Altcoin

Stellar (XLM) Reverses SUI After Up 11% – Charts Its Next Price Target

Credit : ambcrypto.com

- Stellar flipped SUI by market cap after gaining greater than 11% in 24 hours

- XLM’s rally could be attributed to purchasing strain, with the RSI approaching the overbought zone

Stellar (XLM) has fallen over SUI (SUI) by market capitalization after gaining greater than 11% in 24 hours. On the time of writing, XLM, which is now the twelfth largest cryptocurrency with a market cap of $14.21 billion, was buying and selling at a weekly excessive of $0.467.

XLM could possibly be poised for extra beneficial properties as a result of bullish outlook on the decrease timeframe chart. It is a signal that it may attain a multi-week excessive of $0.52 within the close to time period.

XLM sees additional beneficial properties

Stellar shaped a double backside sample on the four-hour chart, indicating {that a} bullish continuation is imminent. The truth is, the essential resistance on the neckline of this sample additionally modified, a sign that the uptrend appeared sturdy.

The following worth goal is now on the 1.618 Fibonacci extension stage ($0.52). This rebound will see XLM declare month-to-month highs.

Quantity histogram bars confirmed that consumers are behind this enhance after shopping for volumes reached $154 million. The Relative Energy Index (RSI) additionally confirmed this, after rising to 71 – an indication that XLM could also be on the verge of being overbought.

(Supply: Handelsview)

The Transferring Common Convergence Divergence (MACD) indicator additionally highlighted bullish momentum. On the time of writing, the MACD line was optimistic and tilted north, highlighting that the bulls have been in management.

Lengthy merchants may derail XLM’s rally

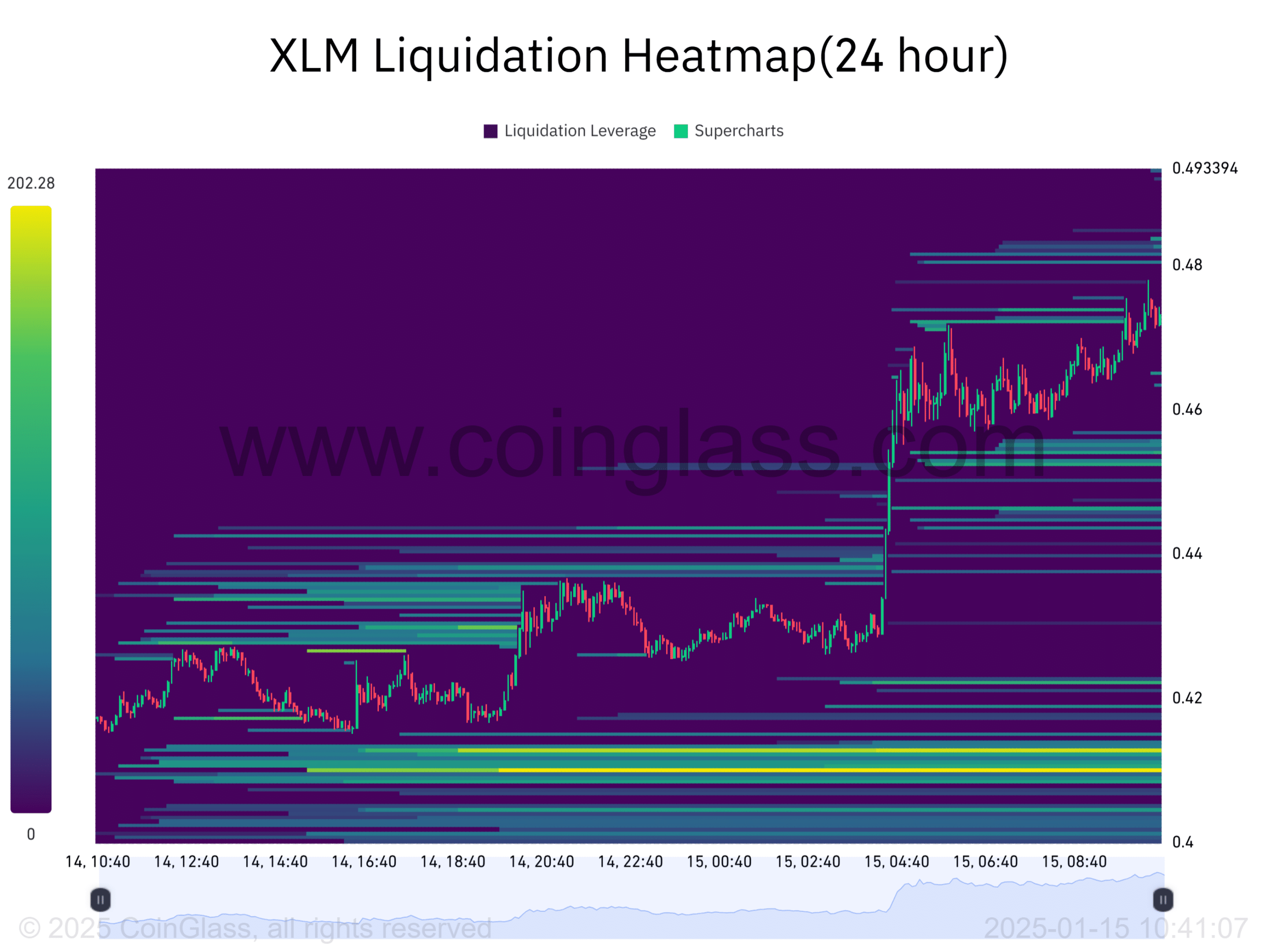

Stellar’s current beneficial properties worn out greater than $1.5 million in brief positions. The liquidations seem to have fueled demand for lengthy positions after financing charges turned optimistic Mint glass. This outlook confirmed that lengthy merchants are actually keen to pay a payment to take care of their positions.

XLM’s liquidation heatmap with a 24-hour lookback interval highlighted these brief liquidations as the worth rose. Nevertheless, there are clusters of liquidation ranges under the worth that may act as magnet zones and pull XLM down.

(Supply: Mint Glass)

The primary liquidation zone to look at is $0.40 – $0.41. Many lengthy merchants are susceptible to being liquidated at this worth stage. If an surprising dip happens, it may possibly trigger a steep downtrend as these merchants start to shut their positions.

Can XLM emerge as a prime ten crypto?

After the newest enhance in market capitalization, XLM is now getting nearer to the turnaround Avalanche (AVAX)whose market capitalization is $15.34 billion. To be among the many prime ten crypto cash, it wants so as to add greater than $5 billion to its market cap to catch up Tron (TRX).

Such an increase may occur as XLM’s market cap rose from about $9.8 billion to $14 billion within the first 5 days of 2025. Nevertheless, these beneficial properties will rely on whether or not Stellar can proceed and keep its upward development.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024