Bitcoin

Strategy plans $500M preferred stock sale to fund Bitcoin buys – Details

Credit : ambcrypto.com

- Technique eyes $ 500 million enhance in inventory gross sales for BTC acquisition.

- The replace of the corporate aroused blended views from the crypto group.

On March 18, Michael Saylor, founding father of Technique (previously Micro Technique), introduced one plan To promote $ 500 million in new ‘perpetual most popular inventory’ (STRF) Bitcoin [BTC] buys.

Lately the corporate had issued a special most popular provide ‘STRK’ for related BTC aims.

This was a part of that of the corporate purpose To select up $ 21 billion by way of share situation and one other $ 21 billion as a result of money owed (convertible notes) for BTC purchases.

Combined views on the plans of the technique

Make clear the distinction between the brand new class of the technique of inventory situation, Bitwise’s head Alpha, Jeff Park, said”

“You should purchase Strk right this moment for a yield of 9.4% with upward convertibility or STRF for a return of 10% with just about no curiosity perform.”

Merely put, Strk will be exchanged for MSTR, however STRF doesn’t have such a perform and entails extra danger.

Nonetheless, some members of the crypto group regarded the ‘excessive leverage’ of Technique as a danger issue for your complete BTC market. One pseudonymous market analyst, Wazz Crypto, stated”

“This ID*OT is at the moment making Bitcoin uninvestable. Can it even be extra digital gold whether it is sure by the solvency of a single firm?”

One other consumer, Simon Dixon, referred to as it a ‘on the subsequent stage danger’ {that a} save could require if it goes down.

“The announcement of technique of a perpetual dividend of 10% paid in {dollars}, based on the dearth of enough greenback earnings and dealing with a Bitcoin-based stability is liable to the following stage.”

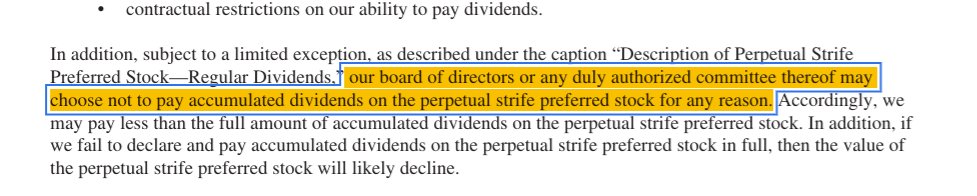

BitMex analysis clarifying That the corporate can stop the dividends of MSTR and STRF holders from paying.

“It appears that evidently $ mstr can stop these dividends from 10% to 18%” to be paid “for no matter purpose.” The seemingly outcome right here is that class A $ mstr shareholders by no means get a dividend fee. “

Supply: X

For his half, BTC critic Peter Schiff talked about the brand new situation of shares ‘ridiculous’ and added”

“The one factor that totally displays (BTC) is the assist of the Trump administration. As quickly as that goes, it is throughout for Bitcoin and $ mstr.”

