Bitcoin

These 3 Signals Statistically Predict Bitcoin’s Next Big Move

Credit : bitcoinmagazine.com

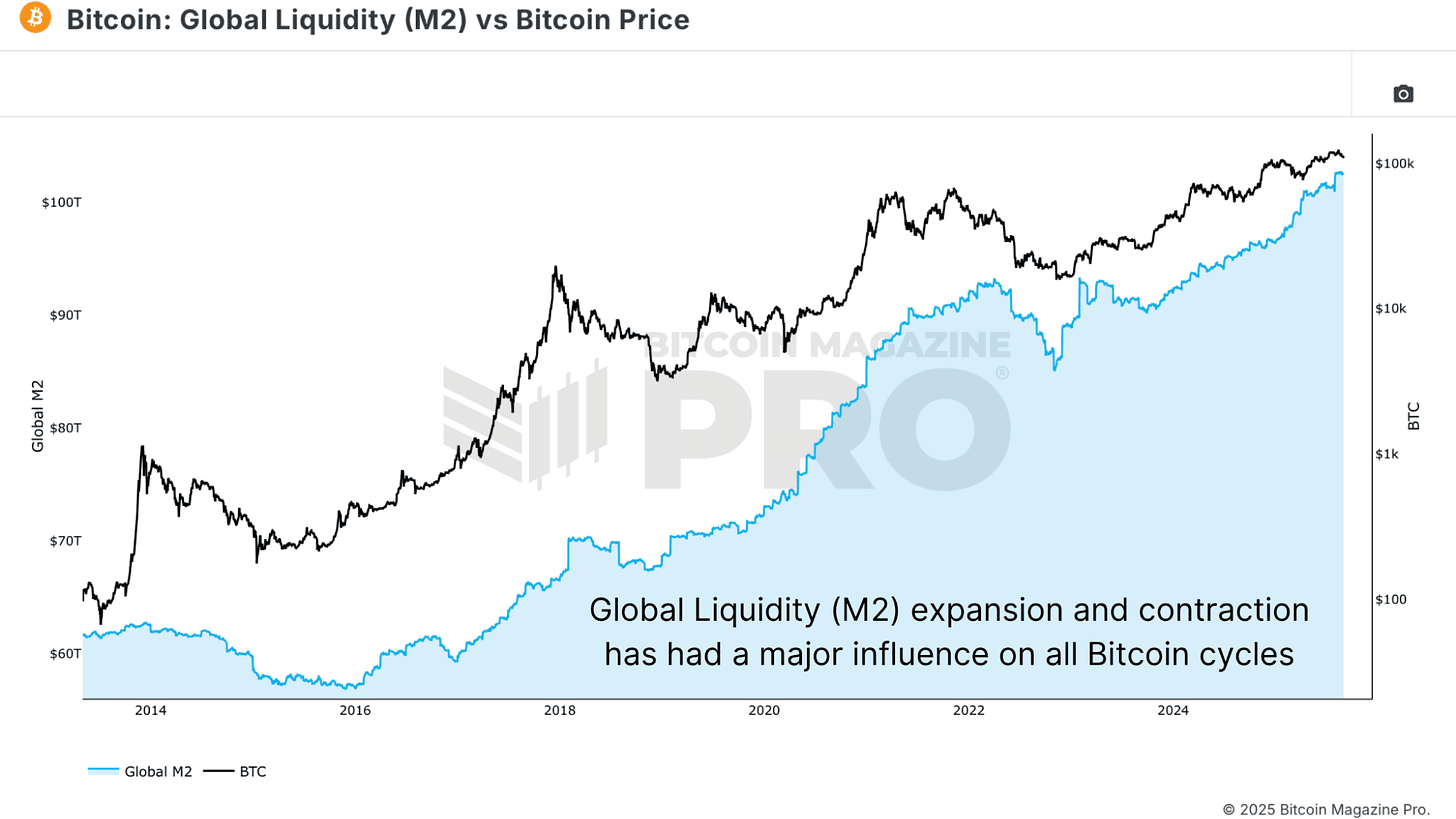

Throughout a big a part of this cycle, international liquidity was one of the vital correct indicators for anticipating the value motion of Bitcoin. The connection between the enlargement of the cash provide and the expansion of the chance asset is nicely established and Bitcoin has adopted that script remarkably intently. However not too long ago we paid good consideration to some different information factors which have been statistically much more correct when predicting Bitcoin goes. Collectively, these statistics assist a clearer image of whether or not the current stagnation of Bitcoin is a brief -term break or the beginning of an extended consolidation part.

