Blockchain

Sony Bank will launch a stablecoin pegged to the yen on Soneium

Credit : cryptonews.net

Soneium, layer-2 di Ethereum, pre-announced on August 23 by expertise large Sony, has revealed that sooner or later it can launch a stablecoin pegged to the yen because of the subsidiary Sony Financial institution.

The brand new blockchain, at present within the testnet part underneath the identify “Minato“, will doubtless be launched in Mainnet within the first quarter of 2025.

The debut of a Japanese stablecoin might immediate a number of different web3 suppliers to put money into strengthening this specific market area of interest, in a context the place the US greenback predominately guidelines.

Let’s examine all the small print beneath.

Sony and the deliberate launch of Ethereum layer-2 Soneium: airdrop coming?

On August 23, Japanese multinational Sony introduced the upcoming launch of the Ethereum layer-2 Soneiumforward of a program that sees the event of a stablecoin that mirrors the worth of the yen. The Japanese tech large, whose core enterprise focuses on video video games and leisure, has out of the blue determined to dive into the blockchain market.

In an in depth weblog publish, it launched the brand new next-generation scalable resolution, which goals to combine builders, makers, group and finish customers collectively.

Introducing #Soneium by #Sony Block Options Labs constructing a next-generation public Ethereum Layer 2 blockchain ecosystem designed to evoke emotion and gas creativity.

Soneium desires to attach Web3 to on a regular basis web providers, making blockchain expertise extra… pic.twitter.com/I7zAIbB5Td

— Soneium 💿 (@soneium) August 23, 2024

Soneium’s mission is to unite extra individuals from totally different backgrounds round one interoperable infrastructure with the broad Web3 sector. Along with most compatibility with exterior purposes, the community might purpose to create new sorts of decentralized providers, that are nonetheless publicly unknown.

The companions becoming a member of Sony on this journey Astar Community, Chainlink, Alchemy, Circle and The Graph. Particularly, Astar will provide its bridging expertise for transferring funds from Polkadot to Ethereum, whereas Chainlink will act because the oracle. Circle is dedicated to supporting the brand new stablecoin, Alchemy supplies RPC help, and The Graph lends its information indexing service.

The ultimate launch date just isn’t but clear, however It’s believed that the mainnet can be introduced within the first quarter of 2025. Many are already beginning to discuss a major crypto airdrop on the way in which, however in the meanwhile solely the “Minato” testnet is on the market to work together with the Sony mission.

There’s additionally an incubation program for brand new tasks, referred to as “Soneium spark”, However no airdrop marketing campaign has been introduced.

Prepared to show 5 minutes into hundreds of {dollars}?

Dive into the Soneium Minato Testnet with this easy information 🚀

Price: $0

Time: 5 minutesDo not miss it! A thread 🧵👇 pic.twitter.com/9VDoZKEZTR

— andrewwwwww (✍️,🧵) (@andrewtalksdefi) September 10, 2024

Sony: the brand new stablecoin pegged to the yen in collaboration with Sony Financial institution

Based on unofficial sources Sony is reportedly contemplating a brand new stablecoin pegged to the yen, in partnership with subsidiary Sony Financial institution.

In latest hours, this picture has been circulating on X, explaining how the subsidiary of the Japanese large can be dedicated to the event of a steady cryptocurrency. The selection to open the Japanese market to stablecoins might be impressed by the already confirmed presence of the American firm Circle (with USDC) in Soneium’s plans.

By doing this, Sony’s layer-2 will help the onboarding of each Western USD-based clients and Japanese YEN-based clients.For now it is simply an experiment (amongst different issues, not formally confirmed) that should be built-in with the nation’s regulatory framework.

The event of a cryptocurrency devoted to the yen in Japan will first should get the inexperienced gentle from regulatory authorities earlier than it will possibly land on the blockchain.

Presently, there are not any clear stablecoin laws within the nation, so timelines could also be longer than anticipated. Sony Financial institution’s aim appears to be to allow its customers to trade cash by means of its personal handy, safe and economical infrastructure.

The presence of a stablecoin is subsequently basic within the plans of the corporate, which focuses closely on Tokyo’s fintech improvement. It’s also clear how establishments’ consideration to the world of digital belongings in Japan is rising considerably.

