Bitcoin

This Bitcoin ETF Strategy Has Outperformed BTC Buy-and-Hold

Credit : bitcoinmagazine.com

Bitcoin ETF entry accelerates the affect of institutional traders available on the market, which reformed BTCs provide dynamics and the general construction. As a result of these ETFs are flooded within the area, many see this wave of institutional participation as an unprecedented shift within the Bitcoin story. However what if this institutional information can’t solely be used to watch the market, but additionally to carry out Bitcoin itself?

Who actually buys Bitcoin ETFs? Outline ‘Institutional’

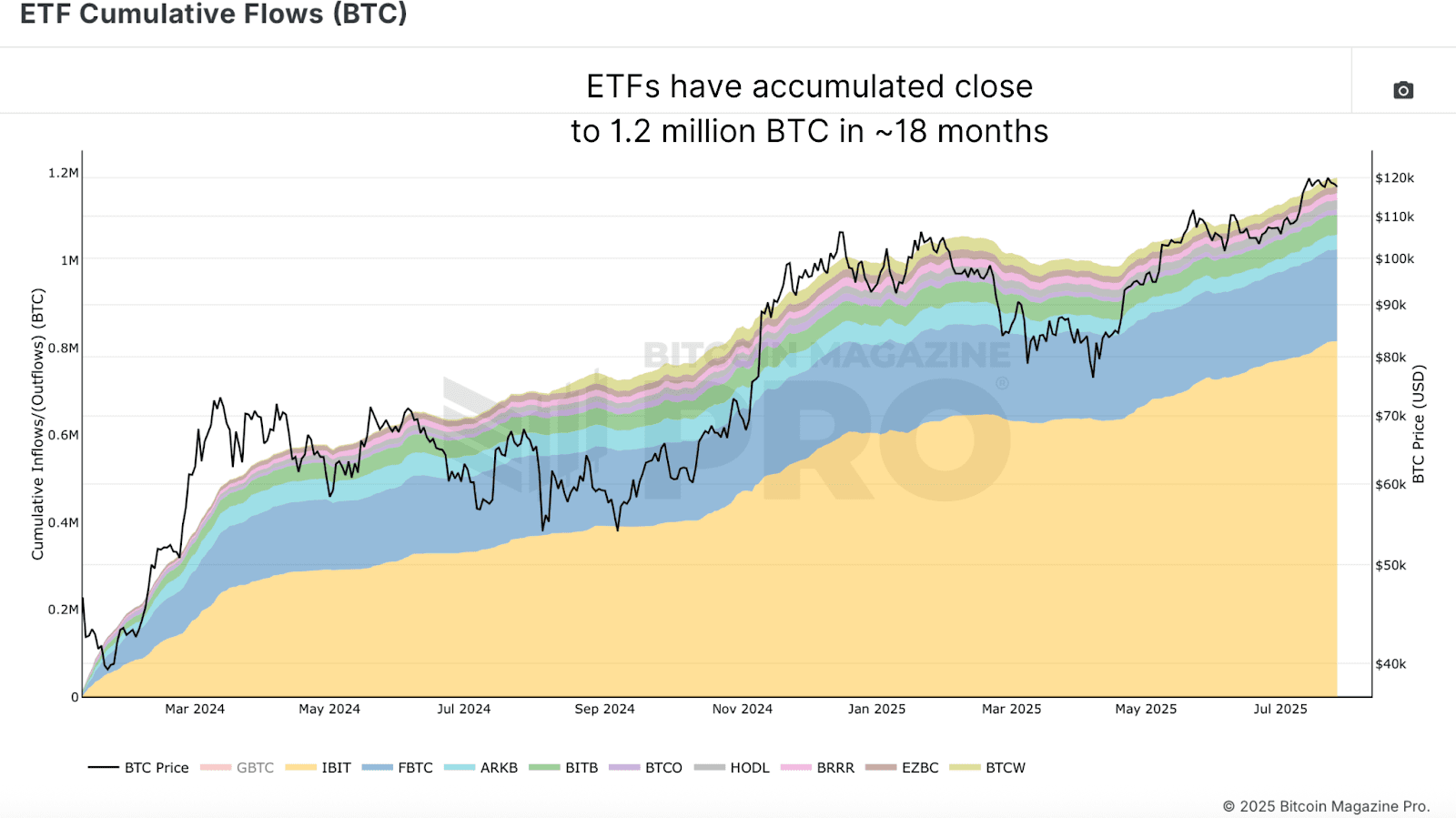

The time period ‘institutional’ is usually used as a steno for ETF patrons, however in actuality this influx characterize a mixture of high-grown people, household companies and a few precise institutional funds. Maybe solely 30-40% are what we’d think about actual establishments. Careless, ETF Cumulative Streams His exponentially grown to just about 1.2 million BTC since January 2024. That may be a remodeling quantity, wherein a helpful a part of the accessible supply of the open market is eliminated for an indefinite interval.

Such a accumulation, particularly together with long-term holding habits of treasury firms and presumably even nation states, has completely modified the Bitcoin liquidity profile. These cash could by no means re -introduce the circulation.

ETF -power information changing right into a worthwhile bitcoin -trading technique

