Blockchain

Sony, SBI, and Startale’s Bid to Build a Global Layer-2 Powerhouse

Credit : cryptonews.net

As competitors amongst Ethereum Layer-2 chains intensifies, Startale Group is positioning Soneium as a compliance-first platform rooted in Japan. With companions corresponding to SBI and Sony, the corporate goals to mix monetary infrastructure with entertainment-driven adoption.

CEO Sota Watanabe spoke to BeInCrypto concerning the long-term imaginative and prescient, development metrics, decentralization, and regulation. The venture seeks to face out globally.

Background: Can a Japan-Born L2 Compete?

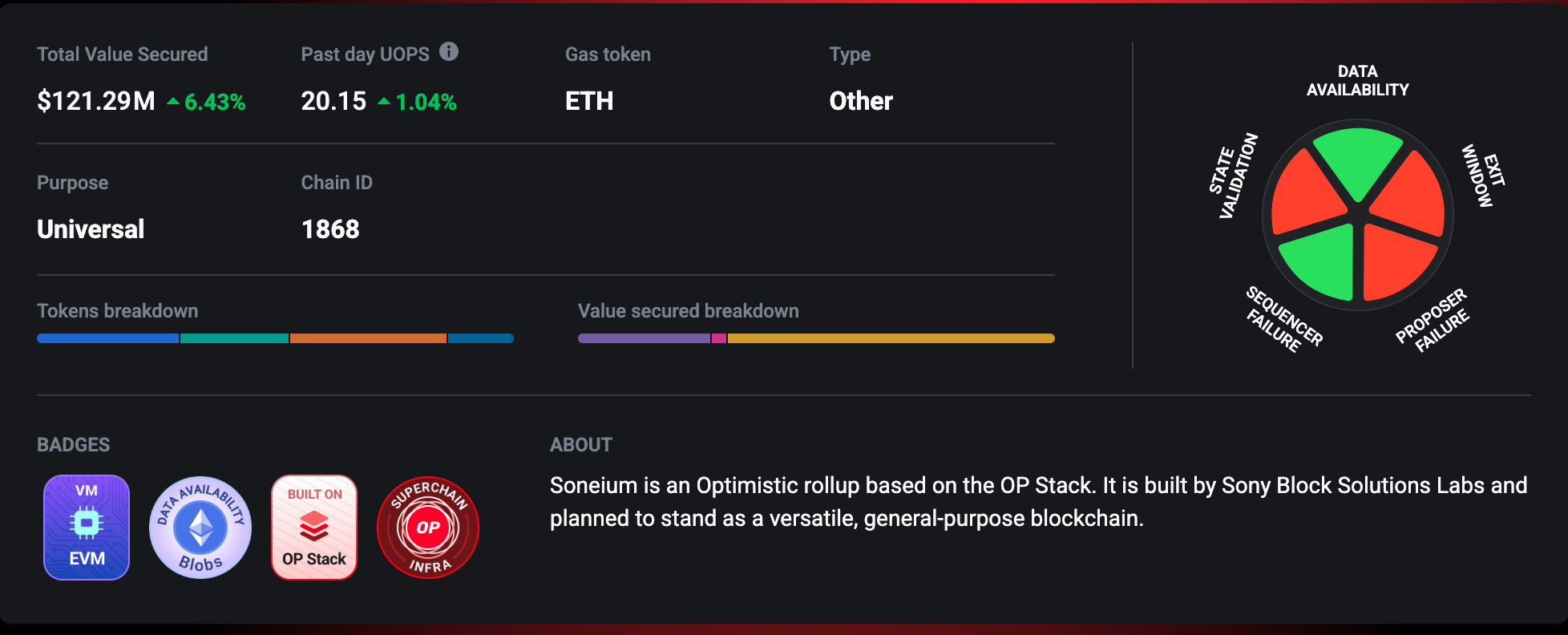

L2BEAT listed Soneium with methodology notes and governance dangers. OKLink confirmed heavy on-chain throughput. Blockscout information ERC-4337 account-abstraction operations, offering a clear log of user-level interactions. Collectively, these alerts present that Soneium is already working at actual scale below exterior scrutiny. They reveal {that a} Japan-born Layer-2 can meet transparency benchmarks set by world leaders.

Sony arrange a JV and incubator in 2023. It introduced Soneium improvement in 2024 and launched mainnet in 2025. In the meantime, SBI Holdings revealed joint-venture plans to attach Soneium with capital markets. Collectively, these alliances sign how leisure and finance are converging in Japan’s blockchain panorama.

Mission and International Imaginative and prescient: Can Japan Lead?

Startale’s medium- and long-term targets deal with constructing a worldwide place past 2025. The corporate goals to show how a Japan-born blockchain can compete on the highest stage. With Soneium, the SBI three way partnership, and different initiatives, Startale is extending its presence throughout each expertise and finance.

Nevertheless, as initiatives multiply, the imaginative and prescient will not be at all times clear. Watanabe mentioned the agency was based to show Japan might ship enterprise-grade blockchain infrastructure. Due to this fact, compliance and reliability, not hypothesis, stay the highest priorities.

