Altcoin

Top reasons why Bitcoin Price returns for the end of June and explodes to New Ath

Credit : coinpedia.org

Bitcoin (BTC) worth has continued to slip into the weekly and month-to-month timetables regardless of the consolidations and turbulent markets within the hourly desk. The flagship coin has shaped a bullish continuation sample after it was rejected on the all time of round $ 111,900, which was accomplished round 22 Could 2025.

Since June 9, 2025, the BTC worth has skilled a substantial resistance degree of roughly $ 110,500, leading to a lower of 2-3 p.c up to now. The drop underneath $ 108k within the final 24 hours has created a palpable concern of additional quick -term correction.

Listed below are vital components to begin FOMO and Bullish Sentiment for Bitcoin quickly

Technical side

BTC Worth has over the previous 5 weeks above an important weekly assist degree round $ 104,354. Prior to now three weeks, the BTC worth has re -tested the Bullish Breakout, which is able to quickly point out a parabolic rally.

In the time-frame of 1 hour, the BTC prize has re-tested a bullish breakout of a falling logarithmic development. Though a strong foundation for the present market correction has not been established, there’s a massive rebound on the horizon.

Breaking USDollar within the midst of crypto regulatory readability

Regardless of the historic makes an attempt by the Donald Trump authorities to strengthen the US greenback, the DXY, who measures the worth of the US greenback towards different vital currencies, has decreased. The Chinese language Yuan and different currencies have strengthened the US greenback.

With Bitcoin normally traded towards the US greenback, the underlying asset will shoot up within the close to future. In the meantime, American supervisors have taken strategic steps to assist the US greenback keep dominant worldwide.

For instance, the nation is planning to make use of Stablecoins by finishing up clear laws. Consequently, the crypto liquidity will enhance significantly with the worldwide cash provide (M2).

Elevated query from institutional buyers

In keeping with aggregated information from BitcointreasuriesThe entities that Bitcoin retains of their treasury have risen by 21 corporations within the final 30 days, which will increase the BTC corporations by 3.28 p.c to three.41 million. Extra institutional buyers, led by Gamestop, have adopted within the footsteps of the technique to make use of the worldwide inventory markets to strengthen their Bitcoin corporations.

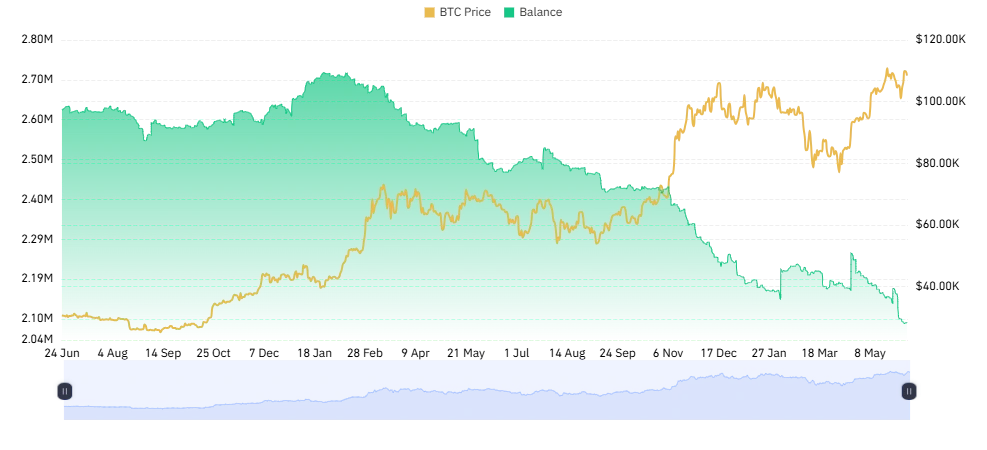

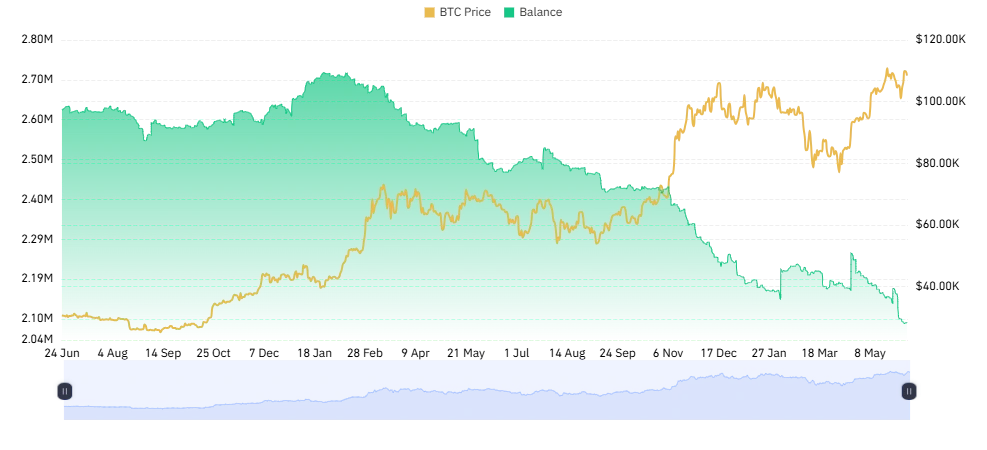

The American place Bitcoin ETFs, led by BlackRock’s Ibit, have continued to gather extra BTCs prior to now yr. Because of this, Bitcoin’s steadiness on centralized exchanges has fallen exponentially to a multi -year low of roughly 2.09 million cash, which confirms a excessive demand for demand shock.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024