NFT

Top cryptocurrencies to watch this week

Altcoins took successful final week, resulting in a $40 billion drop within the international cryptocurrency market cap, which dropped to $2.09 trillion. This week’s trio of one of the best cryptocurrencies are price trying out within the coming days.

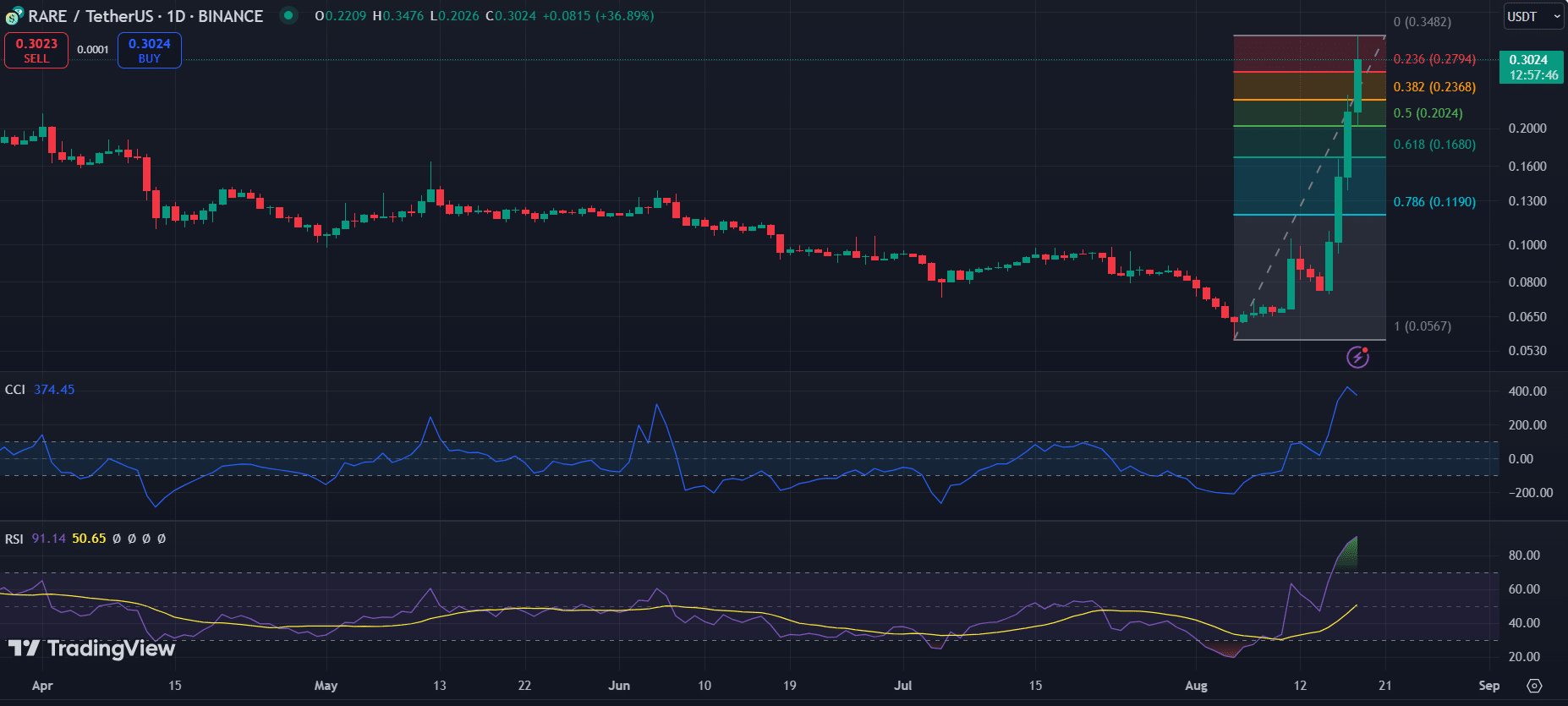

RARE achieves weekly beneficial properties of 223%

SuperRare (RARE), the native token of the NFT market, witnessed volatility final week.

The token began the week up 34% earlier than experiencing a three-day decline from August 12 to 14, dropping 18%.

Nonetheless, in response to a LunarCrush reveal, it rebounded on August 15, triggering a large enhance in social quantity.

Amid a resurgence in curiosity, RARE continued its run, rising 127% in three days and ending the week with a achieve of 223%.

The token’s RSI now stands at 91.14, indicating an overbought situation. This means a potential upcoming correction. The CCI additionally indicators big overbought ranges at 374.45, confirming this sentiment.

