The crypto market is regaining momentum as the worth of Bitcoin (BTC) nears $107,000, whereas high altcoins corresponding to Ethereum (ETH), Solana (SOL) and Avalanche (AVAX) are displaying regular recoveries after current pullbacks. Market sentiment is popping optimistic, supported by renewed institutional curiosity and rising exercise within the chain.

On the identical time, the full stablecoin provide has surged to a document, indicating that there’s a large quantity of sidelined liquidity ready to be deployed. Traditionally, such development in stablecoin reserves has preceded main rallies in Bitcoin, DeFi tokens, and the broader altcoin market, suggesting that the following huge crypto uptrend might be approaching.

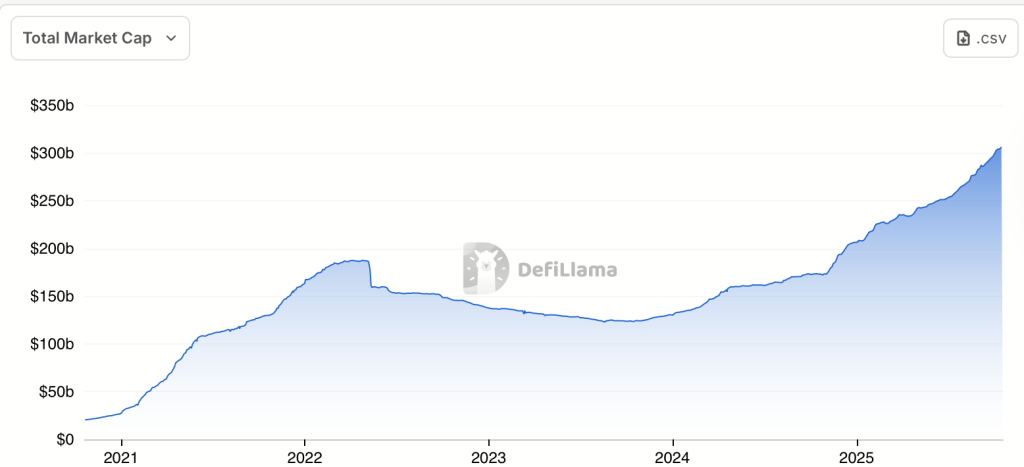

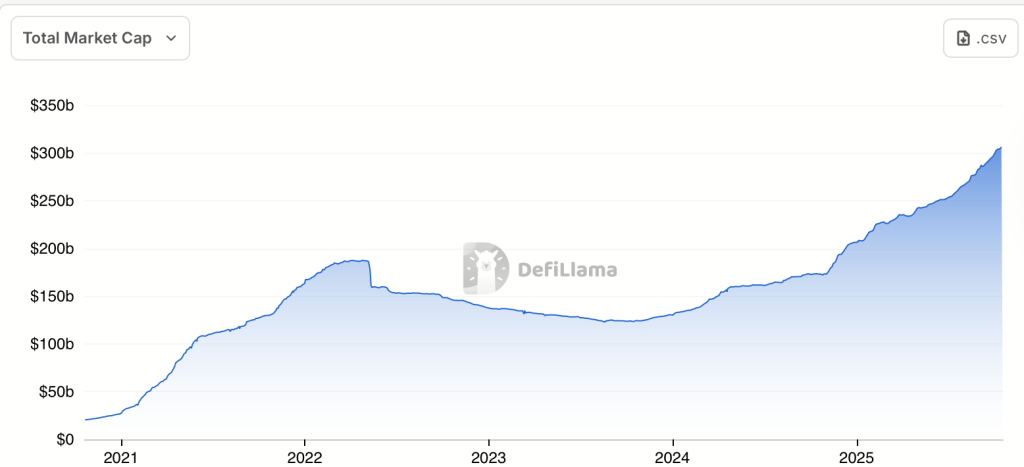

Stablecoin provide reaches a document $304.5 billion

The full provide of stablecoins has risen to a document excessive of $304.5 billion, indicating a serious liquidity build-up within the crypto ecosystem. This large quantity of unused capital signifies rising investor confidence and willingness to reallocate funds into high-return crypto alternatives. Stablecoins, pegged to the US greenback, proceed to function the spine of the crypto financial system, offering stability, seamless transfers and entry to decentralized markets.

Rising market capitalization for stablecoins usually precedes main market actions. It means that traders are gathering dry powder, ready for the proper time to enter the Bitcoin (BTC), Ethereum (ETH) and altcoin markets. Analysts word that such giant reserves are inclined to generate bullish momentum within the broader digital asset sector as soon as they’re reinvested in dangerous belongings or return-generating protocols.

DeFi and tokenization: the following huge locations

Consultants consider that the following huge wave of liquidity might culminate in Decentralized Finance (DeFi) and tokenized real-world belongings (RWAs).

- DeFi developmentLending platforms, decentralized exchanges and yield farms proceed to draw stablecoin inflows searching for actual return alternatives. Enhanced safety and institutional-grade protocols additional legitimize DeFi as a core monetary layer.

- Tokenization wave: Actual-world belongings corresponding to bonds, authorities bonds and actual property are introduced into the chain. Monetary giants corresponding to BlackRock and Customary Chartered are already experimenting with blockchain-based settlements, utilizing stablecoins as the first medium.

A bullish sign for Bitcoin and DeFi

A number of catalysts might gasoline this large liquidity pool – together with regulatory readability, institutional adoption and macroeconomic shifts pushing capital up the chain. A positive coverage transfer or a serious monetary establishment integrating stablecoin funds might set off the following crypto liquidity tremendous cycle.

The record-breaking $304.5 billion in stablecoins is not simply sidelined cash, it is also gasoline for the following huge crypto enlargement. With DeFi, RWAs, and blockchain adoption accelerating, this liquidity might shortly move again into the market, doubtlessly sending Bitcoin, Ethereum, and DeFi tokens hovering to new highs.