Bitcoin -Perrends Pushed by international liquidity shifts

The connection between Global liquidity, in particular M2 money amount, and the price of Bitcoin is troublesome to disregard. When the liquidity expands, Bitcoin tends to collect; When it contracts, Bitcoin struggles.

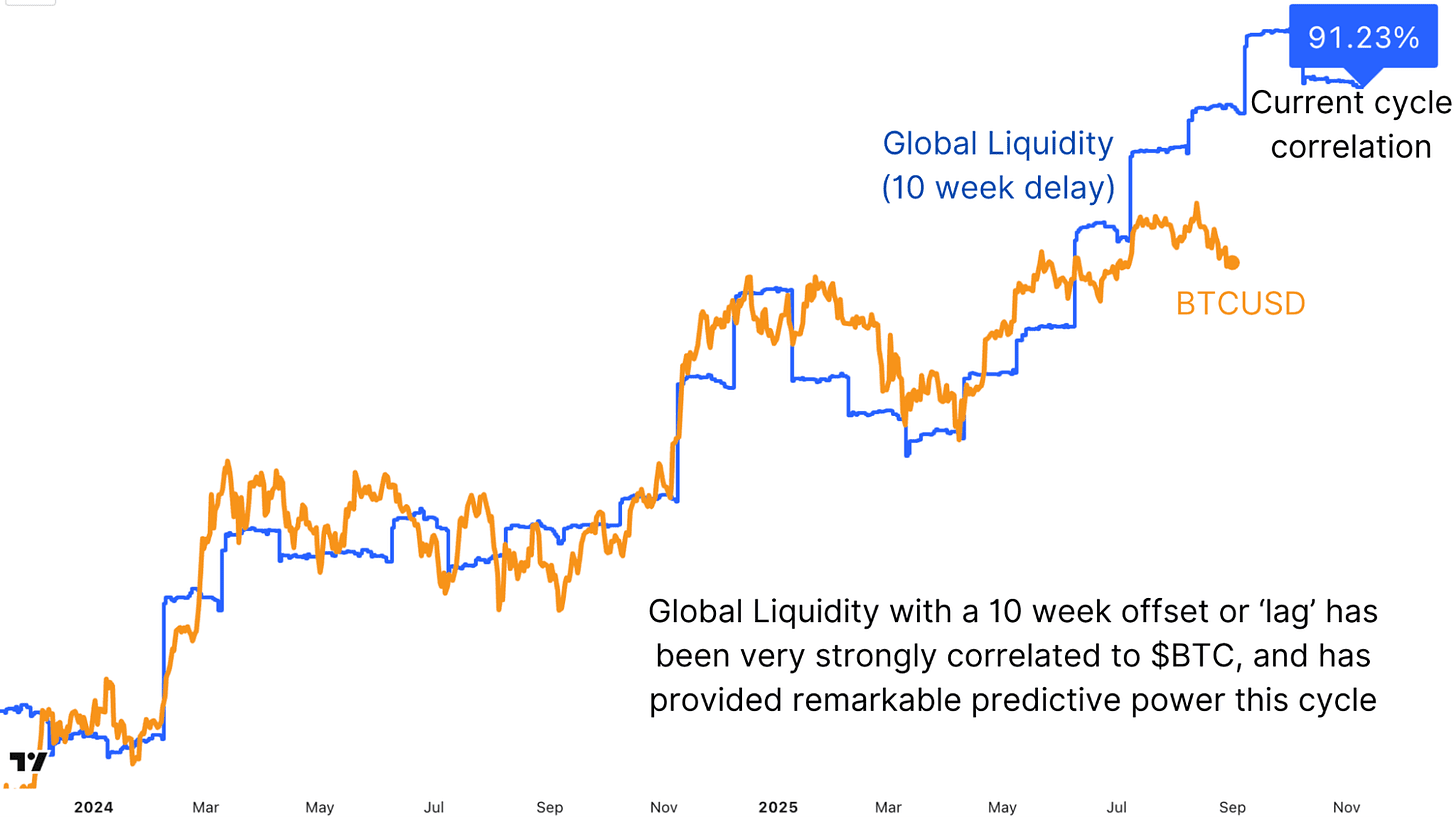

Measured over this present cycle, the correlation is on a powerful 88.44%. Including a 70-day offset pushes that correlation even greater by 91.23%, which signifies that liquidity adjustments usually precede the actions of Bitcoin with simply over two months. This framework has confirmed to be remarkably correct when recording the broad pattern, the place cycle dips are in keeping with the worldwide liquidity aid and the next restoration reflection mirrored renewed enlargement.

But there was a exceptional divergence these days. Liquidity continues to rise and signaling help for greater Bitcoin costs, however Bitcoin itself bought caught after making new heights of all time. This divergence is value monitoring, but it surely doesn’t make the broader relationship invalid. It could actually even counsel that Bitcoin merely lags behind in liquidity circumstances, because it has achieved on different factors within the cycle.