The most recent run has helped RARE surpass the Fibonacci degree of 0.236 because it at the moment seems to be sustaining its place above $0.3. If RARE has the Fibonacci assist at 0.236, it may transfer additional larger.

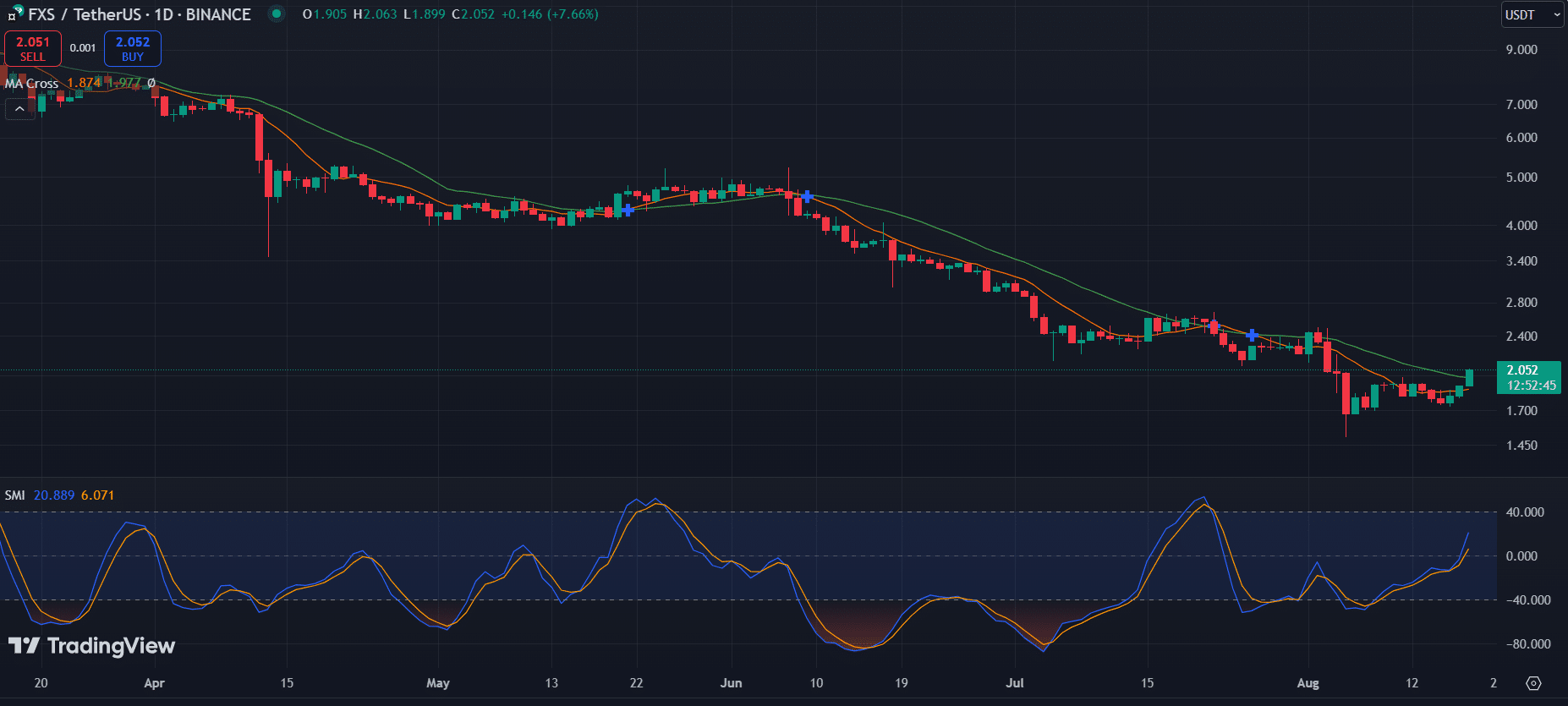

FXS retains its resilience

Frax Share (FXS) confirmed restricted volatility final week, closing at $1,906. This represented a meager decline of 0.67%. This lackluster transfer contrasted with the broadly bearish pattern within the broader market, indicating a touch of resilience from FXS.

Nonetheless, Frax Share’s shifting averages point out bullish potential. The asset not too long ago broke above the nine-day MA (orange line) as short-term momentum turned bullish.

Additionally, the nine-day MA seems to be crossing the 21-day MA (inexperienced line). If this MA cross happens, it may point out a bullish reversal on the horizon.

The Stochastic Momentum Index additionally helps this outlook. The SMI line (blue) has risen above the MA line (orange), indicating that bullish momentum has been constructing. Now that each indicators are in line, FXS could possibly be poised for an upward transfer. Nonetheless, affirmation within the coming days is crucial.

