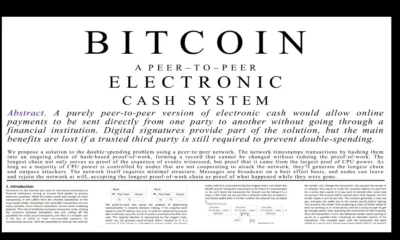

Bitcoin

Szabo’s Micropayments and Mental Transaction Costs: 25 Years Later

Credit : bitcoinmagazine.com

What if each click on you made on-line, solely prices a fraction of 1 cent? What in case your favourite information website, your go-to streaming service and even your every day e-mail use may be paid in small steps, as an alternative of 1 giant piece on the finish of the month? This imaginative and prescient – the place virtually each digital interplay may be monitored by “micropayments” – has been floating over the web financial system for the reason that earliest days. However like a very powerful paper of Nick Szabo, 1999, Micropayments and mental transaction costsBear in mind that there’s rather more than know-how in the way in which.

Twenty-five years later, Szabo’s warnings about psychological transaction costs-the cognitive overhead to resolve whether or not one thing is value paying for fee. Even as a result of developments equivalent to AI-based ‘clever brokers’ and Bitcoin options such because the Lightning Community friction-free Micropayments promise, the observations of Szabo stay essential to know why this concept was not absolutely taken and whether or not that might finally change.

Beneath we’ll examine:

• The nuclear arguments from Szabo’s paper from 1999

• Why Micropayments stayed on the fringes for many years

• How AI and Bitcoin’s Lightning Community attempt to overcome these limitations

• Whether or not the prices of psychological transactions can lastly be lowered sufficient to make Micropayments mainstream

The paper that outlined the dilemma

In Micropayments and psychological transaction pricesNick Szabo has established a fact that technologists have usually neglected: whereas computational prices (equivalent to processing funds, stopping fraud or validating cryptography) may be pushed, the psychological overhead of deciding, monitoring or worrying about every small Prices stay eager excessive.

“Prices for psychological transactions of consumers will quickly dominate the technological transaction prices of the fee system used within the transaction (if they don’t but accomplish that), and efforts for micropayment know-how that emphasize technological financial savings of cognitive financial savings will grow to be irrelevant. “

– Nick Szabo, Micropayments and Psychological Transaction Prices (1999)

The Szabo nuclear argument is that for many shoppers there’s a cognitive “trouble issue” in even the smallest fee selections. Regulate oneself: “Is this text value 2 cents? 5 cents? 10? “Leads shortly to fatigue and overshadows the supposed simplicity of Micrope. Realizing that you’re not nickel and dimmed with each click on is just extra invaluable than the few cash that’s saved.

Sources of those cognitive prices ”?

3 factors are talked about within the newspaper, however they are often rather more.

1. Unsure money flows

Shoppers hardly ever have an ideal foresight in how a lot they are going to earn or spend at any time. Flat prices or bundle cut back the stress of planning and budgeting for these uncertainties.

2. Evaluation of product high quality

In lots of on-line purchases – particularly digital items – you can not know the true ‘high quality’ of what you purchase till you have got used it. Whether or not it’s an article, a recreation or a movie, the psychological effort that’s wanted to resolve “is value this X? “Each time you click on, it may be dearer than the Micropayment itself.

3. Complexity of determination -making

Our brains are good at making quick telephone calls if the guess is excessive or choices, however there are few choices, however horrible When we now have infinite micro determination.

Why Micropayments acquired caught – regardless of new know-how

1. The early hype “web fee”

Within the late nineties and early 2000, the web was praised as a brand new border for micro-billing. Methods equivalent to Netbill, Millicent and Payword Promised frictionless streams of small quantities. The dream? Artists, newspapers and web site house owners would all be paid instantly for each web page view or each minute of used content material.

However even when the processing prices and fraud grew to become extra manageable, the acceptance of customers by no means reached crucial mass. SZABO’s psychological transaction price argument largely explains this: shoppers discovered it simpler to deal with one month-to-month subscription than to deal with numerous cents that fly out of their digital portfolios.

2. The rise of “free” providers funded by ads

Search engines like google and yahoo, social media and information websites progressively have one Free to eat, ads supported mannequin. Why? It’s straightforward within the spirit of the consumer-not registration or micro-counting for every web page loading. Within the meantime, the location proprietor applies your consideration by way of ads.

Even premium content material was interested in a low-sector fee partitions and subscription fashions. As quickly because the psychological load of frequent, small funds was changed by a single month-to-month prices, prospects complained much less and prospects paid extra constantly.

3. “Clever brokers” and AI: Early guarantees, Sluggish outcomes

SZABO additionally anticipated options equivalent to ‘clever brokers’ that might in concept be capable of take care of many micro selections on behalf of the patron. The concept was that an AI may internalize your preferences (“I wish to examine funds, however solely from famend sources, and I’m keen to pay an merchandise of as much as 10 cents.”) After which robotically approve or refuse.

However nonetheless constructing a very customized agent not Requires steady coaching and supervision – solely leaves potential conflicts of curiosity – have confirmed to be extraordinarily difficult. To precisely handle AI, it should perceive your tacit preferences and be trusted to behave in your finest curiosity.

