Bitcoin

Stablecoins Ratio hits 2024 low – Is Bitcoin Ready for $100,000?

Credit : ambcrypto.com

- Bitcoin’s inflow of stablecoins alerts rising buying energy and a possible worth breakout

- A 36% improve in “HODL” conduct of short-term holders strengthens Bitcoin’s upside potential

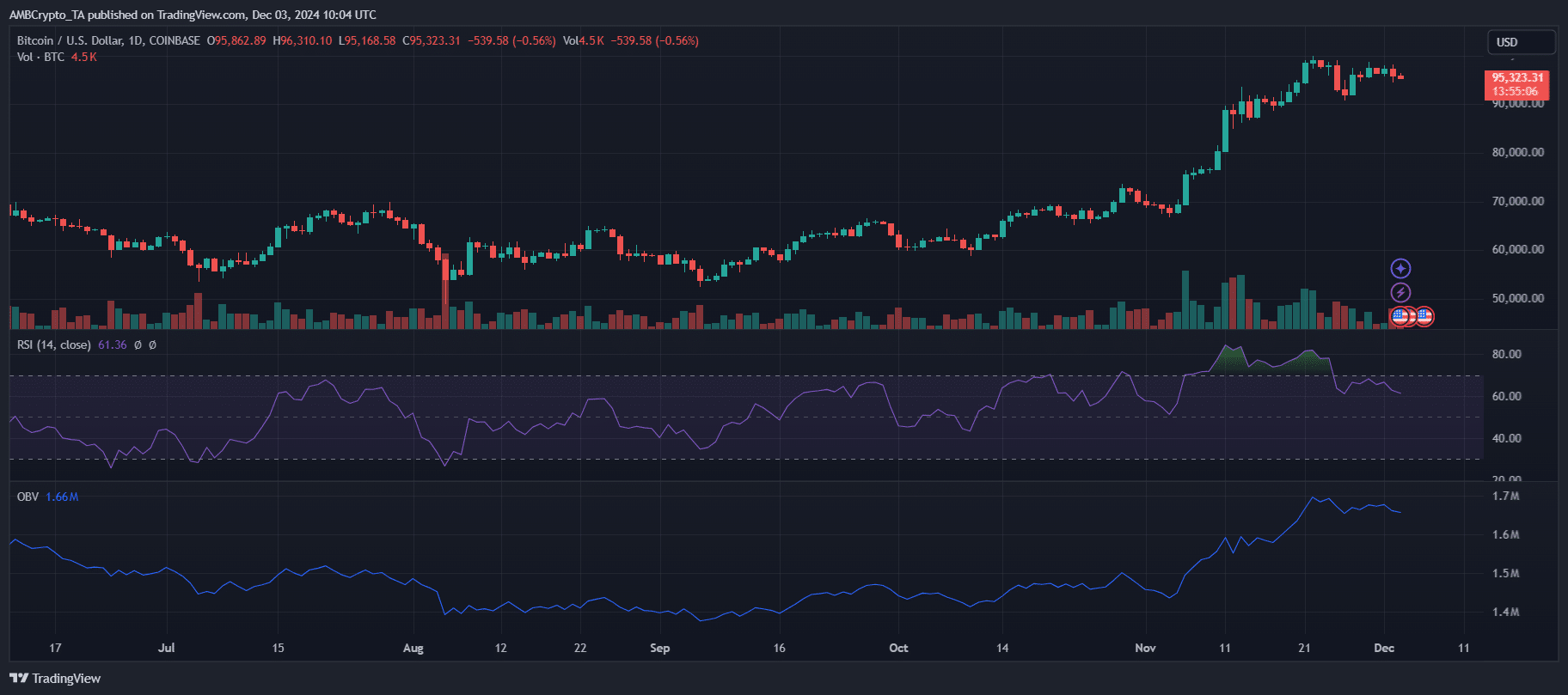

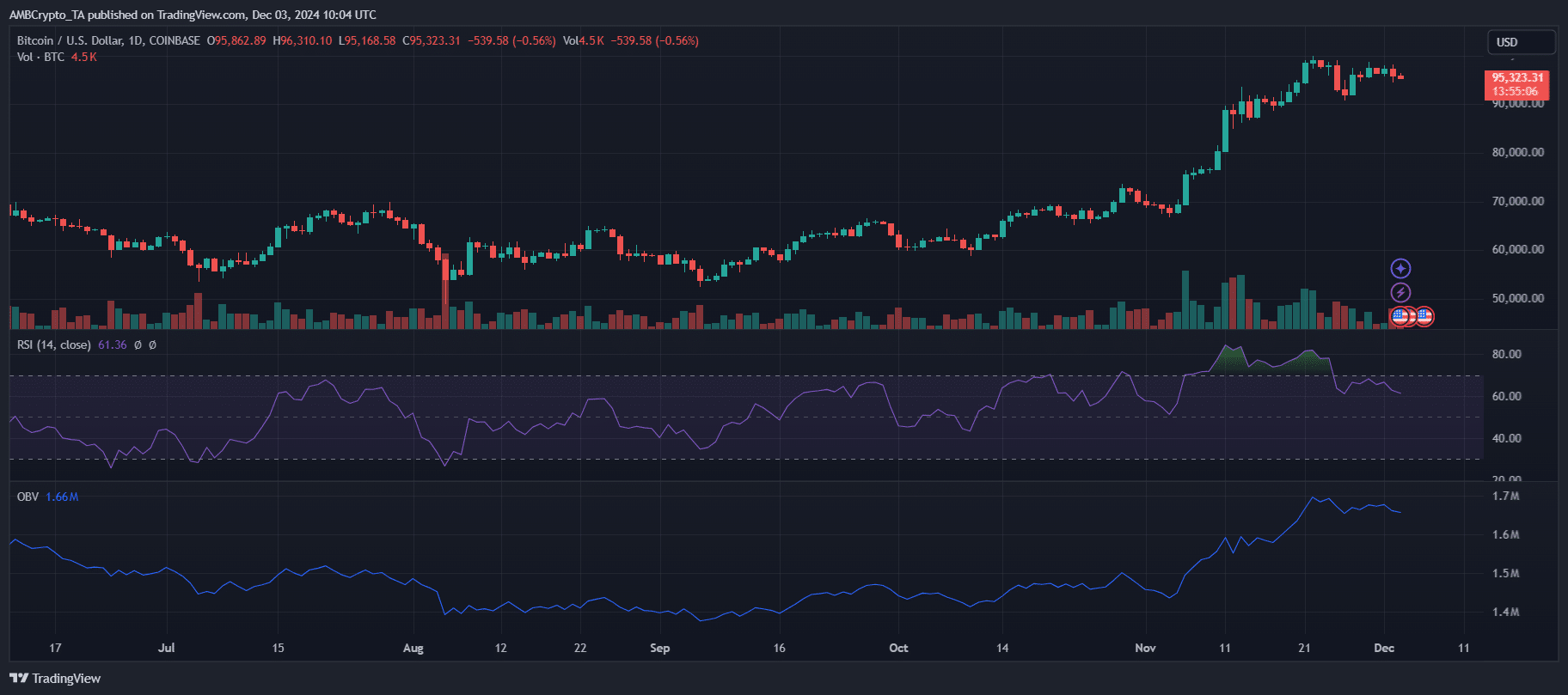

Bitcoin [BTC] not too long ago traded inside a slim vary, with resistance at $98,804 and assist round $94,603. Nonetheless, rising on-chain alerts counsel that the main cryptocurrency could possibly be getting ready for a big upward transfer.

