Altcoin

Top Analyst Predicts 3-6 Month Rally for AVAX – What’s the Target?

Credit : ambcrypto.com

- AVAX rose 8.2% final week amid robust bullish alerts.

- Analysts predicted a possible rally, with worth targets of $130 and $228 within the coming months.

Amid a basic downturn within the international cryptocurrency market, Avalanche [AVAX] has managed to distinguish itself and has change into one of many 20 largest cryptocurrencies with inexperienced efficiency primarily based on market capitalization.

Regardless of broader market declines, AVAX has seen a notable enchancment in efficiency, with property up 8.2% over the previous week.

This optimistic momentum has additionally continued over the previous 24 hours, with the asset posting a further 1.2% achieve and presently buying and selling at round $29.46 on the time of writing.

Subsequent goal for AVAX?

Amid AVAX’s inexperienced efficiency, famend crypto analyst CryptoBullet not too long ago took to X (previously Twitter) to share his views on Avalanche’s present worth motion.

In keeping with the analyst, AVAX has damaged the multi-month ‘Falling Wedge’ sample, a bullish technical sign available in the market evaluation.

Falling wedges sometimes happen after a protracted downtrend, the place the worth consolidates and begins to kind decrease highs and decrease lows, resembling a wedge form.

As soon as the worth breaks above the higher trendline of this wedge, it usually alerts the tip of the bearish pattern and the start of a brand new rally.

CryptoBullet commented in regards to the current outbreak, stating:

“AVAX broke out of a multi-month Falling Wedge. I count on a great rally within the subsequent three to 6 months.”

He additional shared bold worth targets for the upcoming rally, predicting that Avalanche might rise to $130 and probably as excessive as $228 relying on market situations.

These worth targets, whereas bold, replicate the rising optimism surrounding Avalanche because the crypto market seems for indicators of restoration.

Evaluation of the technical traits of Avalanche

Whereas technical evaluation factors to a doable rally for AVAX, a deeper take a look at the asset’s fundamentals is critical to evaluate the chance of such a big worth improve.

