Altcoin

The Terra Classic (LUNC) breakout could lead to a 1,100% rally

Credit : ambcrypto.com

- Terra Traditional (LUNC) is aiming for a breakout with targets at $0.00058046, $0.00098584 and $0.00139122

- Rising buying and selling quantity and cautious bullish sentiment might enhance LUNC as merchants regulate key assist ranges

The crypto market retains a detailed eye on developments Terra Luna Traditional (LUNC) After evaluation pointed to the potential for a breakout, which might end in a rally of over 1,100%. LUNC was priced at $0.0001115 on the time of writing, with a 24-hour buying and selling quantity of $23,876,010.

The token is up 2.20% over the previous seven days, though additionally it is down 2.02% over the previous 24 hours. With a circulating provide of 5.5 trillion tokens, $LUNC had a market capitalization of $614,461,915.

Based on Javon Marks’ analysis thoughEarlier breakouts for $LUNC efficiently met three key worth targets, pushed by robust quantity and market participation. Nonetheless, tThe altcoin worth chart as soon as once more appeared to recommend an identical potential breakout, one that might result in worth ranges of $0.00058046, $0.00098584, and $0.00139122. Particularly if bullish momentum builds underneath favorable circumstances.

Supply:

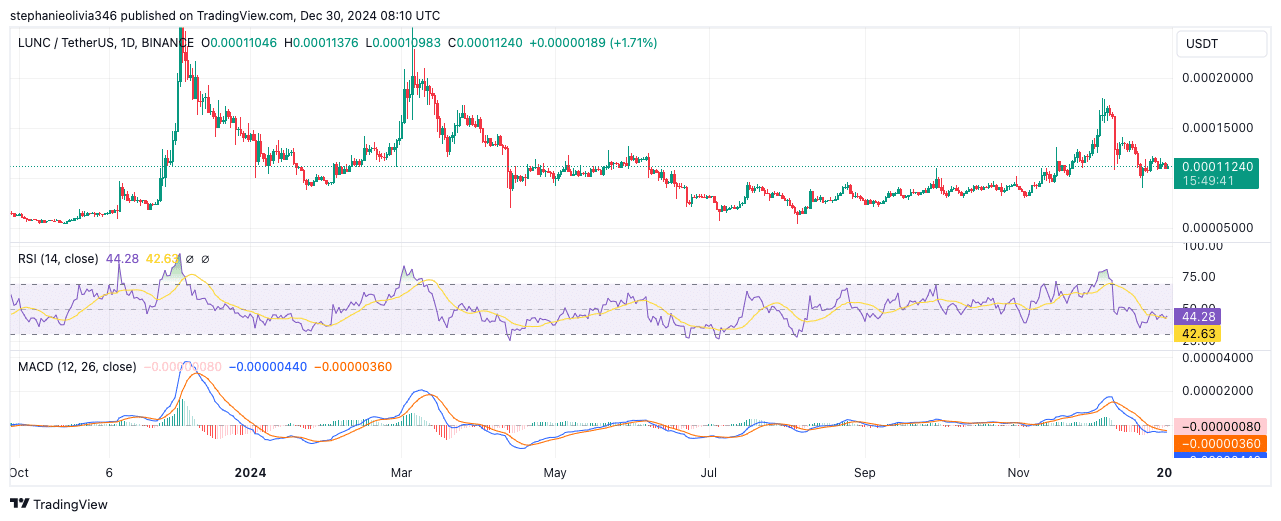

Technical patterns point out consolidation and potential for upward motion

Terra Traditional’s worth chart highlighted a consolidation part, one that might function a foundation for future bullish motion. In reality oneAnalysts have traditionally famous increased lows and a symmetrical or rounded sample, usually related to pattern continuation. These indicators collectively can usually point out that LUNC could also be making ready for a breakout.

Nonetheless, on the time of writing, these technical indicators had been sending combined indicators. For instance, the RSI was at 43.49, indicating bearish momentum however close to impartial territory, hinting at attainable stabilization.

Furthermore, the MACD confirmed a bearish crossover, with the MACD line at -0.0000087 beneath the sign line at -0.00000362, reflecting weak momentum. Key assist was recognized at $0.00009883, which is able to have to be held earlier than any restoration can happen.

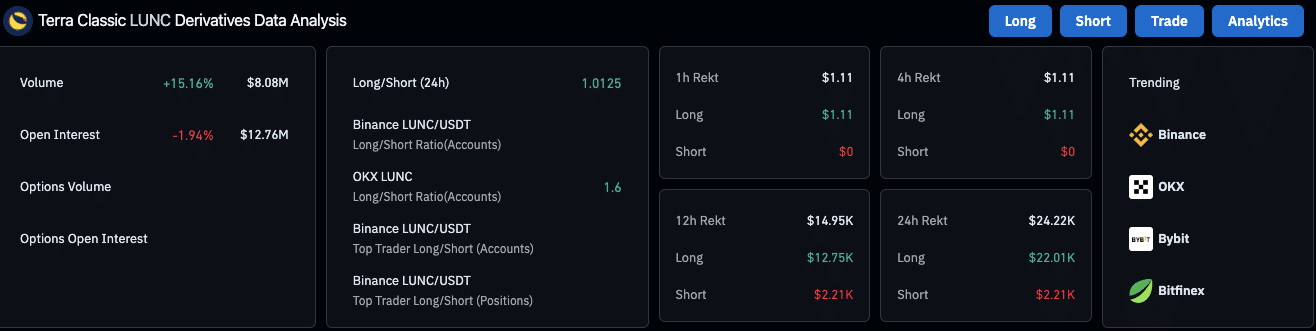

The derivatives market confirmed larger buying and selling exercise

The derivatives marketplace for Terra Traditional noticed a 15.16% improve in 24-hour buying and selling quantity, reaching $8.08 million. This progress indicated elevated curiosity amongst merchants.

Nonetheless, Open Curiosity fell 1.94% to $12.76 million, as a result of some closures of present positions. This mixture of accelerating buying and selling exercise and reducing Open Curiosity could point out indecision amongst market members.

Furthermore, the lengthy/brief ratios confirmed cautious optimism. On Binance, the ratio was 1.0125, indicating virtually equal sentiment between lengthy and brief positions.

In the meantime, OKX reviews a ratio of 1.6, reflecting stronger bullish sentiment amongst its merchants.

Liquidation knowledge signifies low leverage exercise

Within the final 24 hours, $24.22k in liquidations had been recorded, of which $22.01k got here from lengthy positions and $2.21k from brief positions. The upper liquidation of lengthy positions indicated that bullish merchants confronted challenges throughout worth swings.

Nonetheless, the comparatively low liquidation charges additionally indicated restricted leverage exercise, lowering the chance of maximum worth swings.

Because of these developments, Terra Traditional stays one to observe carefully as merchants consider the potential for an additional breakout.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September