Ethereum

Top Performers Go All-In On Ethereum Long Positions With Over $425M in Exposure

Credit : www.newsbtc.com

Ethereum has regained the $3,150 degree after a unstable interval, providing a uncommon signal of energy in an in any other case unsure market. The broader crypto panorama stays sharply divided, with some analysts arguing that ETH and the remainder of the market are nonetheless going through a downward continuation, probably setting new native lows, whereas others consider this correction is just a reset earlier than a a lot bigger bull cycle – probably stretching into 2026.

Associated studying

But one sign stands out clearly within the noise: good whales are unanimously going lengthy on ETH. Knowledge from the chain exhibits that among the most worthwhile and constant whale merchants – every with tens of tens of millions in realized earnings – have opened substantial lengthy positions, collectively exceeding a whole bunch of tens of millions of {dollars}. Their coordinated conduct alerts confidence that Ethereum’s current lows characterize alternative slightly than hazard.

This alignment among the many top-performing whales introduces a compelling counterbalance to bearish narratives. Whereas retail sentiment stays fragile, essentially the most superior market individuals seem like positioning themselves for a much bigger transfer ahead. With Ethereum stabilizing above $3,150, the query turns into whether or not the condemnation of whales will show early or appropriate.

High performers cost Ethereum

In line with Hyperdash facts shared by Lookonchain, among the market’s most profitable and influential whales are aggressively accumulating Ethereum, sending a powerful sign that high-conviction gamers anticipate upside.