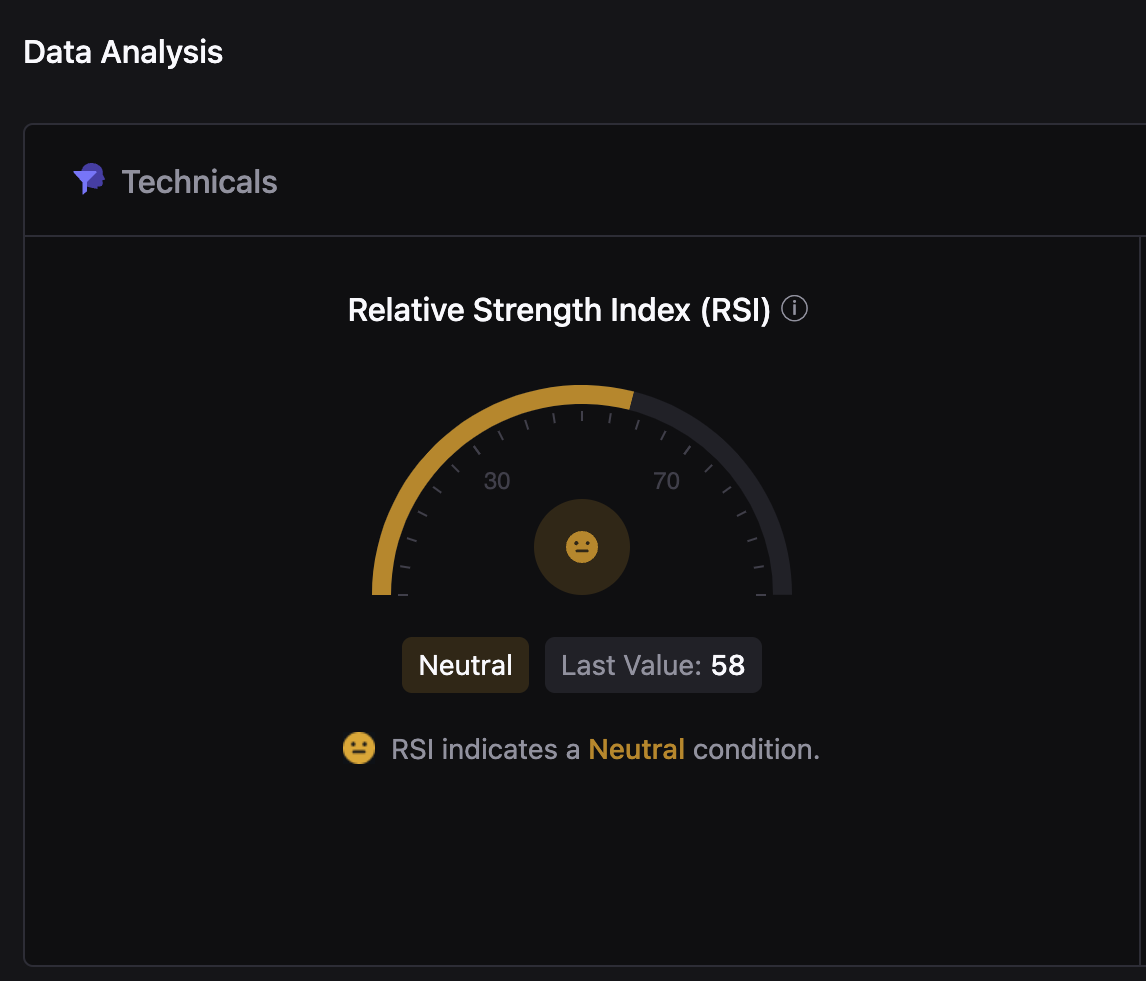

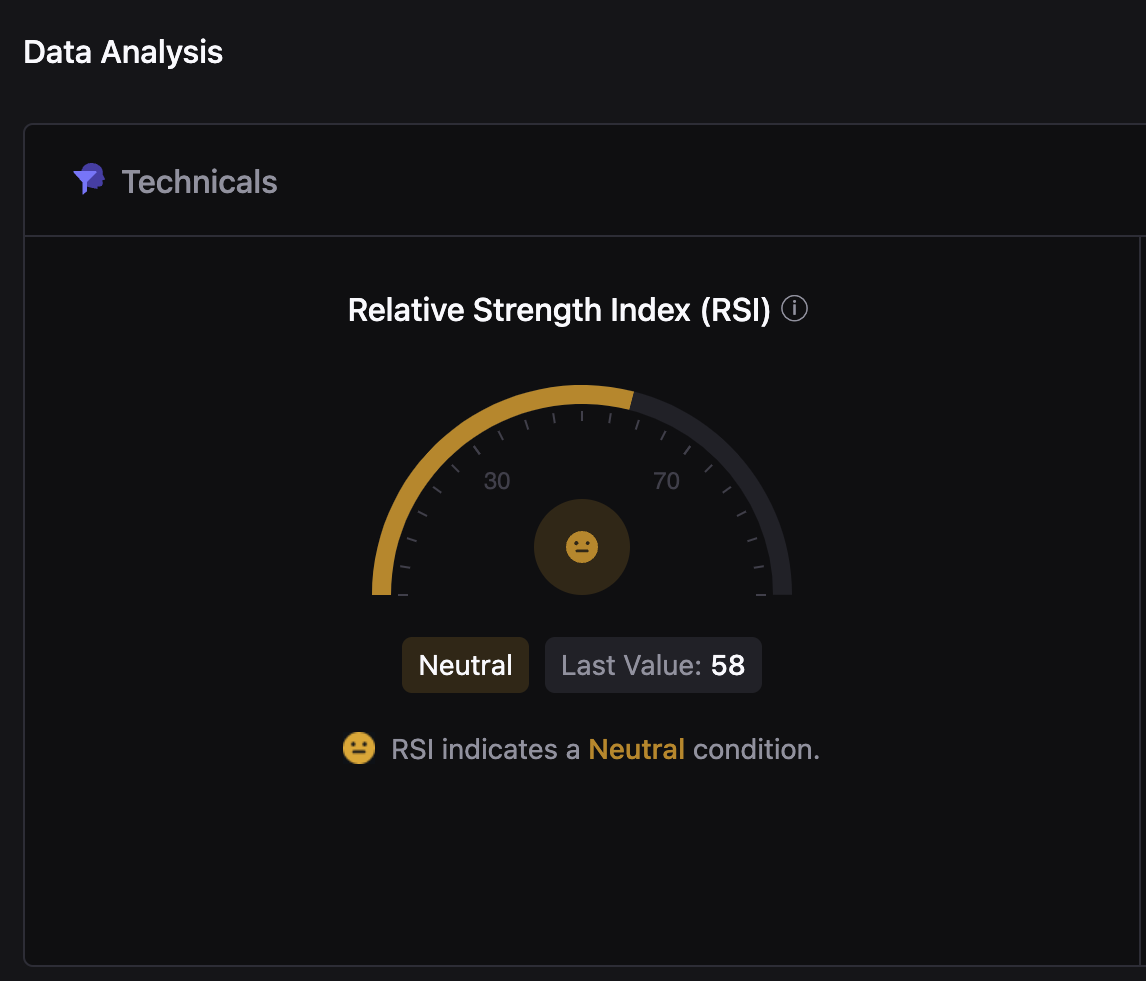

An necessary metric to contemplate is the Relative Power Index (RSI), which measures the momentum of an asset’s worth actions.

The RSI fluctuates between 0 and 100, with values above 70 indicating an overbought scenario and under 30 an oversold scenario.

Supply: CryptoQuant

On the time of writing, Avalanche’s RSI stood at 58 facts from CryptoQuant.

This confirmed that the asset was in a impartial state (neither overbought nor oversold), which supplies room to maneuver up or down primarily based on broader market components.