“We imagine that the subsequent iteration of the web will likely be constructed on blockchains. I wish to see Japan take a lead on that. That’s the explanation we based Startale. We aimed to indicate Japan can develop world-class blockchain infrastructure. This isn’t only for crypto fans. It’s for enterprises. It’s for firms like Sony, SBI, and different world conglomerates that demand reliability, compliance, and safety.”

Mission: Deliver the World Onchain.

How: Make the most of distribution channels and conventional property.

What: Construct chains to apps vertically beginning with Sony and SBI.

Why: Simpler for current firms to accumulate crypto customers than for crypto to accumulate current customers.

That’s us.

— Sota Watanabe (@WatanabeSota) September 18, 2025

He added that the long-term imaginative and prescient is for Japan to face as a worldwide chief in blockchain. Simply because the nation exported manufacturing and tradition, Startale goals to export blockchain infrastructure. To attain this, the agency is constructing a group that blends engineering experience with enterprise improvement and partnerships.

Funding Story: Resilience Amid Headwinds?

The broader Layer-2 market is seeing slowing capital inflows. Current tokens additionally wrestle to maintain investor attraction. How Soneium is perceived subsequently issues. Watanabe famous that scale and composability at the moment are baseline options. Consequently, Startale goals to face out via distribution channels and new person segments.

“The trade has been maturing. Competitors has shifted past current crypto customers to thoroughly new person segments who’ve by no means engaged with crypto earlier than. The variety of firms transferring on-chain in 2025 makes this clear. Startale and Astar have labored on this since 2023. We’re good at securing distribution channels, and that turns into a moat.”

He cited exercise knowledge: as of September 2025, Soneium had processed over 295 million transactions (OKLink confirmed 297.16 million). It averaged roughly 90,000 each day lively addresses and greater than 4.8 million addresses in whole. It additionally recorded over 350,000 account-abstraction operations. These figures, subsequently, reveal scale.

Nevertheless, L2BEAT’s Complete Worth Secured rankings present Arbitrum and Base securing tens of billions in property, underscoring the hole. Furthermore, educational analysis corresponding to Optimistic MEV in Ethereum Layer 2s highlights how MEV extraction and spam hundreds range throughout Arbitrum, Base, and Optimism. This frames Soneium’s development not solely in uncooked numbers but additionally within the high quality of utilization.

On the similar time, Flashbots analyzed spam hundreds throughout OP-Stack rollups, reminding observers to weigh high quality alongside throughput. Requested which metrics matter most—TVL, person base, or utility development—he as a substitute pointed to distribution channels. In his view, securing new pipelines for adoption is a extra sturdy moat than chasing uncooked numbers.

Token Design: Sustainability or Sticking Level?

Soneium at present makes use of ETH as fuel. However questions stay about native tokens and sustainable income. Watanabe acknowledged {that a} native token might arrive later, a problem tied to U.S. SEC scrutiny of Layer-2 “independence.”

For now, he burdened that sustainable income should come from sequencer charges, joint ventures, and compliance-driven providers. Token incentives, in contrast, are short-lived. The U.S. Securities and Alternate Fee issued KPI-disclosure steerage that requires readability on development and worth creation. Due to this fact, Watanabe emphasised reinvesting sequencer revenues, joint-venture earnings, and account-abstraction exercise again into the ecosystem as a substitute of counting on fast token incentives.

“The Layer-2 ecosystem has matured shortly. Differentiators like scale, composability, and protocol-level innovation at the moment are baseline necessities. Merely launching with a bridge or a DEX isn’t sufficient. Our method is to safe distribution, develop into new person bases, and reinvest sequencer and JV revenues into the ecosystem to help long-term development.”

Sony’s Edge: Catalyst for Native Demand?

Soneium’s TVL nonetheless leans on bridged property. DeFiLlama reveals this reliance clearly, in distinction to the extra diversified liquidity profiles of Arbitrum and Optimism.

However, Sony’s IP supplies a client channel few chains can match. Watanabe outlined plans to tokenize music, movie, and gaming content material. He additionally highlighted wallets, compliance instruments, and account abstraction to make experiences seamless.

“Startale is engaged on leisure and media use instances on high of Soneium. We provide alternatives to tokenize music, movie, and gaming with ecosystem builders. We additionally present wallets, account abstraction, and compliance instruments that allow these fan experiences and monetization fashions. This drives native demand as a result of customers have interaction with content material they love, not hypothesis.”

Between Centralization and Decentralization

Soneium nonetheless runs a centralized sequencer and a centralized fraud-proof authority. L2BEAT already flags these as governance dangers. Arbitrum’s DAO, as an example, enforces timelocks on upgrades. In the meantime, Base stays tied to Coinbase via its sequencer. On this context, Soneium’s phased method seems to be like a deliberate steadiness between usability and compliance.

