Adoption

Stablecoin usage surges in Latin America amid continued struggle with high inflation

Credit : cryptoslate.com

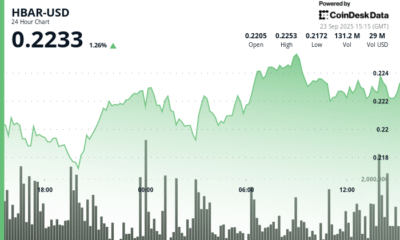

Stablecoins like USDT have turn into an essential monetary software in Latin America, serving to residents address continued financial volatility, in line with international adoption of Chainalysis report.

The area, which accounts for 9.1% of world crypto worth acquired, noticed substantial development this 12 months, largely pushed by rising institutional curiosity and client adoption of digital belongings.

From July 2023 to June 2024, Latin America acquired practically $415 billion in crypto, placing it barely forward of East Asia in international crypto exercise regardless of decrease adoption charges.

Argentina led the area with $91.1 billion in crypto worth acquired, carefully adopted by Brazil’s $90.3 billion. Brazil has seen renewed institutional exercise, with a 48.4% enhance in high-quality transactions between the fourth quarter of 2023 and the primary quarter of 2024.

USD-pegged stablecoins particularly have performed a central position in offering safety towards inflation in international locations reminiscent of Argentina and Brazil, the place native currencies have depreciated sharply.

Monetary stability

Stablecoins have turn into a lifeline for residents in international locations combating financial instability. In Argentina, inflation rose to 143% in 2023, inflicting many to search for options to guard their financial savings towards the devaluation of the Argentine peso (ARS).

The report famous that using stablecoins boomed, particularly within the wake of newly elected President Javier Milei’s financial “shock remedy” measures, which devalued the ARS by 50%.

Information from Bitso, a number one regional change, exhibits that stablecoin buying and selling volumes skyrocketed following main financial occasions. For instance, when the ARS fell under $0.002 in December 2023, stablecoin buying and selling volumes exceeded $10 million the next month.

Argentina’s dependence on stablecoins is additional mirrored in its 61.8% share of stablecoin transaction quantity within the area, surpassing Brazil’s 59.8% and the worldwide common of 44.7%.

Institutional exercise

In the meantime, Brazil has seen a big rebound in institutional crypto exercise after a short lived decline in early 2023.

In accordance with the Chainalysis report, the nation witnessed a 29.2% enhance in institutional-sized transactions – these above $1 million – between the final two quarters of 2023, with an extra 48.4% enhance between the fourth quarter of 2023 and the primary quarter of 2024. .

Consultants attribute this restoration to the SEC’s approval of Bitcoin and Ethereum ETFs in January, which fueled curiosity in digital belongings amongst institutional traders.

The report additionally highlights the involvement of main monetary establishments, together with the arrival of world gamers reminiscent of Circle, which launched its USDC stablecoin in Brazil in Could.

This elevated curiosity is additional supported by Brazil’s progressive regulatory atmosphere, with initiatives such because the Drex pilot program – a central financial institution hybrid digital foreign money (CBDC) platform – attracting international consideration.

As crypto markets in Latin America proceed to develop, stablecoins are poised to play a vital position in offering monetary stability, particularly in international locations experiencing inflation and foreign money devaluation.

Talked about on this article

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024