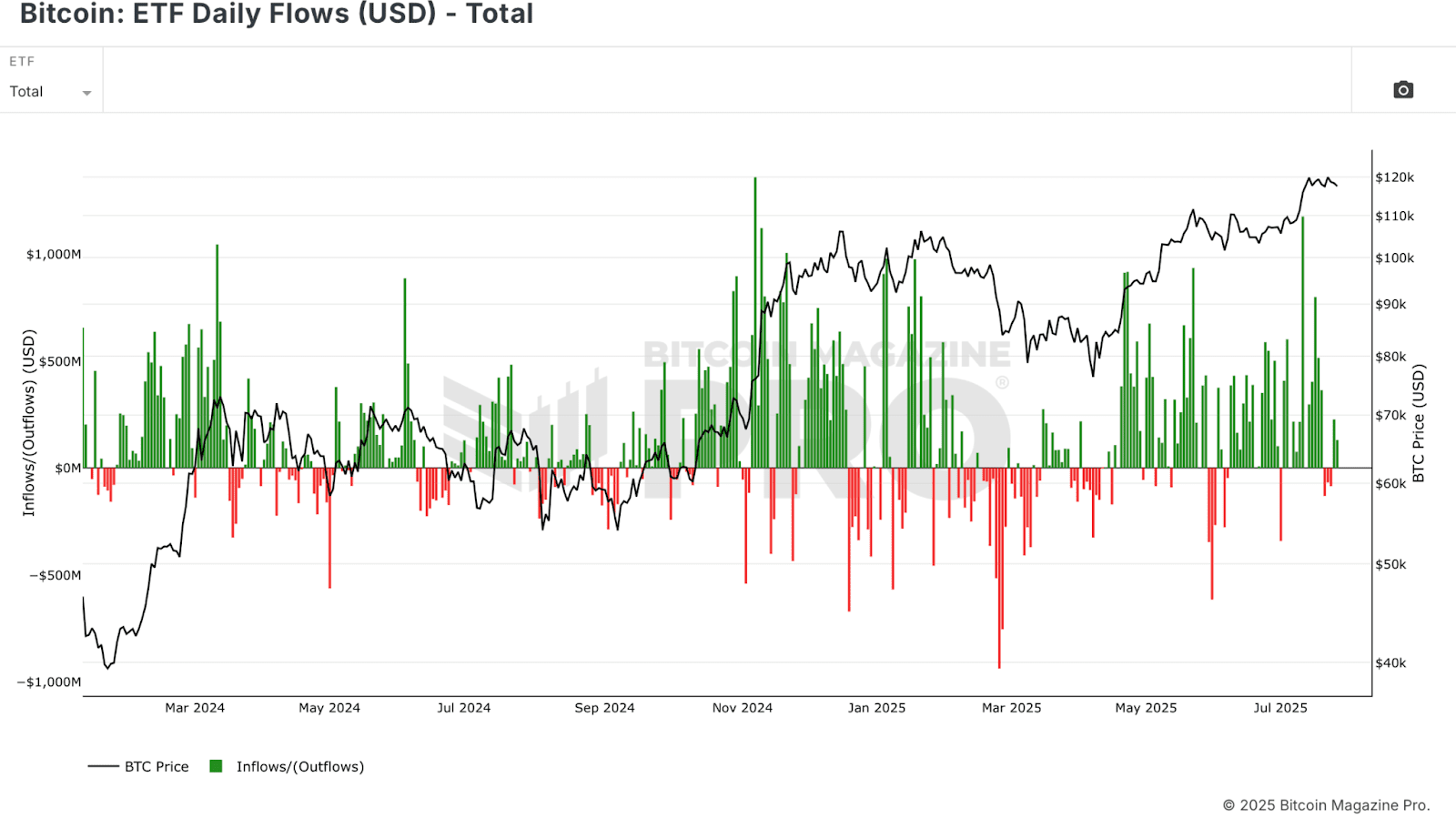

Many assume that these ETF individuals are the embodiment of sensible cash, sensible traders shifting in opposition to the grain to take advantage of the retail sentiment. However the information tells a distinct story. Evaluation of the ETF Daily Flows (USD) Graphics reveals a herd-like habits of exhausting shopping for in native tops and capitulate on native soils.

