Bitcoin

Tracking Bitcoin’s Hidden Momentum Signal

Credit : coinpedia.org

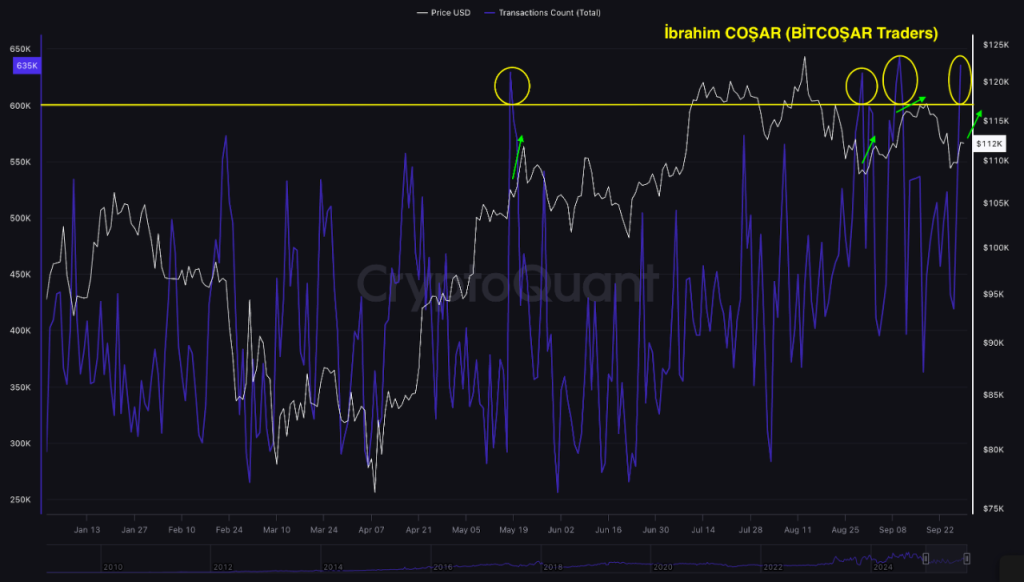

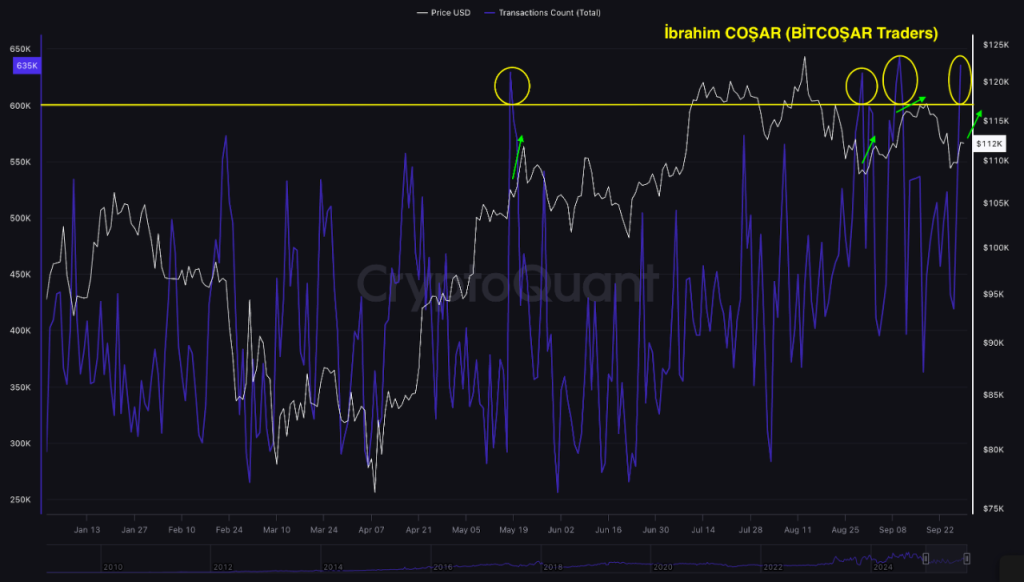

An professional just lately outlined an attention-grabbing however potential BTC prime concept that pulls consideration. This concept is more and more influenced by a hidden however highly effective sign that’s noticed from transaction ramps that exceed the 600K threshold.

Information on chains emphasizes a direct correlation between the exercise degree of Bitcoin and potential value will increase, whereas institutional accumulation continues to strengthen the long-term BTC value forecast tales.

The 600K transaction citness and BTC value

Current knowledge from Cryptoquant Insights have emphasised a placing sample, as it’s discovered when the entire transaction rely of Bitcoin surpasses or approaches 600,000, BTC value USD tends to ignite an upward pattern.

This threshold, visibly because the finish of 2024, nearly acts as a set off for a renewed momentum. The Bitcoin Worth chart reinforces how elevated community consumption instantly corresponds to bullish exercise.

