Altcoin

THIS Bitcoin metric is approaching ZERO

Credit : ambcrypto.com

- Bitcoin fell 8.42% on the weekly charts, resulting in an increase in bearish market sentiment

- An accumulation pattern rating approaching 0 might influence the cryptocurrency

In current months, Bitcoin has seen excessive volatility on the value charts. Though BTC has reached an all-time excessive of $73,000 in 2024 and the market has turn out to be extra favorable because the launch of ETFs, it has additionally seen greater volatility.

On the time of writing, BTC was buying and selling at $54,239, having dropped 8.42% prior to now week.

And but it’s nonetheless exhibiting some indicators of life with a current enhance in buying and selling quantity. In truth, the numbers for this have elevated by 63.13% to $48.6 billion within the final 24 hours. Nonetheless, what does this imply for BTC’s market prospects within the quick and long run? Can Bitcoin now absolutely get better?

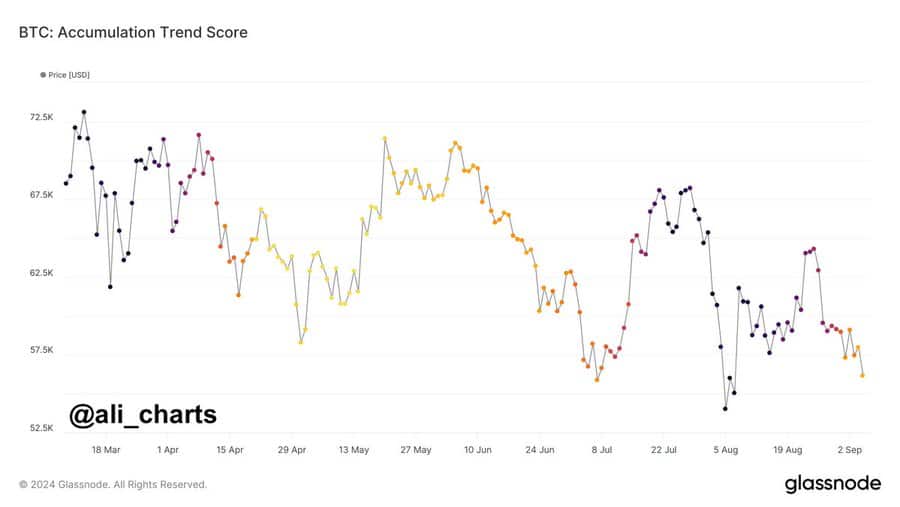

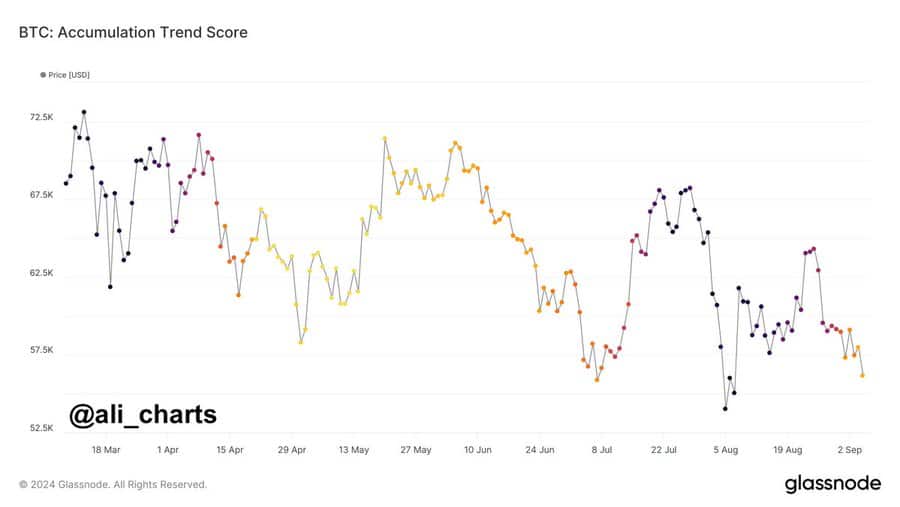

Properly, in accordance with the favored crypto analyst Ali Martinez’s Based mostly on this suggestion, BTC might doubtlessly see decreased participation. He made this declare by citing the declining accumulation pattern rating.

Market sentiment evaluation

In keeping with Martinez, the buildup pattern rating is presently approaching zero. Because of this market contributors distribute or don’t accumulate BTC.

