Policy & Regulation

South Korean Court Issues Crucial Ruling on Exchange Difficulty

Credit : cryptonews.net

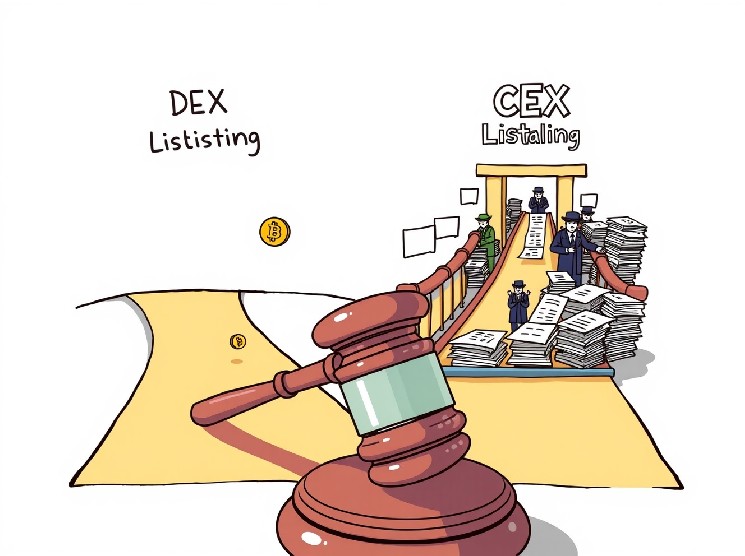

The world of cryptocurrency is continually evolving and brings new authorized precedents and clarifications. A latest milestone resolution of a South Korean Court docket has given essential perception into the assorted challenges concerned in Dex CEX checklist. This assertion formally acknowledges the numerous distinction in issue between getting a token acknowledged on a decentralized Alternate (DEX) versus a centralized change (CEX), a distinction that may deeply affect how tasks method their market entry and contractual similarities.

Why is DEX CEX checklist so completely different? Perception into the core distribution

Perception into the angle of the courtroom requires an additional consideration of the basic operational fashions of those two major forms of cryptocurrency exchanges. The ruling of the South Korean courtroom underlines that the trial for one Dex CEX checklist varies dramatically, primarily due to their underlying buildings and regulatory environments.

On the one hand, centralized festivals (CEXS) act as gatekeepers within the crypto world. They work with strict compliance with the laws, intensive due diligence and infrequently demand a protracted, rigorous evaluation course of for every token that’s searching for an inventory. This intensive analysis often contains assessing the legitimacy of the venture, technological innovation, the credibility of the event crew, market potential and compliance with numerous authorized frameworks.

Conversely, decentralized exchanges (DEXS) on an authorizationless mannequin. Which means that virtually everybody can provoke the commerce for a token by merely creating a sensible contract and organising a liquidity pool. This design inherent removes the necessity for the approval of a government, which implies that the accession threshold is significantly decrease and the method rather more accessible for brand new tokens.

The definitive perspective of the Seoul Court docket in comparison with Dex CEX -list necessities

The precise case that this introduced essential distinction to mild included a dispute over a efficiency bonus linked to a cryptocurrency checklist contract. A plaintiff argued that the point out of a carbon credit score -coupled token on a dex met a contractual requirement for an “abroad change” checklist.

They sought a considerable fee of six million tokens and believed that their actions had reached the circumstances of the settlement. Nevertheless, the thirty third division of the civil instances of the Central Court docket of Seoul, on 4 September, has indicated a definitive judgment that this interpretation challenged.

The courtroom has positively rejected the claimant’s declare. It explicitly emphasised that the comfort of making a sensible contract and organising a liquidity pool on a Dex can’t be equated with the strict, versatile evaluation course of required by a CEX. This historic assertion is a transparent precedent for the way “change checklist” may be interpreted in future contractual agreements, particularly regarding Dex CEX checklist circumstances and their accompanying rewards.

What are the far-reaching implications for crypto tasks and contracts?

This ruling of the South Korean courtroom has a substantial weight for cryptocurrency tasks, builders and traders, not solely domestically, however within the international blockchain eco system. It underlines the essential significance of clear, exact language in any contracts with regard to token lists and efficiency statistics.