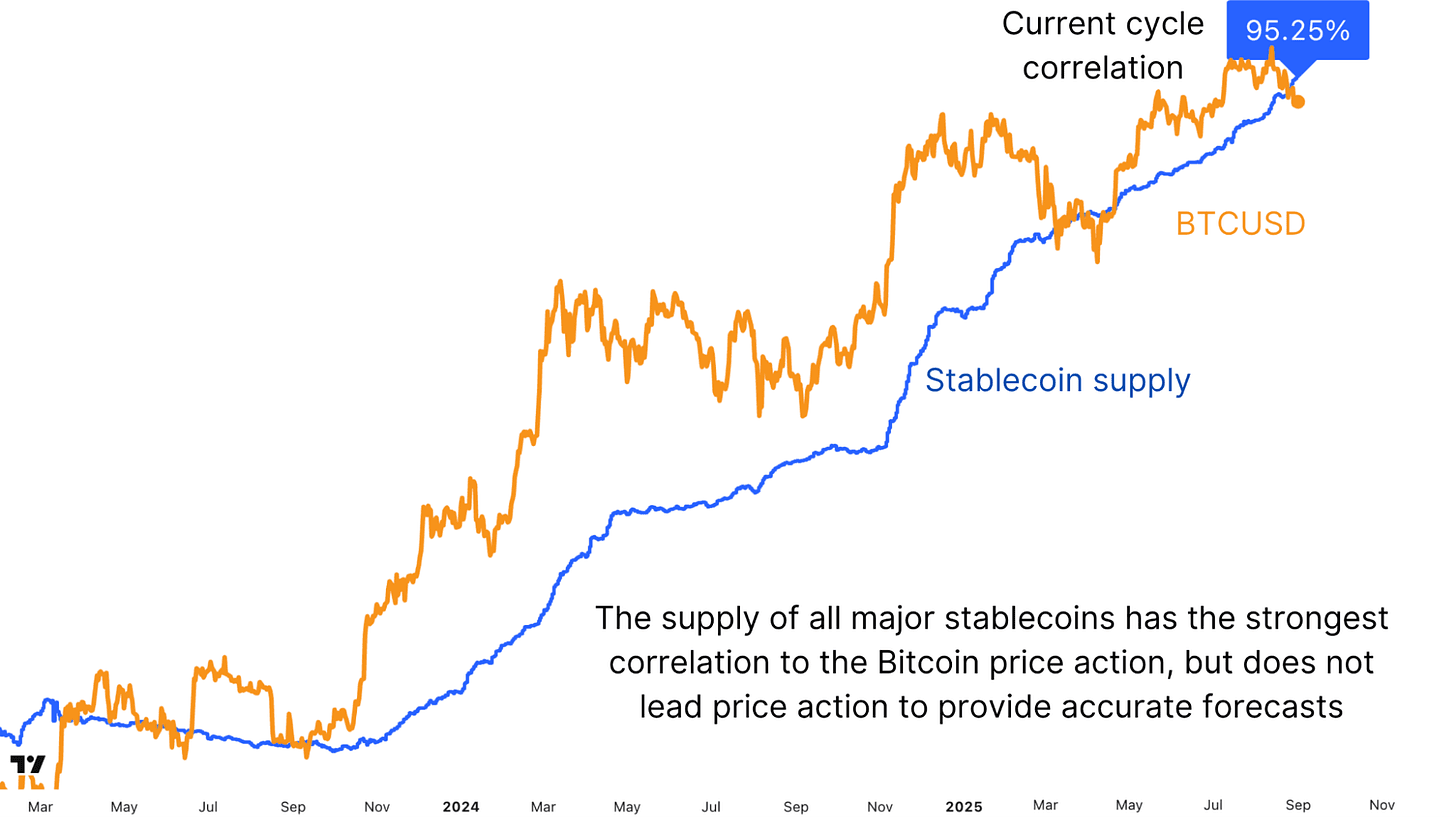

Stablecoin supply Signaling Bitcoin -market rises

Though international liquidity displays the broader macro setting, Stablecoin Provide provides a extra direct view of capital to enter digital belongings. When USDT, USDC and different stablecoins are overwhelmed in giant portions, this “dry powder” is ready for rotating in Bitcoin and finally extra speculative altcoins. Surprisingly, the correlation right here is even stronger than M2 at 95.24% with none offset. Any main inflow of the liquidity of the Stablecoin has been preceded or accompanied by a rise within the worth of Bitcoin.

What makes this metric highly effective is the specificity. In distinction to the worldwide liquidity, which incorporates your entire monetary system, the expansion of the Stablecoin is crypto-native. It represents direct potential demand inside this market. However right here too we see a divergence. Stablecoin Provide has been aggressively expanded and has made new highlights, whereas Bitcoin is consolidated. Traditionally, such variations don’t final lengthy, as a result of this capital is finally searching for effectivity and flows in threat belongings. Whether or not this implies that the profit or a slower rotation can nonetheless be seen, however the energy of the correlation makes it one of the vital necessary statistics to observe within the brief to medium time period.