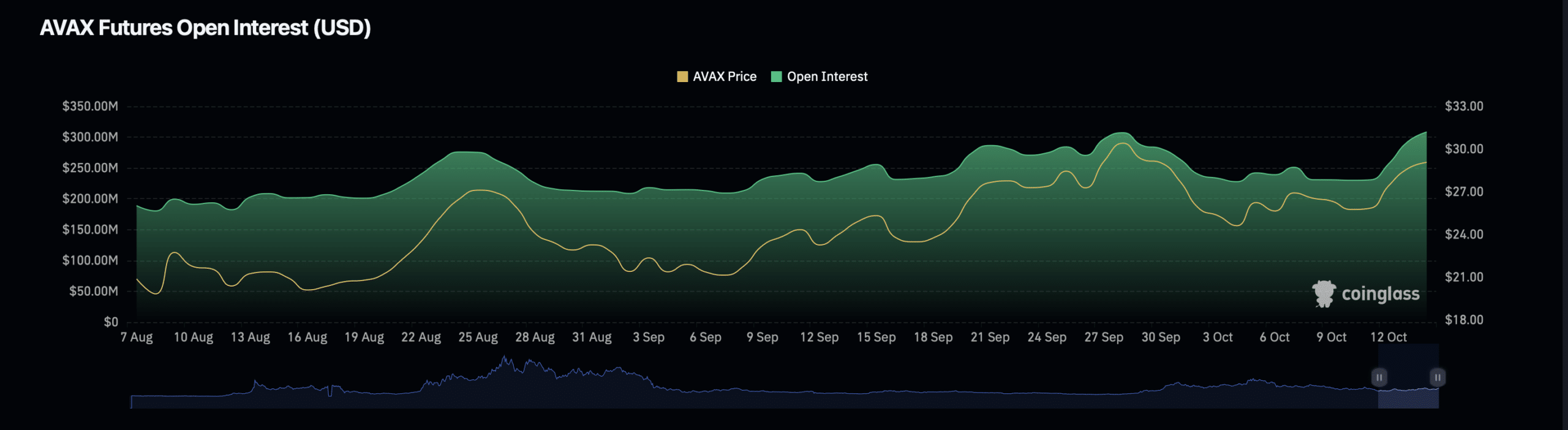

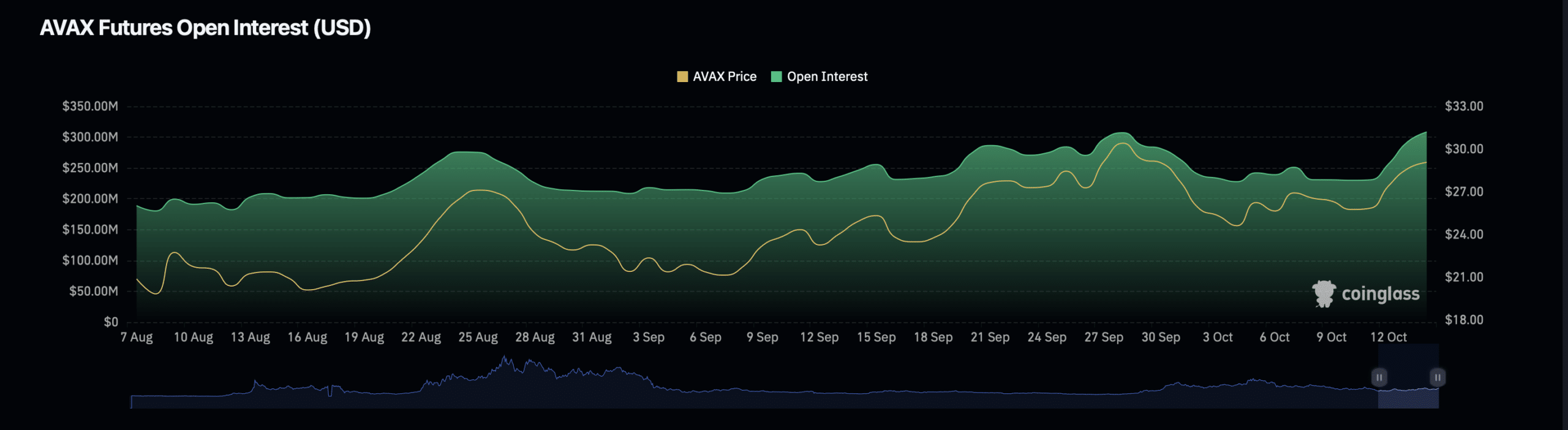

Moreover the RSI, one other essential metric is Open Curiosity, which measures the whole variety of open futures contracts for an asset.

Facts from Coinglass revealed that AVAX’s Open Curiosity was down 2.33%, valued at $299.64 million on the time of writing.

Supply: Coinglass

Learn Avalanche [AVAX] Value forecast 2024–2025

Nevertheless, this decline was offset by a big 27% improve in AVAX’s Open Curiosity quantity, which reached $541.01 million.

This indicated rising participation within the AVAX derivatives markets, an element that would affect the asset’s worth motion within the brief time period.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024