Altcoin

Steno Research – 2025 could be the biggest crypto year yet!

Credit : ambcrypto.com

- The bull run has been attributable to favorable macroeconomic situations, the US presidential elections and rising institutional adoption

- Report claimed that Bitcoin [BTC] might probably rise to $150,000, with Ethereum [ETH] Attain $8,000

The market’s momentum has been growing because the starting of the yr. In actual fact, the full cryptocurrency market capitalization elevated by 4.21% to $3.41 trillion. Buying and selling volumes additionally elevated by 18.20%, with complete valuations reaching $114.86 billion.

Steno Analysis has now recognized this as the primary section of a broader bull cycle. A number of tokens are anticipated to achieve all-time highs, with main belongings comparable to BTC and ETH getting into essential phases of value discovery.

Favorable market situations and the ‘Trump impact’

In line with Shorthand researchA supportive financial atmosphere and the upcoming inauguration of Donald Trump because the forty seventh President of the US, identified for his pro-crypto place, might present a significant increase to the market restoration.

The ‘Trump impact’ was already seen in November 2024, when Bitcoin [BTC] rose to a brand new all-time excessive of $108,000 after his election victory, peaking in December. As discussions round a possible Bitcoin Reserve proceed to achieve traction, this might additional gas the anticipated market rise.

Steno Analysis attributed the anticipated rally to a number of elements, with Bitcoin and Ethereum significantly benefiting [ETH]. The report famous:

“An unprecedentedly favorable regulatory atmosphere for cryptocurrencies, a supportive macroeconomic atmosphere characterised by falling rates of interest and improved liquidity, and Bitcoin’s traditionally robust post-halving efficiency.”

