Analysis

Top Reasons Why Bitcoin (BTC) Price is Poised for a Breakout in the Next Few Hours

Credit : coinpedia.org

The cryptem markets are braced for the subsequent value promotion. The bulls and bears put ample strain on the Bitcoin value, through which the bulls gave the impression to be conquering. Because of this, the star smoking elevated the essential resistance for the second time prior to now 30 days. The U-shaped restoration means that the bulls are on observe to push the BTC prize to a brand new ATH and listed below are the primary the reason why a crypto bull run is on the horizon.

Tether mints $ 3b USDT

Tether, the issuer of the world’s largest Stablecoin, has simply crushed billions of USDT and despatched shock waves by the cryptomarkt. Traditionally, giant USDT cash have merged with elevated liquidity within the markets, which acts as a bullish catalyst. Extra USDT means extra capital obtainable for use in Bitcoin and Altcoins. This injection of liquidity enhances the buying strain, making the market larger.

In accordance with the info, Tether has hit a billion USDT within the final 24 hours, which brings the full to $ 3 billion within the final 4 days. The prospect of a powerful revival is just a hypothesis, because it has taken place prior to now. Not all crushed USDT instantly enter the blood circulation, as a result of a substantial half could be held in Tether’s Treasury as a listing earlier than they’re launched for exchanges. That’s the reason the influence on Bitcoin and different altcoins depends upon how shortly this liquidity is used.

Fed tariff reductions on the horizon

The cuts of the fed charge have been reliably adopted as a rocket gas for crypto, as could be seen in the long run of 2024 when the Dovish coverage coincided with rising BTC & ETH costs. At the moment, ETF flows and commerce quantity have risen, however with the FED that retains fastened and inflation, bulls appear to be extra cautious. Bitcoin has risen with an enormous double digit margin in each October and November after September charge discount.

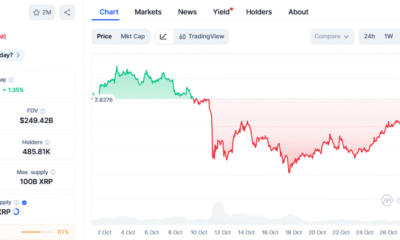

As could be seen within the graph above, the final time the FED made a charge discount in September 2024, the market rose by 75%, whereas the BTC value rose by nearly 100%. The BTC value at present consolidates inside a decent attain, however continues to have an enormous bullish momentum. In such a second it’s anticipated that one other charge discount will propel the markets excessive. Nevertheless, the worth was additional confronted with an enormous withdrawal and subsequently the traders are anticipated to turn into cautious.

Pack!

But the timing is essential. With Bitcoin who floats within the neighborhood of essential resistance ranges and traders who view potential macro -economic catalysts reminiscent of rates of interest, the $ 3B may act because the spark that BTC pushes in its subsequent outbreak. Conversely, if market sentiment shifts or regulatory fears, this new liquidity can enhance volatility and result in sharper value fluctuations in each instructions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now