Has one thing modified in 25 years?

Though the insights of Szabo stay legitimate, the panorama differs in 2024 (and additional) in a couple of essential methods:

1. Consumer interfaces have improved

From intuitive cell portfolios to chatbots, the design of the consumer interface is competitions previous to the place it was in 1999. Some friction was deleted: you may faucet to pay, use password registrations or combine with wearables. However the cognitive overhead– The act of deciding whether or not a purchase order is value it – has not disappeared. Even a single faucet is an excessive amount of if you must do it lots of of instances a day.

2. Blockchain & Cryptocurrencies

The Lightning Community is meant to find out funds by calling in near-instant transactions with very low prices. It doesn’t remedy the nuclear argument of the article, which assumes that technical transaction prices are zero. However the lightning community is the present finest normal and protocol on the web for open, interoperable cash to circulation on the web.

3. Ai comes within the chat

Instruments equivalent to chatgpt, superior customized suggestion engines and agent frameworks have made it attainable to regulate experiences deeper to each consumer. In concept, an AI assistant can study your style or budgets so effectively that you’re hardly ever disturbed with prompts with micro-approval, whether or not it could automate it completely inside a sure funds. Nevertheless, constructing that belief in an AI agent stays an impediment. The query is “Is that this value it?” To “What does my AI agent do?”

Wanting forward: Are we prepared for a Micropayment Renaissance?

To make mass adoption occur, folks should stop them from feeling nickel and dimmed at each flip. Even when the technical reimbursements are virtually zero, the psychological transaction prices micropalisms can really feel cumbersome. Making micropitiments as invisible as attainable, whereas conserving monitor of the worth that’s exchanged is due to this fact essential.

Getting Micropayments good will in all probability require a reconsideration of enterprise fashions, there are thrilling examples by which Micropayments are on the rise as a possible technique:

• Pay-per-api name

Within the AI Saas world, the micropetes already bloom (referred to as credit or tokens). As a result of corporations strictly consider the use on ROI and enterprise wants, they’re much less deterred by the psychological friction that buyers retains remotely. They use simply as a lot as they want in actual time.

• Suggestions and donations

Small, voluntary funds for makers or open-source initiatives can work as a result of they don’t trigger the identical sense of obligation. Customers donate out of gratitude or group spirit, making Micropayments extra a gesture than a pressured cost. Stacker Information and Nostr have put this paradigm ahead with the assistance of the lighting community.

Sensible design for seamless experiences

Whatever the enterprise mannequin, the design of consumer expertise is the important thing to creating micropayments sensible. The better the interface, the extra “invisible” the funds grow to be. Some concepts embody:

• Automated guidelines and AI: Have customers set huge preferences (“I do not thoughts spending as much as $ 2/day on premium articles”) and belief an clever agent to deal with selections within the background.

• Bundled invoices: Accumulate a number of micro-loading in a single easy-to-understand rationalization, which reduces the psychological toll of every particular person transaction. Ideally, this may be a regular and cross-product, as an alternative of laid out in one area of interest or vertical.

• Intuitive suggestions: provide clear however minimal directions – equivalent to a progress bar of month-to-month bills – that helps customers to maintain prices with out being overwhelmed.

Overcoming the cognitive limitations recognized by Nick Szabo requires not solely sooner, cheaper transaction rails, but in addition considerate design that’s appropriate for actual human psychology. When these components come together-on AI-based automation, use-based fashions that don’t really feel invasive and a consumer interface that’s virtually frictionless the Micropetes an actual Renaissance.

Conclusion: The insights of Szabo nonetheless rule

Nick Szabo’s paper from 1999 has confirmed to be remarkably seen and stopped in spite of everything these years. Even when know-how is extra superior web speeds, blockchain-based fee rails and superior AI, the central drawback:

Individuals do not all the time wish to consider small funds.

It is not simply About software program or cryptography; It’s concerning the psychology of how we respect consideration, comfort and safety. Micropayments can solely succeed if these psychological prices may be minimized or “thrown away”. AI brokers and the Bitcoin Lightning Community are essential new items of the puzzle, however their success is determined by the supply of a consumer expertise that hides or automates the selections about Micrope fee.

Will the following 25 years lastly convey an period the place Micropayments bloom? Attainable – if we learn the way we will make paying a fraction of a penny feeling so easy As a month-to-month subscription. Even then we will notice that micropayments are simply One other arrow within the arrow cooker From fee fashions, along with advertisements -based, subscription -based and outright “free” affords.

However for now, Szabo’s warning is: a world of pure micropayments nonetheless Becidt with human psychology. Our psychological transaction prices are sensible, and if the options of the long run – whether or not they’re AI, lightning or one thing else – don’t sort out our deeper choice for simplicity, Micropayments will stay an intriguing thought that can by no means be fully the usual.

References and additional studying

• Szabo, N. (1999) ““Micropayments and mental transaction costs“

• Fishburn, P., Odlyzko, AM and Siders, RC (1997) ““Fixed reimbursement versus unit prices for information goods“

• Nielsen, J. (1998) ““The case for micropayments“

• Rivest, RL and Shamir, A. (1996) ““Payword and Micromint – Two simple micropayment schedules“

This can be a visitor put up by Jacob Brown. The expression of opinions are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September