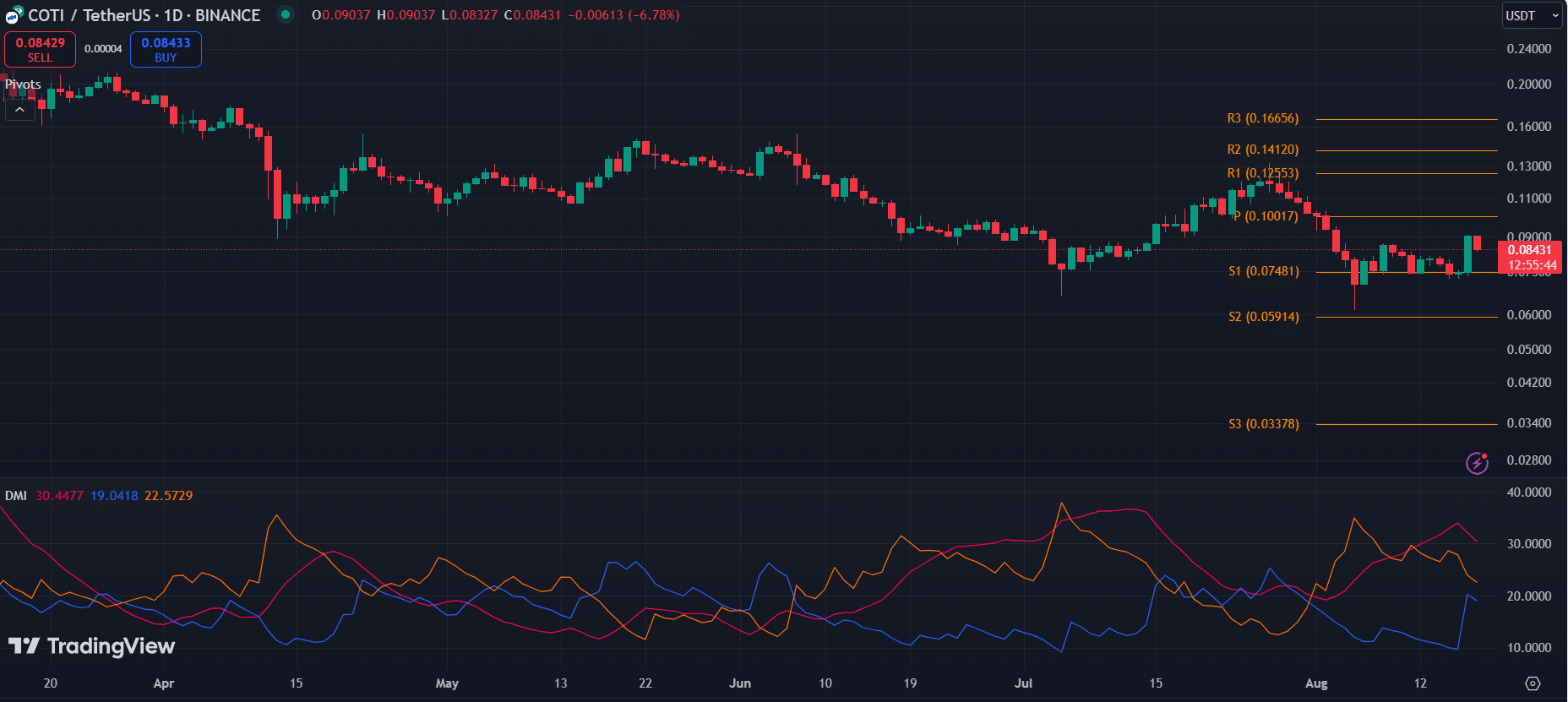

COTI is confronted with combined emotions

COTI (COTI) has been bearish this previous week, dropping 14% from August 11 to fifteen. Nonetheless, on Saturday it recorded a 21% enhance to finish the week up 10%.

The asset has now corrected as it’s underneath promoting strain.

The every day pivot factors present key resistance at $0.10017, $0.12553 and $0.14120. COTI’s fast assist is at $0.07481, which quantities to S1.

A breakdown under S1 may push costs in direction of S2 at $0.05914.

In the meantime, the Directional Transferring Index signifies bearish momentum. The ADX (pink line) is at 30.4, suggesting a robust pattern, whereas the -DI (orange line) at 22.57 is above the +DI (blue line) at 19.04, confirming bearish strain.

COTI’s means to stay above S1 is essential. Failure to take action may trigger additional draw back, whereas breaking the Pivot may present a possibility for a restoration rally.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now