Altcoin

The price climbing from BNB to $ 730 depends on these factors!

Credit : ambcrypto.com

- Liquidity progress on the BNB chain has been appreciable, with a rally as much as $ 730 that appears possible within the graph

- Sentiment in the marketplace indicated that there’s a bearish pressure, however shopping for quantity can destroy it

For the primary time in additional than a month BNB Bullish wins on the charts, with the crypto by nearly 2% in 24 hours. This, after an earlier downward development, had the losses of just about 17% with traders.

This rally can mark the beginning of a big motion, particularly if BNB exceeds a important resistance line and cools the gross sales strain within the derivatives market. That’s the reason it’s price exploring the potential motion of BNB in a deeply.

Liquidity influx reinforces the value motion of BNB

In response to Ambcrypto’s evaluation, there was a outstanding influx into the BNB chain, with the identical intensification of latest occasions. These influx not solely contributed to the value rally, however have additionally insisted a rise within the whole worth (TVL).

TVL measures the quantity of BNB deposited and locked over totally different protocols on the BNB chain. A stroll means that extra traders lock their belongings, indicating belief in a possible worth rally.

Supply: Defillama

Between 12-15 March, the TVL from BNB Chain rose by $ 496 million, which represents the quantity of BNB in the protocols. Additionally the size of this Liquidity influx could be related to a stroll in energetic addresses throughout this era.

On the time of writing, energetic addresses peaked at 1.1 million after a month-to-month low of 959,200 on 8 March, with the transaction depend hit 4.5 million. The expansion in these statistics, along with the value and TVL, hinted to the dominance of patrons in the marketplace.

BNB is confronted with key resistance

BNB has pushed the aforementioned worth stick with a resistance line that has been in forming since mid -February. Within the final two events when the value contact with this resistance, this led to a fall throughout the board.

If it sees an infringement above this degree, there’s a excessive likelihood that the energetic revenue of 23.48percentwill obtain and climb as much as $ 732.