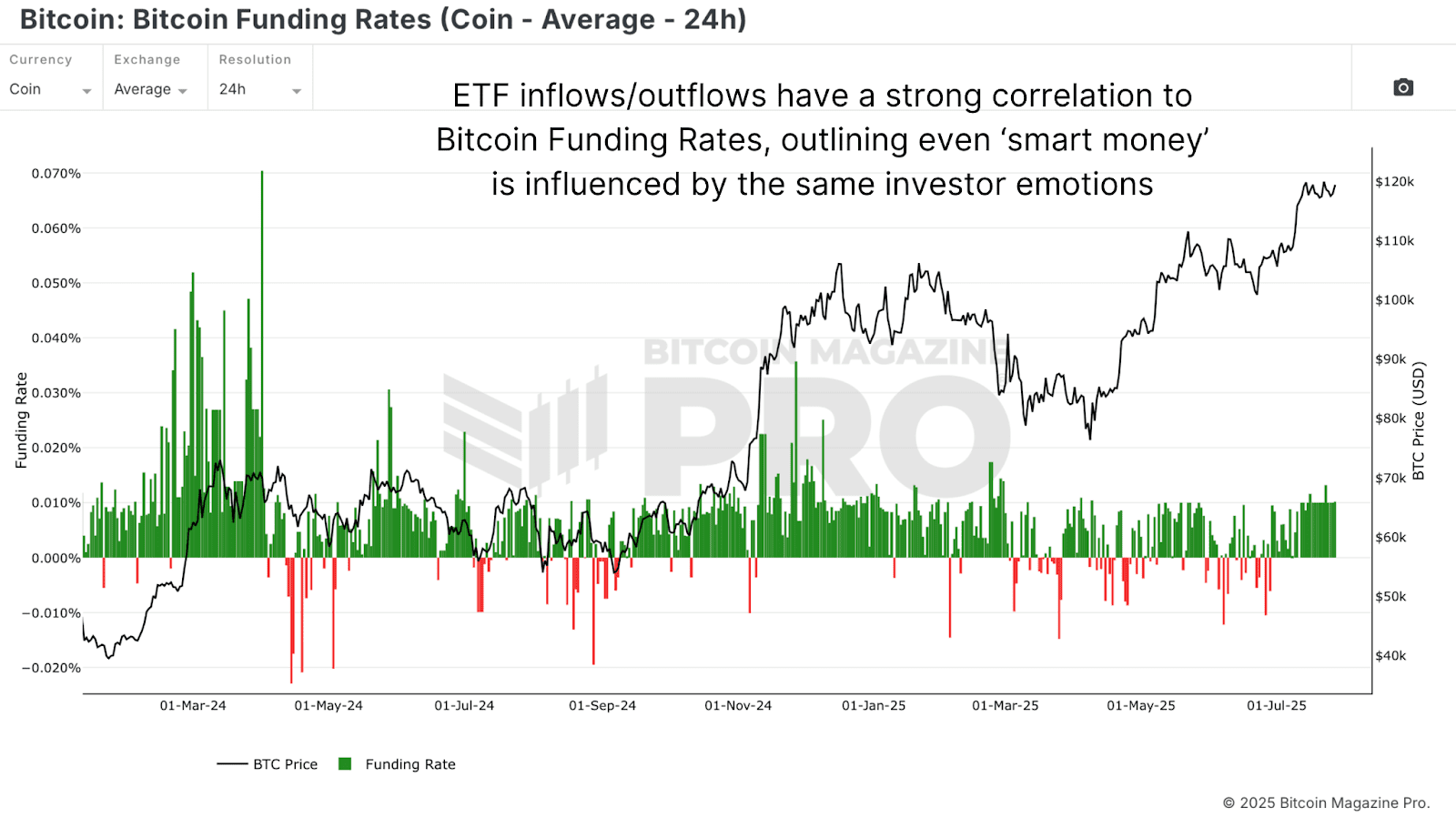

A comparability between ETF flows and Bitcoin finance ratesA barometer within the retail commerce exhibits a creepy synchronicity. Shopping for and promoting settings primarily in Lockstep with Retail, not for them. This shouldn’t be stunning. Human psychology, cognitive bias and FOMO don’t cease influencing folks alone as a result of they handle massive sums of cash. Even Treasury departments from massive firms usually purchase euphoria.

