Bitcoin

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Credit : bitcoinmagazine.com

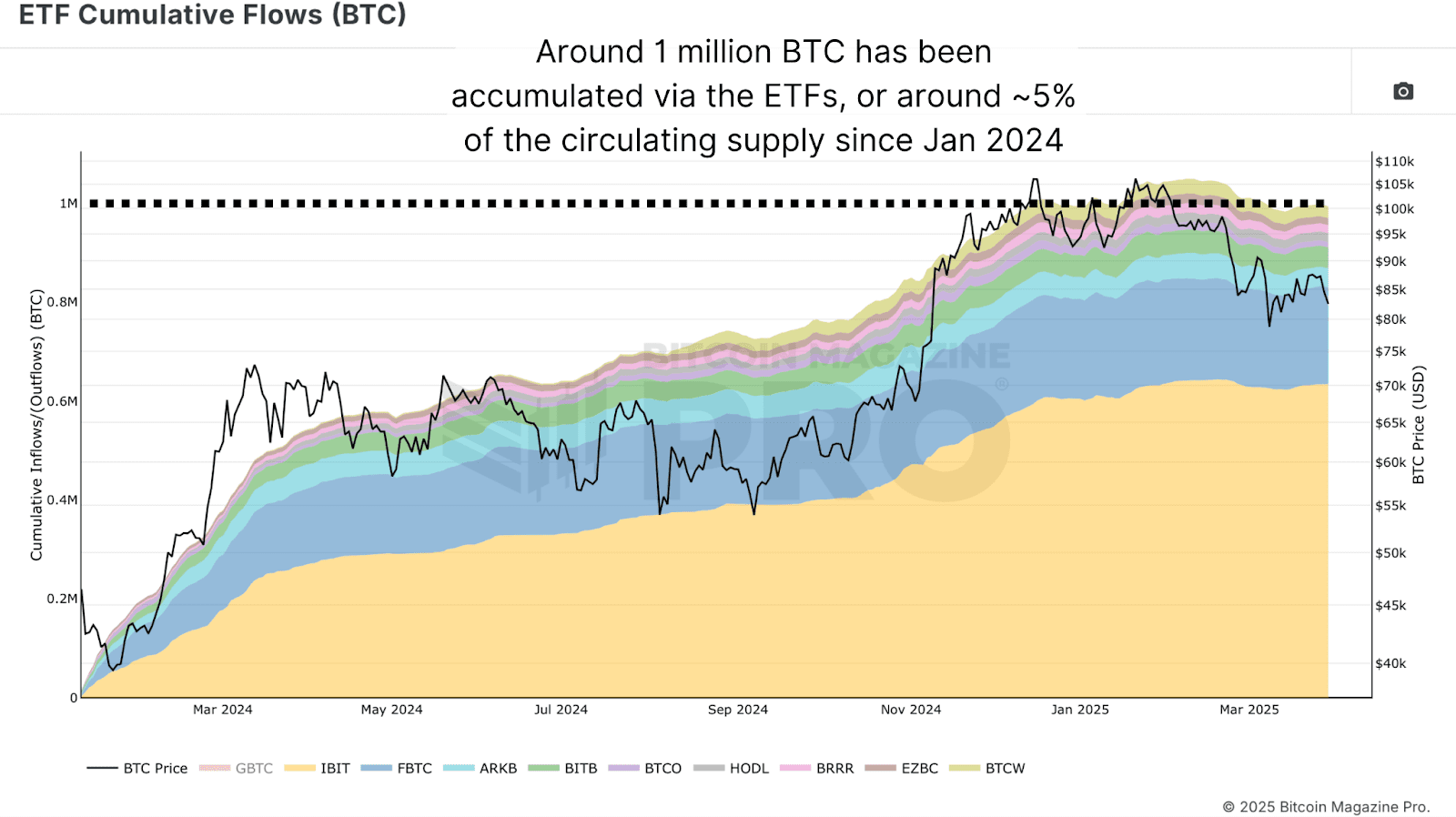

Bitcoin has seen an institutional capital influx on a quite incomprehensible scale. Billions of {dollars} movement in Bitcoin ETFs, which reformed the lies -litry panorama, the influx of influx and investor psychology. Though many individuals interpret this motion as sensible cash with performing complicated methods supported by their very own analyzes, a shocking actuality emerges: exceeding the establishments might not be as tough because it appears.

View a latest YouTube video right here for a extra in-depth view of this topic:

