Policy & Regulation

The SEC ‘regrets confusion’ it may have invited stating some tokens are securities

Credit : cryptoslate.com

The U.S. Securities and Trade Fee (SEC) has filed an amended grievance towards Binance within the District of Columbia, introducing procedural updates and authorized modifications to the unique submitting.

The modification, accepted this morning, features a movement beneath Federal Rule of Civil Process 15(a)(2), accompanied by a memorandum explaining the explanations for the modifications, a proposed amended grievance, and a redline model the modifications are highlighted.

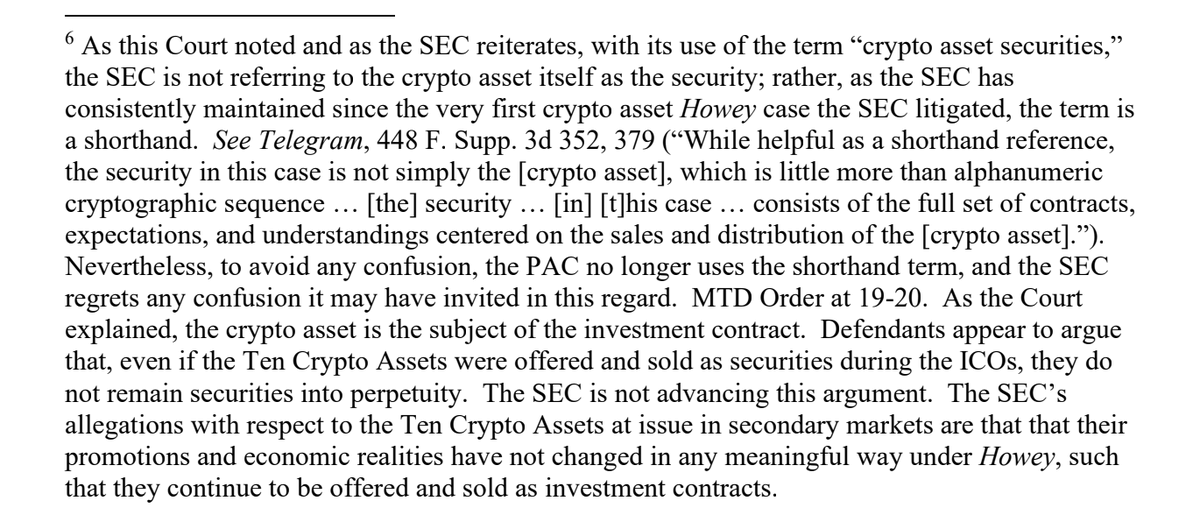

Paul Grewal, Chief Authorized Officer at Coinbase, commented on the SEC’s amended grievance through social media. “The SEC regrets any confusion it might have attributable to falsely and repeatedly stating that tokens themselves are securities,” he famous, highlighting footnote 6 of the amended grievance. He questioned the SEC’s long-standing place, stating:

“The SEC has completely ‘insisted’ that tokens themselves are securities, evident from the lengthy observe document of their regulation via enforcement marketing campaign. Why mislead the Court docket?”

Grewal shared an excerpt from the grievance, which clearly states the SEC’s remorse.

Grewal additionally addressed the SEC’s method to Ethereum (ETH) transactions, noting that the company is unclear on how ETH transactions have meaningfully modified in comparison with different digital belongings beneath scrutiny.

He famous:

“In some way, ETH transactions have modified in a significant manner that the Ten Crypto Property haven’t, to keep away from the company’s clutches. How? That is apparently for the SEC to know, and for the remainder of us to search out out on our personal if and after we get sued.”

In keeping with the amended grievance, the submitting references extra paperwork, together with an order denying defendants’ movement to dismiss in a associated case, SEC v. Payward, Inc. (Crack). Procedural deadlines have been set, requiring Binance and its co-defendants to reply by October 11, both by opposing the SEC’s movement or submitting a consent discover.

Authorized analysts recommend the SEC’s modification might be an try and strengthen its case amid criticism over regulatory readability. The company is beneath fixed scrutiny from business members who declare that its enforcement actions lack clear tips for what constitutes a safety in crypto.

Binance is beneath regulatory strain from the SEC, which claims the platform operated unregistered inventory exchanges and misled traders. The alternate has constantly denied these allegations and reaffirmed its dedication to compliance and cooperation with regulators.

The deadline for Binance and its co-defendants to answer the SEC’s amended grievance units the stage for a major authorized showdown forward of the US elections, the place crypto regulation is changing into more and more essential.

Business demand for regulatory readability continues to develop, with many calling for definitive steering relatively than enforcement motion as the first technique of regulation.

Talked about on this article

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024