Bitcoin

The Good, The Bad, And The Unknown

Credit : bitcoinmagazine.com

Everybody has heard the Chinese language proverb British misquote: “May you live in interesting times,” and the way it’s imagined to be a curse. It sounds deep, like a quote for edgelords over 80.

However have you ever ever thought-about the choice? In line with the Anglo-Saxon Chronicle, there have been almost two centuries the place nothing a lot occurred. Vivian Mercier famously known as Ready for Godot “a play during which nothing occurs, twice.” However nothing occurring 191 instances? I’ll take attention-grabbing instances any day.

And that’s precisely what we now have now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been speaking so much just lately about how Lightning is the common language of the bitcoin economy and the way bitcoin is a medium of exchange (and it really is; read our report).

These two arguments now appear to be converging. Due to Lightning working as a standard language, it makes bitcoin interoperable with a variety of adjoining applied sciences, like USDT. And USDT goes to turbocharge bitcoin into new use instances, new markets, and new challenges on a scale that the Lightning ecosystem has but to expertise.

Given the selection, I’d slightly dive head first into the unknown than spend the afternoon on the sofa. All of the cool stuff is within the unknown. (Picture: pxhere)

Given the selection, I’d slightly dive head first into the unknown than spend the afternoon on the sofa. All of the cool stuff is within the unknown. (Picture: pxhere)

USDT on Lightning is terra incognita. Attention-grabbing instances certainly. So let’s take into consideration what it means for USDT to hitch Lightning and for Lightning to maneuver USDT — the alternatives, the dangers, and the huge open questions.

Lightning was initially meant to extend the throughput of the bitcoin blockchain, so bitcoin was to be its solely cargo. Taproot Assets is a new protocol that permits fungible property (e.g. stablecoins) to be transmitted over Lightning as hashed metadata piggybacking on the identical infrastructure used to course of bitcoin funds.

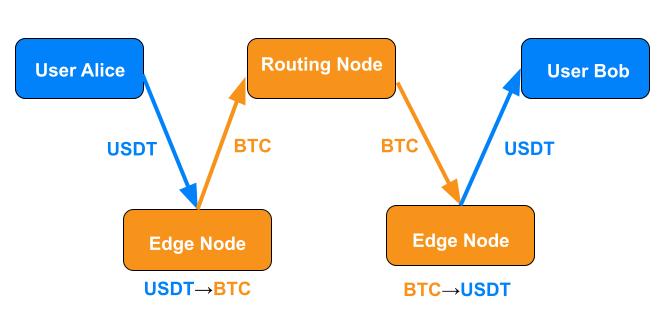

The best way it really works is fairly easy for anybody who understands Lightning. The recipient generates an bill that pings edge nodes (i.e. the nodes connecting customers to the broader community) for trade charges between bitcoin and the asset in query — USDT within the present case. As soon as the consumer accepts an edge node’s trade charge, they generate an bill for the fee and ship it to the payer. The payer sends the asset to the sting node on their very own aspect, the sting node converts the whole lot right into a normal-looking bitcoin fee, the fee proceeds by means of routing nodes alongside the community as traditional, the sting node on the recipient’s finish converts the fee again into the unique asset (USDT) and forwards it to the recipient.

Taproot Property leverages the flexibility of Lightning and bitcoin to let customers switch new sorts of property over the community, utilizing bitcoin because the common medium of trade. One corollary of all of the nodes talking Lightning is that any routing nodes between the sting nodes see solely BTC in transit. Lightning tells them methods to transfer BTC, and that’s all they’re doing so far as they know. Superior.

However there’s extra to it than simply technical specs. USDT is, in any case, a large medium of trade. Tens of billions of USDT worth change palms day-after-day unfold throughout hundreds of thousands of funds. Its every day buying and selling volumes are in the identical ballpark because the Brazilian actual and the Indian rupee. It is a huge deal. So what does Lightning imply for USDT, and what does the addition of USDT imply for Lightning?

… for Bitcoin

To date, a lot of the technique to bitcoinizing commerce has centered on orange pilling as many individuals as attainable and rising the circular economy one consumer at a time. This technique has maybe reached the limits of its scale. The circle has grown massively within the final decade and a half, nevertheless it’s nonetheless restricted, and we have to suppose by way of hundreds of thousands at a time.

