Altcoin

Trader Selloff Could Push ALMOST to $10 – How and Why?

Credit : ambcrypto.com

- On-chain metrics confirmed a lowering variety of energetic addresses, whereas Open Curiosity additionally dropped in latest days

- Technical indicators present that NEAR’s latest downturn has misplaced momentum

NEAR has been among the many least performing tokens in the marketplace currently, down 16.44% up to now month and one other 6.57% up to now 24 hours – an indication of its bearish trajectory.

Nevertheless, regardless of this unfavorable sentiment, market evaluation indicated that bearish momentum may weaken considerably. This cooling off interval may set the stage for a major value restoration, doubtlessly offsetting latest losses.

Lack of curiosity pushes NEAR decrease

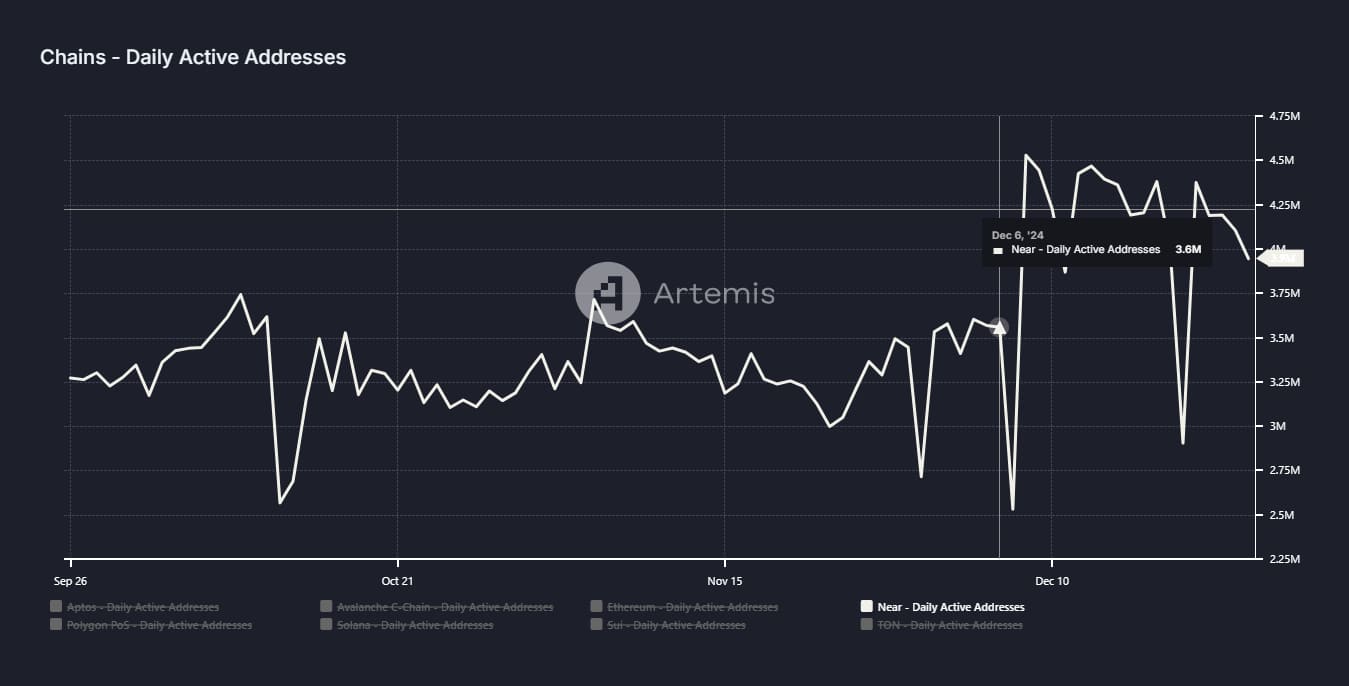

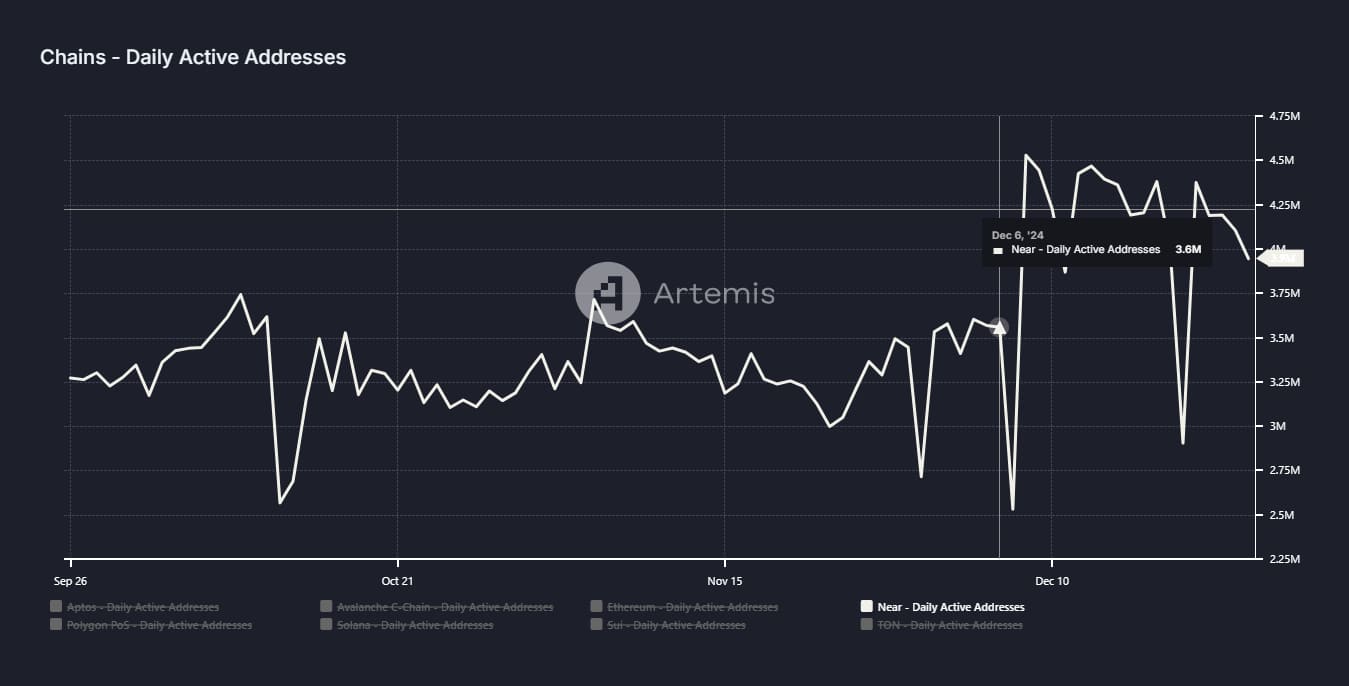

There was a lower within the variety of every day energetic addresses on the NEAR community, as reported by Artemis – An indication of declining curiosity amongst customers and traders.

Lively addresses (AA) are an necessary measure of a community’s usefulness and utilization, and they’re carefully tied to a token’s perceived worth. When each Lively Addresses and the value drop on the similar time, it signifies declining curiosity, doubtlessly resulting in additional value drops.

On the time of writing, NEAR’s variety of every day energetic addresses fell sharply for 4 consecutive days, from 4.4 million to three.9 million. This decline was mirrored within the value of NEAR, with the crypto buying and selling at $5.11 on the time of writing, in response to CoinMarketCap.

Supply: Artemis

