Analysis

Toncoin Price Set for 20% Rally, Buy Signal From On-chain Metrics

Credit : coinpedia.org

Amid the continuing market reversal, Telegram-linked Toncoin (TON) has skilled a breakout from a protracted consolidation zone, with on-chain metrics now signaling a purchase sign. Previous to this rally, TON consolidated between $5.38 and $5.80, near the $5.75 resistance stage of the previous two weeks.

TON Worth momentum

Nevertheless, right this moment’s spectacular rally broke out of that territory and altered the general market sentiment. On the time of writing, TON is buying and selling across the $5.90 stage and has skilled a worth enhance of over 4.5% within the final 24 hours. Throughout the identical interval, buying and selling quantity elevated by 6.5% and continued to rise steadily, indicating renewed curiosity from merchants and traders.

The potential cause behind the worth rally is the bullish market sentiment and the upcoming airdrop in October 2024.

Toncoin technical evaluation and upcoming ranges

In keeping with skilled technical evaluation, TON seems bullish and is now buying and selling above the 200 Exponential Shifting Common (EMA) on a day by day time-frame, indicating an uptrend. The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an up or down pattern.

Primarily based on the historic worth momentum, post-breakout, there’s a sturdy risk that TON might rise 20% to the $7 stage within the coming days. Nevertheless, this bullish thesis will solely maintain if TON closes its day by day candle above the $5.90 stage, in any other case it might fail.

Bullish statistics within the chain

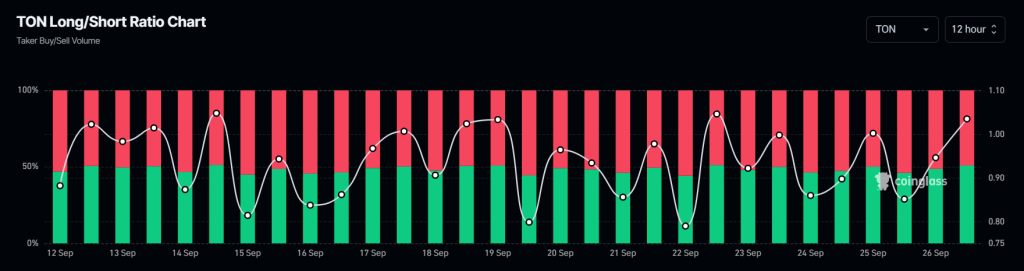

As of now, TON’s bullish outlook is additional supported by on-chain metrics. Mint glass The TON Lengthy/Quick ratio presently stands at 1.035, indicating sturdy bullish market sentiment amongst merchants.

Moreover, future open curiosity has risen 5.7% over the previous 24 hours, indicating that merchants could also be constructing extra lengthy positions than brief positions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024