Now that USDT and BTC are natively interoperable on Lightning, the circle has gained tangents. With USDT on Lightning, every occasion to a fee — the payer and the recipient — can select whether or not to make use of BTC or USDT on their very own finish, and neither relies on the opposite’s choice. A buyer pays in BTC, and the service provider can obtain USDT. Or the shopper pays in USDT, and the service provider can obtain BTC. Or they’ll each use the identical asset. It doesn’t matter. As soon as each property are native to Lightning, they grow to be robotically, frictionlessly interchangeable. Everyone seems to be free to go for bitcoin’s benefits as a medium of trade grown from the underside up by the customers or for USDT’s benefits as an asset whose value is as secure as US financial coverage and Tether’s liquid reserves.

Lightning and, by extension, bitcoin stand to realize millions of users and billions of {dollars} price of spending energy. It’s a qualitative extension of bitcoin’s utility. The brand new use instances will do extra good for bitcoin than a boatload of orange capsules. It’s additionally doubtlessly a quantitative explosion for Lightning. Lots of these new customers may not even know that they’re utilizing Lightning due to its efficacy because the common language of the bitcoin economy. However we ol’ faculty Lightning vets know. That is what we’ve been constructing in direction of.

And since we simply talked about how Lightning would make USDT simpler for American customers to entry, USDT may also make it simpler for them to make use of Lightning. American tax regulation treats BTC like an equity, making every fee a doubtlessly complicated concatenation of tax occasions. But when US customers can entry Lightning with an asset that by no means incurs capital positive factors, then they’ll have entry to a lot of Lightning’s benefits with out one in every of its specific regulatory drawbacks.

…for Tether

Tether usually points USDT on confirmed blockchains which have achieved important market traction, and so they have no interest in launching their own. USDT is currently available on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Community, Solana, Tezos, Ton, and Tron. Notice that these are all proof-of-stake (PoS) blockchains (besides Liquid, which makes use of a federation), in order that they’re essentially extra centralized than bitcoin.

These blockchains additionally face completely different tradeoffs. Ethereum is comparatively decentralized for a PoS blockchain, however its transaction fees are notoriously high. Tron is cheaper. Maybe that’s why, according to one estimate, almost 7x extra month-to-month lively retail USDT customers go for Tron over Ethereum and ship 8x extra retail quantity over Tron. However Tron is notoriously centralized, making it a choke level for USDT. If Tron had been to fail, Tether would lose one thing like half of its whole capability throughout all blockchains. Ouch. By permitting USDT to be transacted over Lightning, which is inherently decentralized, Tether mitigates their dependency on low-cost, centralized blockchains.

Additional, Lightning might make USDT way more handy to make use of within the US market. US exchanges generally restrict USDT transactions to sure blockchains. For instance, Coinbase says “Coinbase solely helps USDT on the Ethereum blockchain (ERC-20). Don’t ship USDT on every other blockchain to Coinbase.” Lightning offers huge exchanges like Binance, Coinbase, and Kraken (which already assist Lightning right now) a decentralized different for USDT funds to supply their customers.

The brand new American administration has mooted onshoring the whole stablecoin business and steered that regulating it’s their “first priority.” In different phrases, they’ll be paying very shut consideration to each growth. So long as stablecoins like USDT are pegged to the greenback, those that management the greenback and revenue from it should wish to management the stablecoins too.

Regulators suppose they’ll even enhance on freedom by regulating it. They’ll’t assist it. It’s of their nature. However it follows that, as USDT positive factors utility on Lightning and Lightning positive factors utility as a way to maneuver USDT, we’re all going to be attracting higher scrutiny from regulators. It’s laborious to say how a lot they’ll really be capable of do or what they’re going to strive, nevertheless it gained’t be any enjoyable. Regulation is all the time friction.

One space that’s more likely to entice regulatory scrutiny is the sting nodes. Typical centralized exchanges are typically topic to KYC/AML guidelines in lots of jurisdictions. If the sting nodes can be robotically exchanging USDT and BTC and forwarding funds, they could additionally look so much like standard exchanges to regulators, who tend not to like decentralization. 🙄

What’s It Price? What’s It Value?

Whereas Lightning does supply customers and USDT some important advantages, it’s not clearly the very best all-around answer for each fee involving USDT. Lightning customers anticipate low charges. So do USDT customers who use centralized blockchains and custodial exchanges. However including a second asset to Lightning provides some monetary concerns that everybody — routing nodes, customers, and particularly edge nodes — must reckon with.

First, the sting nodes are offering the everyday duties of LSPs — retaining customers related to the community with sufficient channels and sufficient liquidity to maintain these funds transferring — as well as to changing between property. That conversion is a useful service that deserves compensation, and it may also be dangerous (see under).

