Bitcoin

The Bitcoin Report: Parabolic Growth Predicted for Q4 2024

Credit : bitcoinmagazine.com

As we enter the fourth quarter, a interval traditionally recognized for sturdy Bitcoin efficiency, the most recent version of The Bitcoin Report from Bitcoin Journal Professional delivers important insights into Bitcoin’s evolving market dynamics. Utilizing a mixture of on-chain quantitative knowledge, technical evaluation and macroeconomic views, this report supplies a complete overview of Bitcoin’s positioning, highlighting crucial alternatives and challenges for each traders and market individuals.

Key highlights from the report:

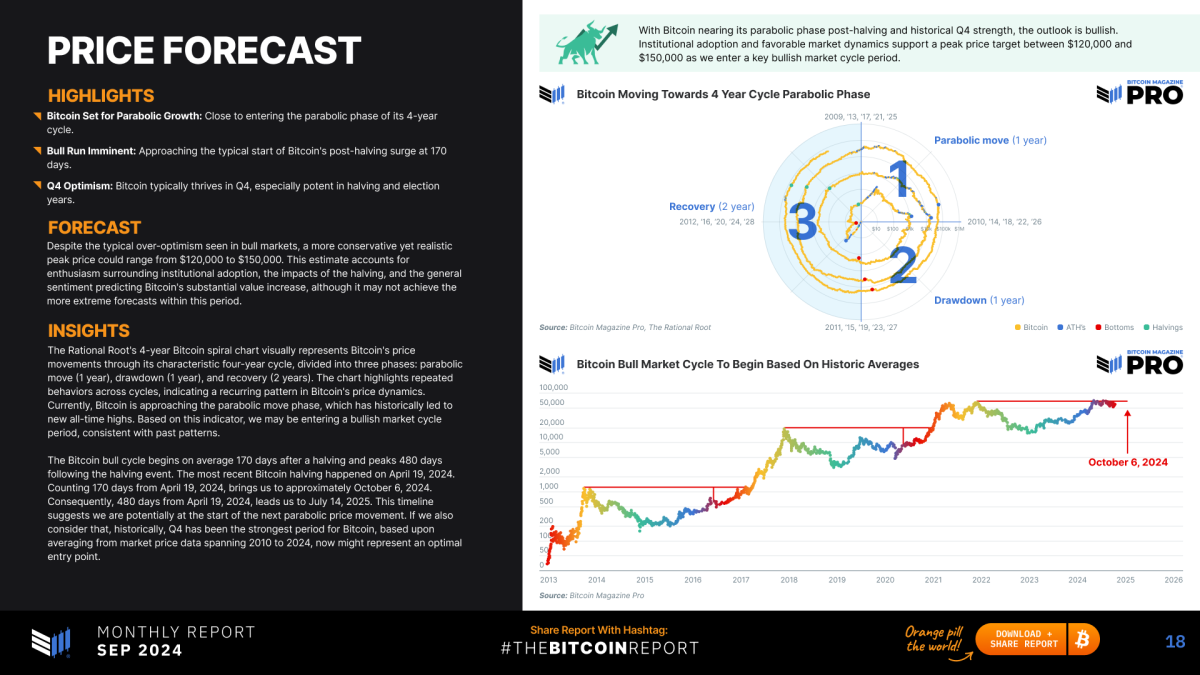

- Historic fourth quarter efficiency: Bitcoin has delivered a mean return of 23.3% within the fourth quarter, exhibiting a powerful seasonal pattern towards bullish efficiency.

- Breaking by means of important resistance: Current technical evaluation factors to Bitcoin breaking by means of key resistance ranges, probably paving the best way for parabolic progress.

- Derivatives market momentum: The derivatives market is exhibiting renewed momentum, with rising open curiosity and decreased leverage on the foremost exchanges.

- Restoring mining profitability: Mining profitability has recovered, with the hash worth hitting a two-month excessive, signaling a strengthening of Bitcoin’s underlying fundamentals.

- Institutional accumulation: In September, US Bitcoin ETFs purchased 17,941 Bitcoins – 32.9% greater than the 13,500 new Bitcoins mined in the identical interval, indicating important institutional demand.

This 21-page report is constructed on a strong basis of on-chain metrics, technical evaluation, and macroeconomic elements. It supplies an in-depth examination of Bitcoin’s latest market developments, together with traits similar to institutional accumulation and restoration of mining profitability. With the fourth quarter delivering traditionally sturdy returns for Bitcoin, the report highlights how macroeconomic elements – similar to potential fee cuts from the Federal Reserve and liquidity injections from the Individuals’s Financial institution of China – may act as a catalyst for Bitcoin’s continued progress. In a low-debt setting in derivatives markets, this financial coverage may result in one other Bitcoin rally.

Knowledgeable evaluation and insights

That includes unique commentary and insights from main trade figures similar to Lyn Alden, The rational rootAnd Julian Linigerthis second month-to-month version of The Bitcoin Report is a must-read for traders and fans alike.

The analytical rigor introduced on this version is additional enriched by the views of thought leaders similar to Philip Swift, Pete Rizzo, Dr. Michael Tabone, Dr. Demelza Hays, Patrick Heusser, Lucas Betschart, Lucas Pfeiffer, Pascal HugliAnd Joel Kai Lenz. Their insights cowl a spectrum of points, together with macroeconomic coverage implications, sector-specific developments and technical indicators. By leveraging the collective experience of main analysts, The Bitcoin Report delivers an unparalleled breadth of study, from micro-level habits alongside the chain to macro-level geopolitical and financial elements influencing Bitcoin’s adoption curve.

Share, focus on and interact

We invite you to learn and obtain the September version, full of insights that will help you keep forward on this quickly evolving market. Whether or not you are managing portfolios, on the lookout for long-term publicity to Bitcoin, or simply staying knowledgeable, The Bitcoin Report supplies the data it is advisable to keep on high of the traits.

Be at liberty to share the contents of the report, take screenshots and put up on social media utilizing the hashtag #TheBitcoinReport. By following these conversations, we are able to enhance future editions and proceed to ship high-quality content material to the Bitcoin group.

Alternatives for sponsorship and collaboration

Serious about sponsoring future editions of The Bitcoin Report or exploring prospects for joint publication? Work with us to achieve publicity within the fast-growing Bitcoin house.

For extra data please contact Mark Mason bee mark.mason@btcmedia.org to debate how your model may be a part of this thrilling initiative.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now