Altcoin

SuperVerse Crypto Reaches $1 Billion Market Cap in 30 Days: Can SUPER Keep Its Profits?

Credit : ambcrypto.com

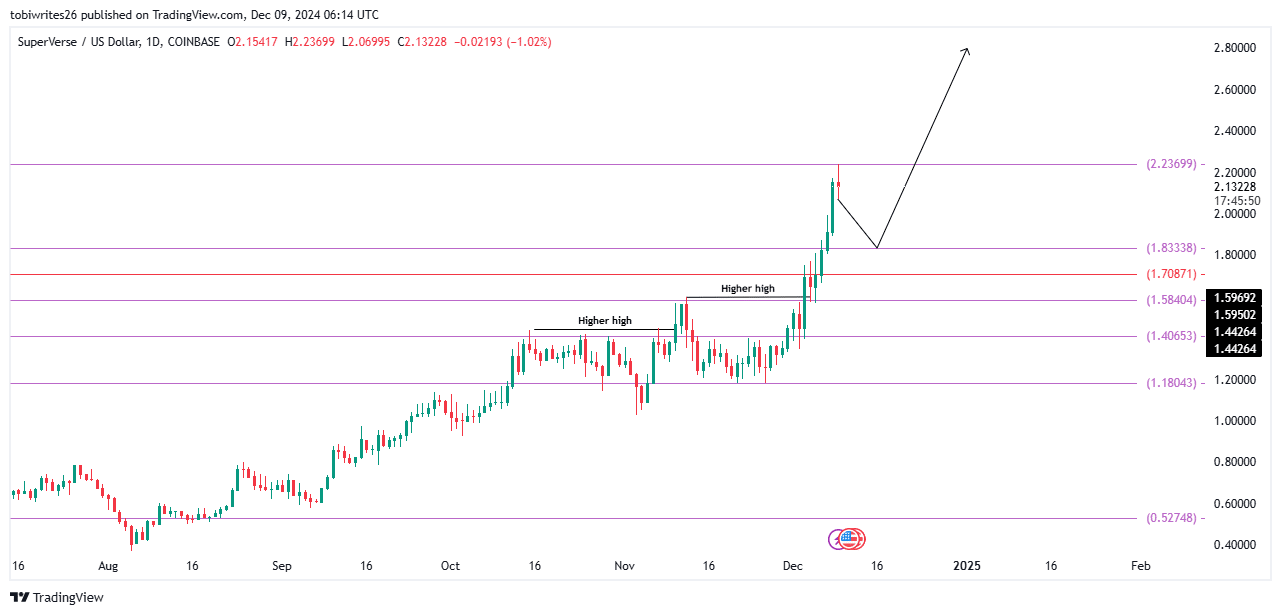

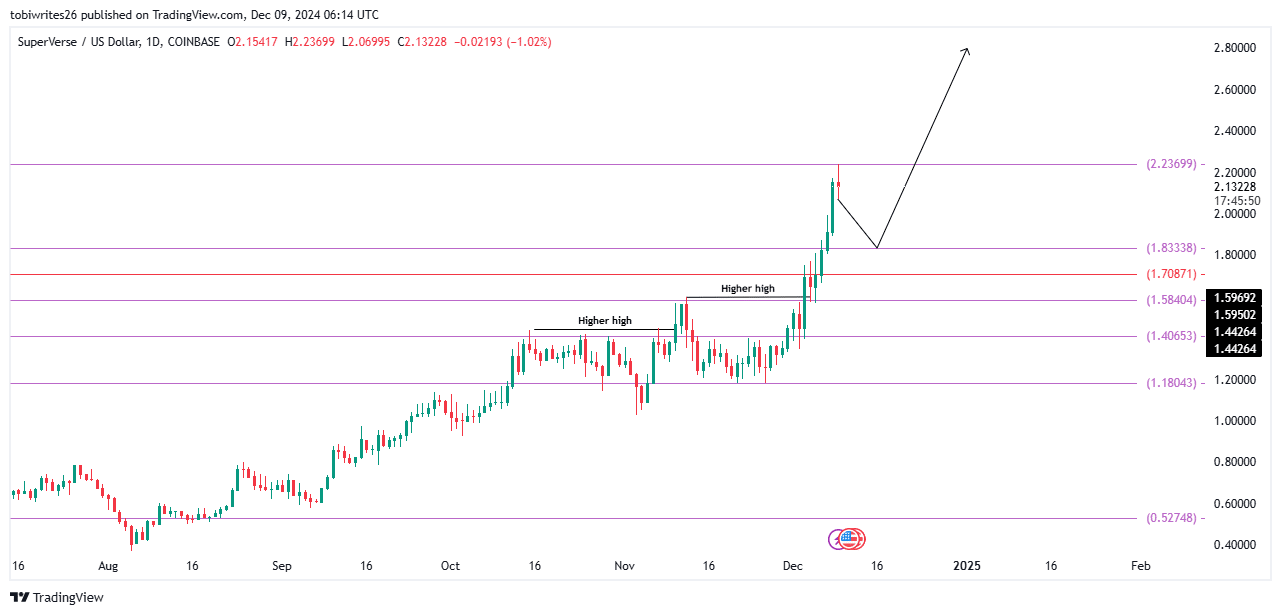

- A Fibonacci retracement confirmed the place the value of SuperVerse crypto may briefly fall.

- Warning stays as constructive Change Netflow highlights the potential for elevated promoting strain.

Over the previous month, SuperVerse [SUPER] has skyrocketed 60%, according to broader market features. This rally pushed the market cap to a powerful $1 billion in simply 30 days.

Latest strikes recommend patrons stay in management, aiming to push the asset to unknown highs. Nonetheless, it isn’t but clear whether or not this momentum can maintain amid potential market headwinds.

Decline-Rally Sample: What’s Subsequent for SUPER?

In accordance with the chart, there’s a good likelihood that SUPER’s upward momentum will briefly pause because it seems for a key help stage the place sufficient purchase orders may reignite the rally.

The Fibonacci retracement software highlighted the 0.382 stage, situated at $1.83, as the closest help zone. This represented a possible decline of 18.14% from the current peak earlier than the restoration resumes.

Nonetheless, there’s a risk that the decline may lengthen additional to the 0.5 retracement stage, marked by the $1.70 value zone, earlier than an upward continuation.

Supply: buying and selling view

Evaluation from AMBCrypto recognized a key issue that might contribute to this potential short-term decline in SUPER’s value.

