Ethereum

This ETH Staking Pool Just Passed Binance to Become the fourth-largest ETH Staker

Credit : coinpedia.org

It isn’t usually that Binance is overtaken in one of many many crypto sectors it dominates. But it surely has simply been surpassed in an {industry} the place it has a big presence – and the place a big variety of belongings are at stake. Fairly actually: till lately, Binance was the fourth largest Ethereum staking service. Nonetheless, lately it briefly ceded its crown to a competitor that has been nipping at its heels for fairly a while: SSV.

Though SSV Community’s leap to fourth place was short-lived and Binance subsequently regained its place, this may be taken as a press release of intent. SSV’s efficiency bodes effectively not just for its non-custodial ETH staking service, but in addition for the well being of your complete Ethereum staking ecosystem. That is as a result of SSV’s progress is indicative of a know-how it developed and is now used industry-wide to distribute Ethereum’s validator set: DVT.

SSV rises within the Staking Pool rankings

Ethereum staplers can select from quite a lot of established non-custodial staking swimming pools. This enables stakers to deposit lower than the minimal of 32 ETH required to make use of a validator, and never having to fret about {hardware} set up and upkeep. Their ease of use, coupled with the power to withdraw ETH nearly immediately, has made them the answer of alternative for thousands and thousands.

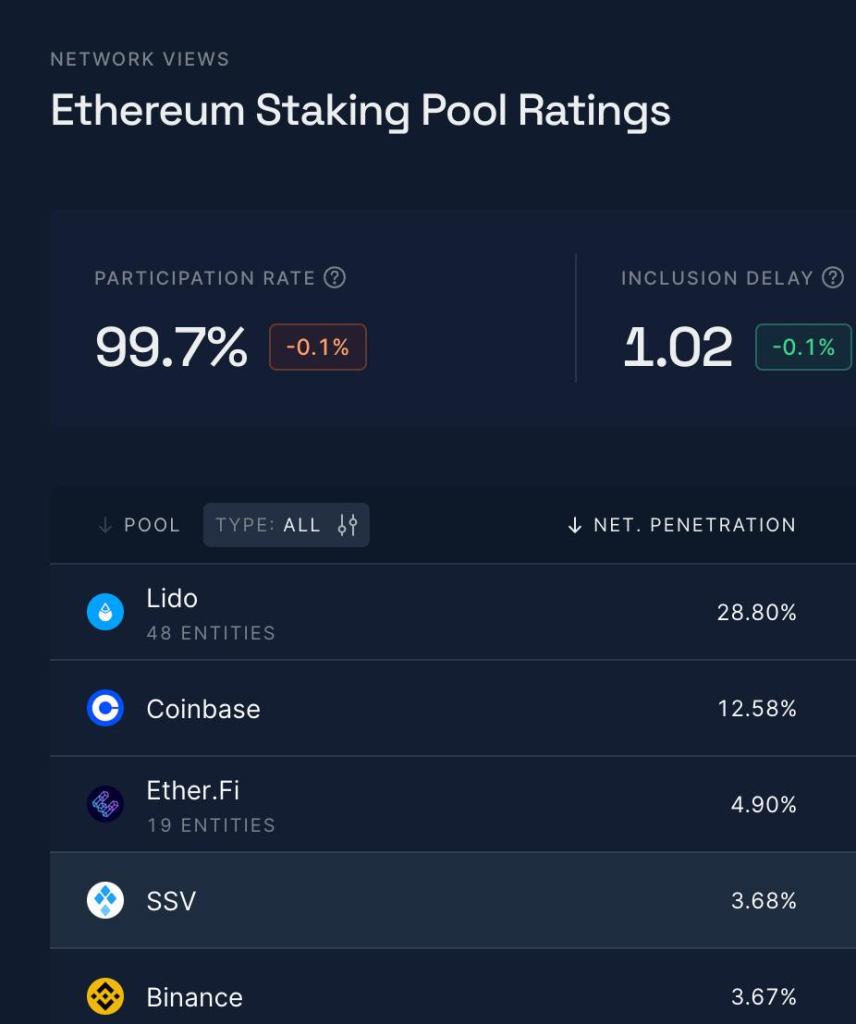

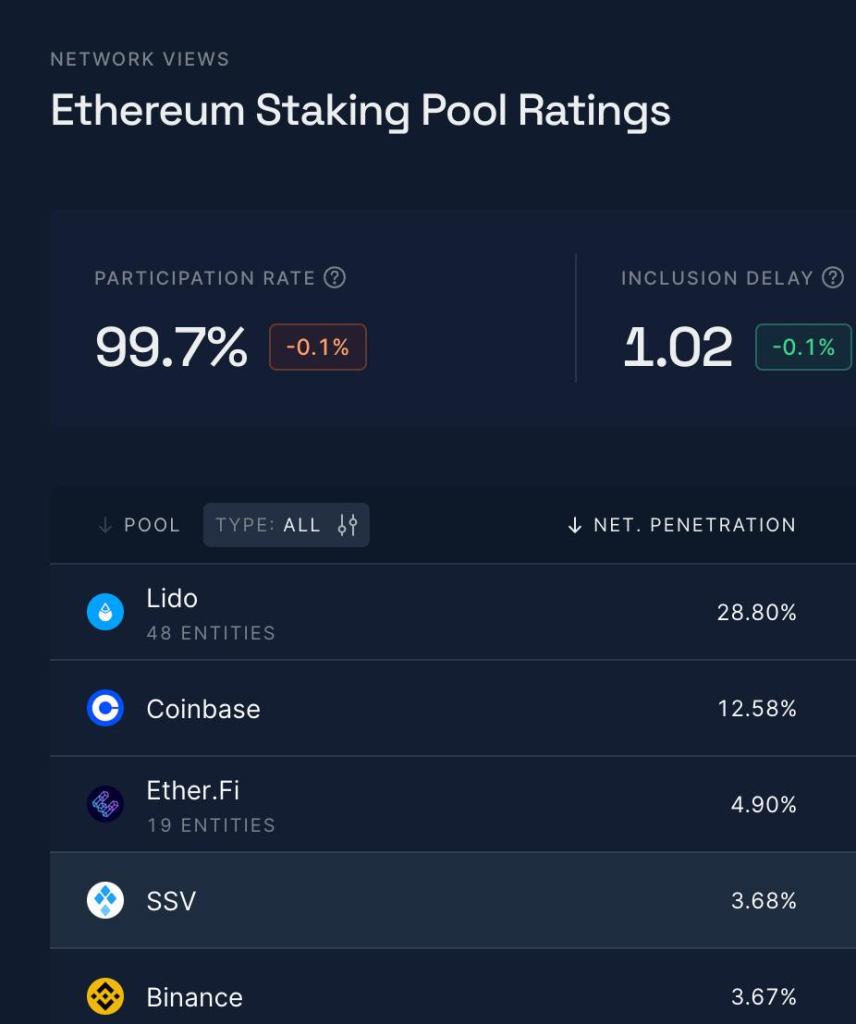

Lido has lengthy dominated the Ethereum staking panorama, capturing round 28% of all staked ETH, whereas Coinbase is in second place. It is unlikely that these two massive gamers will probably be ousted anytime quickly, however the remainder of the highest 5 are very shut.

