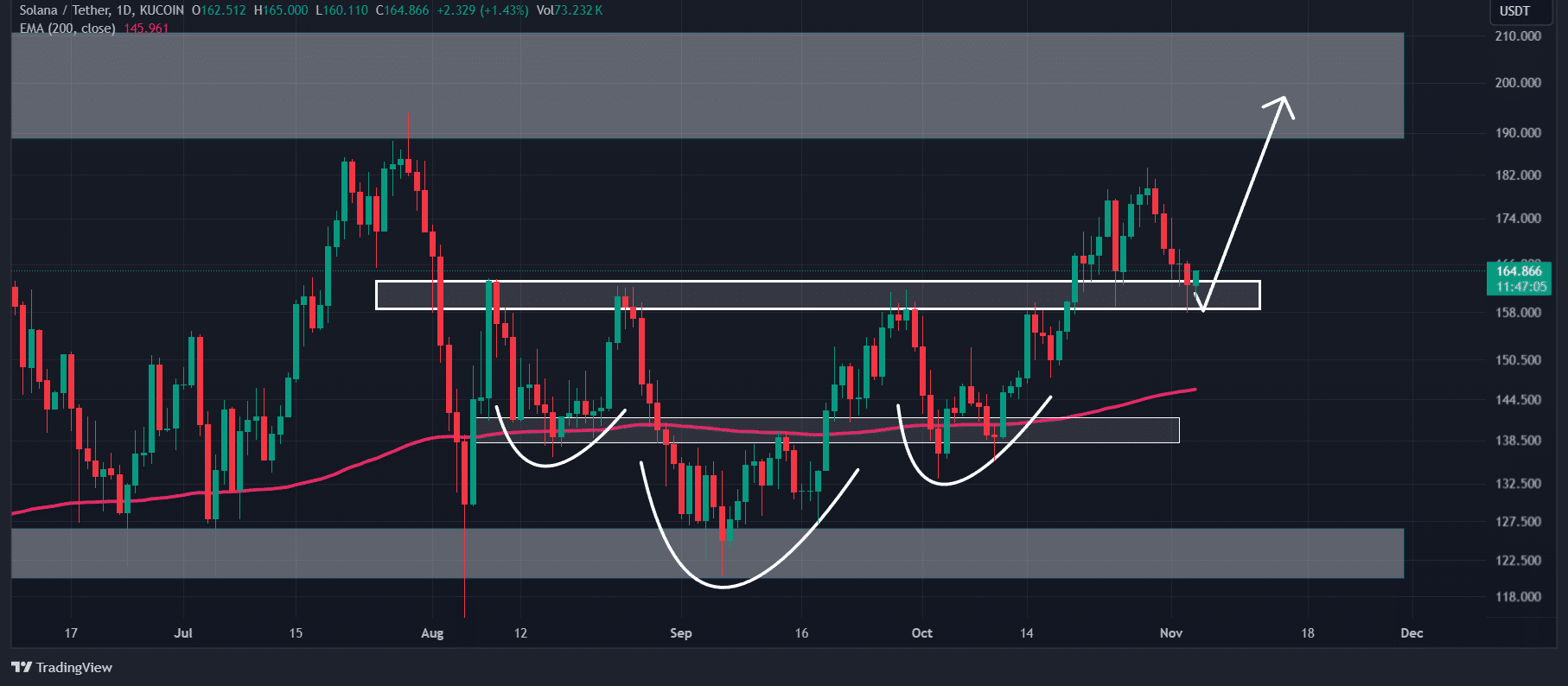

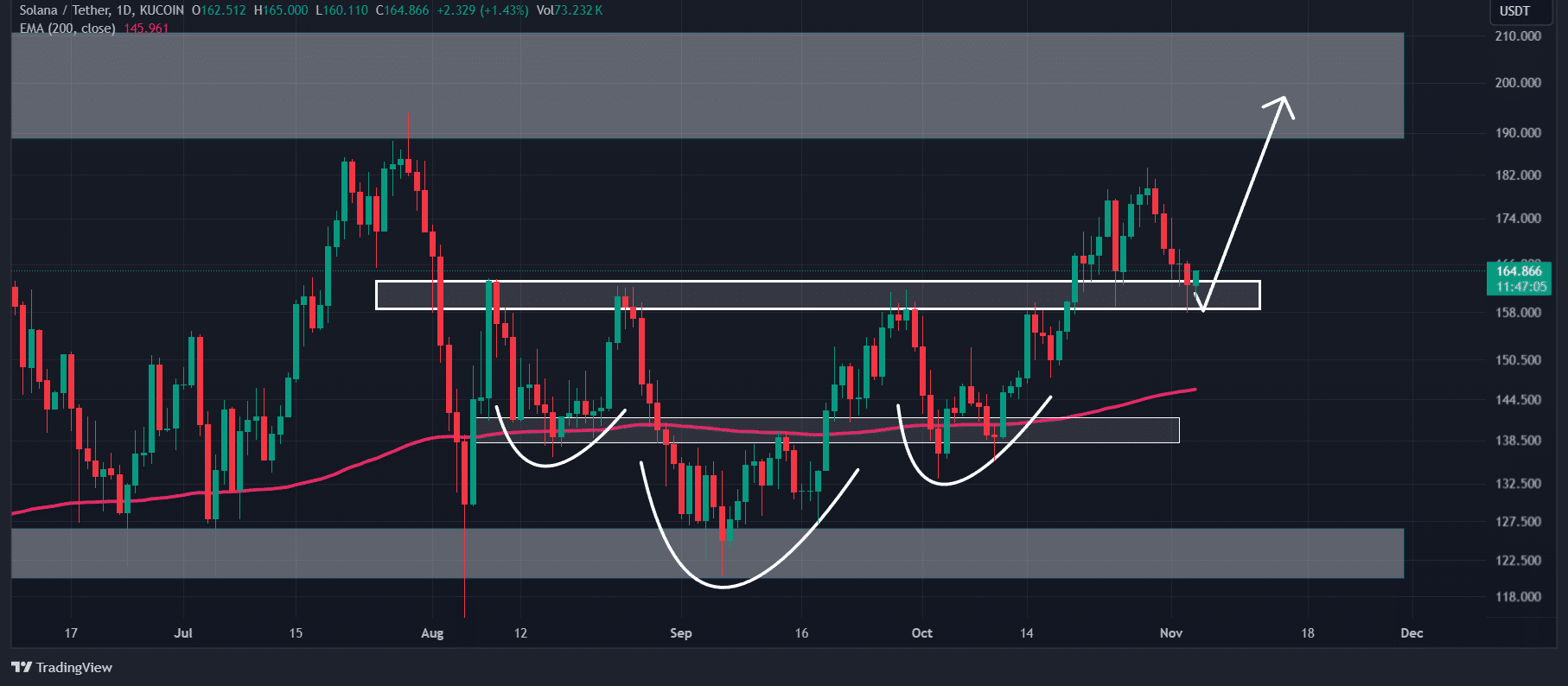

The current worth decline within the broader market pushed Solana (SOL) to the breakout degree of its inverse head-and-shoulders worth motion sample. On the time of writing, SOL gave the impression to be testing this degree once more after breaking by means of the charts.

Market sentiment

But the prevailing market sentiment appeared unsure. Particularly in gentle of the truth that the market is exhibiting slight indicators of restoration after a major decline.

Some even consider that the aforementioned interval of depreciation was a correction part. Others consider that the market has fallen resulting from normal uncertainty because of the upcoming US elections, geopolitical tensions and different components.

Solana worth evaluation and key ranges

Nevertheless, regardless of these components, SOL’s technical evaluation prompt a bullish outlook and hinted at a possible upside rally within the coming days.

