Web 3

Stockrich Enters the Global Fintech Elite, Officially Launches the Global Asset Link Initiative

Credit : web3wire.org

As world fintech enters a essential section of parallel improvement in intelligence and industrialization, US fintech firm Stockrich is accelerating its emergence as a supplier of underlying infrastructure for world capital markets. The corporate has not solely efficiently entered the primary stage of fintech, but additionally introduced the launch of a strategic venture codenamed ‘World Asset Hyperlink (GAL)’ in Silicon Valley, aiming to construct a future-oriented AI-driven securities contract and sensible collaboration system.

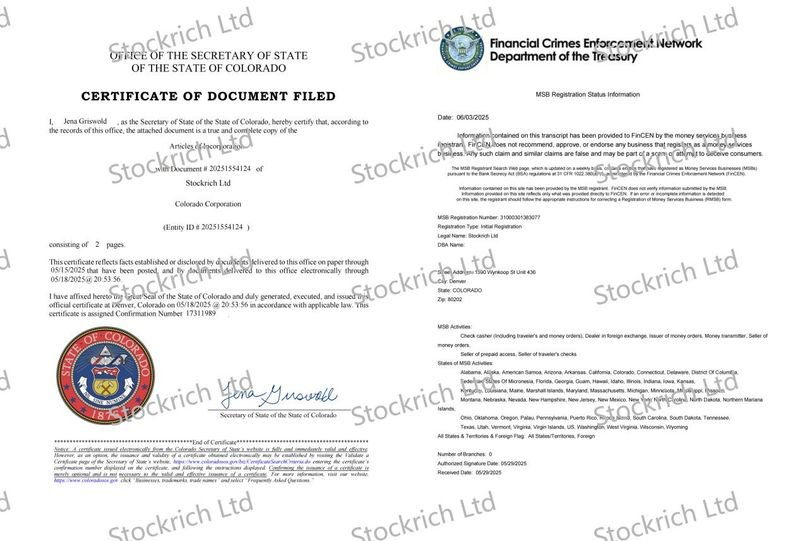

Stockrich is a fintech firm registered in the USA and has each SEC registration approval and FinCEN MSB registration approval for monetary companies. It has additionally initiated compliance entry processes in a number of jurisdictions, together with the EU MiCA and Singapore MAS. Its core positioning is that of an ‘AI-driven fairness contracts infrastructure platform’, geared toward constructing a basic basis for world cross-border capital collaboration.

AI-powered system-level infrastructure: a brand new paradigm for world collaboration

What Stockrich affords shouldn’t be a conventional alternate mannequin, however a full-stack platform that integrates AI algorithms, blockchain contracts and clever danger administration, to assist the execution of securitized property throughout property, areas and currencies. The core modules of the platform embrace:

- · Sigma Inventory Contract Engine: Additionally known as the ‘AWS of fairness contracts’, it helps modular integration with varied markets, brokers, funds and intermediaries, enhancing asset liquidity and enhancing matching effectivity.

- · AI technique engine and dynamic danger administration module: By integrating market volatility components and macro variables, it autonomously adjusts danger publicity and hedging paths to construct adaptive buying and selling habits.

Multi-site regulatory retention and adjustment system: Helps integration with varied monetary regulatory methods to make sure compliance and transparency throughout accounts, funds and techniques.

By way of these methods, Stockrich not solely reconstructs the execution boundaries of world commerce, but additionally promotes the formation of a brand new capital infrastructure round ‘AI + contract finance’.

Launching the World Asset Hyperlink Initiative: 5 Key Junctions for World Structure

At a fintech discussion board in Palo Alto, California, Stockrich formally introduced the launch of the “World Asset Hyperlink Initiative” (GAL), which incorporates three core architectural layers:

- 1. Sigma Good Contract System: Helps the technology of customized contracts, automated matching and hedging.

- 2. Omega Liquidity Community: Connects liquidity swimming pools in key markets in Europe, America and Asia, mechanically routing the optimum channels.

- 3. Delta Threat Management Hub: Embedded with a self-learning danger administration engine primarily based on giant fashions, outfitted with black swan occasion alert capabilities.

The 5 world implementation facilities are positioned in New York, Singapore, Zurich, Dubai and London and canopy key command nodes, regional market entry, personal fairness interfaces and experimental fields for metallic and power asset derivatives.

Compliance, safety and world regulatory coordination

The Stockrich platform has handed a collection of world safety certifications, together with ISO27001, SOC 2 Sort II and FISC (US Nationwide Monetary Info Safety), and has established an end-to-end KYC/AML system. The corporate has additionally utilized to affix worldwide compliance organizations and collaborate on technical testing throughout a number of regulatory sandboxes to advertise the incorporation of “technique evaluation APIs” into regulatory visions, constructing a brand new paradigm of “technology-driven compliance.”

The platform additionally achieves low-cost integration with varied methods comparable to brokers, custodians, asset administration and cost clearing by way of an open API structure, additional cementing its place as a ‘regulatory-friendly buying and selling engine’.

Strategic objective: Lay the inspiration for AI Capital collaboration

Stockrich’s founder acknowledged: “We aren’t constructing a inventory alternate; somewhat, we’re constructing an underlying working system for an clever capital collaboration community.

Going ahead, Stockrich will proceed to concentrate on the next areas:

- · Speed up the acquisition of compliance registration approvals throughout a number of nodes in Asia, the Center East and Europe.

- · Launched an AI model-based portfolio buying and selling engine and technique sharing platform.

- Collaborate with regional regulatory businesses to construct a “regulatory know-how integration testing community.”

- · Establishing a worldwide commonplace system for AI capital cooperation.

Within the overarching development of compliance as the inspiration, AI because the core and globalization as the world, Stockrich is changing into probably the most essential infrastructures for ‘cross-border clever securities cooperation’. Trade analysts consider that its improvement path will function a reference paradigm for future world clever monetary platforms.

Media contact

Contact individual: Candis P. Haag

Firm identify: Stockrich Ltd

Web site: https://stockrich.com/

、

Disclaimer: The data on this press launch shouldn’t be an invite to speculate neither is it meant as funding recommendation, monetary recommendation or buying and selling recommendation. Investing entails dangers, together with the potential lack of capital. It’s extremely really useful that you simply follow due diligence, together with session with knowledgeable monetary advisor, earlier than investing or buying and selling in cryptocurrency and securities. Neither the media platform nor the writer will probably be held accountable for any fraudulent exercise, misrepresentation or monetary loss arising from the content material of this press launch.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024