Policy & Regulation

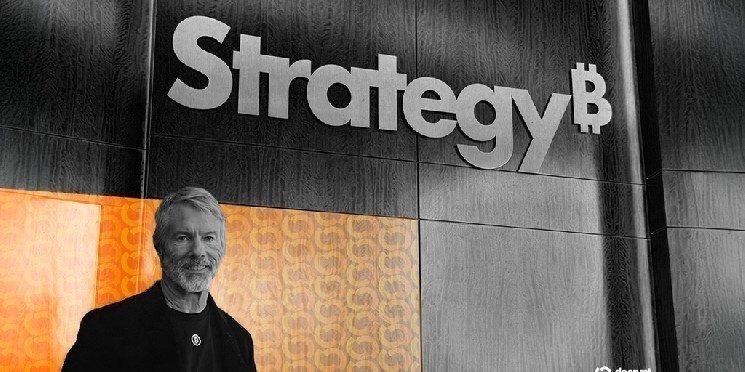

Strategy Investors Drop Lawsuit Over Bitcoin Profitability Promises

Credit : cryptonews.net

Traders in Bitcoin Behemoth technique have rejected a Class-Motion proper case towards the corporate as a result of they reportedly made false and deceptive statements about profitability.

The go well with was Initially submitted in MightThe corporate accusing to show software program improvement to a full-time technique of Bitcoin-accumulation of deceptive traders in regards to the impression that new crypto accounting practices would have on profitability.

This yr is technique, which is presently proudly owning $ 68 billion WORTH of BTC, switched to a accounting customary of the true worth with which the quarterly-to-quarter fluctuations may embrace within the worth of held Bitcoin on the steadiness sheets.

Earlier the corporate took on its bitcoin at unique buy prices; Though it may write down drops within the worth of the token as ‘depreciation’, it couldn’t mark the value raised Except tokens have been bought.

Traders who submitted lawsuits towards technique and its management earlier this yr claimed that the corporate misled them by overestimating the optimistic impression that this new accounting technique would have on the corporate’s profitability.

When the technique introduced a web loss by $ 4.22 billion Within the first quarter of 2025 – regardless of the historic enhance in Bitcoin through the earlier six months – the shaving assets began repulsive.

However on Thursday, claimants in some of the distinguished Authorized instances towards the corporate selected to voluntarily reject their claims. The collectively decided dismissal, submitted to a federal court docket in Oost -Virginia, the place technique relies, was carried out with prejudice – which implies that the claims can’t be made once more in court docket.

Decrypt Reached for the attorneys of the claimants who requested why they’d dropped their claims, or if an association had been reached with technique, however didn’t instantly obtain a response.

In latest weeks, Technique has needed to take care of different criticism of the way it presents its unorthodox enterprise mannequin to shareholders.Earlier this month, a distinguished Wall Avenue advisor overwhelmed The corporate for evaluating its price-gain ratio with Apple and Nvidia-a motion that was “100% fraudulent” stated the adviser, as a result of the latest efficiency of the corporate was powered by a “one-off” rise in Bitcoin, not for enterprise foundations that can in all probability return.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024