Supply:

In context, the buildup pattern rating displays the relative measurement of entities actively accumulating cash on-chain when it comes to BTC holdings. A worth near 1 means that contributors are accumulating cash. A worth nearer to 0 signifies that contributors are dividing their belongings.

So when the buildup pattern rating flashes 0, it signifies there aren’t any patrons from any cohort, indicating distribution. At any time when BTC hits a low in a bear cycle, it sees a surge in accumulation as traders purchase the dip. Nonetheless, after the bear market cycle continues, an absence of accumulation happens as a result of they lack confidence within the cycle.

Based mostly on this evaluation, the buildup rating from late August to early September 2024 is approaching zero. This implies higher dispersion and a weakening of accumulation amongst contributors. Such a situation means that bigger gamers and long-term holders usually are not shopping for – a sign of bearish sentiment.

That is additionally an indication of insecurity amongst traders in regards to the near-term rally. These market circumstances lead to promoting strain, resulting in a value drop on the charts.

What do the value charts say?

Whereas the figures highlighted by Martinez offered an in depth image of prevailing market sentiment, the broader market has borne the brunt of the current restoration.

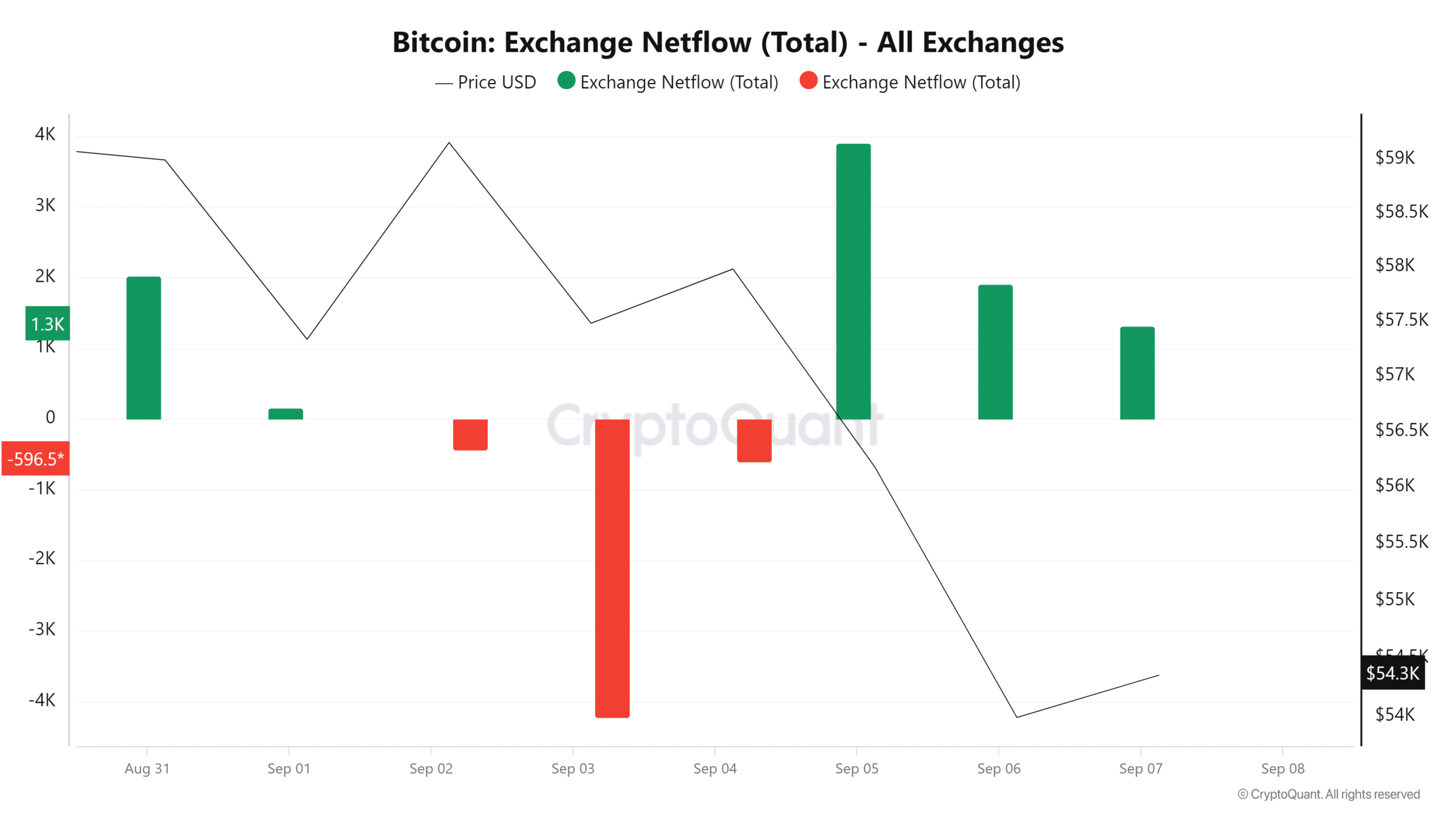

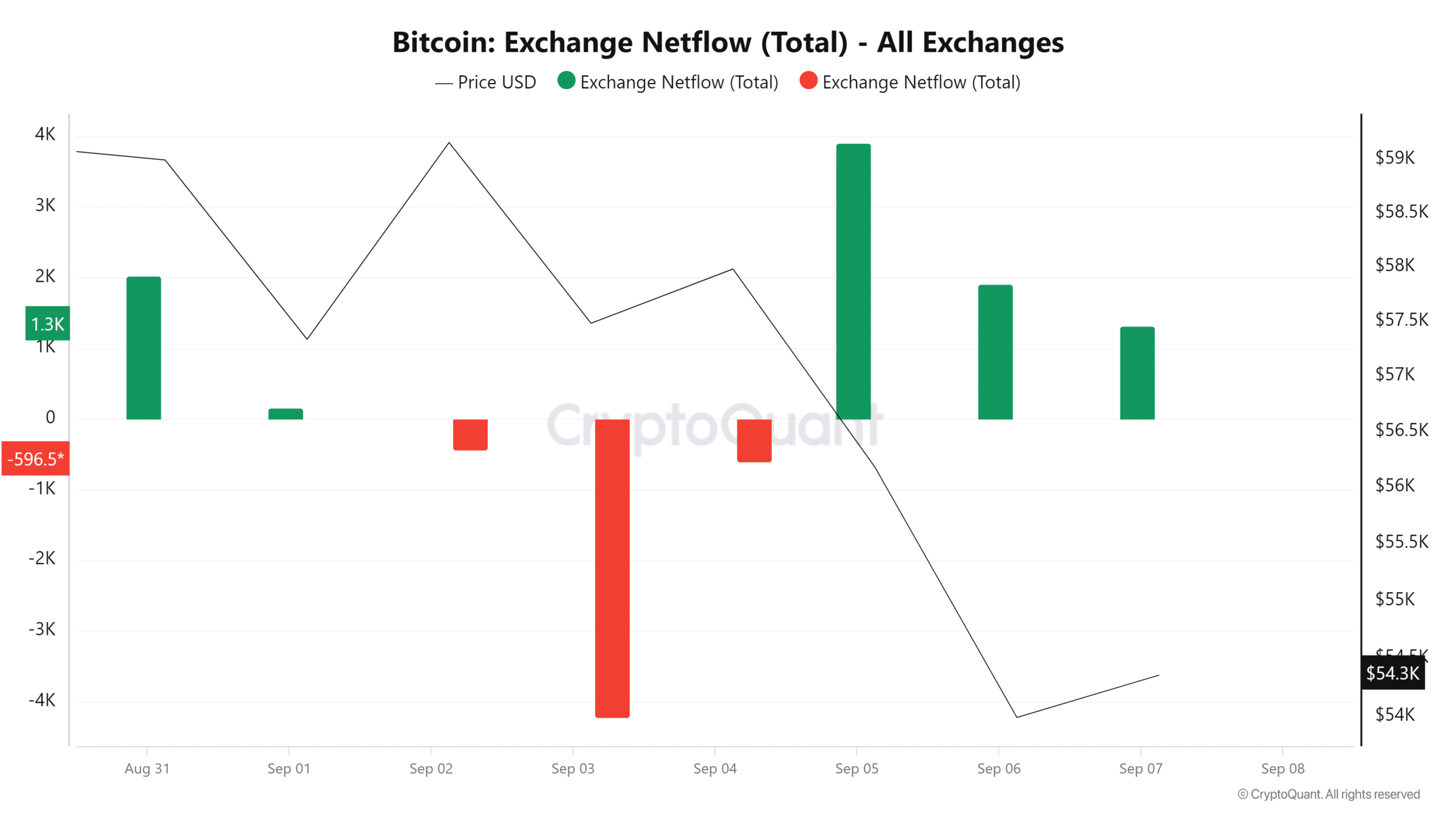

Supply: Cryptoquant

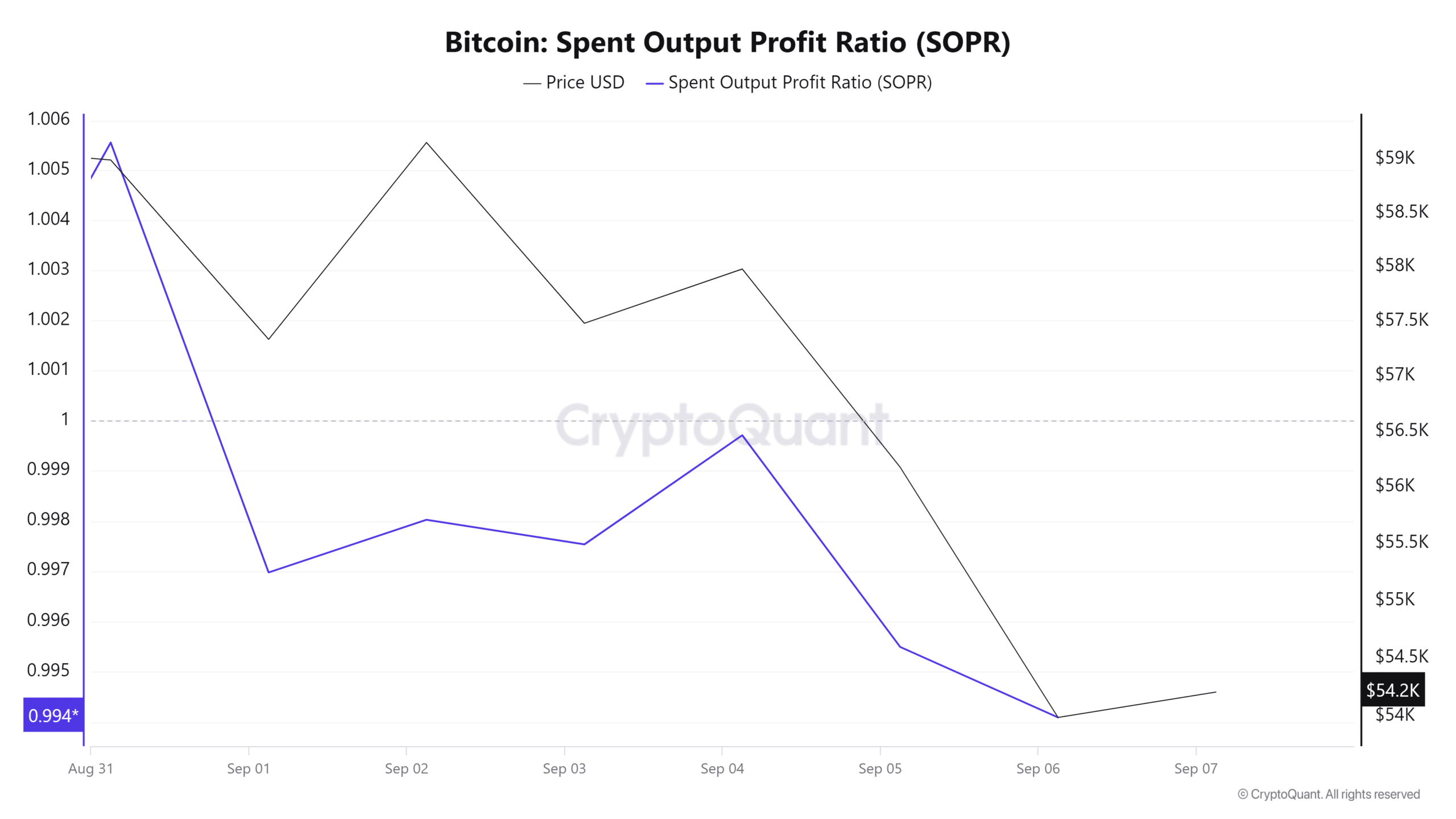

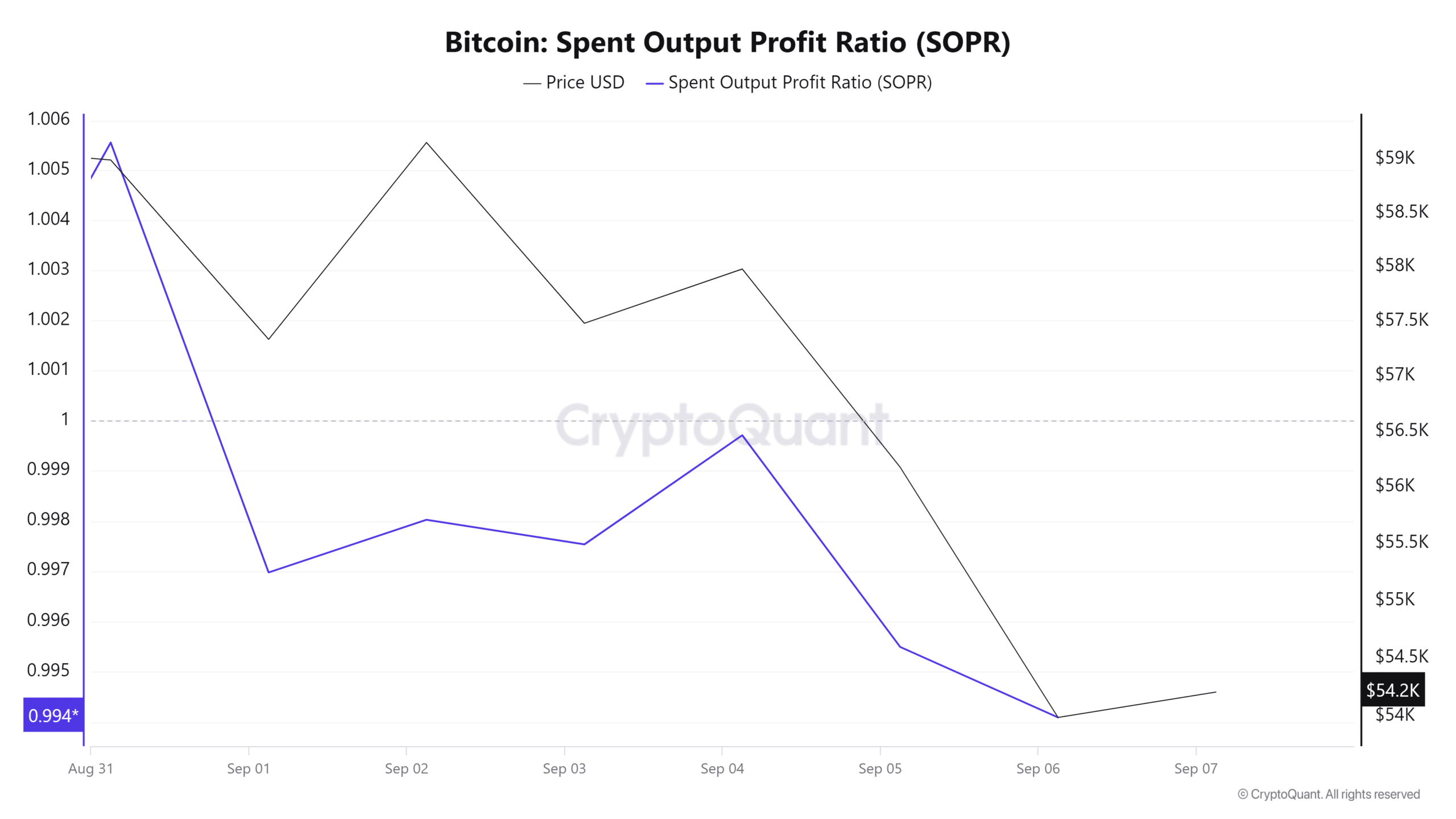

For starters, Bitcoin’s main holder SOPR has fallen from 2.4 to 1.6 over the previous seven days. This confirmed that though long-term house owners promote at a revenue, the dimensions of the revenue decreases. Due to this fact, merchants promote at a loss as they turn out to be much less assured within the short- to medium-term prospects for the asset.

This situation additionally appeared to point that traders are pessimistic about future value will increase and are making ready for an additional bearish situation.

Supply: Cryptoquant

Furthermore, Bitcoin’s AC flows have remained comparatively optimistic over the previous seven days. In seven days, there have been optimistic AC flows in 4 days – an indication that extra traders are making ready to shut their positions. Right here, a rise in inflows on the inventory exchanges may end up in distribution, if it results in gross sales.

In gentle of all these elements, it may be predicted that if promoting strain continues, BTC is vulnerable to falling under $50,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024