Bitcoin perform better – Investing such as institutions

Canary within the Bitcoin -Kolenmine

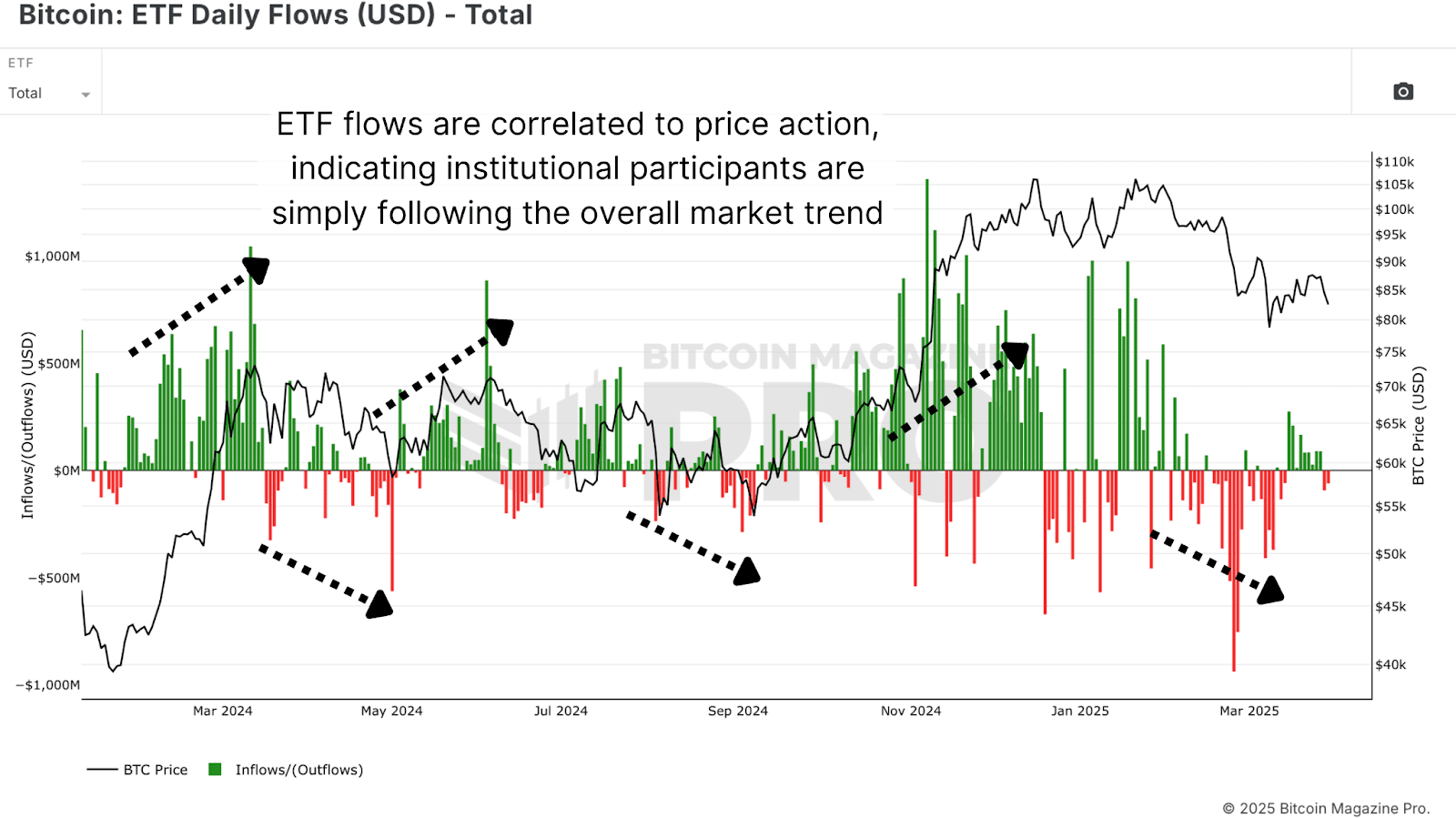

Some of the revealing datas units which might be accessible at the moment is Daily Bitcoin ETF current data. These flows, indicated in USD, present instant perception into how a lot capital the Bitcoin ETF ecosystem enters or leaves on a sure day. This knowledge has a surprisingly constant relationship with value motion within the brief to medium time period.

It is necessary that, though these flows do influence value, they aren’t the first movers of a marketplace for a number of trillion {dollars}. As a substitute, ETF exercise features extra as a mirror for a large market sentiment, particularly as a result of retail merchants dominate the amount throughout pattern bends.

Surprisingly easy

The common retail investor usually feels surpassed, overwhelmed by the info and damaged of the tactical finesse establishments that supposedly use. However institutional methods are sometimes easy trend-following mechanisms that may be emulated and even surpassed with disciplined implementation and the best threat estimate:

Strategic guidelines:

- Purchase when ETF flows are constructive for the day.

- Promote when ETF flows turn out to be damaging.

- Carry out every commerce at Every day Shut, utilizing 100% portfolio entry allocation for readability.

- No complicated TA, no pattern traces, simply observe the streams.

This technique was examined utilizing Bitcoin Journal Professionals ETF knowledge from January 2024. The fundamental assumption was a primary import on January 11, 2024, on ~ $ 46,434 with subsequent transactions dictated by electrical energy modifications.

Efficiency versus buy-and-hold

Backtesting This primary guidelines set yielded a return of 118.5% from the top of March 2025. Then again, a pure buy-and-hold place yielded 81.7% in the identical interval, a decent return, however an virtually 40% underperformance in comparison with this proposed Bitcoin ETF technique.

It is necessary that this technique limits the subdivisions by decreasing publicity throughout downtrends, characterised by institutional outputs. The composite benefit of avoiding steep losses, greater than catching absolute tops or soils, is what drives outperformance.

Institutional conduct

The prevailing fable is that institutional gamers work at superior perception. In actuality, most Bitcoin ETF influx and exit pattern connections are usually not predictive. Establishments are threat -managed, extremely regulated entities; They’re usually the final to come back in and the primary to go away based mostly on pattern and compliance cycles.

What this implies is that institutional transactions have a tendency to bolster the prevailing value momentum. This reinforces the validity of using ETF flows as a proxy sign. When ETFs purchase, they verify a directional shift that’s already unfolding, in order that the retail investor “Surf the Golf” of their capital inflow.

Conclusion

Up to now yr it has confirmed that beating Bitcoin’s buy-and-hold technique, probably the most tough benchmarks in monetary historical past, just isn’t unimaginable. It requires neither leverage nor complicated modeling. As a substitute, Retail Traders can profit from institutional positioning, profit from market construction shifts with out the burden of prediction.

This doesn’t imply that the technique will work eternally. However so long as establishments proceed to affect the prize by way of these giant, seen stream mechanics, there’s a result in simply observe the cash.

If you’re taken with extra in -depth evaluation and actual -time knowledge, think about testing Bitcoin Magazine Pro For invaluable insights within the Bitcoin market.

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your individual analysis earlier than you make funding selections.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024