Why transaction exercise issues

Transactionllations function a proxy for demand inside Bitcoin Crypto. A rise in exercise reveals that extra customers are concerned within the community, which provides liveliness and liquidity.

Because the use grows, the customer strain grows and infrequently arouses rallies.

In essence, the expert sees this 600K degree as a “coronary heart charge indicator” for BTC value. It will point out when the market is prepared for acceleration.

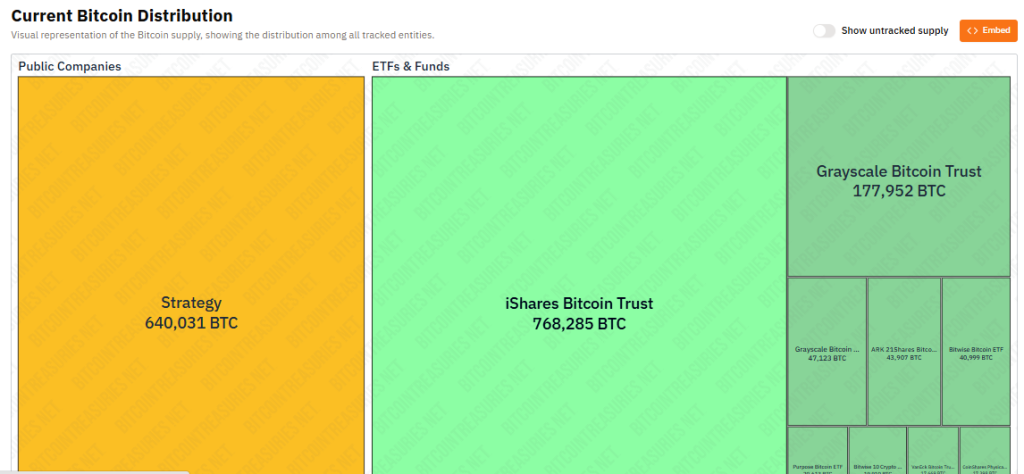

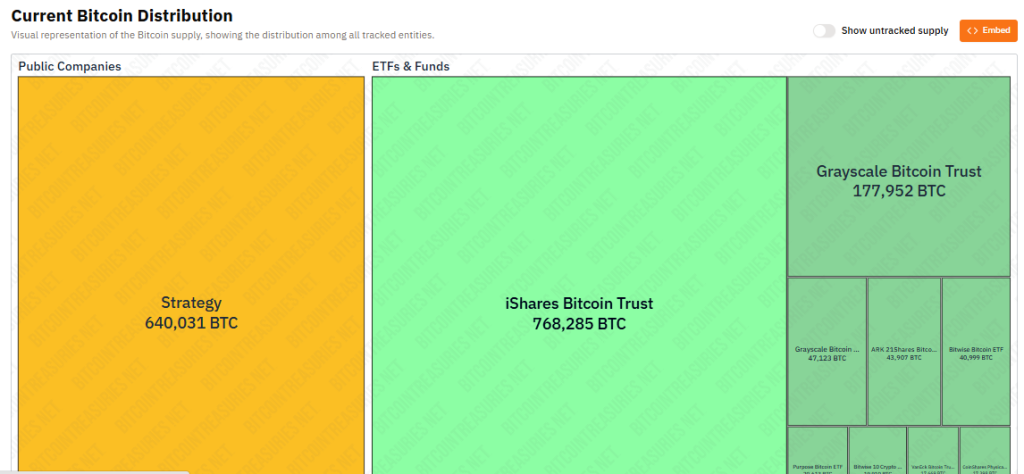

Institutional accumulation reinforces the prospects

Along with the momentum on the chain, institutional traders proceed to purchase the dip. MicroSstratey unveiled a brand new buy of 196 BTC for $ 22.1 million with a median of $ 113,048 per coin. This brings its whole possession to 640,031 BTC acquired at a value foundation of $ 73,983 per bitcoin. The buildup underlines long-term conviction, whereby Bullish BTC value prediction tales are strengthened.

For comparability: Marathon Digital Holdings is second in public corporations with 52,477 BTC.

Along with enterprise treasury, ETFs and trusts play an necessary function in BTC value help.

Blackrock’s Ishares Bitcoin Belief leads with 768.285 BTC beneath administration, whereas Bitcoin Belief of Grayscale owns 177,952 BTC.

These large allocations illustrate the rising institutional footprint in Bitcoin Crypto and its impression on BTC prize sprognosis situations.

This implies {that a} different leg is additional than the all time of August, and the spherical variety of $ 130,000 can be the primary and doubtlessly most conservative, goal to attempt for. Nevertheless, warning continues to be justified and traders should keep away from FOMO.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September