Altcoin

The prize struggle of Ethereum – will the voice of trust of President Trump be the key?

Credit : ambcrypto.com

- The Q1 strokes of Ethereum have brought about a debate in regards to the long-term worth

- Regardless of current losses, Trump’s help can point out the belief within the potential of Ethereum for future restoration

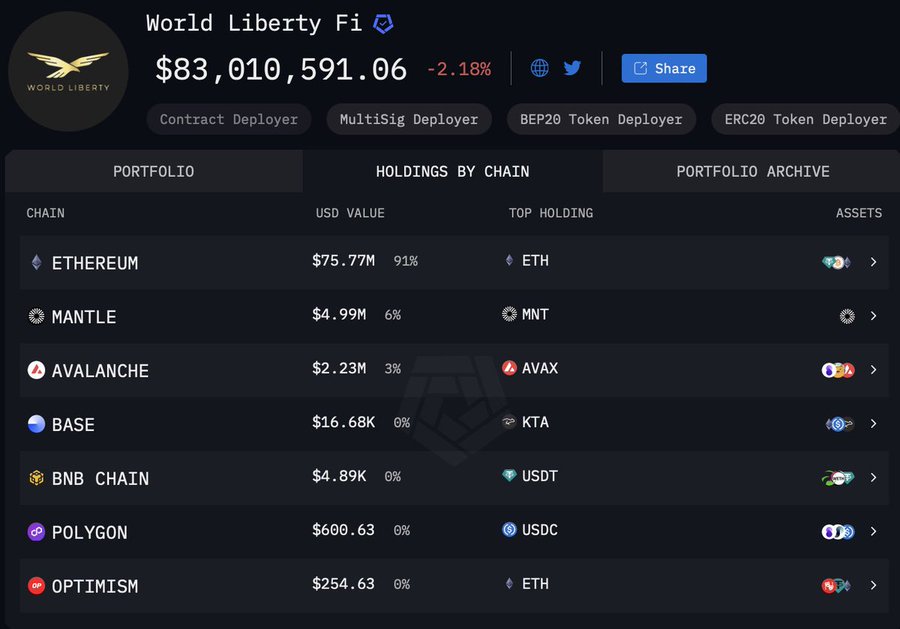

Ethereum [ETH] is confronted with its most difficult quarter in years, with a delayed improve and a gradual market efficiency, one element stands out -91% of President Trump’s crypto firms are anchored on the Ethereum -Blockchain.

Whereas the community is scuffling with its present obstacles, this necessary funding has infected hypothesis in regards to the lengthy -term views of Ethereum. Might Trump’s help be a sign of untouched potential, or is Ethereum’s wrestle solely the start of a deeper decline?

Ethereum – A rocky begin till 2025

Supply: X

ETH has included one of many worst Q1 variations in recent times. In reality, the return of March in the meanwhile that the effectivity was -10.95percentwas, after a steeper lower of -31.95percentin February -under the common return of March of +19.48%.

