Altcoin

Toncoin’s Rally to $5,804 Stagnant Amid Mixed Signals – What’s Next?

Credit : ambcrypto.com

- TON fashioned an inverse head and shoulders sample on the each day chart.

- Unfavourable Netflow change charge indicated a attainable upward shift, however combined indicators nonetheless cloud the market’s course.

The previous week has been turbulent for Toncoin [TON]with a lower out there worth of 9.26%. Though indicators of restoration are seen, progress is minimal, with a modest acquire of 0.52% within the final 24 hours.

Regardless of the lackluster efficiency, a glimmer of optimism stays as AMBCrypto notes the potential for constructive momentum going ahead.

Bullish potential for TON

On the time of writing, TON has fashioned an inverse head and shoulders sample, a traditional sign of potential bullish momentum.

As proven within the map, the sample consists of three peaks: a left shoulder, a better head and a proper decrease shoulder.

A bullish affirmation usually happens when the value breaks above the neckline, which connects the 2 valleys between the shoulders.

At present, TON has not but damaged the neckline. As soon as it does, it might verify the bullish pattern, with a possible worth goal of $5,804. If not, it might fall to the October low of $5,139 or decrease.

Supply: buying and selling view

Nevertheless, assessing on-chain metrics is vital to find out if an outbreak is imminent.

