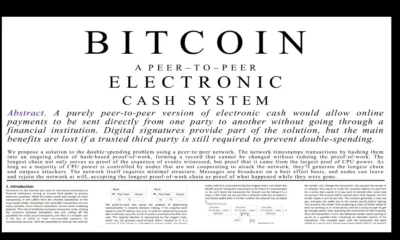

Bitcoin

The halving paradox: Why miners earn more despite getting 93.75% less Bitcoin

Credit : ambcrypto.com

Key Takeaways

Has Bitcoin’s worth improve saved tempo with the lower in provide on account of halvings?

Sure, after which some. Bitcoin’s worth progress has exceeded the decline in provide in all 5 halving intervals.

Do miners at the moment earn kind of than miners in 2020?

Present miners earn 3,125 BTC per block [$340,000] Already, greater than 2020 miners have earned double the quantity of Bitcoin.

Bitcoin miners at the moment earn simply 3,125 BTC per block – 93.75% lower than the 50 BTC they obtained in 2012. But they’re richer than ever.

This counterintuitive actuality reveals one among Bitcoin’s most fascinating financial options: much less BTC has persistently meant extra prosperity.

The Bitcoin numbers inform the story

Historic information from Unleashed exhibits a transparent sample throughout Bitcoin’s 5 halving intervals. Every period has ended with block rewards value extra in {dollars} than when it started, regardless of miners receiving half of the BTC midway by.

Period 4 [2020-2024] exhibits this completely. Miners began incomes 6.25 BTC per block value $54,000.

They ended the period incomes the identical 6.25 BTC, however value $398,000 – a rise of 637%. Bitcoin’s worth improve utterly overshadowed the provision discount.

Supply: Unchained

The present Epoch 5 continues this development. Block rewards began at $199,000 [3.125 BTC]. With Bitcoin now buying and selling round $109,000, those self same 3,125 BTC blocks are value round $340,000.

We’re just a few months right into a four-year period, however block rewards are already up 71%.

Because of this a miner making 3,125 BTC per block at the moment is making extra money than a 2020 miner making double Bitcoin. [6.25 BTC] at first of period 4.

Why Conventional Economics Misunderstands Bitcoin

The usual logic of shortage suggests {that a} 50% discount in provide ought to scale back gross sales by 50%. Bitcoin defies this. As a substitute, miners who survive the preliminary halving shock usually see a 300-600% improve in income by the tip of the period.

This creates a singular mining economic system. When the halving happens, miners face a right away 50% drop in income.

Nevertheless, people who climate the storm sometimes turn out to be extra worthwhile inside 12 to 18 months as the worth of BTC adjusts to the brand new provide dynamics.

Miners are promoting regardless of file rewards

Current information on the chain provides an intriguing twist. Glassnode exhibits that miners distributed Bitcoin at a charge not seen for the reason that FTX collapse in September and October 2025.

These heavy promoting occurred whereas miners have been incomes probably the most priceless block rewards in BTC historical past.

Supply: Glassnode

A number of components clarify this: revenue taking after BTC examined $125,000, working prices that required fixed {hardware} upgrades, and publicly traded mining corporations realizing earnings for shareholders.

The timing, simply earlier than Bitcoin’s correction from $125,000 to present ranges, means that some miners have efficiently timed an area high.

What comes subsequent

If the patterns maintain, Epoch 5 may find yourself with block rewards of greater than $1 million per block, regardless that miners solely obtain 3,125 BTC. This could require Bitcoin to succeed in $320,000 or greater by 2028.

The essential query is sustainability. Every halving requires bigger worth multiples to keep up the sample.

Epoch 2 wanted a 55x improve, Epoch 3 wanted 13.5x, and Epoch 4 wanted 7.4x. As BTC’s market cap grows, these multiples turn out to be tougher to attain.

Nevertheless, growing institutional adoption, potential authorities bond purchases, and BTC’s maturing function as a retailer of worth may present the required demand for a number of extra eras.

The underside line

Whereas miners are making 93.75% much less Bitcoin than in 2012, they’re making lots of of 1000’s of {dollars} per block.

For fifteen years, unfold over 5 eras, much less has meant extra at BTC. Whether or not this stays the case is determined by BTC’s capacity to proceed appreciating quicker than its provide decreases – however up to now the paradox stays robust.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now