Supply: TradingView

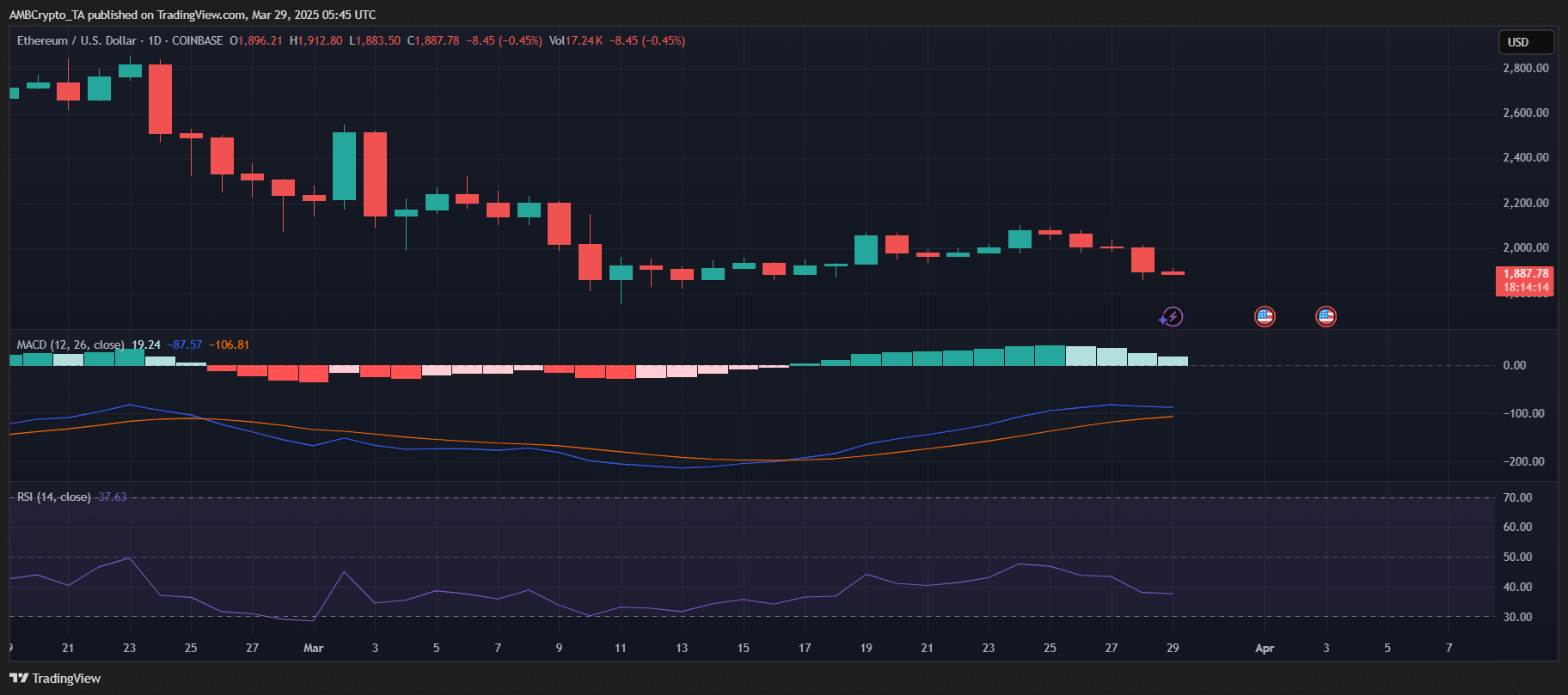

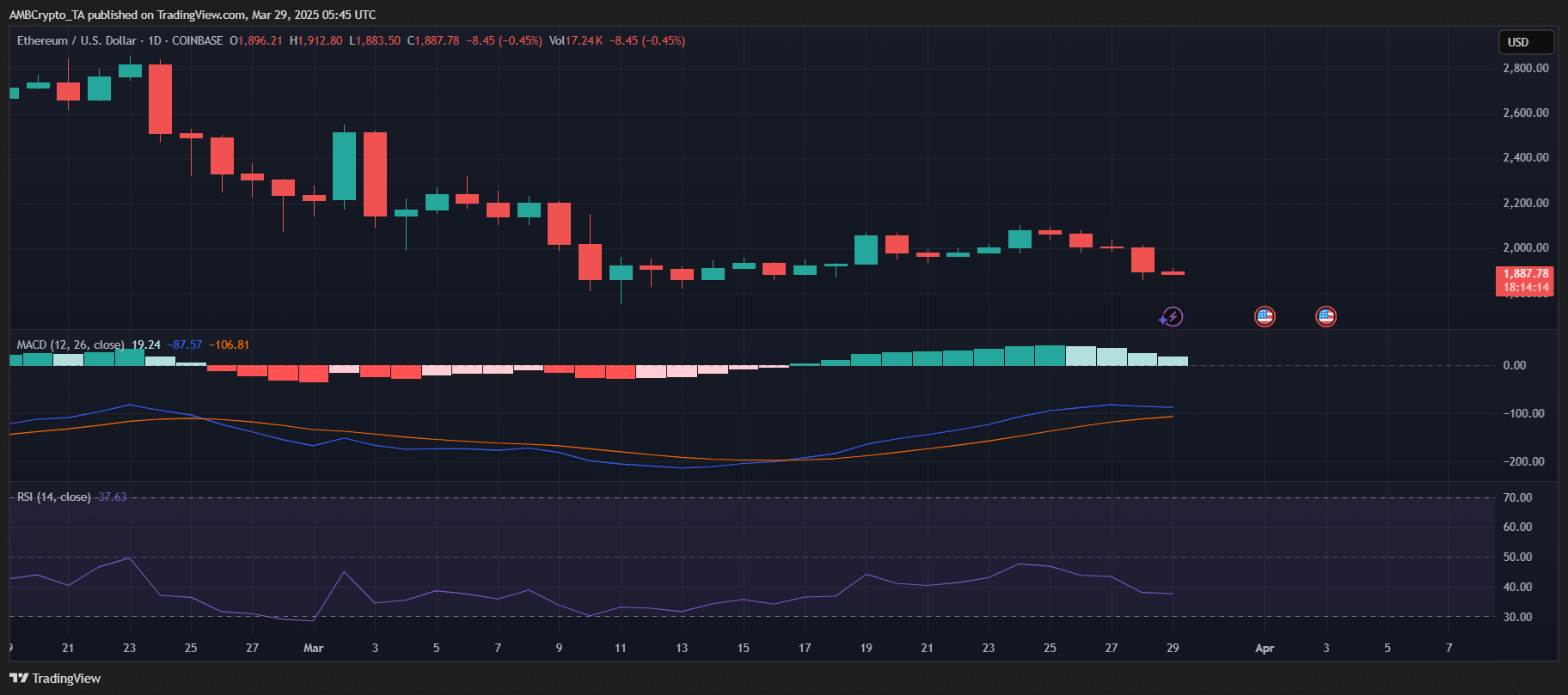

Technical indicators emphasised this bearish -trend, with ETH -dealing at round $ 1,887 on the time of the press. The MACD revealed the rising bearish -momentum, whereas the RSI was almost 37 – which signifies over -sold circumstances. A collection of pink candles on the Day by day Chart underlined the continuing gross sales stress in March.