SuperVerse crypto faces downward strain

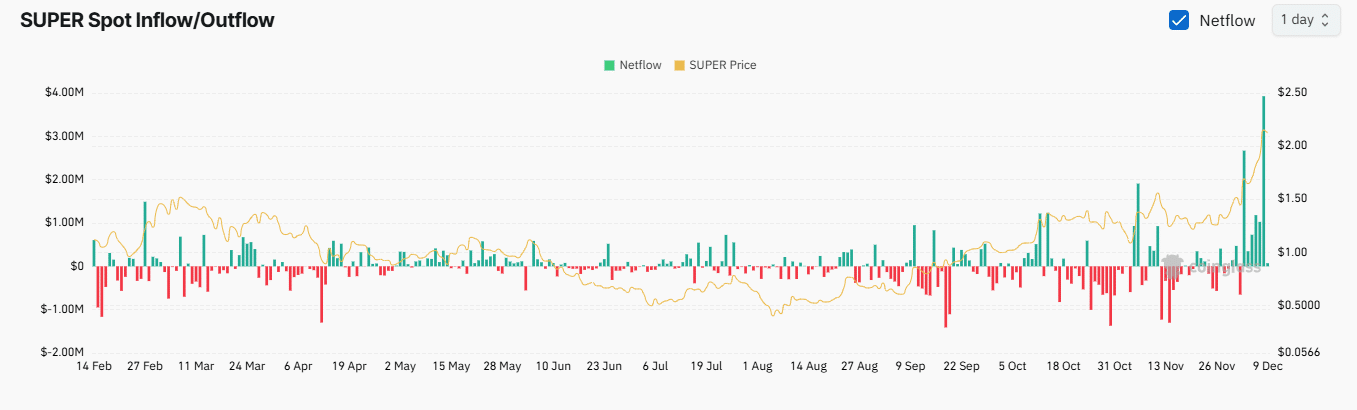

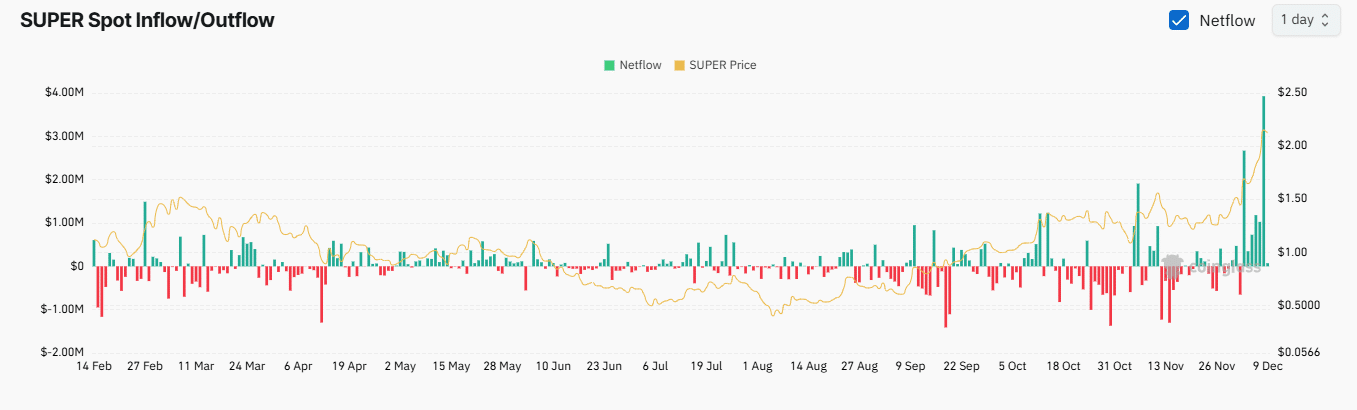

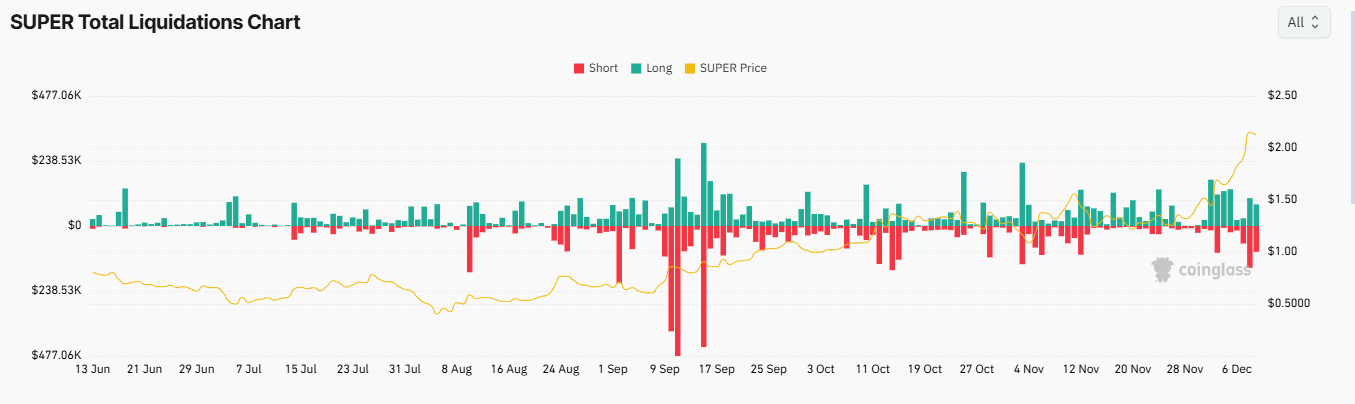

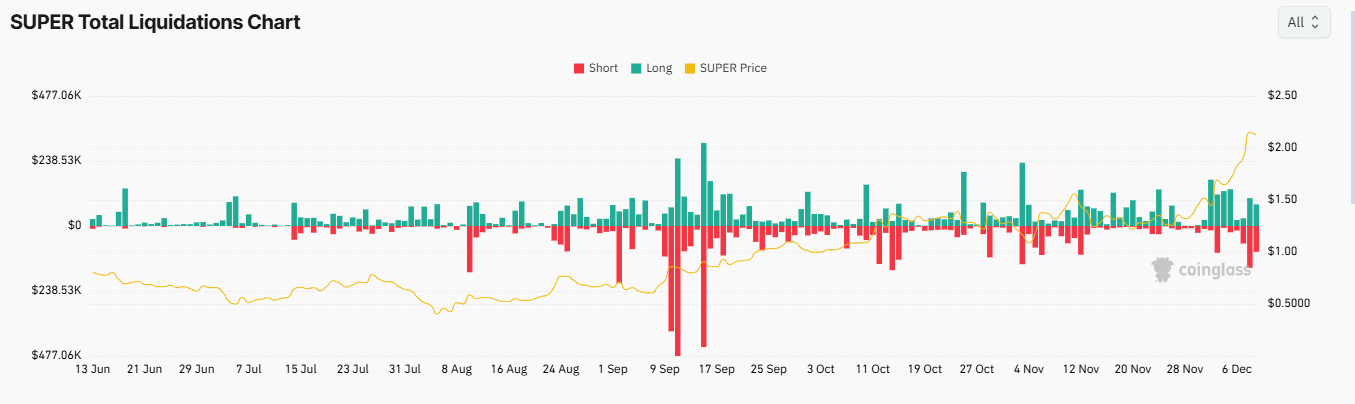

Knowledge from Coinglass revealed that on December 8, SUPER recorded the very best every day Change Netflow since inception, including $3.93 million in property to cryptocurrency exchanges.

Change Netflow measures the distinction between asset inflows and outflows on exchanges. A constructive internet circulate signifies elevated promoting exercise as property are moved to exchanges for liquidation.

Conversely, a destructive internet circulate signifies that holders are withdrawing property from the exchanges, indicating long-term liabilities.

Supply: Coinglass

For SUPER, Netflow is each excessive and constructive, signaling vital gross sales exercise. This elevated promoting strain has contributed to a drop in demand, inflicting costs to fall.

In accordance with the chart, help ranges might be discovered on the Fibonacci retracement of 0.382 ($1.83) or probably on the retracement stage of 0.5 ($1.70).

The market stays firmly bullish

Present market sentiment signifies a powerful bullish outlook for SUPER, supported by key metrics inside this vary.

12 months up to now, Open Curiosity – a metric that tracks the whole variety of unsettled futures contracts – is up 9.81% to $41.46 million.

This improve signifies that extra patrons are getting into the market with lengthy positions, which may result in the asset rising increased than its present ranges.

Learn the one from SuperVerse [SUPER] Worth forecast 2024–2025

Moreover, brief liquidations have surpassed lengthy liquidations, with shorts price $296.48K closing within the final 24 hours. This dynamic places some downward strain available on the market, however in the end advantages patrons.

Supply: Coinglass

These circumstances point out that the market has a desire for lengthy positions. If this development continues, SUPER may surpass its current highs.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024