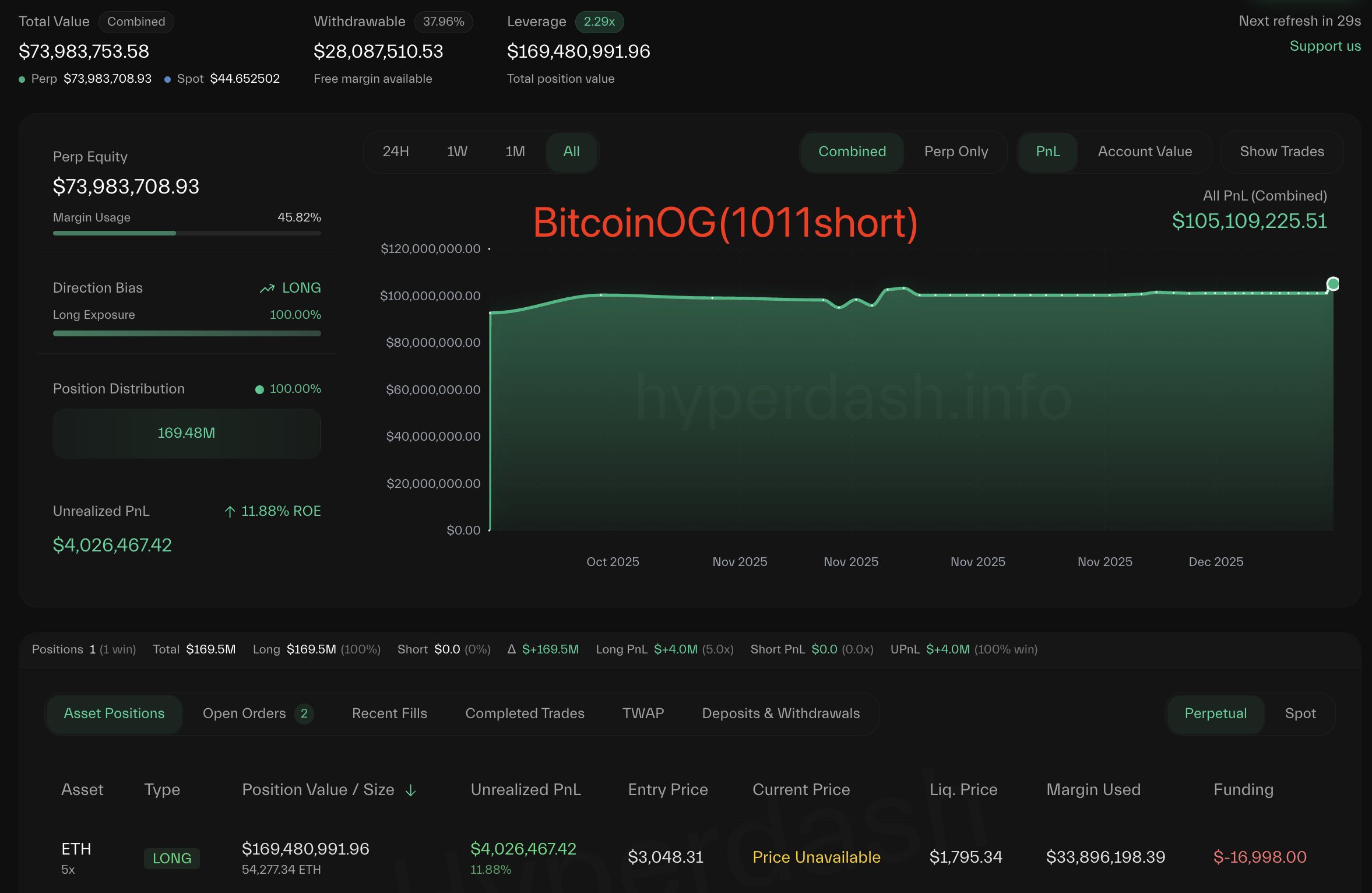

One of the crucial notable is BitcoinOG, the dealer extensively credited for shorting the market through the violent 10/10 crash, a transfer that earned him vital credibility. With a complete realized PNL of $105 million, BitcoinOG is now firmly positioned on the bullish facet, with 54,277 ETH value roughly $169.48 million.

One other main participant is the well-known Anti-CZ whale, named for its historic sample of taking the alternative facet of positions favored by Binance founder Changpeng Zhao. With a formidable whole PNL of $58.8 million, this whale at the moment has an extended place of 62,156 ETH – an enormous place of $194 million. His trades have usually been early indicators of the course of the broad market, additional reinforcing this shift towards bullish publicity.

Lastly, pension-usdt.eth, a constantly worthwhile whale deal with with $16.3 million in realized earnings, long 20,000 ETH value $62.5 million.

Taken collectively, these positions mirror a unified view among the many top-performing whales: regardless of market uncertainty, they’re positioning for the ability of Ethereum.

Associated studying

The weekly construction exhibits early indicators of stabilization

Ethereum’s weekly chart exhibits a market making an attempt to regain its footing after a pointy multi-week decline from the $4,500 area. The current restoration from $3,150 is a significant growth as this degree carefully aligns with earlier weekly help from mid-2024 and sits simply above the 50-week transferring common – an space that always acts as a trend-defining zone. ETH briefly fell under this area through the November sell-off, however consumers stepped in aggressively, producing a powerful weekly surge that alerts demand at decrease ranges.

Regardless of this restoration try, ETH stays under key resistance ranges. The 20- and 100-week transferring averages are above present value and converging, making a zone of potential rejection until momentum strengthens. For now, ETH is buying and selling in a transition construction: now not aggressively down, however no confirmed bullish reversal on excessive time frames but.

Associated studying

Quantity patterns additionally help this interpretation. Promoting quantity has declined in comparison with the capitulation section, whereas the current inexperienced candles present reasonable however regular shopping for curiosity, indicating accumulation slightly than full-out risk-taking.

If ETH can obtain consecutive weekly closes above $3,200–$3,300, the chart opens the door for a retest of the $3,600–$3,800 vary. Nevertheless, for those who fail to carry $3,150, you danger one other transfer in the direction of $2,800 help.

Featured picture of ChatGPT, chart from TradingView.com

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now