Altcoin

Toncoin’s Risk Exposure Ratio – Here’s why traders should pay attention to this

Credit : ambcrypto.com

- Toncoin’s danger publicity ratio has elevated, which is an indication of market confidence

- Market indicators advised that TON might see a development reversal and put up features

On the weekly charts is Toncoin [TON] made a average restoration on the value charts. Throughout this era, the altcoin rose from an area low of $4.7 to a excessive of $6.09. Nevertheless, over the previous three days, the altcoin has made a slight comeback. On the time of writing, Toncoin was buying and selling as excessive as $5.66 – down 0.98% prior to now 24 hours.

This, after the altcoin depreciated by 10.81% on the month-to-month charts.

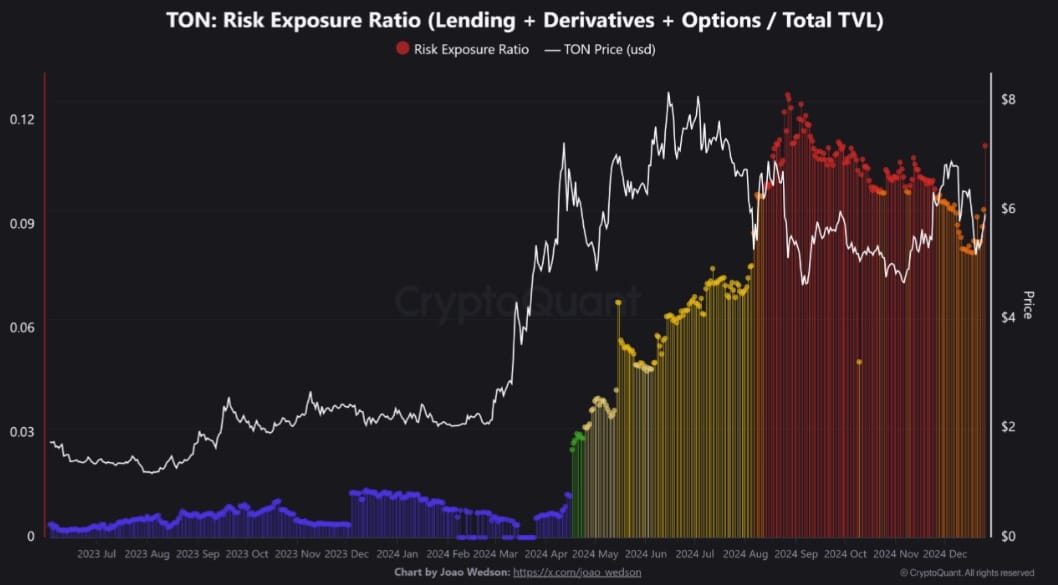

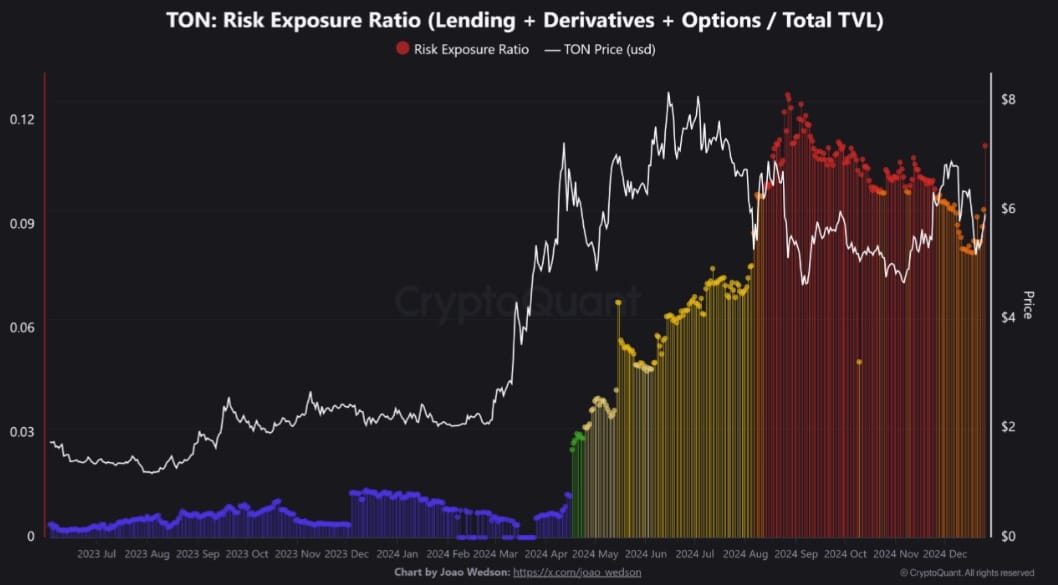

This market volatility has analysts speaking. One in all them is Cryptoquant analyst Joao Wedsonwith the analyst noting a spike in TON’s danger publicity ratio – an indication of potential bullishness.

Toncoin’s danger publicity ratio is rising

In his evaluation, Wedson said that TON’s danger publicity ratio at present means that the extent of danger inside the Toncoin community is pretty excessive.

Supply: Cryptoquant

In keeping with him, the explanation behind this improve is that a good portion of TON’s TVL has been allotted to numerous areas resembling lending, derivatives and choices, that are extremely uncovered to market liquidity dangers.

As such, the danger publicity ratio has been on a sustained upward development since Toncoin’s final main value rally. This upward motion is an indication of accelerating capital inflows into leveraged monetary merchandise resembling loans and derivatives.

Whereas this improve might pose stability points, it may be an indication of market confidence. Rising demand for derivatives and leveraged securities means rising market optimism – an indication of confidence out there development and buyers’ bullish sentiment.

Nevertheless, over-indebted networks can enlarge losses throughout bearish tendencies. This facet can due to this fact be considered positively by speculative merchants who’re profiting from the rising demand to revenue from derivatives markets.

What does it imply for the value of TON?

Whereas the rise within the danger publicity ratio might point out warning because it correlates with increased volatility, it might additionally level to market confidence and bullish sentiment.

Supply: Santiment

We are able to see this constructive sentiment and market confidence within the continued decline in provide on the inventory exchanges.

This has fallen from 1.9 million to 1.82 million over the previous week – an indication of elevated accumulation as buyers switch TON tokens to non-public wallets for self-custody.

Supply: IntoTheBlock

Furthermore, the whales have turned bullish over the previous three days, with the web circulate of main holders turning constructive to 122.33 million TON tokens. This implied that whales purchase and accumulate extra tokens than they promote.

A rise in whale capital inflows demonstrates market confidence.

Supply: Santiment

Lastly, Toncoin’s price-DAA divergence has remained constructive over the previous week. A constructive DAA divergence implies that the current value will increase are supported by rising energetic addresses. So the market is wholesome and has sturdy fundamentals.

In conclusion, it seems that the rise in danger publicity ratio has pushed extra speculative merchants into the market. If this development and capital inflows proceed, Toncoin will put up extra income. As such, TON might regain its $6.2 degree. Nevertheless, if conservative buyers keep away from the market and shut their positions for concern of elevated volatility, the TON might fall to $5.4.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now