Supply: TradingView

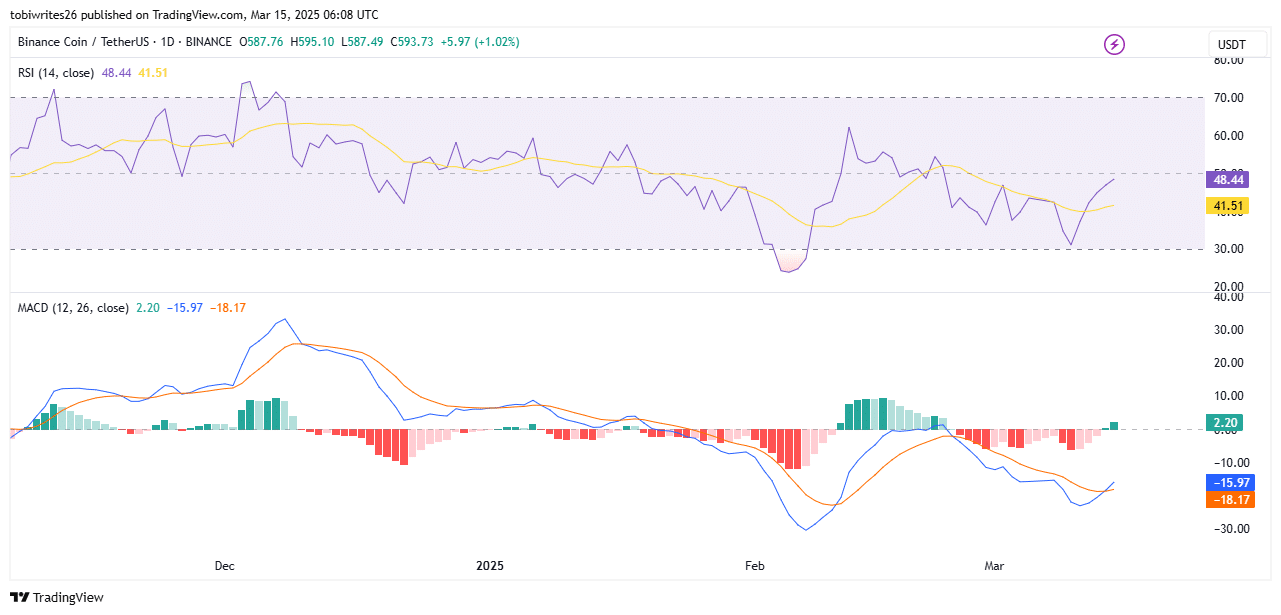

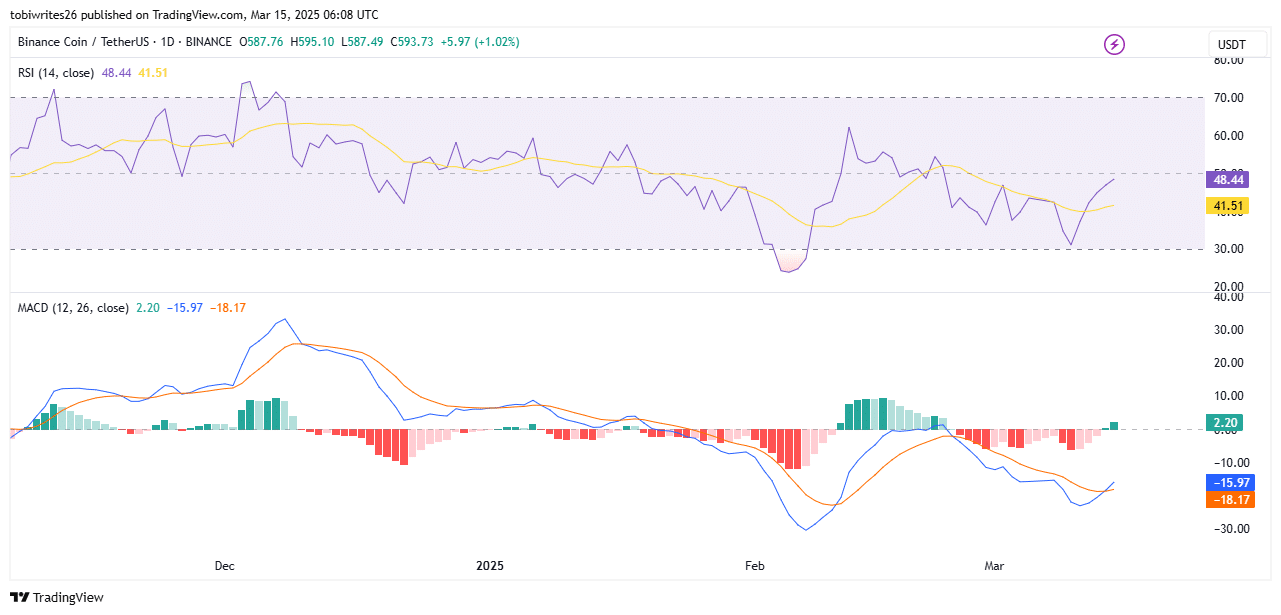

Technical indicators on the graph hinted to the potential for a market trally. On the time of the press, the relative power index (RSI) and the transferring common convergence -divigence (MACD) referred to a bullish state of affairs for the altcoin.

The each day RSI motion additionally revealed that it may very well be actively larger tendencies. Particularly for the reason that RSI appeared to shut to the acquisition zone – above 50.

Supply: TradingView

The MACD additionally fashioned a traditional golden intersection sample that happens when the blue MacD line crosses the orange sign line.

Such a sample often precedes a bullish out there. If this occurs, a BNB outbreak may happen within the brief time period.

Dischairage knowledge Present combined sentiment at merchants

Regardless of a excessive bullish sentiment in the marketplace, some merchants have bought. On the time of writing, the open curiosity in each the Futures and the choice markets had fallen by 2.30% and 1.56% respectively.

A falling open curiosity signifies that stressed contracts on the derivatives market could be potential to be stuffed by brief merchants who anticipate a worth lower. This often stops upward worth motion or influences an assault of depreciation within the charts.

Supply: Coinglass

Nonetheless, derivatives merchants on Binance and OKX have continued to purchase, with the long-to-korter ratio flashing measurements of 1.43 and a couple of.18 respectively. When this ratio is above 1, this implies shopping for greater than promoting. And, the additional above 1 it’s, the stronger the acquisition quantity is over the market.

If derivaten merchants proceed to purchase in these festivals, the gross sales strain of different cohorts within the derivatives market would stay minimal. Solely then can the BNB worth get away within the charts.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024