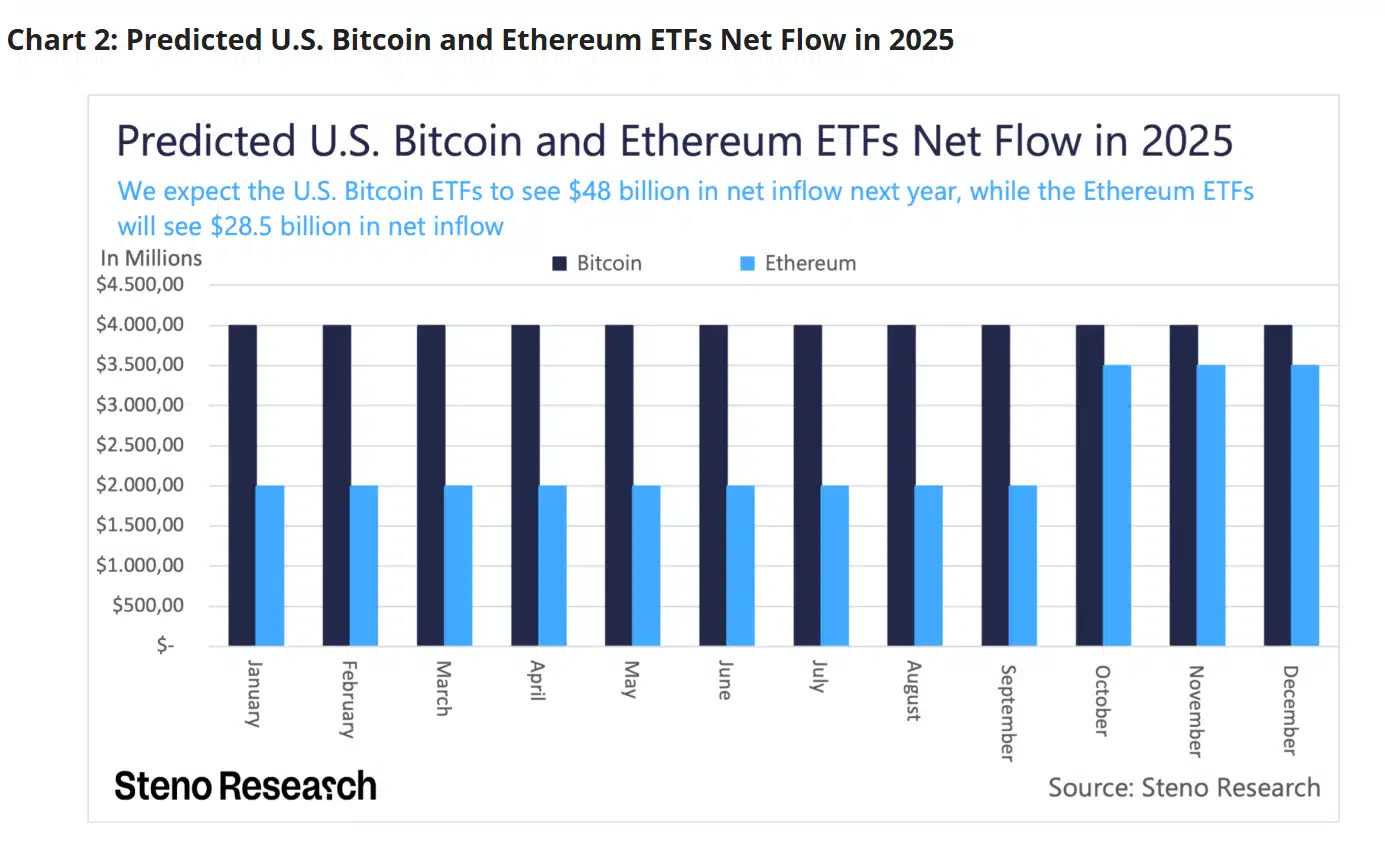

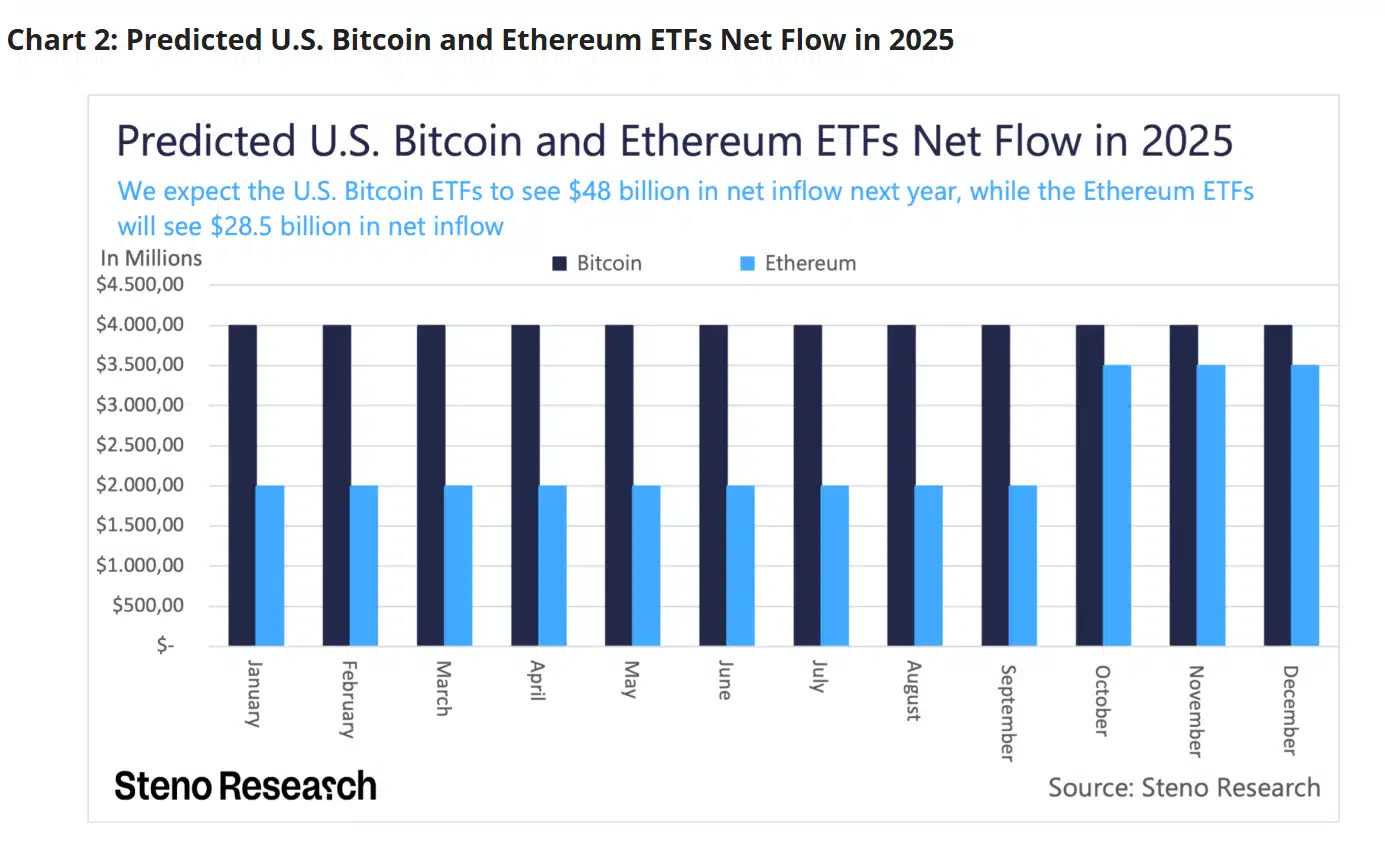

Moreover, Steno predicted that the US-based Bitcoin and Ethereum exchange-traded funds (ETFs) will attain new milestones, with BTC and ETH ETFs anticipated to achieve $48 billion and $28.5 billion in belongings beneath administration, respectively. The higher consciousness amongst institutional buyers of those belongings is anticipated to drive these inflows.

Supply: Steno analysis

“With institutional adoption set to achieve unprecedented ranges, inflows into Bitcoin and Ethereum ETFs will proceed to develop.”

The rise in discuss of ETFs for different tokens might additionally contribute to broader market development, implying an growth past simply the highest two belongings.

BTC, ETH and altcoins poised for vital positive aspects

Steno Analysis additionally claimed that Bitcoin [BTC] and ether [ETH] might put up enormous positive aspects, with BTC anticipated to hit an all-time excessive of $150,000 and ETH to rise to $8,000. These predictions appeared to be associated to elements beforehand outlined.

Steno additionally pointed to a coming altcoin rally, pushed by a rising ETH/BTC ratio and a decline in Bitcoin’s dominance.

Right here it’s price noting that the ETH/BTC ratio measures the worth of Ethereum towards Bitcoin. The next ratio signifies a rising ETH worth and has traditionally preceded altcoin will increase.

Steno predicted that the ETH/BTC ratio will attain “not less than 0.06,” marking the beginning of a broader altcoin run. On the identical time, Bitcoin’s dominance is anticipated to drop to 45%, additional paving the best way for the expansion of altcoins.