Supply: https://x.com/delzennejc/standing/1833243834563650038

The non-USD stablecoin market

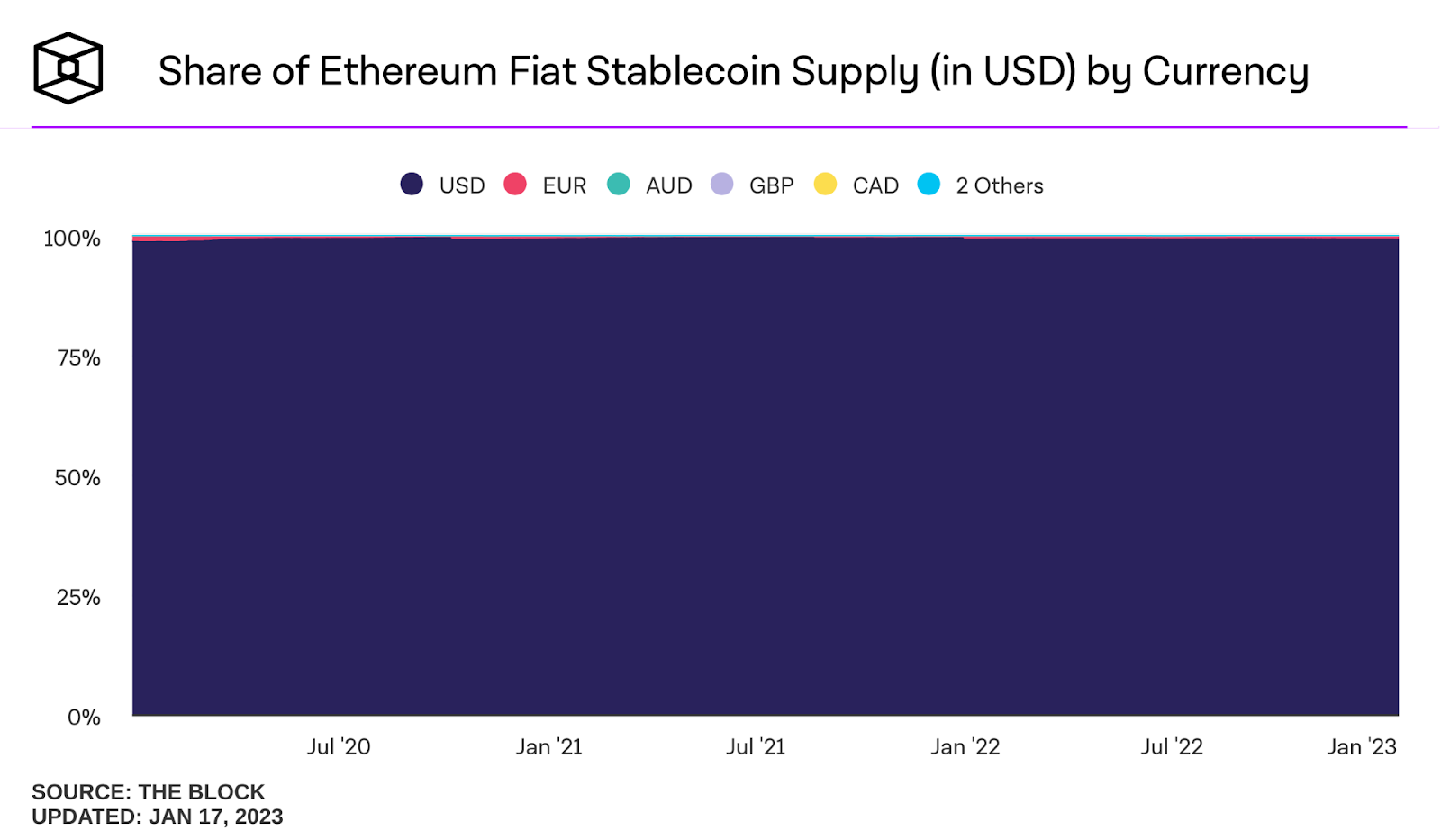

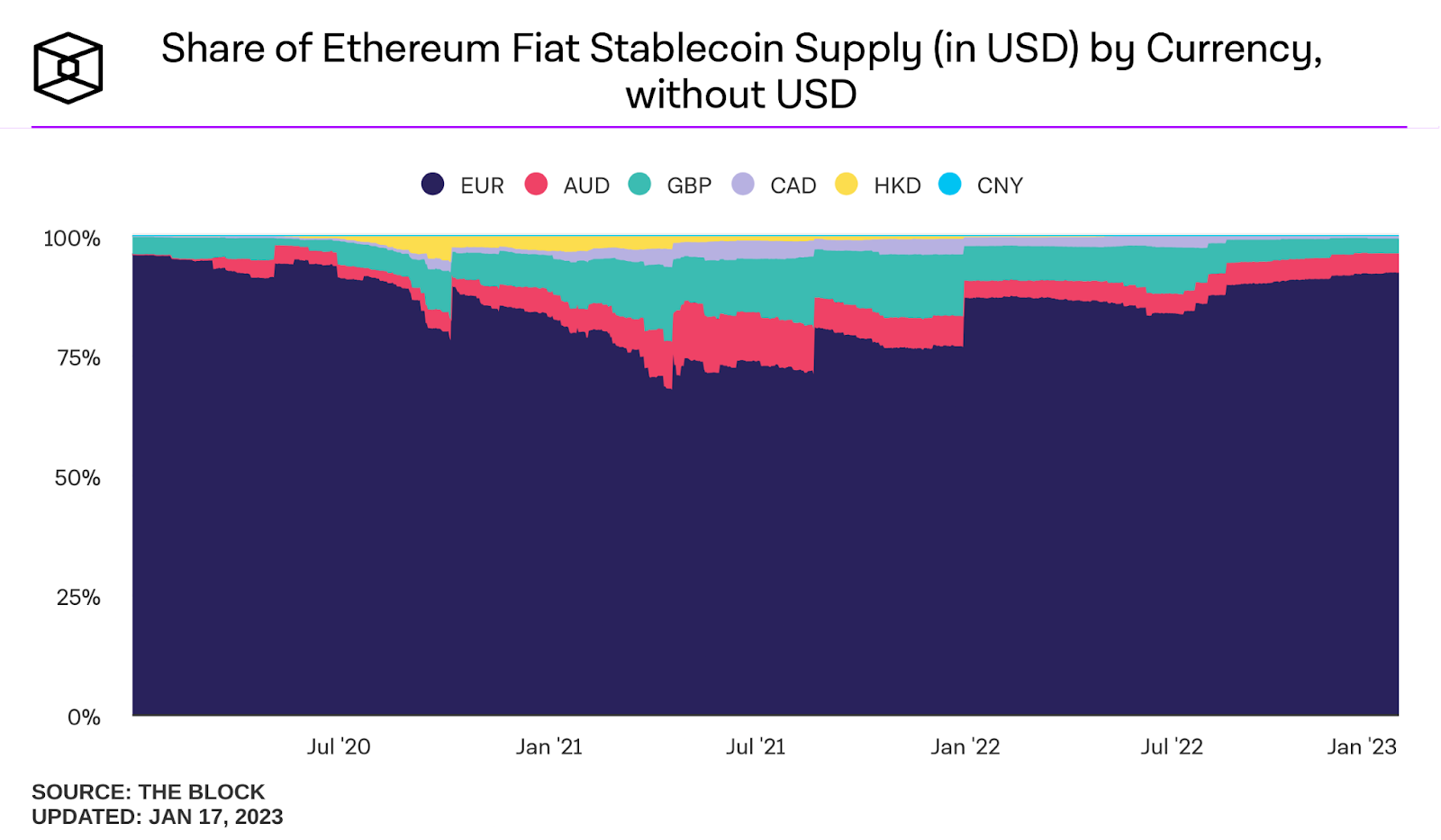

Sony, by launching a brand new yen-based stablecoin for its personal blockchain Soneium, might turn into a market area of interest that’s utterly dominated by the American presence. Based on information from The Block, the fiat stablecoin market on Ethereum is 99.32% managed by the US greenback.

The remaining 0.68% of the share, with a complete worth of greater than $600 million, is then in flip monopolized by the euro, which controls a major 92% of it. The Australian greenback (AUD) and the British pound (GBP) play a marginal position with 4.04% and three.09% respectively of the stablecoin market by which the USD is excluded.

There’s at present little room for the yen within the panorama of cryptographic stablecoins. into which first the Individuals after which the Europeans plunged headlong.

The growing affect of many net social organizations in measuring one of many business’s most essential essential graphic assessments highlights a possible for this sector. On this regard, Brad Garlinghouse, CEO of Ripple, said a number of days in the past that he’s satisfied that Japan will expertise robust demand for a yen stablecoin.

Based on what was stated in an interview:

“Folks will need to maintain yen-denominated stablecoins, and I feel it is solely a matter of time.”

The cryptocurrency trade Binance, which has had its personal department Binance Japan for a number of months, is contemplating a stablecoin, identical to Sony Financial institution is at present doing. The largest drawback proper now’s associated to the regulation of digital belongingsthe place the dearth of a transparent framework limits main investments by people and establishments.

Nonetheless, after Sony, an enormous with an annual turnover of over 3 billion {dollars}, made public its intentions within the crypto world. It’s doubtless that many others will comply with in his footsteps.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now