Ethereum

Timing Ethereum reversal? THIS condition might signal ETH/BTC bottom

Credit : ambcrypto.com

- ETH has regained $2,500 after final week’s Fed pivot, boosting the ETH/BTC pair.

- Based on Cowen, ETH/BTC might backside if the pair had been to regain the 50-day MA short-term development.

The market has proven much less curiosity in it Ethereum [ETH] regardless of the debut of the US spot ETH ETF within the third quarter. ETH fell 25% within the third quarter, hitting a document low on the ETH/BTC pair, which tracks the altcoin’s relative efficiency Bitcoin [BTC].

However final week’s Fed pivot tipped the altcoin to regain $2,500 after rallying for 3 consecutive days.

The rebound was additionally marked by web inflows of $8.2 million over the previous two buying and selling days for US spot ETH ETFs.

When will ETH/BTC backside?

Nevertheless, crypto analyst Benjamin Cowen was nonetheless cautious about ETH strengthening and an ETH/BTC backside.

Cows declared that the ETH/BTC backside might stay elusive if the pair fails to reclaim the 50-day shifting common (MA), citing the 2016 and 2019 traits.

“After #ETH/#BTC broke in 2016 and 2019, the underside was reached after ETH/BTC acquired again above its 50D SMA…So so long as ETH/BTC is < 50D SMA, it's nonetheless doable for ETH/BTC to go decrease.”

However he added that the pair might get better if it bounces above the 50-day MA, which was at 0.04255.

“However as soon as the 50D SMA is surpassed, I feel it is extra doubtless than not that the underside has been reached.”

Supply: Cowen/X

Worth motion above the 50-day MA typically signifies bullish short-term momentum.

In the meantime, some whales benefited from ETH’s current worth improve. A widely known one per Spot On Chain whale offered 15K ETH price $38.4 million on Kraken. The handle has seen two extra sell-offs within the third quarter, every resulting in a slight decline in ETH.