Second, USDT is more likely to enhance transaction quantity significantly, which implies that LSPs and routing nodes must hold extra liquidity on the community to ahead these funds. They don’t take the identical shortcut as custodial exchanges, which simply must replace their inside ledgers. The economics of liquidity allocation nonetheless apply, solely extra so.

Will Lightning be capable of compete with centralized blockchains like Tron for USDT funds? The reply will most likely resemble the reply to most questions on matching applied sciences with use instances: every expertise could have sure strengths and weaknesses that suggest it for sure use instances and never others. As traditional, the market will determine it out. Nonetheless, for the reason that expertise wasn’t tailor-made to this specific use case, value discovery can be a means of trial and error, which takes time.

Free Name Choices? Uh oh.

Edge nodes face the chance of the “free-call-option problem,” which is attention-grabbing sufficient to benefit its personal dialogue right here. It is a new danger, and it’s inherent to any scenario involving two property in a single Lightning fee.

Lightning funds have to be accomplished inside a sure time with a purpose to be settled, or the bill cancels robotically. That point is the “T” in HTLCs — hashed, time-locked contracts.

When the sting nodes bid with their trade charges for a USDT↔BTC fee, they calculate their bids primarily based on parameters like their present liquidity scenario and the spot value. However the customers have a window between accepting the sting node’s bid and the expiration of the HTLC during which to settle the fee. Costs can transfer in that window. If I provoke a USDT fee at one charge, then I can wait till the speed strikes in my favor earlier than I launch the preimage to settle it. If the speed strikes in opposition to me, I merely don’t launch the preimage. In that case, the sting node may provoke a channel closure to redeem their funds, however that’s a gradual (and subsequently expensive) course of. If it strikes in my favor, the sting node is on the hook for the distinction. Heads, I lose nothing. Tails, I fleece the sting node.

Funds involving any mixture of property on Lightning give the consumer a call option. Conventional monetary establishments handle their draw back danger in promoting name choices by including the chance to the worth. These choices can get very costly for unprepared edge nodes. Just ask Kilian and Michael at Boltz, who initially introduced this entire difficulty to my consideration and had the category to explain it for all of us within the ecosystem. The choice is for the sting nodes to cost the decision choice into their quotes, identical to conventional monetary establishments. Intertemporal arbitrage is nice work if you may get it.

Customers aren’t the one supply of concern for edge nodes both. If a routing node fails to ahead the preimage — whether or not by means of intent or malfunction — the sting node might nonetheless be on the hook. At the least with routing nodes, it is likely to be attainable to implement some type of popularity system to assist select the route. Nonetheless, a popularity system for finish customers may not be possible as new customers can be always becoming a member of the community.

The free name choices have by no means been an issue for Lightning till now as a result of the community has solely handled a single asset: bitcoin. If the free-option drawback grew to become severe sufficient, one might think about a number of parallel, single-currency Lightning Networks rising. One for bitcoin. One for USDT. One other for … If bitcoin will get minimize out of the loop, we are going to lose the good thing about bitcoin interoperability. We’d even wind up regretting bringing USDT onto Lightning within the first place.

Bitcoin was all the time meant to be revolutionary. Disrupting damaged fiat is the entire level and all the time has been. We’re in it for the revolution. We all know that change and disruption was by no means going to be a clean course of.

However change is an efficient factor. Progress is only a sort of change that folks welcome. We welcome USDT on Lightning as a result of we see the chance. It will possibly symbolize progress for USDT customers, for Lightning, and for bitcoin.

Like every change, although, it’s going to require cautious thought, preparation, sharp instincts, and fast reactions. You don’t go into uncharted territory with out the fitting gear and some expertise. Anybody within the Lightning liquidity enterprise goes to face some new challenges, but in addition stands to make some huge positive factors.

Tether stands to realize a cheap, decentralized distribution community and higher entry to the important US market. Lightning stands to realize a large infusion of liquidity and customers. Bitcoin can be natively interoperable with USDT. That’s why there’s a lot pleasure.

However regulators are watching. And edge nodes will solely supply the indispensable conversion providers if doing so is worthwhile, not ruinous. So let’s method this variation as we do all new developments in Lightning: by pondering laborious, designing fastidiously, hardening our code, getting ready the market, and by no means shedding sight of our final objective, which is to comprehend the common bitcoin financial system.

It is a visitor publish by Roy Sheinfeld. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024