Blockchain

tokenization and revolution in USA trading

Credit : cryptonews.net

Etoro Put together itself at a turning level: Yoni Assia, CEO of the platform that has been talked about on Nasdaq since Might, confirmed in an interview about Fortune the opening to his blockchain To help thousands and thousands of month-to-month transactions and to speed up the vary of recent digital belongings corresponding to Tokenized shares on Ethereum.

What’s Etoro’s personal blockchain and why is that vital?

Assia defined that The present blockchain infrastructure is just not sufficient To help the big quantity transactions that’s managed by Etoro each month. “We can’t deal with thousands and thousands of month-to-month transactions on the present networks,” explains the CEO. For that reason, Etoro is contemplating a sideways -like: a “gentle chain” that’s related to a principal blockchain, capable of course of quicker and cheaper operations whereas sustaining the principle system safety.

The corporate is in Superior negotiations with 4 or 5 platforms Know-how companions select, however has not talked about one but. No launch is predicted quickly, however the route is obvious: with a patented blockchain, Etoro needs to enhance your entire ecosystem, from commerce to digital belongings, to interoperability between portfolios.

What adjustments for customers with the tokenization of shares?

Assia has the tokenization of the most well-liked shares and ETFs In the USA, straight on Ethereum. The tokenization course of transforms conventional shares into digital ERC20 belongings (the token -standard on Ethereum), making it attainable to deal with, switch and handle the commerce 24/5 routinely, towards the present limitations of inventory market hours.

There can be a launch 100 tokenized shares and ETFsTogether with a very powerful names of the US. European customers will initially have entry by way of a particular ready listing, with the promise of subsequent enlargement.

The tokenized shares can be Transferable between Etoro Digital WalletsReleasing the highway for decentralized funds, even for regulated results. A robust benefit, provided that different rivals (corresponding to Robinhood) take comparable steps, however within the midst of many regulatory issues.

How does Etoro match within the race for the tokenization of Wall Avenue?

After the announcement, Bloomberg Confirmed that the Etoro initiative follows Robinhood’s, who promised tokenized belongings for European clients. In distinction to Robinhood, nevertheless, Etoro has opted for the standard expertise (Ethereum, ERC20) and gradual entry strategies (ready listing, solely within the first occasion) to forestall controversies and regulatory dangers.

Robinhood has had issues after an airdrop of “OpenAi -Tokens” turned out to be a derived contract and never precise fairness: the information led to criticism from American regulatory authorities. Etoro As a substitute, deal with transparency, compliance and a step -by -step method: each tokenized belongings corresponds to actual underlying shares or ETFs.

The transferability Pockets-to-Pockets brings conventional funds nearer to the rules of Defi (decentralized financing), the place management stays within the palms of the customers, albeit on regulated infrastructures.

What’s the market response: does Etor lose floor?

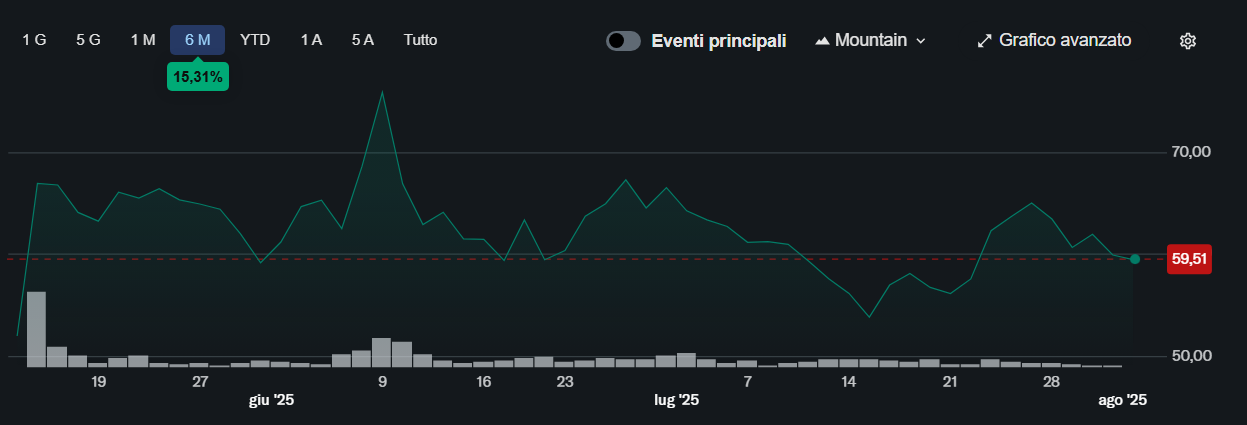

Regardless of the information, the worth of Etor (The Etoro shares talked about on Nasdaq) skilled a decline: -4% on June 18clap $ 60 per share in comparison with the file of $ 79 achieved on June 10, for a basic lack of 24%. The market appears to be ready for concrete proof in regards to the effectiveness of the blockchain mannequin and the actual potential of large-scale tokenization.

Graph of the prize development of the Etor shares because the listing on the inventory trade. Supply: Yahoo Finance

TradingView exhibits the downward development previously week, with buyers intently monitoring the precise acceptance of Tokenized shares and future partnerships within the blockchain sector.

“` HTML

Etor quotes from TradingView

1m “],” fontsize “:” 10 “,” header fontsize

“ `

What are the dangers and advantages for Etoro clients?

Those that be a part of the ready listing for Azioni Tokenizzaat Can profit from quick commerce, prolonged hours and higher flexibility when managing their digital belongings. Nonetheless, dangers with regard to laws, token volatility and the safety of the blockchain infrastructures used stay.

Assia guarantees most warning and regulatory cooperation to keep away from “Robinhood instances”. The gradual method, initially restricted to Europe and inside Etoro portfolios, signifies warning but additionally a transparent willingness to open a brand new season of classical commerce, with tokenized belongings Lastly out there 24/7.

What is occurring now: results and future prospects for commerce and blockchain

ASSIA’s announcement marks a change of tempo: The hybridization between conventional and defi Now enter the operational part, however the actual sport will rely upon:

- Belongings of the longer term Etoro -Blockchain to essentially help “thousands and thousands of transactions”

- Person suggestions on tokenized shares and 24/7 usability

- Response from supervisors and competitors within the US and Europe

With the competitors on this space and the markets have gotten increasingly more reactive to technical improvements, The way forward for Tokenized commerce might change face within the coming weeks. Observe the Etoro group and the upcoming official bulletins to not miss updates on blockchain and monetary tokenization.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International