Altcoin

This is what the newest divergence of Ethereum means for the opportunities of the price limitation of ETH

Credit : ambcrypto.com

- The most recent bullish divergence of Ethereum hinted on the finish of Beerarish Pattern and the beginning of a bullish pattern

- CVD revealed that many DEX merchants take a revenue or shut their positions

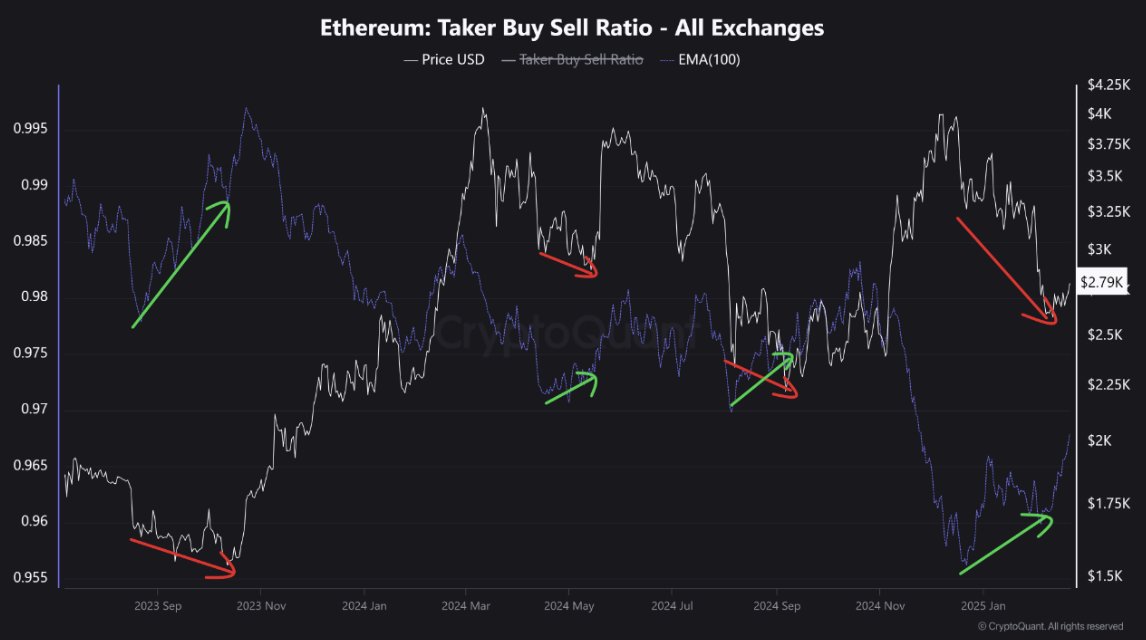

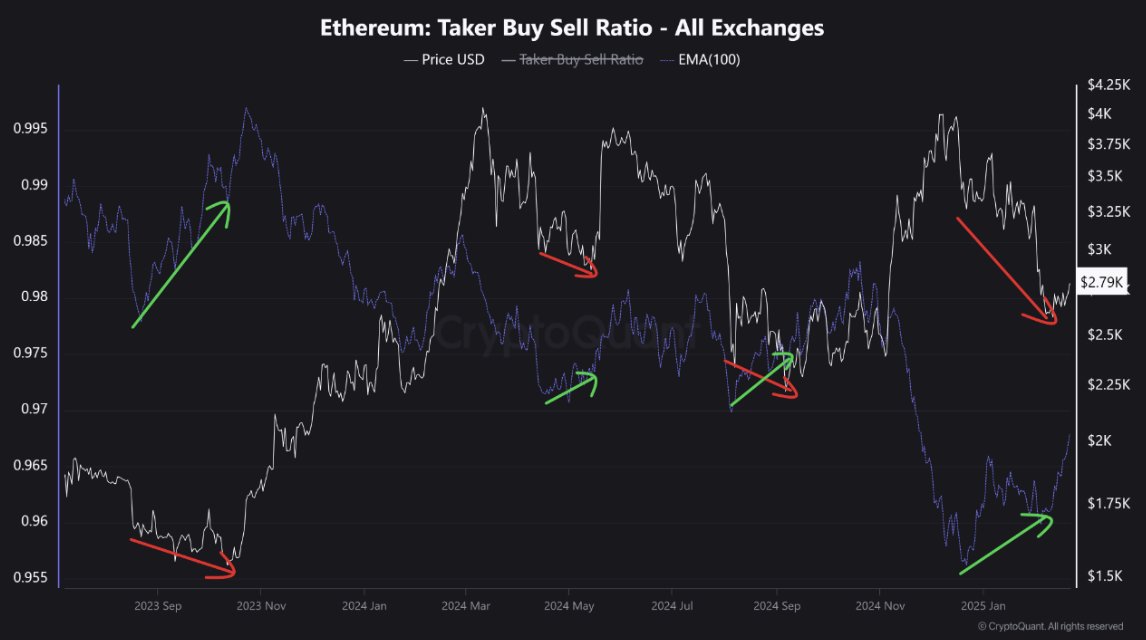

The Ethereum (ETH) market, on the time of the press, projected a big bullish divergence, one which was recognized by the Taker Purchase-Promote-Ratio on the value pattern. Such a divergence typically precedes a market restoration within the charts.

For instance, in September 2023, regardless of the value that dropped to just about $ 1500, the Taker Purchase-Promote ratio started to rise-one signal of constructing strain build-up. This shortly resulted in repairing ETH to the $ 2,000 stage.

From November 2024 to January 2025, the value of Ethereum additionally fell to round $ 2,700. The Purchase-Promote ratio of Taker, nonetheless, as soon as once more flashed an upward pattern and emphasised the potential buy curiosity regardless of the lower within the value of the Altcoin.

Supply: Cryptuquant

Traditionally, such patterns level on the finish of Bearish phases and provoke new bullish developments.

The most recent teamwork urged that regardless of the time value of the $ 2,800 press, a emergence could possibly be imminent. This might mirror in earlier patterns the place the rising Taker -Koop exercise correlated with value restore.

Whales versus good DEX merchants

As well as, current actions within the Ethereum ecosystem introduced a putting distinction between large-scale consumers and lively merchants at decentralized festivals. This was within the midst of rising costs, earlier than the sharp fall as a result of Bybithack the place $ 1.4 billion ETH was misplaced.