As an addition to the uncertainty, the ecosystem stays unsure whereas merchants anticipate coming upgrades. Sentiment stays cautious, whereby the ETH worth motion additionally continues to mirror the skepticism of the broader market.

Trump’s crypto holdings – what we all know

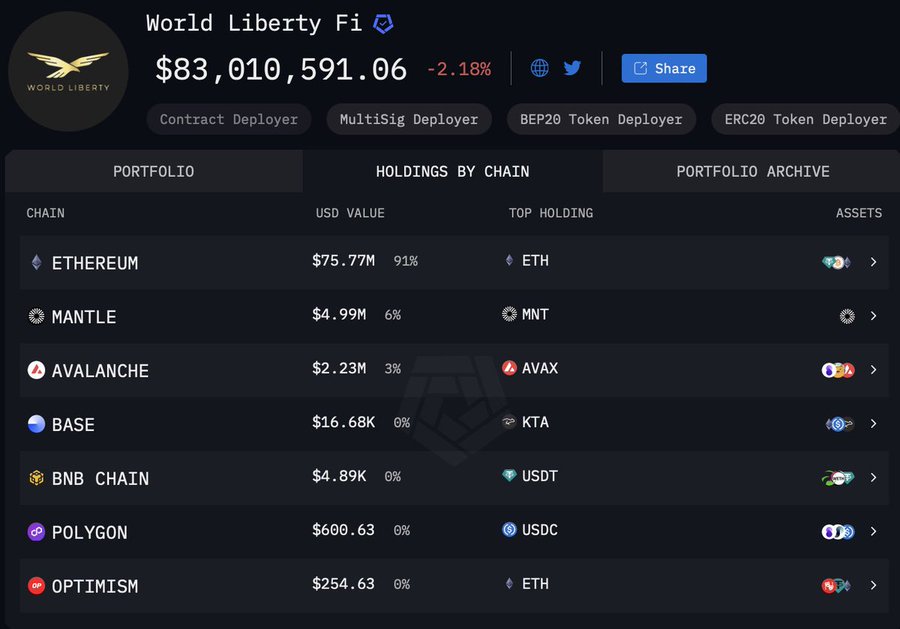

President Donald Trump’s monetary footprint within the crypto world is bigger than many expectations. Because of the necessary management of his household about World Liberty Monetary (WLFI), it’s clear that Ethereum performs a central function.

Current knowledge has proven that 91% of the Crypto portfolio of WLFI – Price round $ 75.77 million – is at present anchored in Ethereum.

Supply: X

This substantial dedication to ETH raises questions in regards to the affect of Trump on the way forward for the community, particularly within the midst of Ethereum’s steady struggles. Though the market sentiment stays shaky, the oblique approval of Trump might mirror the belief within the worth proposition of Ethereum in the long run.

In view of the size of his firms, all shifts in Trump’s crypto place can wrinkle by the market, which influences each the valuation of ETH and the broader public notion.

The case for undervaluation

Some market observers declare that ETH can at present be undervalued, in order that the necessary significance of the Trump household is seen as a voice of belief within the resilience of the lively. This angle pertains to historic knowledge – such because the decline of Ethereum in 2020 – the place Beararish Cycli finally made approach for restoration. This is usually a signal that the present struggles can mirror patterns.

Nevertheless, not everyone seems to be satisfied.

Skeptics imagine that the persistent decline of ETH can result in new lows, so {that a} lengthy -term bearish momentum runs the chance. Bitcoin’s persistent damaging 1-year proportion change also can have an effect on ETH, which drags it additional down. As well as, considerations about lowered liquidity and the lowering belief of buyers potential dangers that may dispute the soundness of actively.

The steadiness of those views can rely on Ethereum’s course of on broader market dynamics and / or monetary notes comparable to Trump’s actually sign power or a fleeting voice of belief.

What’s the subsequent step for Ethereum?

The long run restoration of ETH could be powered by numerous elements. A possible catalyst is the implementation of Sharding, which goals to enhance scalability and scale back prices. Institutional significance can also be rising, with the Clearstream planning of Deutsche Boerse to supply the guardianship and settlement providers for Ether, stimulating participation.

Lastly, the potential approval of ether-based ETFs might entice appreciable consumption of capital, particularly for the reason that Trump administration maintains a pro-crypto place. Within the Defi room, Ethereum stays essentially within the occasion of market challenges, with its function in decentralized purposes intact.

Nevertheless, regulatory readability about setting and Ethereum -based tokens can be important, and the supporting method to administration can strengthen the belief of buyers and promote additional acceptance.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now