Statistics point out uncertainty

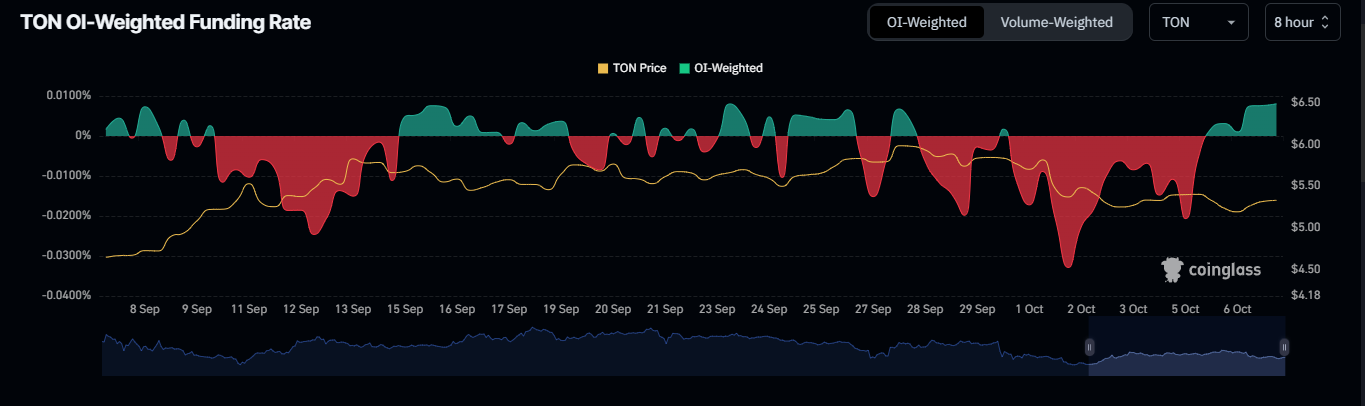

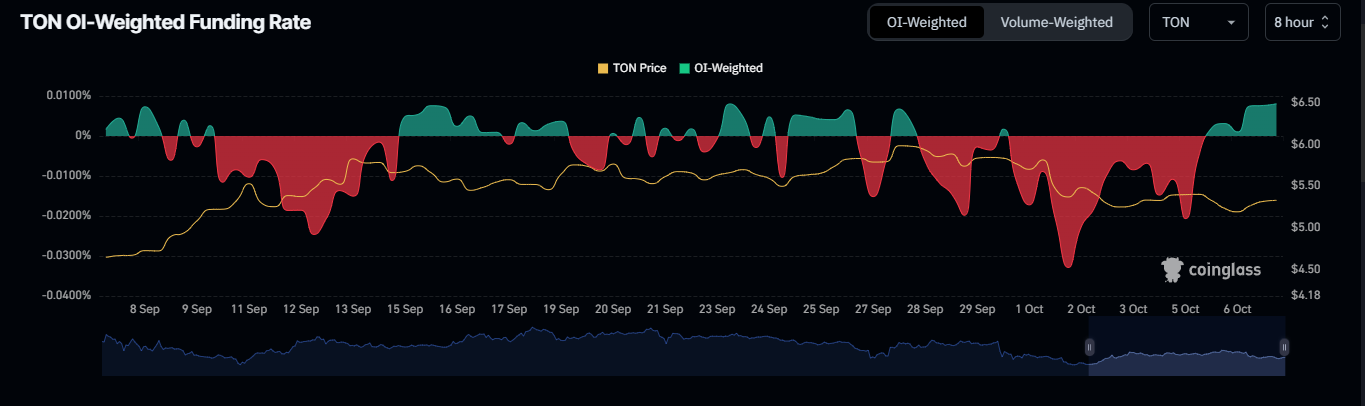

In response to Coinglass, the OI-weighted funding charge has remained constructive and stood at 0.0080% on the time of writing, indicating bullish sentiment out there.

The OI-weighted funding charge combines open curiosity and funding charges to evaluate market sentiment and the prices of holding lengthy or brief positions in derivatives.

Supply: Coinglass

Whereas this measure signifies a attainable bullish transfer, liquidation information signifies neutrality, indicating a attainable downward shift.

Latest information exhibits that $268.15k has been liquidated from the market, with $146.96k from lengthy positions and $121.19k from brief positions, reflecting a comparatively balanced market.

For a bullish breakout to happen, a bigger wave of brief liquidations can be required, with a big distinction over lengthy liquidations. If this does not occur, TON might fall to $5,139.

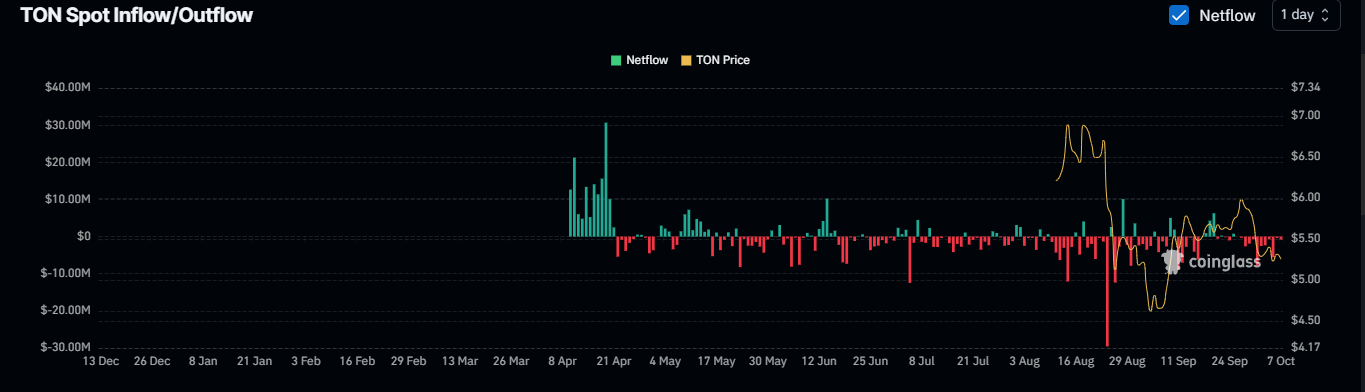

Diminished provide might set off an outbreak

Latest information exhibits {that a} important quantity of TON has been withdrawn from a number of exchanges over the previous seven days, which might influence market dynamics.

Learn Toncoin’s [TON] Value forecast 2024–2025

In response to Mint glassGreater than $19 million price of TON has been delisted from the exchanges, indicating that merchants are selecting to maintain their belongings personal moderately than promote them.

Supply: Coinglass

If this detrimental inventory market web movement continues, it might reinforce the present bullish sentiment out there. This might probably contribute to an outbreak.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024