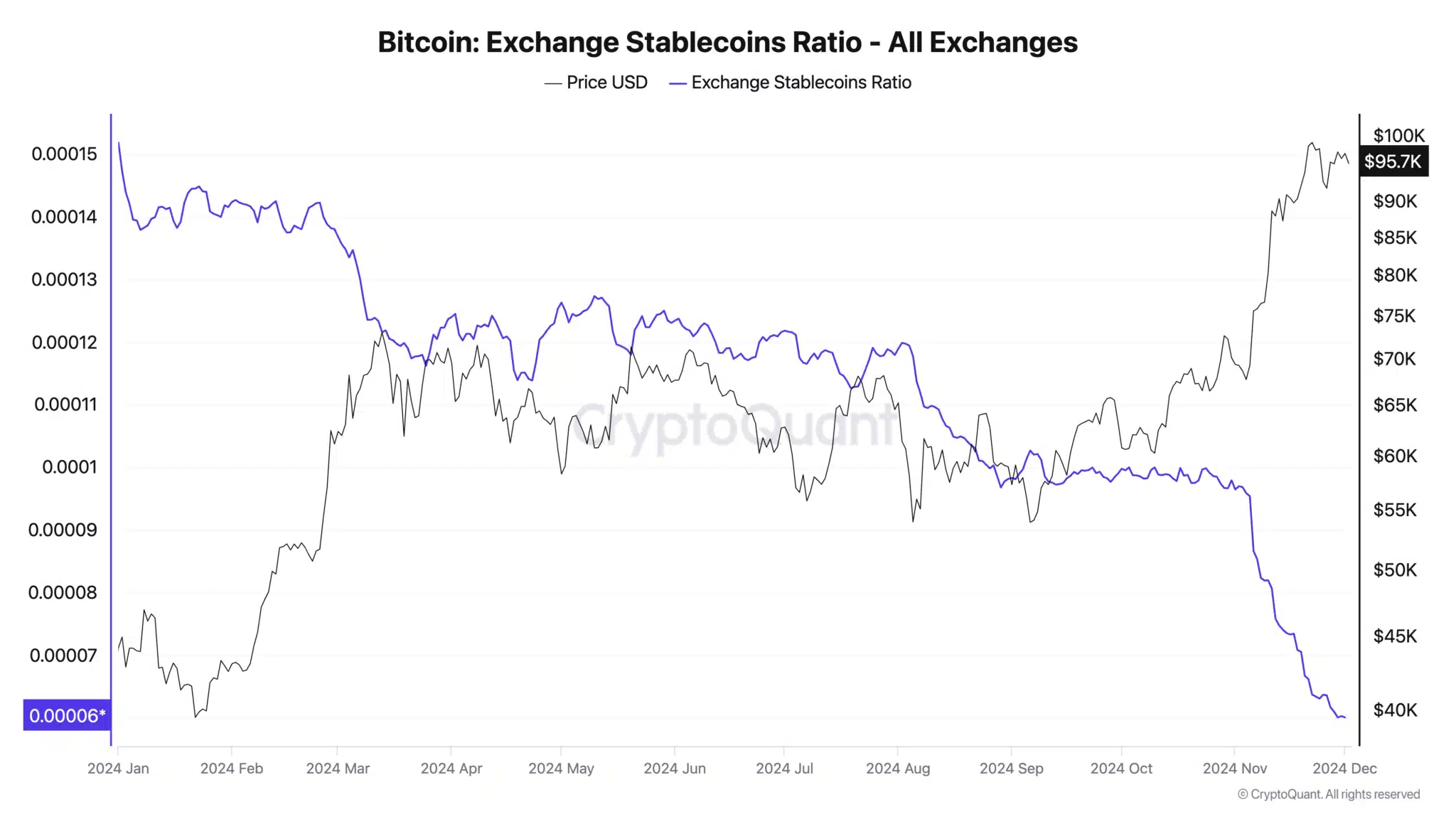

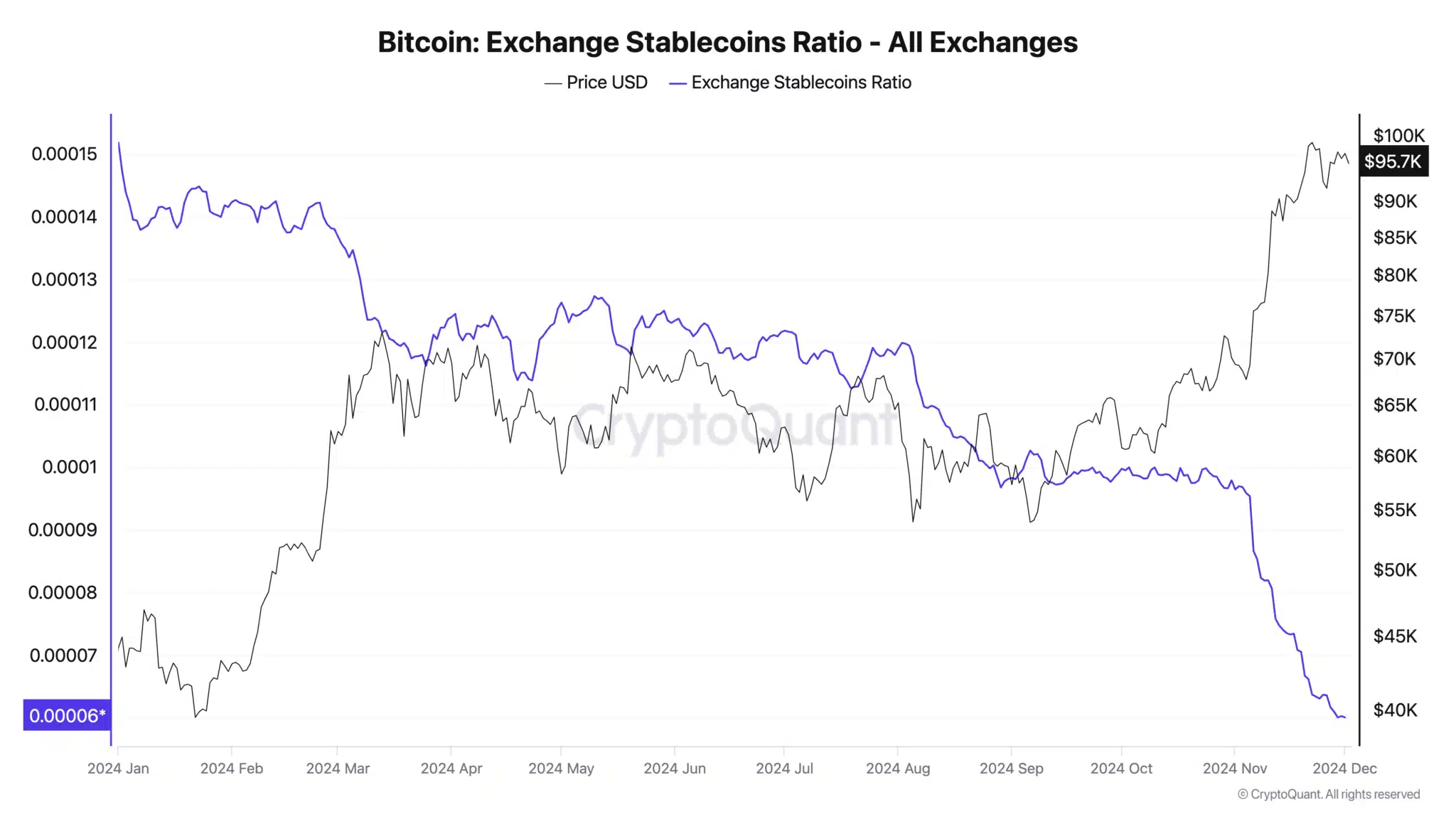

Specifically, the Trade Stablecoins Ratio has seen a pointy decline, indicating a rise in buying energy on the exchanges. This shift in market dynamics has led to hypothesis that Bitcoin could also be poised for a rally, probably breaking the present worth vary and shifting to new highs.

Because the market braces for potential development, investor sentiment is turning into more and more optimistic.

A take a look at BTC’s efficiency

Bitcoin’s current buying and selling vary displays a consolidating market, with the value struggling to interrupt the $98,804 resistance degree whereas assist stays above $94,603.

The every day RSI at 61.41 signifies average bullish momentum, though a transparent breakout sign is lacking. Notably, buying and selling volumes have proven a small decline, indicating that the market is cautiously ready for a decisive transfer.

Supply: TradingView

OBV maintains an upward trajectory, underscoring continued shopping for strain regardless of worth stagnation. This distinction between worth and OBV signifies latent bullish potential.

Furthermore, the decline within the Trade Stablecoins Ratio reinforces this outlook, indicating a build-up of buying energy on the exchanges.

A break of the resistance at $98,804 may catalyze momentum in direction of $100,000, however failure to keep up momentum dangers a return to decrease assist ranges.

Trade stablecoins ratio and hodling impression

The Trade Stablecoins Ratio, which now stands at 0.000060, the bottom degree in 2024, underlines the numerous buying energy on the exchanges. This metric displays the rising provide of stablecoins relative to Bitcoin, indicating that traders are effectively positioned to accumulate BTC.