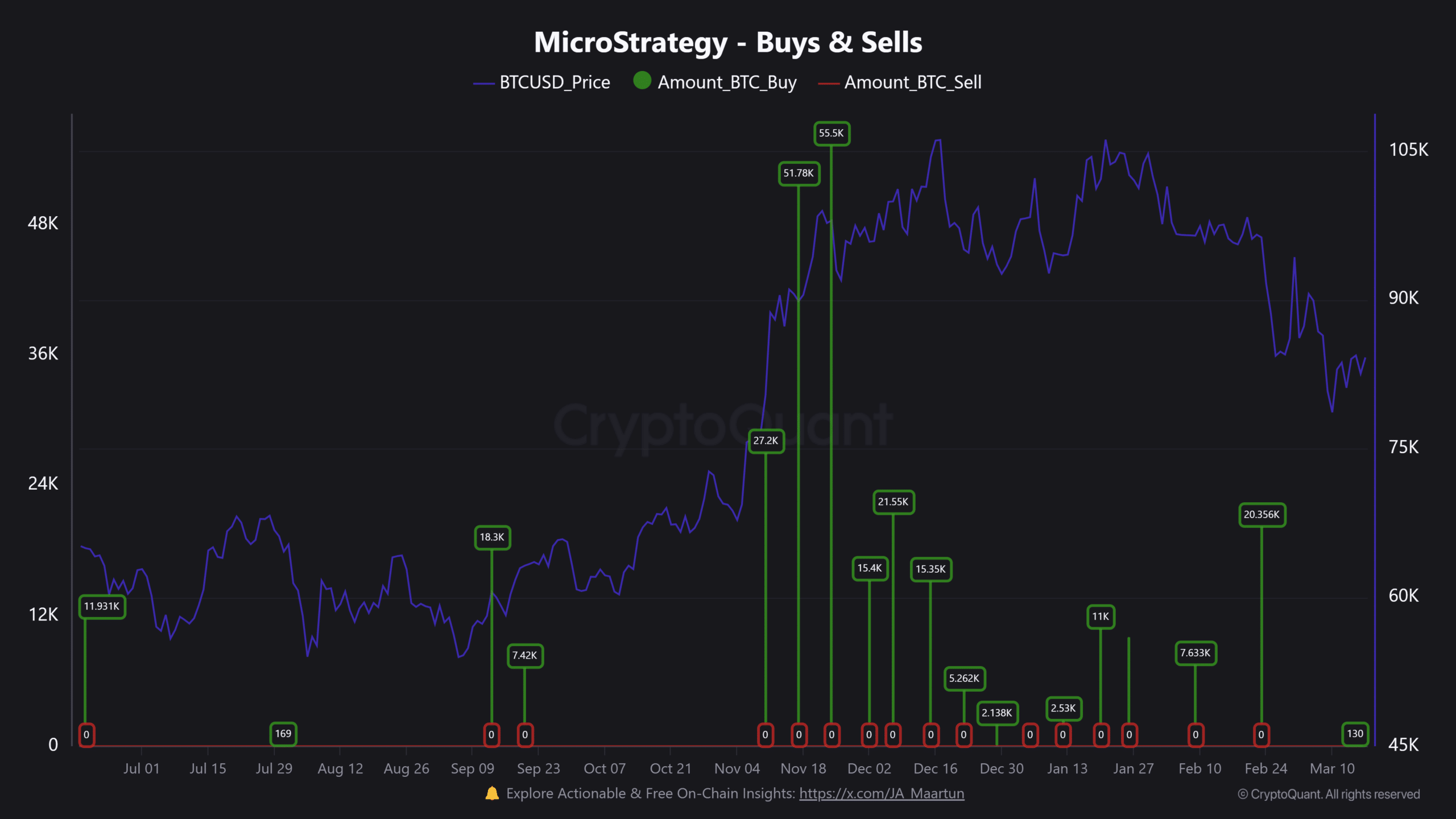

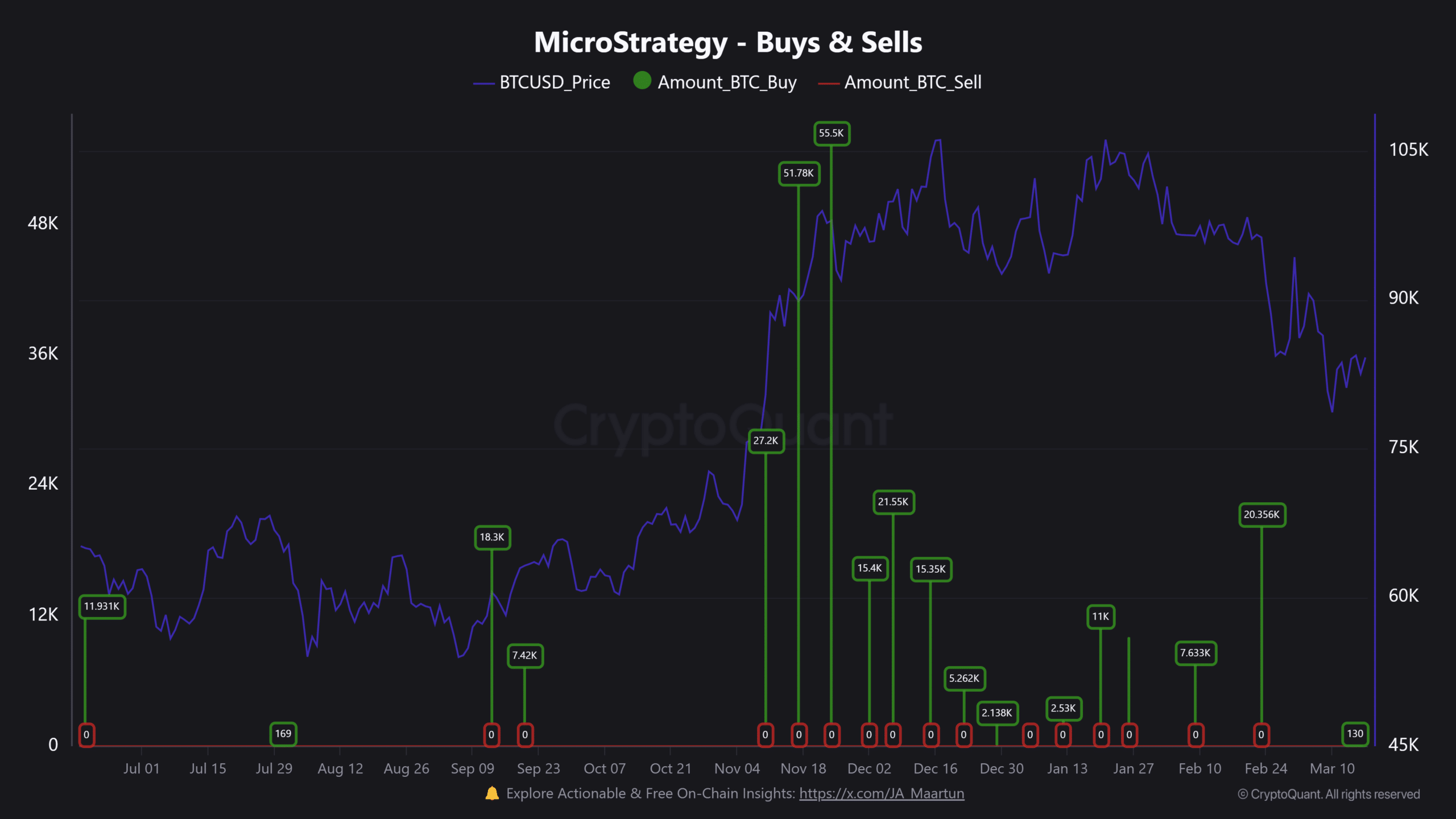

Compared with the final quarter, the BTC buy tempo of the corporate was delayed in 2025. On March 16 it purchased 130 BTC, which elevated its inventory to 499,226 cash – a verify of two.3% of the entire BTC provide.