It’s outstanding that whale accounts have carried out their participations by accumulating a further 140,000 ETH-what a bullish place or a long-term deal with signifies. This large acquisition appeared to be in accordance with an upward pattern within the ETH value, and factors to sturdy confidence in massive holders.

Supply: ICRYPTOAI/X

Nonetheless, the cumulative quantity delta (CVD) indicated a pattern wherein Good DEX merchants have more and more taken a revenue or have closed their positions. This refers to a potential sentiment shift or threat aversion at value ranges of the press.

This gross sales exercise could cause the brief -term value volatility or strain if the revenue is assured, in distinction to the buildup conduct of the whales. The advanced interaction can result in quite a lot of brief -term versus lengthy -term results on the Ethereum route.

Ethereum’s Log Curves

Ethereum, on the time of writing, acted within the introduced zone. This implies traditionally a possible reversal on the charts. The ETH prize appeared to behave underneath this essential threshold within the logcurve zones – which will increase the prospect of a value bounce.

Traditionally, such a positioning has issued massive rebounds, corresponding to mid -2017 and on the finish of 2020. Throughout this era, ETH navigated from the over -sold area to increased zones, which displays a powerful buy rate of interest on noticed ranges of values.

Supply: Coinvo/X

Conversely, though over -sold circumstances typically get well Herald, exterior market shocks or broader arary sentiment can destroy this potential, and push ETH additional down earlier than an ideal restoration takes place.

The prevailing over -sold standing can catalyze a bullish reversal or trigger an extended downward pattern.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now