Altcoin

This Bitcoin – Metriek often marks turning points – what does it say now?

Credit : www.newsbtc.com

The stability of Bitcoin Korteterehouder has usually proven shifts within the neighborhood of market tops and soils. That is what the pattern of the metric now indicators.

Bitcoin brief -term holder has not seen any huge shifts currently

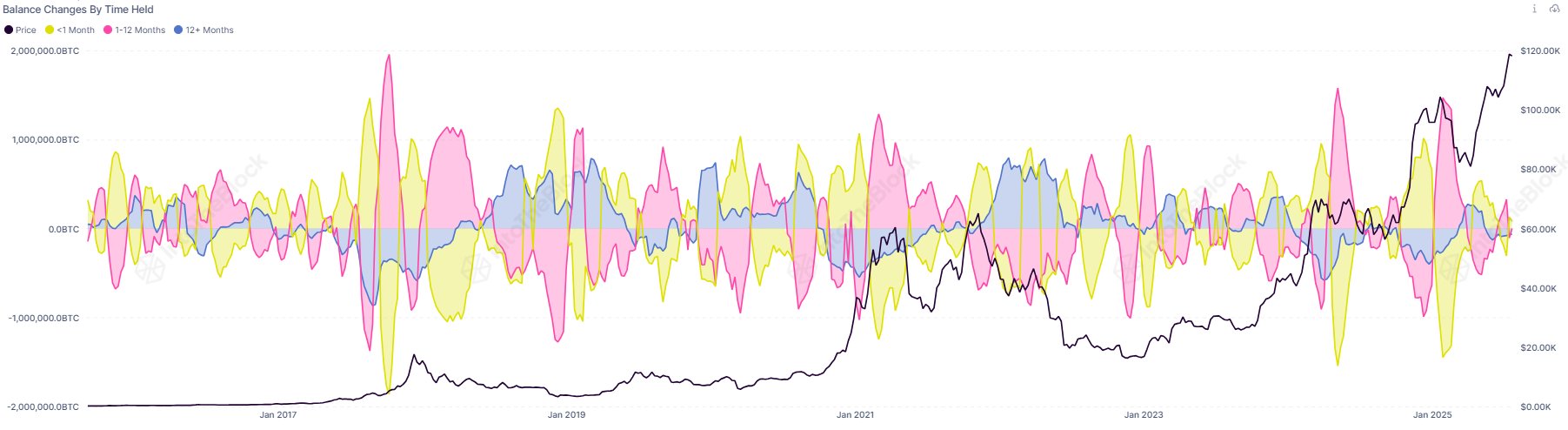

In a brand new one after On X, Institutional Defi Options supplier Sentora (previously Intotheblock) shared a graph that exhibits how the pursuits of the assorted Bitcoin investor teams have modified through the years. The cohorts in query are divided based mostly on maintaining time.

The evaluation firm classifies traders in three teams: merchants, cruisers and hodlers. The merchants embrace the holders who put on their cash lower than a month. This group corresponds to the newcomers within the sector and the traders who take part in excessive -frequency transactions.

The cruisers are traders who’re now not like this within the brief time period, however they haven’t constructed up sufficient resilience to be in it for a very long time. Cruisers who achieve maintaining previous the yr turns into a part of the diamond palms of the community: the Hodlers.

Now beneath is the graph for the online change within the supply that these three Bitcoin teams have of their palms.

As proven within the graph above, these cohorts have traditionally demonstrated a sure sample close to Bending Factors within the Energetic. “Fluctuations in Saldi usually sign market circuit factors within the brief time period holders of the holder,” notes the evaluation firm.

Throughout main tops and soils, merchants usually register a pointy peak of their stability, whereas cruisers and hodlers take part in revenue realization or capitulation. When these older teams promote, the age of their cash is decreased to zero and they’re introduced into the availability of merchants.

It’s clear from the graph that though Bitcoin just lately noticed a pointy rally to new all-time highlights (ATHS), there have nonetheless been no main adjustments within the merchants’ shares. “Fascinating is that we do not see any huge shifts in the mean time,” says Sentora. It’s nonetheless to be seen whether or not which means the present rally nonetheless has room to develop.

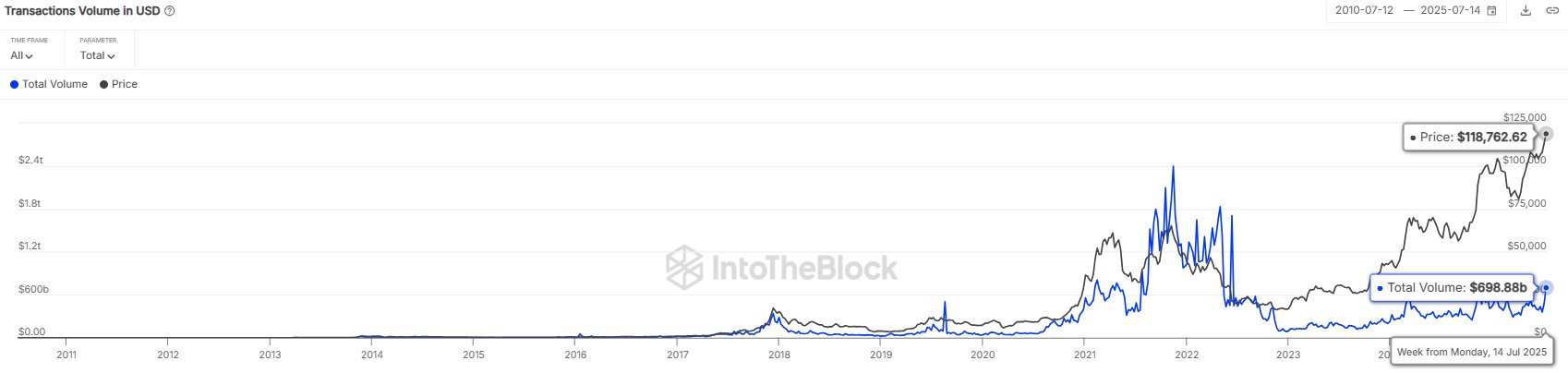

In a unique information, the cryptocurrency has seen a rise in transaction exercise on the chain, because the evaluation firm has said in one other X after.

The weekly Bitcoin transaction quantity reached practically $ 700 billion final week, the best degree since 2022. Though this does point out that exercise is as excessive because it has ever been on this cycle, it’s nonetheless crammed in in comparison with the highlights of the 2021 Bull Run.

BTC value

Bitcoin remains to be caught in Sideways Motion, as a result of his value trades round $ 119,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024