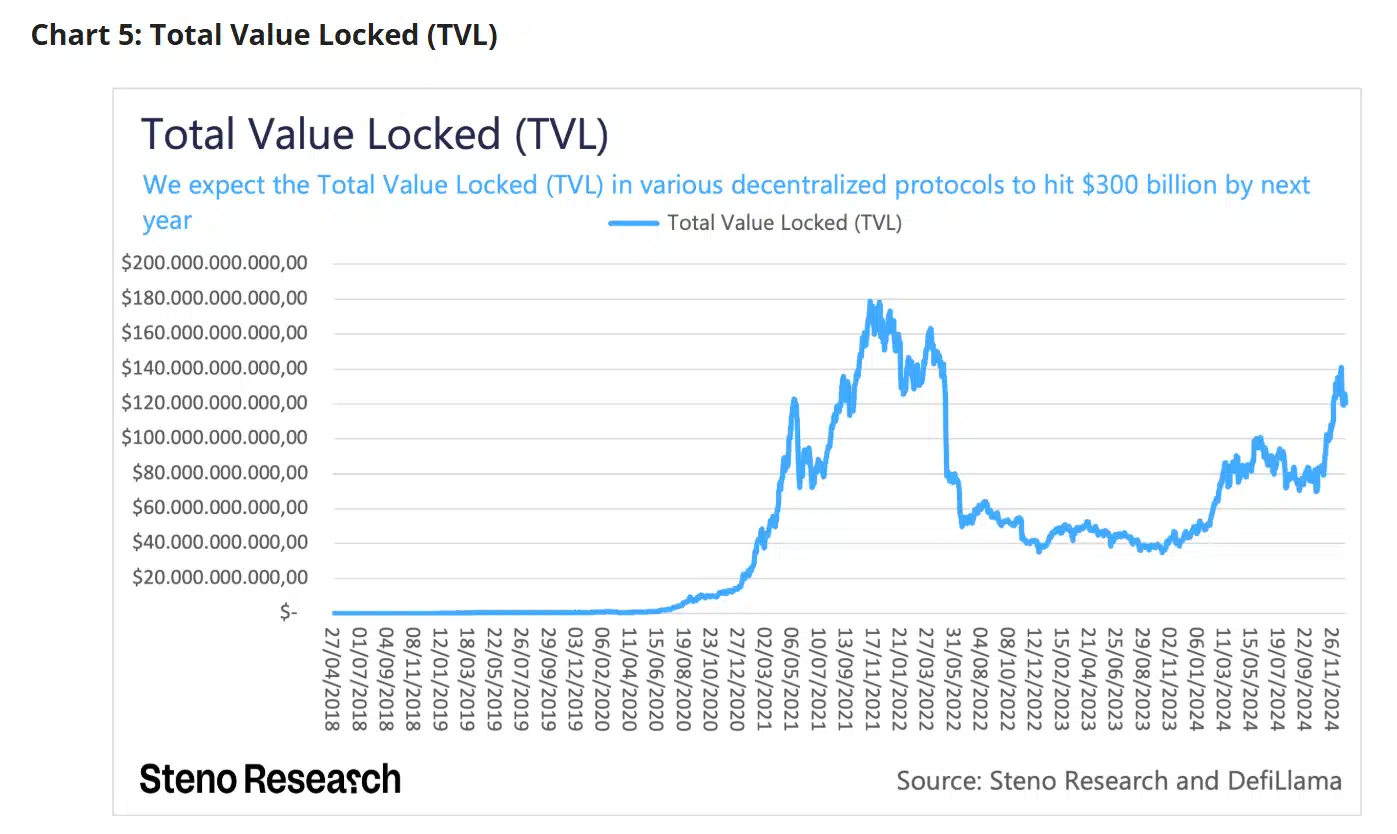

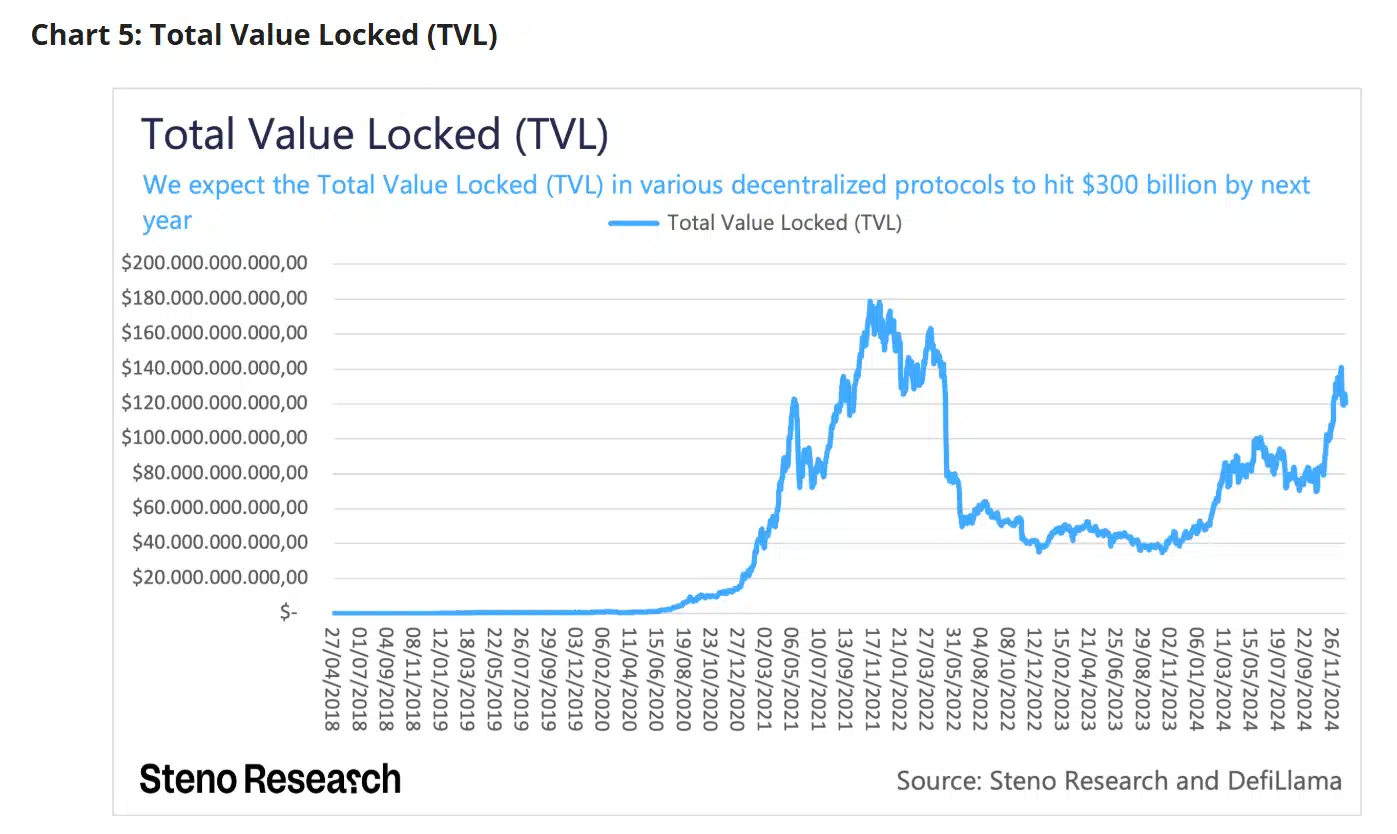

The decentralized finance (DeFi) sector can also be anticipated to flourish. In line with the aforementioned report, the Complete Worth Locked (TVL) for decentralized protocols will rise to $300 billion – practically doubling the earlier file excessive of $180 billion in 2021.

Supply: Steno analysis

This rise in TVL highlights the potential for enormous liquidity inflows into decentralized protocols – a transparent indication of rising confidence within the sector’s long-term prospects.

Market is making ready for a rise in liquidity

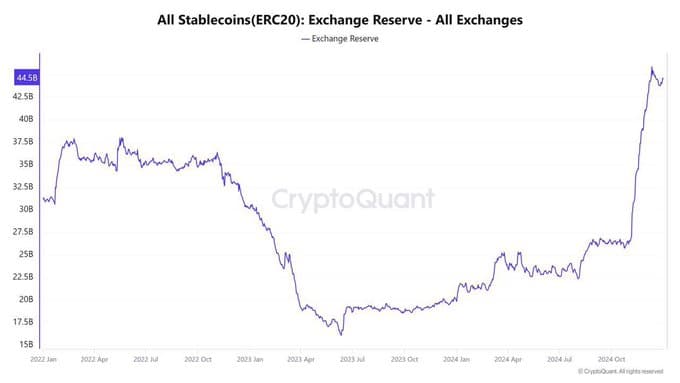