Crucial assortment eating places and usable insights for the trade embody:

- Improved contractual readability: Future agreements should explicitly decide whether or not a “point out” particularly refers to a CEX, a Dex or each. Ambiguity, as on this case, can result in expensive and time -consuming authorized disputes.

- Strategic checklist planning: Tasks which might be geared toward broader market assumption and noticed legitimacy can nonetheless give precedence to CEX statements, regardless of their increased entry barrier. DEX, nevertheless, stay a useful preliminary step for figuring out early liquidity and group involvement.

- Refined traders: Buyers and institutional gamers are prone to regard CEX listings as a stronger validation of credibility, stability of a venture, the steadiness and viability in the long run, given the rigorous analysis course of. This may have an effect on funding selections and venture valuations.

- Common management: The ruling emphasizes the growing authorized and regulatory management of the crypto area and insists on extra outlined phrases and tasks for all members.

Finally, the ruling provides a sturdy authorized framework that clearly separates the 2 forms of provides, which influences the best way through which efficiency bonuses, inventory releases and different contractual obligations are linked Dex CEX checklist are considered and maintained.

Navigate by means of the way forward for DEX CEX checklist: a brand new normal?

The choice of the Central Court docket of the Central Court docket is extra than simply an opinion in a single case; It represents a basic clarification for all the crypto ecosystem. By formally recognizing the big inequality in issue Dex CEX checklistThe courtroom has given the a lot wanted authorized precedent that the trade should contemplate.

This assertion stimulates larger precision and accountability in authorized and enterprise transactions inside the blockchain area. It serves as a strong reminiscence that though decentralization provides unimaginable accessibility and innovation, the trail to common acceptance usually implies that navigating by means of the stricter necessities of conventional monetary gateways.

Cryptocurrency tasks and stakeholders should now rigorously contemplate this distinction when drawing up contracts, setting developmental mile poles and strategizing their presence in the marketplace. This resolution determines a brand new normal for understanding the worth and energy associated to various kinds of change lists.

Often requested questions (continuously requested questions)

V1: What’s an important distinction between a Dex and a CEX, in keeping with the courtroom’s resolution?

A1: The courtroom dominated that CEXs require a rigorous evaluation course of for token reliefs, with intensive due diligence and compliance. Dexs, then again, permits DEXs to simply begin commerce by creating a sensible contract and liquidity pool, making the itemizing course of significantly simpler and permissionless.

V2: Why do the South Korean courtroom prepare that Dex -listings are simpler?

A2: The courtroom’s reasoning was based mostly on the operational fashions. CEXS has central authorities which might be decentralized, whereas DEXS is decentralized, so that somebody can point out tokens with out approval, just by organising the required good contracts and liquidity.

V3: How does this assertion affect cryptocurrency venture contracts?

A3: This assertion emphasizes the necessity for excessive readability in contracts. Agreements involving token lists should explicitly state whether or not a “point out” refers to a CEX, a Dex or each, to forestall future authorized disputes about efficiency bonuses or different obligations.

V4: Does a DEX checklist provide the identical advantages as a CEX checklist?

A4: Though DEX lists provide accessibility and early liquidity, CEX listings usually provide a broader market vary, elevated investor confidence attributable to rigorous management and noticed legitimity. The courtroom’s resolution means that they aren’t equal when it comes to the hassle and validation that they signify.

V5: Is it all the time higher to say on a CEX than a Dex?

A5: Not obligatory. The “higher” possibility depends upon the targets of a venture. Dex’s are wonderful for tasks at an early stage which might be searching for instant liquidity and group involvement. CEXs are sometimes most well-liked for tasks geared toward mainstream acceptance, institutional investments and better visibility, regardless of the tougher Dex CEX checklist course of.

Was this text helpful in understanding the essential distinctions in cryptocurrency change lists? Share your ideas and this text together with your community on social media to maintain the dialog going and to tell others about these important authorized developments within the crypto world!

For extra details about the most recent explorations of our article about necessary developments that form Cryptocurrency change Worth promotion.

Safeguard: The data supplied shouldn’t be commerce recommendation, bitcoinworld.co.in is not any legal responsibility for investments made on the premise of the data supplied on this web page. We strongly suggest unbiased analysis and/or session with a professional skilled earlier than we make funding selections.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024