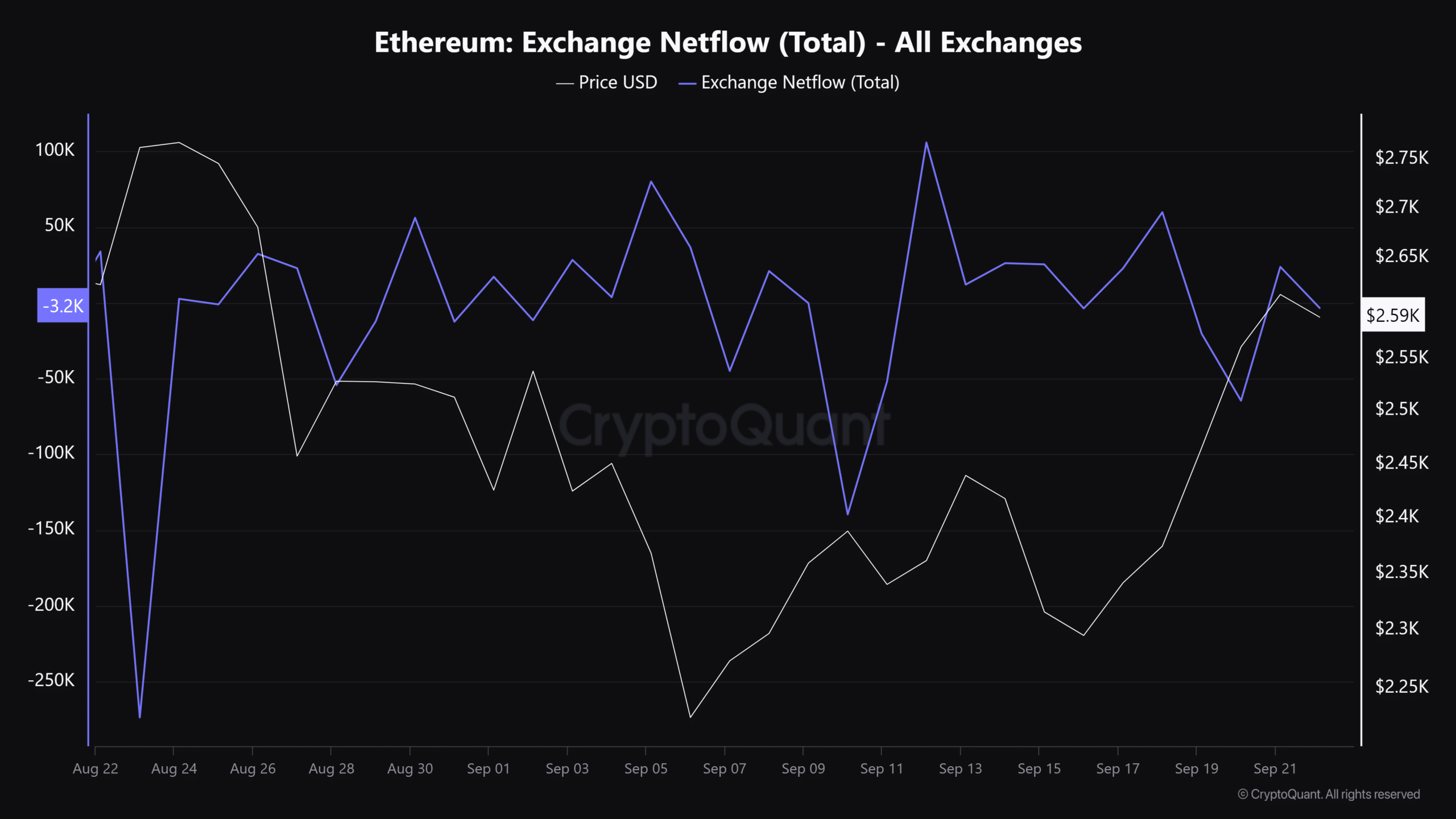

Supply: CryptoQuant

That stated, total trade grid energy declined regardless of the current spike. This steered that promoting strain on centralized exchanges has moderated. Ergo, this might be certain that the ETH worth continues to rise restoration.

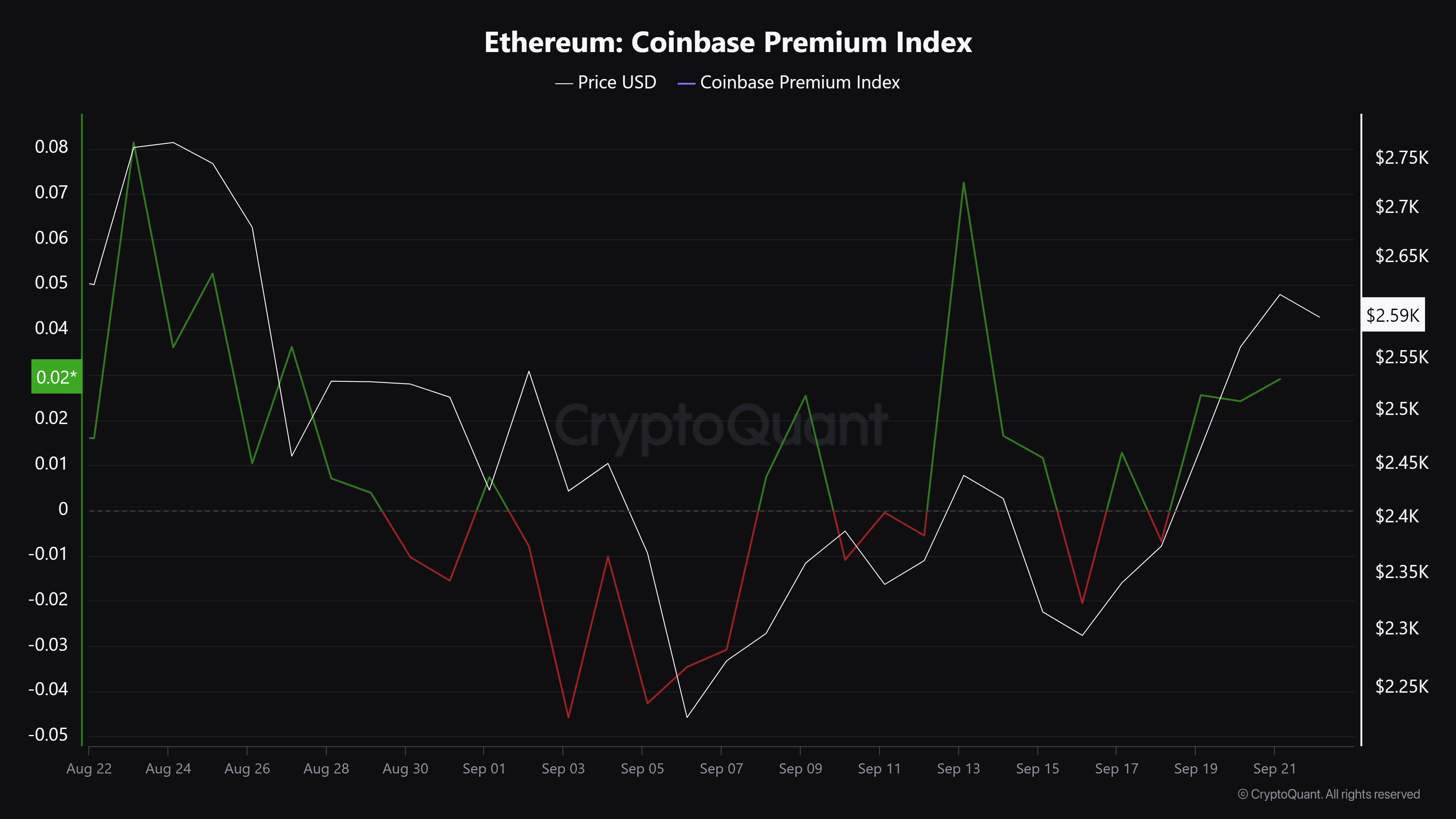

The diminished promoting strain has coincided with elevated demand for Ethereum amongst US buyers, as evidenced by the Coinbase Premium Index and up to date optimistic US ETH ETF flows.

Nevertheless, it stays to be seen whether or not ETH’s restoration will proceed after the euphoria related to the Fed price lower subsides.

Supply: Coinbase

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024