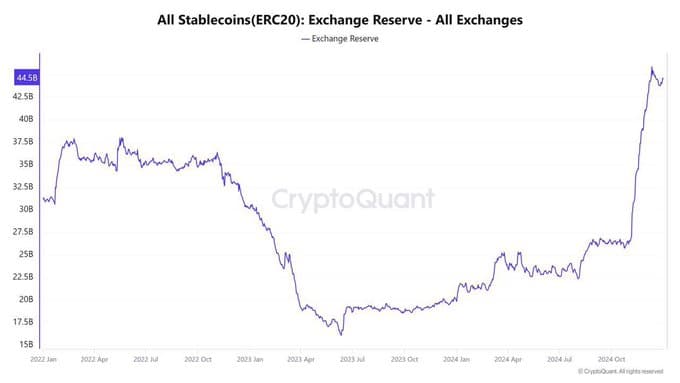

The optimism out there is already taking form, and the identical is mirrored within the enhance within the Stablecoin Alternate Reserves.

In actual fact, Binance’s stablecoin reserves had risen to $44.5 billion as of December 31, 2024, indicating a exceptional liquidity pool able to assist asset purchases that may start at any time.

Supply: CryptoQuant

Traditionally, a rise in stablecoin reserves on exchanges means the market is making ready for a giant transfer – according to the expectations outlined within the Steno report.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now