Altcoin

STX and Bitcoin: Correlation of 0.86 Indicates Big Moves – Next $4 Rally?

Credit : ambcrypto.com

- Stacks’ sturdy correlation with Bitcoin steered a doable rally.

- STX is buying and selling above the 200 EMA however has damaged again into four-month resistance.

The correlation between stacks [STX] and Bitcoin [BTC] Costs had been sturdy, with a correlation coefficient of 0.86. Stacks served as a high-beta play on Bitcoin and offered leverage throughout the BTC ecosystem.

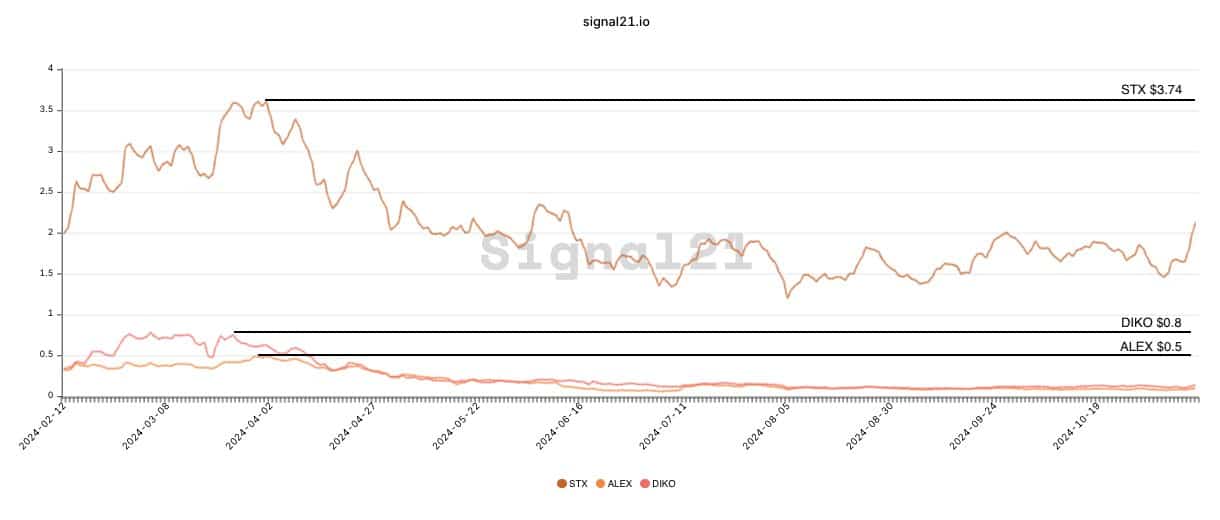

Equally, ALEXLabBTC (ALEX) and Arkadiko Finance (DIKO), main DeFi protocols on the Stacks platform, provided larger beta capabilities tied to STX.

This created a multi-layered funding potential throughout the rising Bitcoin ecosystem. Nonetheless, STX, ALEX and DIKO remained nicely under their March highs from earlier this 12 months.

Supply:

This backdrop units the stage for assessing how Stacks might carry out, following Bitcoin’s future strikes.