Supply: Cryptuquant

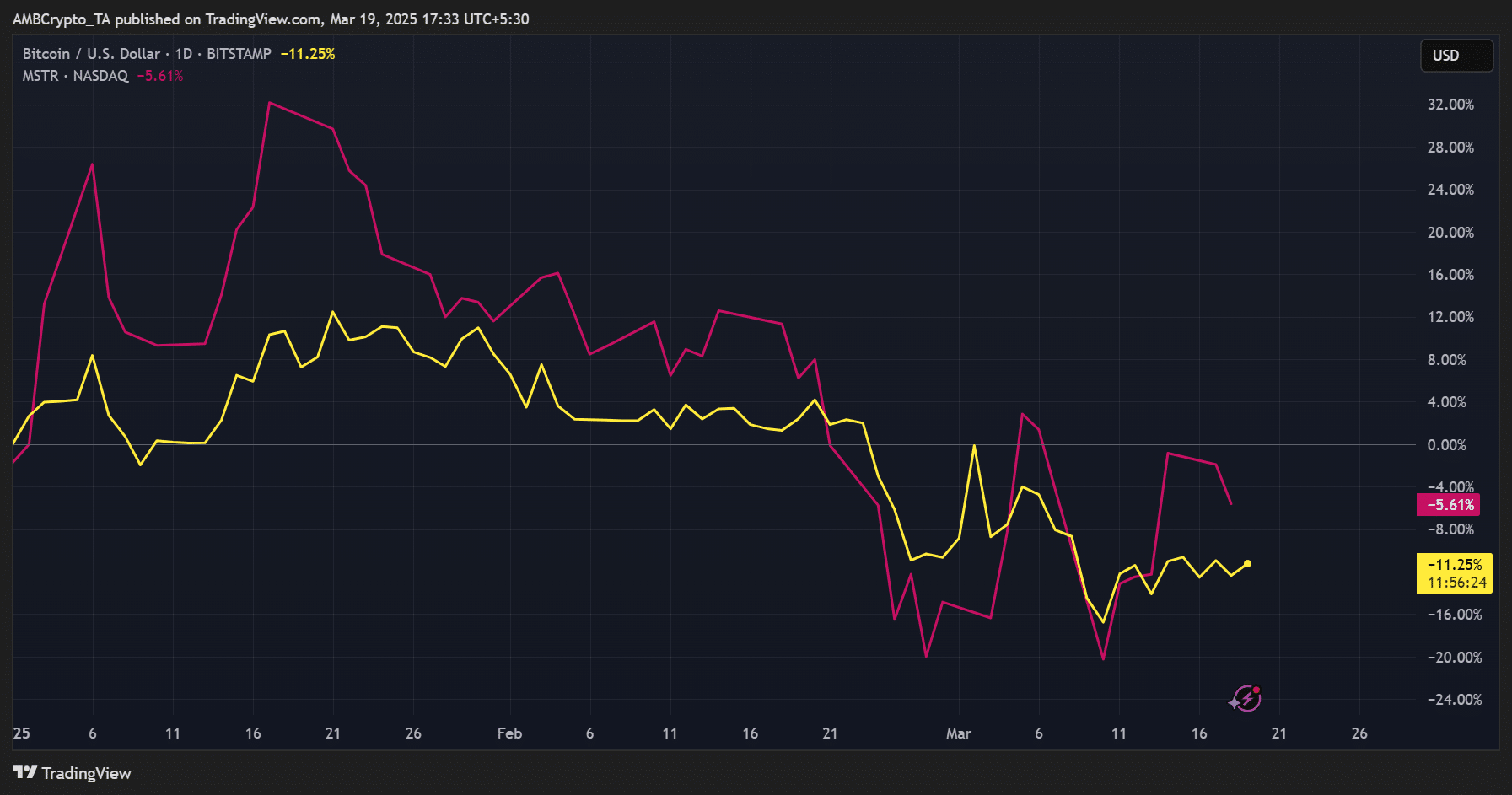

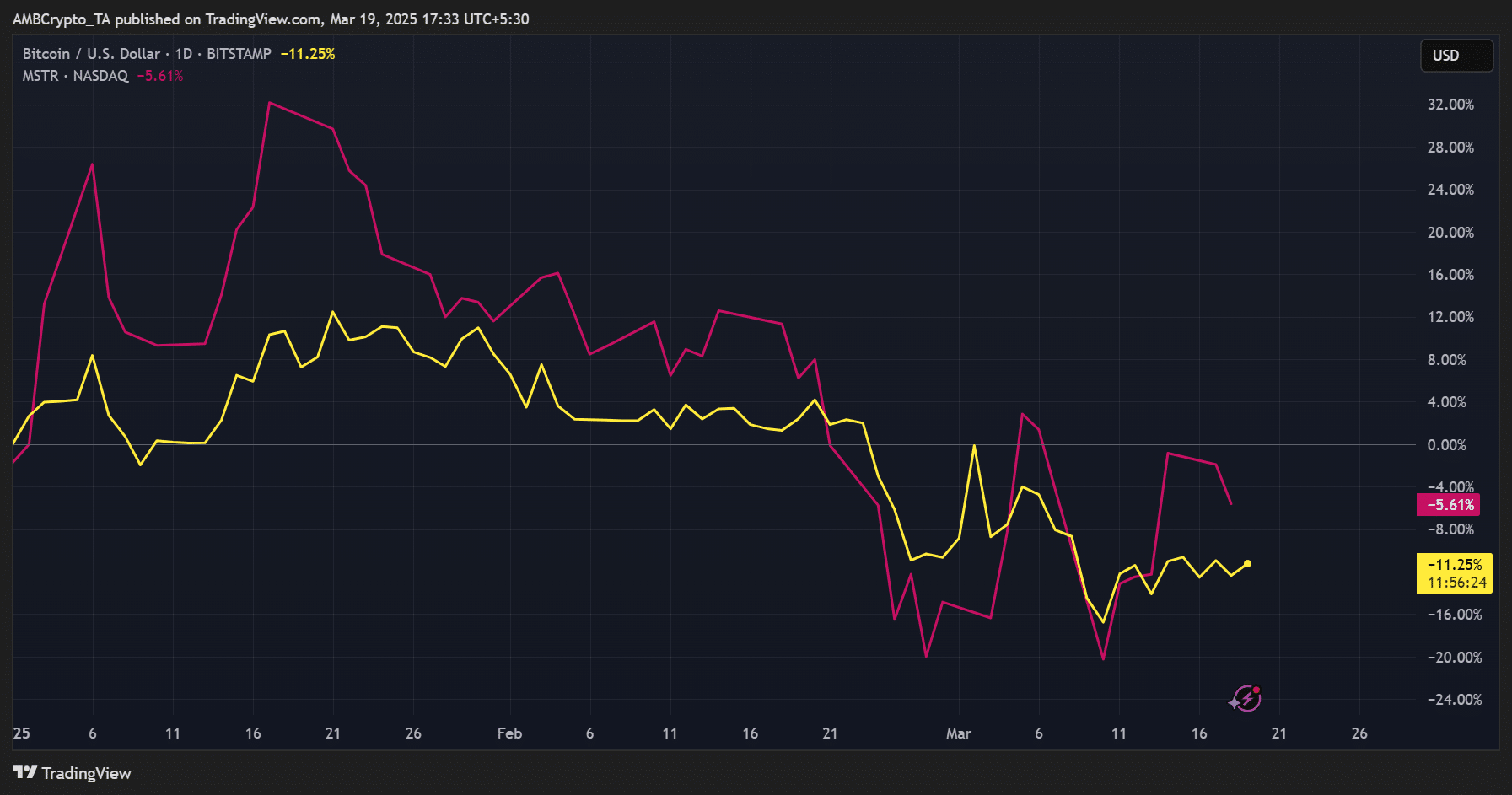

From this letter, MSTR was appreciated at $ 282, with 48% a lower in comparison with its current highlights of $ 543, after current BTC losses. Prior to now two weeks it fluctuated between $ 230 and $ 300 as a result of BTC remained under $ 90k in the identical interval.

On a year-to-date (YTD) efficiency, MSTREN stored the risk-off sentiment higher and solely fell 5% in comparison with the autumn in BTC from 11%.

Supply: MSTR vs BTC, TradingView

Final week MSTR made a revenue of 26%, as a result of BTC has re -tested $ 85k, which means that the share might submit a robust restoration if the cryptocurrency reversed its losses.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024