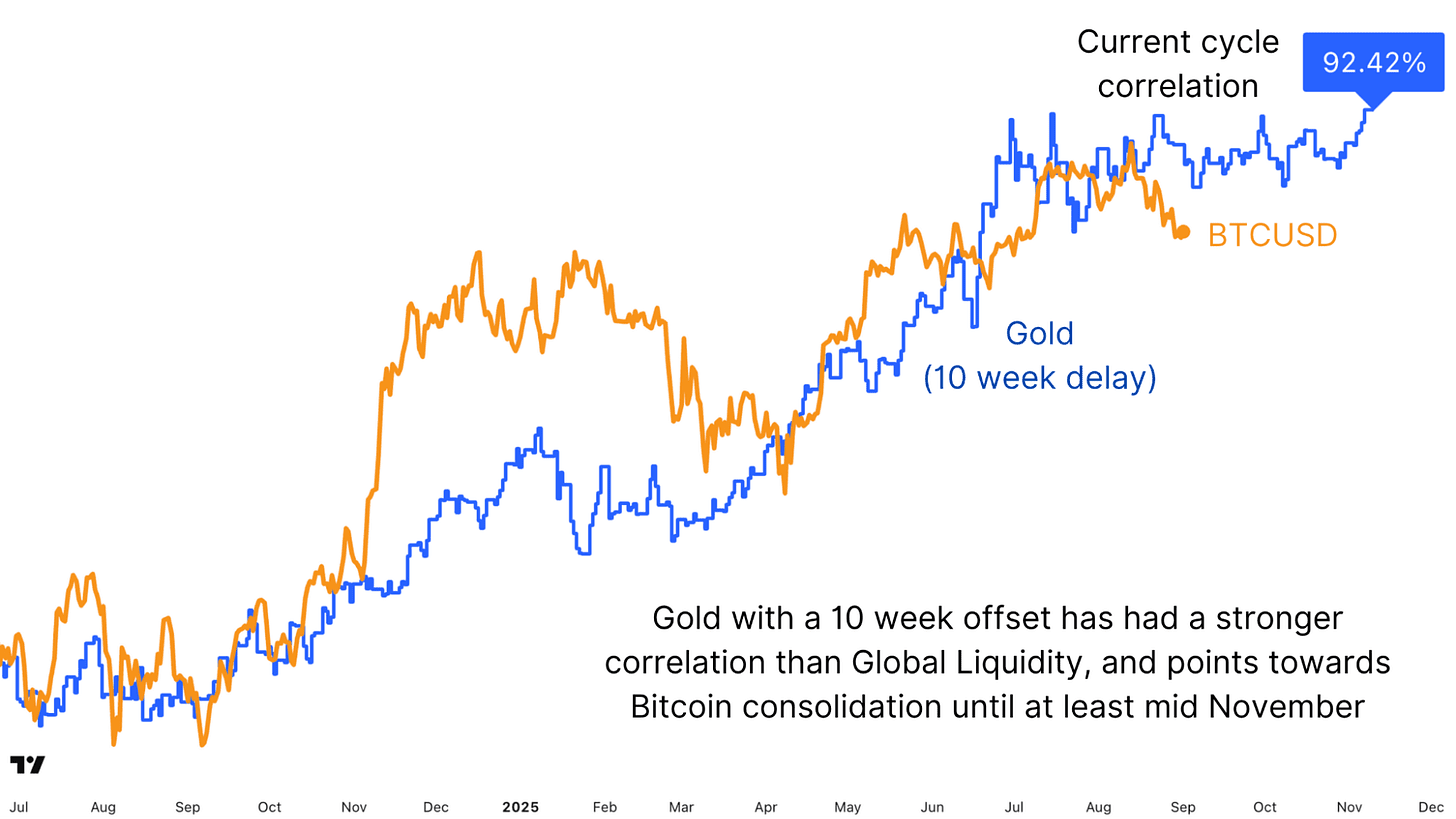

Bitcoin predictive energy of Gold’s excessive correlation delay

At first look, Bitcoin and was not persistently sharpened robust correlation. Their relationship is jerky, generally shifting collectively, different occasions diverging. Nevertheless, when making use of the identical 10 -week delay, we utilized to the worldwide liquidity information, a clearer image emerges. On this cycle, gold with an offset of 70 days reveals a correlation of 92.42% with Bitcoin, greater than the worldwide M2 itself.