Ether.fi is sizzling proper now third placewith a share of round 5%, leaving a neck-and-neck race for fourth and fifth place between Binance and SSV. After fleetingly overtaking Binance, which holds 3.79%, SSV is now simply behind with 3.63%. It is a notable improve for SSV, which has seen fast progress since its launch in January.

SSV now has a TVL of over $3.3 billion, with nearly 1.3 million ETH staked and over 40,000 validators working SSV’s staking consumer. Within the Ethereum stakepool scores, SSV additionally scores extremely for the rated effectiveness score (RAVER) at 97%. This can be a measure of how effectively validators have labored over time and award factors for finishing duties successfully.

DVT adoption is rising

SSV is a number one advocate of distributed validator know-how, having built-in the Easy DVT module into quite a few staking protocols. This serves to diversify the set of node operators and permits solo staplers to take part as node operators. DVT helps improve buyer variety, improve fault tolerance, and cut back dependency on dominant validator units, leading to a stronger and extra decentralized Ethereum staking panorama.

Along with seeing TVL improve, SSV has made vital progress in onboarding builders seeking to construct DVT-powered staking and retaking purposes. By integrating SSV, retake protocols can prolong Ethereum’s crypto-economic safety to L2, whereas securing the bottom layer. SSV’s DVT infrastructure permits ETH validator nodes to be geographically distributed amongst a number of machines, eliminating single factors of failure and rising resiliency.

DVT has been one of many success tales of the present market cycle, as staking protocols have built-in the know-how and builders have created staking apps that use it to strengthen the validator set out there to the patron and enterprise segments they serve. SSV’s rise within the Ethereum rankings will not be solely a testomony to its success as a staking answer: it’s also a significant metric for charting DVT adoption.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September