Traditionally, such circumstances have preceded bullish worth motion as demand exceeds provide.

Supply: CryptoQuant

Furthermore, the rise in hodling conduct amongst Bitcoin holders is a notable issue within the brief time period. Information from CryptoQuant exhibits a 36% improve of their common holding interval over the previous month.

Supply: Into The Block

This reduces direct gross sales strain, promotes shortage in the marketplace and strengthens worth stability.

Collectively, these dynamics – the low Trade Stablecoins Ratio and elevated confidence amongst holders – improve Bitcoin’s potential to interrupt the $98,804 resistance, with $100,000 more and more inside attain.

What are you able to anticipate from Bitcoin?

On the time of writing, Bitcoin was buying and selling at $95,323, barely beneath the important thing resistance degree of $98,804. The inflow of stablecoins on exchanges, mirrored within the low Trade Stablecoins Ratio, signifies vital buying energy that would drive demand.

If short-term holders preserve their ‘HODL’ technique and investor sentiment stays bullish, Bitcoin may overcome this resistance and transfer nearer to the psychological $100,000 mark.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

Nonetheless, any improve in promoting strain may see BTC consolidate inside its present vary or return to the important assist degree at $94,603 earlier than trying one other breakout.

The trajectory of the market depends upon whether or not demand maintains its momentum within the coming classes.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024