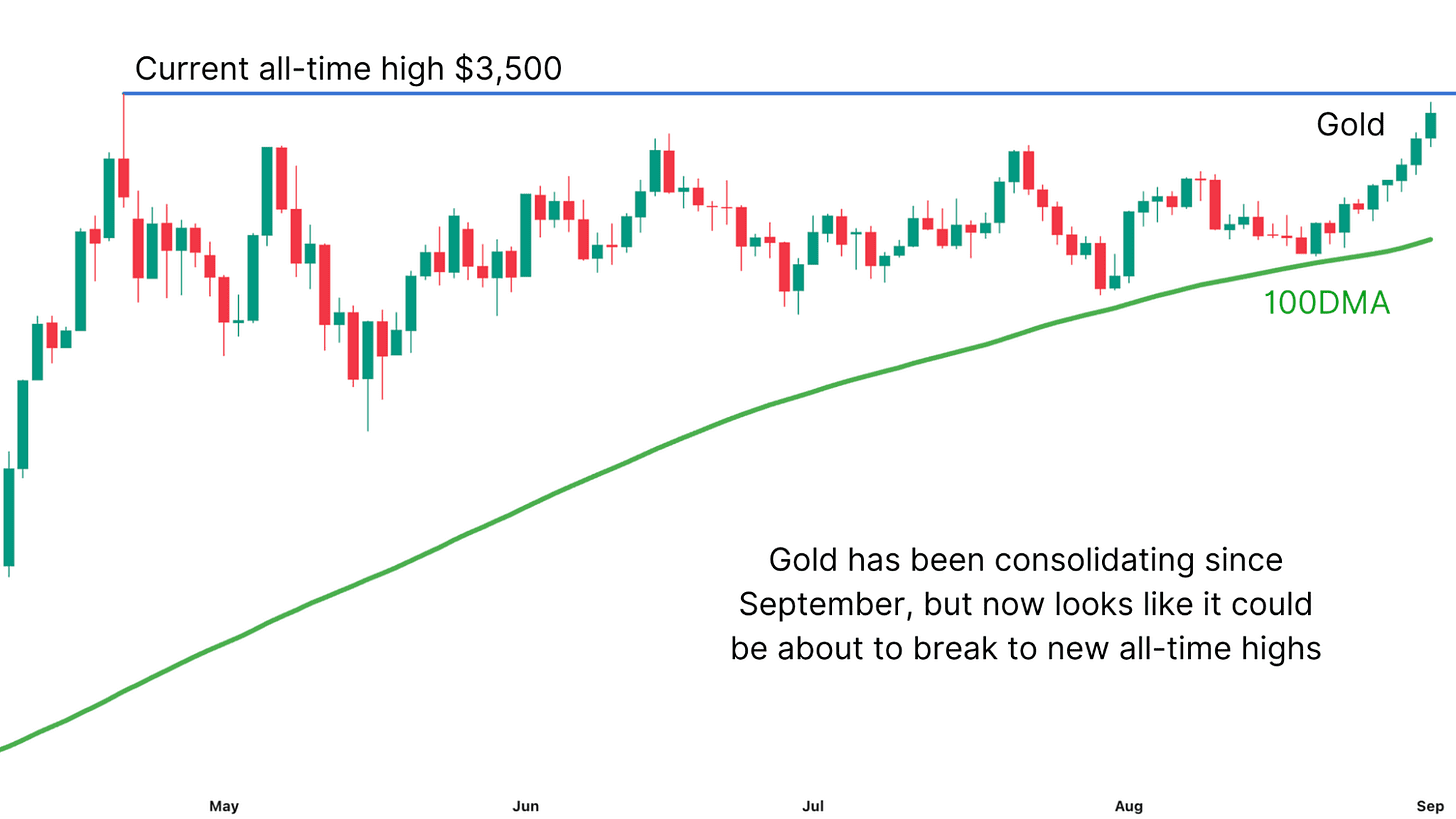

The alignment is placing. Each belongings tied virtually on the similar time on the soil, and since then their most necessary conferences and consolidations have adopted comparable processes. Extra not too long ago, gold is locked up in a protracted -term consolidation part and Bitcoin appears to reflect this together with his personal turbulent lateral motion. If this correlation applies, Bitcoin can stay accessible till a minimum of mid -November, following the stagnant habits of Gold. However with gold that now appears to be like technically robust and is prepared for brand spanking new all-time highlights, Bitcoin might shortly observe if the story of “Digital Gold” confirms itself once more.

Bitcoin’s subsequent transfer predicted by necessary market statistics

In abstract, these three statistics, international liquidity, Stablecoin Provide and Gold, provide a strong framework for predicting the next actions of Bitcoin. World M2 has remained a dependable macro anchor, particularly with a 10-week delay. The expansion of the Stablecoin provides the clearest and most direct sign from the incoming crypto query, and the accelerating enlargement suggests growing stress for greater costs. Within the meantime, the delayed correlation of Gold provides a stunning however helpful predictive lens, which factors to a interval of consolidation earlier than a potential outbreak later within the coming weeks.

Within the brief time period, this confluence of alerts means that Bitcoin can proceed to cut apart, which displays the stagnation of Gold, even when the liquidity grows within the background. But when gold breaks to new highlights and the difficulty of Stablecoin stays on the present tempo, Bitcoin can arrange for a strong finish -of -year rally. For now, persistence is the important thing, however the information means that the underlying circumstances stay favorable for Bitcoin’s lengthy -term course of.

Did it like this deep dive in Bitcoin worth dynamics? Subscribe to Bitcoin Magazine Pro on YouTube For extra professional market insights and evaluation!

Go to for extra in -depth analysis, technical indicators, actual -time market warnings and entry to professional evaluation Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. At all times do your individual analysis earlier than you make funding selections.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024