Bitcoin ETF circulate technique versus buy-and-hold: The outcomes

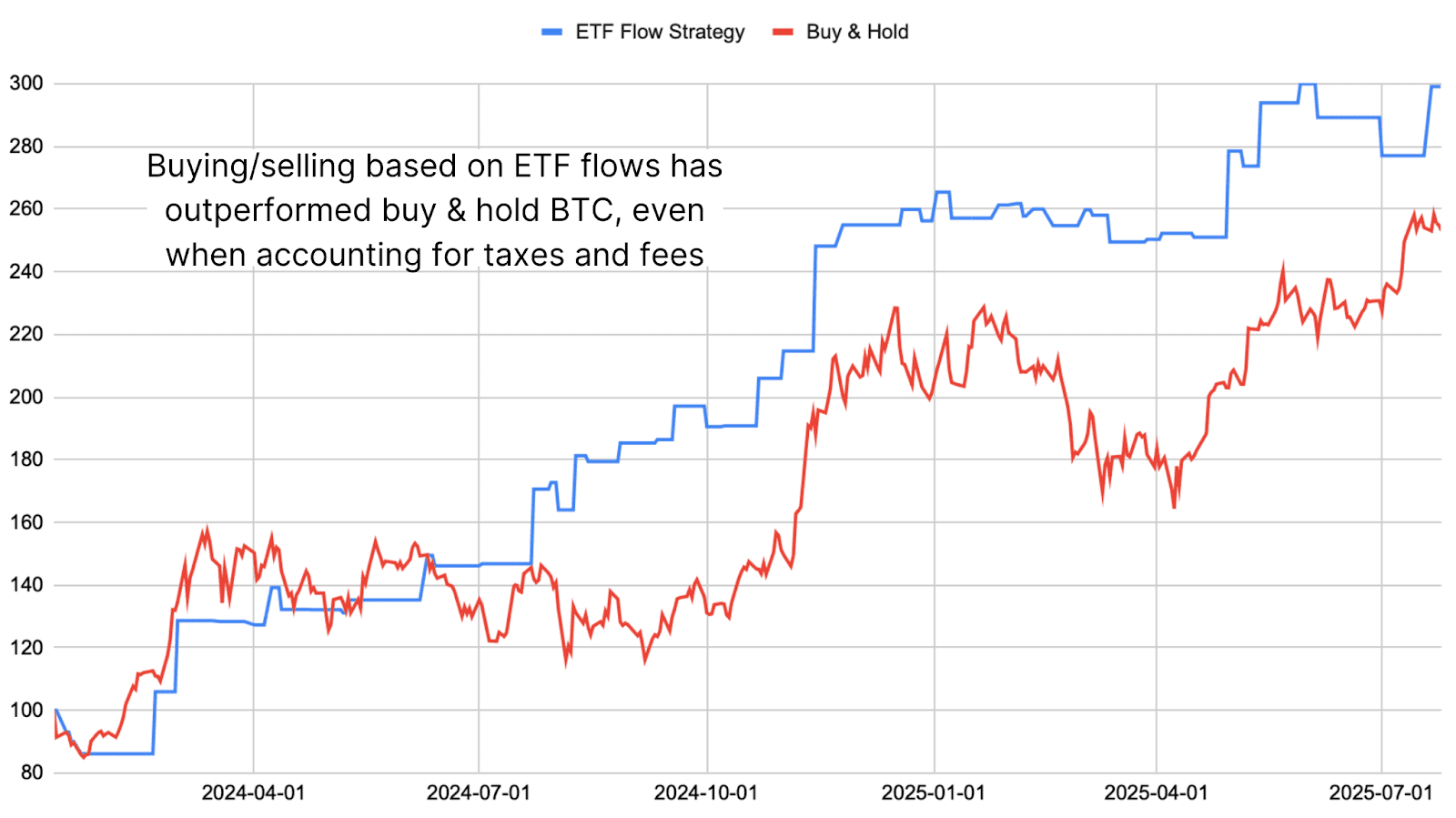

If ETF patrons merely purchase the pattern of shopping for as the value rises and the sale as the value decreases, their influx and outflow can function a possible enter/exit sign, or higher, as a momentum indicator when accurately interpreted. To check this idea, we now have made a easy technique utilizing ETF present information through the Bitcoin Magazine Pro API.

The logic is easy: purchase Bitcoin when ETF’s influx present and promote once they present outflow. It isn’t an ideal sign; Early transactions present characters and a noticeable underperformance in comparison with shopping for and holding, however when this technique is utilized over the whole wingspan since ETFs have been launched, the returns are spectacular. Virtually 200% versus round 155% for a buy-and-hold technique. Even with components in a nominal tax price of 20% on worthwhile transactions, the technique nonetheless carried out higher than.

Do it’s important to use a Bitcoin ETF technique?

This sort of tactical technique just isn’t for everybody. Many Bitcoiners are lengthy -term holders who would by no means think about promoting. However for individuals who are keen to handle dangers and conquer Edge out there, this ETF-based technique affords a approach to make use of the habits of the massive market individuals.

So, following institutional flows provides you a lead? In itself, most likely not constant. Though it’s undoubtedly spectacular, it has labored for therefore lengthy, I personally doubt it will work in a number of cycles. However together with the broader market context, it turns into a great tool for measuring the pattern and strengthening different alerts to composite returns.

Did it like this deep dive in Bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube For extra knowledgeable market insights and evaluation!

Go to for extra in -depth analysis, technical indicators, actual -time market warnings and entry to knowledgeable evaluation Bitcoinmagazinepro.com.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your individual analysis earlier than you make funding choices.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now