Based on AMBCrypto’s worth evaluation, SOL was at a vital help degree at $161 on the time of writing. A worth reversal was recorded inside a four-hour window.

Supply: TradingView

Based mostly on the altcoin’s current worth motion and historic momentum, if SOL closes a each day candle above the $167 degree, there’s a sturdy risk that the asset might rise to $195 and even increased.

On the time of writing, SOL appeared bullish because it traded above the 200 Exponential Transferring Common (EMA) on each the four-hour and each day time frames.

In the meantime, the Relative Energy Index (RSI) indicated a possible upside rally within the coming days, with the identical within the oversold territory.

Bullish statistics within the chain

On-chain knowledge additional supported SOL’s constructive outlook. Based on the on-chain analytics firm Mint glassSOL’s Lengthy/Brief ratio stood at 1.02 on the time of writing – the very best for the reason that market began falling. A ratio above 1 is an indication of bullish sentiment amongst merchants.

Nevertheless, SOL’s Open Curiosity fell 7% over the previous 24 hours, indicating that merchants have liquidated their positions as a result of current worth drop. Moreover, merchants could also be hesitant to construct new positions right now.

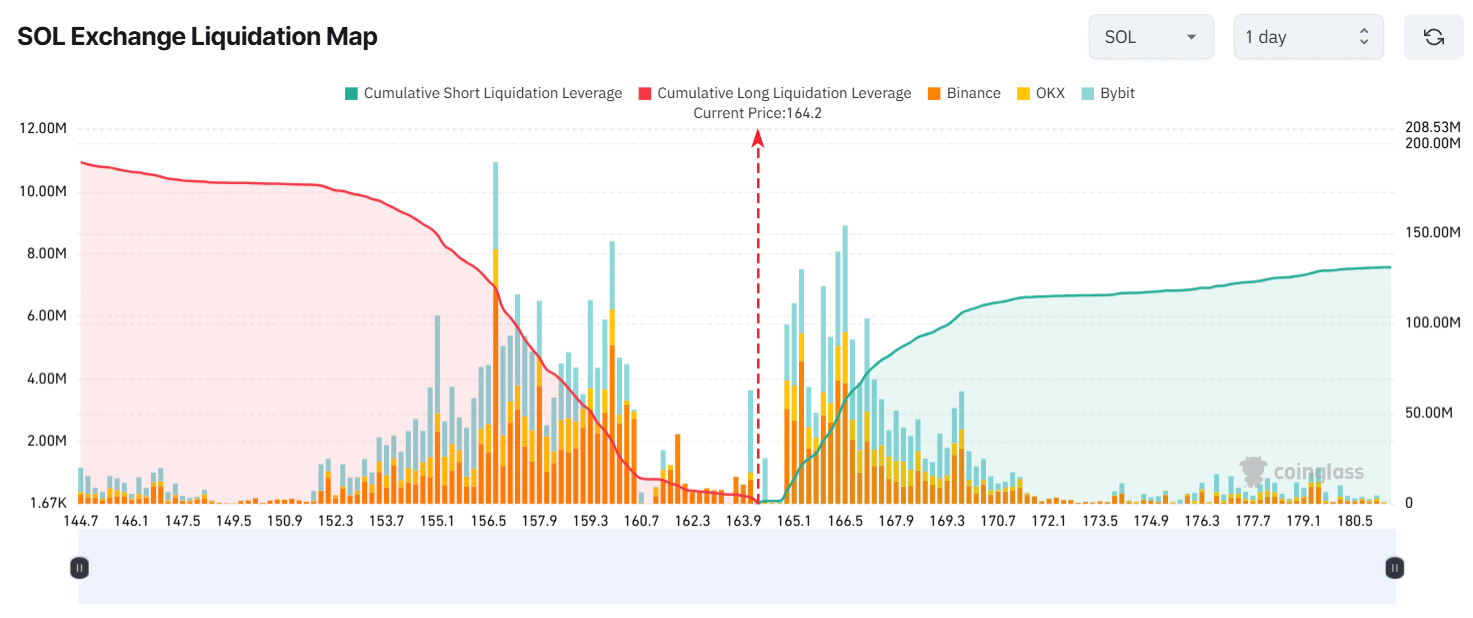

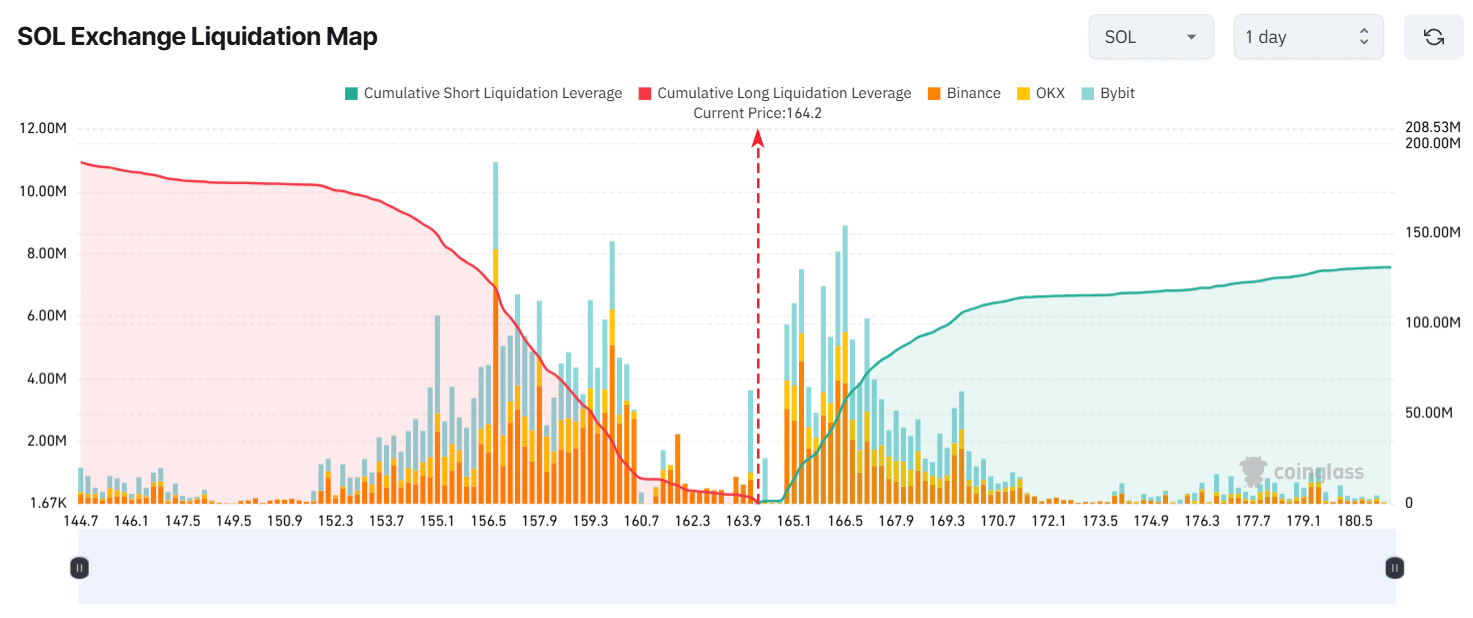

Important liquidation ranges

Supply: Coinglass

Presently, the important thing liquidation ranges are at $156.7 on the draw back and $166.5 on the upside, with merchants at these ranges being over-leveraged.

If market sentiment stays bullish and the worth rises to the $166.5 degree, brief positions price practically $57.6 million will probably be liquidated. Conversely, if sentiment adjustments and the worth falls to the $156.7 degree, lengthy positions price roughly $120 million will probably be liquidated.

When combining these on-chain metrics with technical evaluation, it was discovered that bulls dominated the property. Merely put, there’s probably a very good near-term worth rally for SOL.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024