“Pure decentralization with out usability received’t obtain mass adoption. Full centralization defeats the aim of Web3. We started with a centralized sequencer for stability and scale. From there, we’re upgrading the community step-by-step towards extra open and ultimately decentralized fashions.”

He cited the Yoake live performance app, the place followers voted on-chain with out realizing it. This instance reveals how invisible UX can merge compliance with Web3 capabilities.

Enterprise Technique in Asia: Belief as a Pillar?

In Japan, Singapore, and Hong Kong, enterprises prioritize auditability and predictable prices. For a Sony-aligned L2, belief is central. Watanabe described three pillars: regulatory-first infrastructure, cross-border scalability, and developer-friendly integration. Startale calls this framework Leisure Tokenized Belongings (ETA). It packages programmable rights and royalties round cultural IP. Thus, enterprises can undertake blockchain with out sacrificing compliance or person belief.

“Our technique focuses on enabling enterprise adoption, and Soneium is a key a part of that. Enterprises care most about three pillars: regulation with strong safety, scalability throughout Asia and past, and seamless infrastructure corresponding to wallets and account abstraction.”

Connecting Japan’s Strengths to Capital Markets

Startale and SBI shaped a three way partnership to launch tokenized inventory and RWA markets. SBI Holdings revealed an in depth launch on the initiative. Watanabe argued that Japan’s mixture of regulatory readability, trusted establishments, and cultural IP supplies a bonus in shaping tokenization at scale.

“Japan has a novel mixture of strengths that may form the way forward for tokenization. Our regulatory readability, trusted monetary establishments, and globally influential cultural IP put us ready few different markets can match. Our broader imaginative and prescient is to make Japan a mannequin for the way tokenized markets can work at scale.”

Managing Settlement Lags and Value Gaps

Tokenized property in different contexts revealed foundation danger from gaps between on-chain execution and off-chain settlement. Watanabe mentioned Startale will apply safeguards modeled on conventional markets, together with circuit-breaker-style pauses and clear person disclosures calibrated with regulators.

“Settlement lags and pricing gaps are actual challenges in tokenized markets, and our precept is easy: Startale builds infrastructure that applies regulated-market requirements. Automated safeguards can pause buying and selling when discrepancies exceed thresholds, calibrated with regulators and modeled on current requirements for circuit breakers.”

Japan’s Monetary Companies Company finalized guidelines below the Cost Companies Act and the Monetary Devices and Alternate Act (FIEA). As well as, Reuters reported that additional amendments might develop the scope of economic devices.

Stablecoin Interoperability and UX

By 2025, a number of regulated stablecoins are anticipated to coexist—from bank-backed devices to USDC and GHO—elevating UX challenges. Watanabe mentioned infrastructure ought to soak up complexity, not customers. With account abstraction, customers can depend on acquainted log-ins, restoration flows, and gasless transactions. Chambers & Companions outlined how Japan’s stablecoin regime aligns with this compliance-first design.

“We anticipate a number of bank-backed and controlled stablecoins to coexist, and we design for interoperability throughout them. Our philosophy is easy: Web3 ought to really feel as intuitive as Web2. Behind the scenes, our account abstraction framework removes friction—customers can log in with acquainted credentials, recuperate accounts simply, and transact with out worrying about fuel.”

Tokenization and the Position of ETFs

Japan’s blockchain market might develop materially this decade. This raises questions on whether or not tokenization will scale back reliance on ETFs and proxy shares. Watanabe argued that direct, fractional, programmable publicity with real-time settlement can streamline company actions and alter how liquidity is packaged.

“Tokenization basically redefines the function of ETFs and proxy shares by eradicating the necessity for layered monetary wrappers. A token can straight characterize the underlying asset with real-time settlement, clear possession, and world attain. Good contracts allow automated market making and peer-to-peer buying and selling throughout time zones, whereas treasuries can automate dividends and governance rights, reducing prices and operational danger.”

Regulatory and Coverage Technique

International frameworks are evolving. The European Fee revealed Markets in Crypto-Belongings (MiCA) texts. Japan’s Monetary Companies Company finalized home guardrails. The U.S. Securities and Alternate Fee additionally issued KPI-disclosure steerage. Watanabe framed Startale’s infrastructure as compliant by design. Consequently, he argued that Japan can function a mannequin for balancing innovation with belief.

“We had been early supporters of Japan’s Cost Companies Act and the Monetary Devices and Alternate Act as a result of they supply a transparent framework that balances innovation with belief. Our job is to make sure our infrastructure meets not solely Japan’s requirements but additionally MiCA, SEC steerage, and different world guidelines. Finally, our aim is for Japan to reveal that Web3 may be each revolutionary and compliant—setting the usual for world adoption.”

Watanabe’s remarks painting Soneium as a Layer-2 designed for enterprises below Japan’s regulatory readability and supported by institutional partnerships. The technique emphasizes distribution channels, entertainment-driven demand, phased decentralization, and market safeguards. For traders and enterprises, the check is whether or not headline development converts into sturdy adoption—and whether or not Japan’s framework can credibly function a template for world tokenization.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024