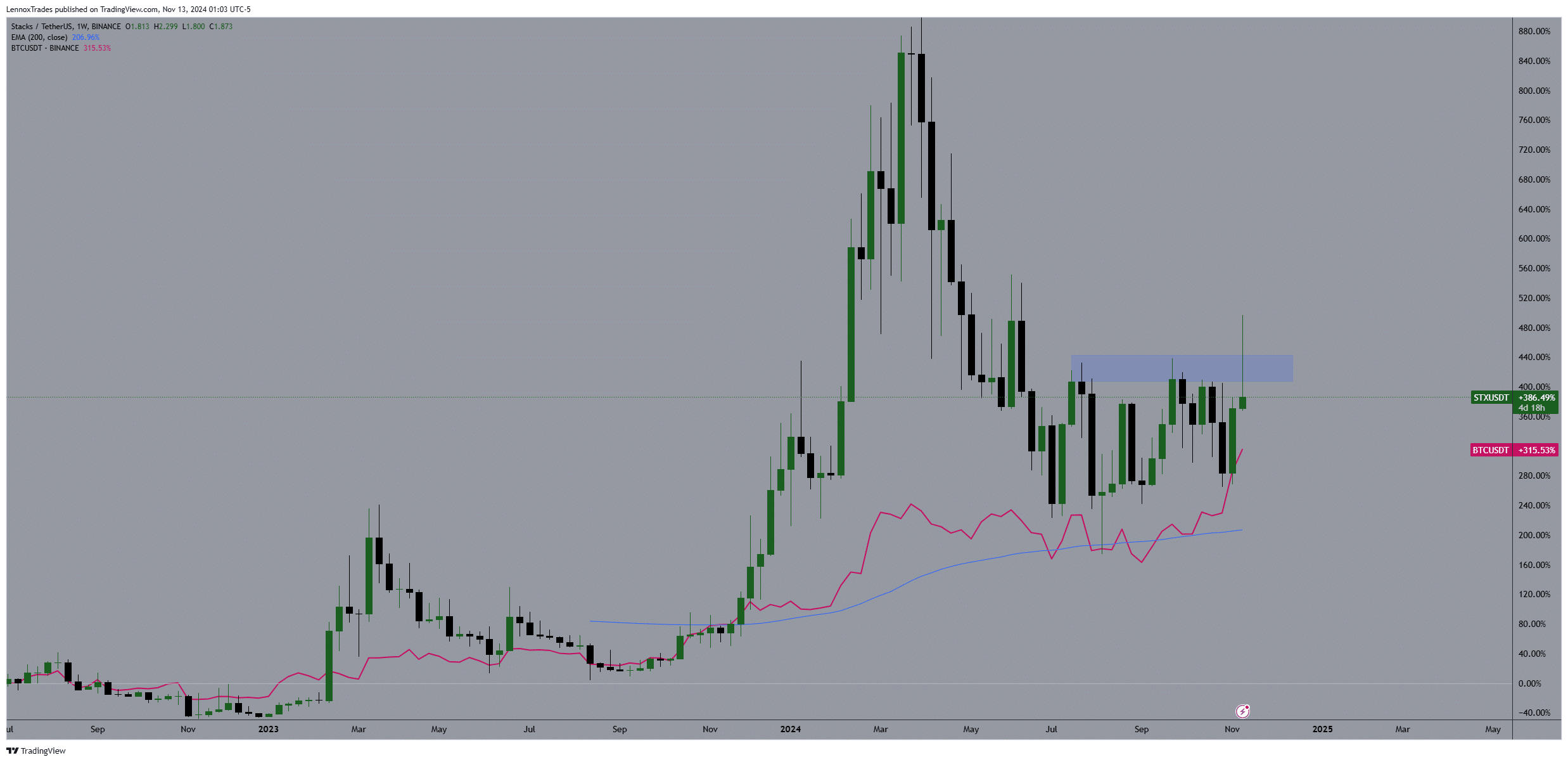

STX is buying and selling above the 200 EMA

Stacks’ worth motion briefly broke above a four-month resistance stage however then fell again inside this vary, indicating a doable false breakout on the weekly time-frame.

Regardless of this retracement, STX traded above the 200-day EMA, indicating an total bullish long-term development. The notable inexperienced candlestick breaking via resistance, adopted by a pink one, illustrates the volatility and uncertainty on the breakout level.

Nonetheless, sustaining a place above the 200 EMA on the weekly time-frame affords a secure outlook, which helps potential future positive factors.

Supply: buying and selling view

Evaluating STX’s proportion positive factors to Bitcoin’s efficiency exhibits a correlation of their worth actions, with STX mirroring Bitcoin’s total market actions.

This correlation steered that if Bitcoin continues its uptrend, STX might certainly pursue the $4 goal. Observing Bitcoin’s trajectory shall be essential for predicting STX’s strikes, particularly because it confirmed indicators of following Bitcoin intently.

Open rates of interest and premium index

When Stacks broke out of the consolidation sample inside a sure vary, open curiosity rose sharply, indicating STX could be purchased from merchants, presumably in anticipation of a rally to $4.

On the identical time, the Aggregated Premium additionally noticed a major spike, indicating that merchants had been keen to pay the next premium on futures contracts in anticipation of future worth will increase.

This aligned with the amount bars exhibiting elevated buying and selling exercise, additional supporting the bullish sentiment round STX.

Supply: Velo/Tradingview

Learn stacks [STX] Worth forecast 2024-25

Given rising Bitcoin costs and elevated conventional monetary consideration, it’s possible that the Bitcoin ecosystem like STX will profit.

The rise in open curiosity, coupled with rising premiums and quantity, might propel the token to new highs as a part of the broader bullish momentum within the cryptocurrency markets tied to Bitcoin’s efficiency.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now