AMBCrypto’s evaluation additionally revealed excessive promoting stress, particularly from derivatives merchants, which additional weighed on NEAR’s value efficiency.

Derivatives merchants present a insecurity in NEAR

Promoting stress on NEAR has additionally elevated, particularly amongst derivatives merchants who’ve primarily taken quick positions.

In accordance with Coinglass, the long-to-short ratio for NEAR was 0.8793, indicating a rise within the variety of quick contracts. Merchants open quick positions once they count on a value drop. An extended-to-short ratio of lower than 1 displays a larger variety of sellers, with decrease numbers indicating stronger bearish sentiment.

The influence of this promoting stress appeared to turn into obvious when NEAR’s Open Curiosity was examined. Actually, it fell 6.86% within the final 24 hours, to $237.39 million on the charts.

Supply: Coinglass

Liquidation information additional mirrored bearish market sentiment. Of the $966,310 price of contracts liquidated available in the market, $901,510 got here from lengthy merchants, who suffered losses when the value moved towards their predictions. This development means that NEAR’s value may proceed its downward trajectory.

Nevertheless, technical indicators appeared to level to a potential weakening of the bearish development.

For instance, the Common Directional Index (ADX), which measures the power of a market development, confirmed a declining worth on the weekly chart. A excessive ADX worth signifies a powerful development, whereas a downward ADX signifies weakening momentum.

On the time of writing, NEAR’s ADX was at 17.85 whereas in a downtrend, that means promoting exercise may quickly decelerate. If this development continues, NEAR may see a restoration and commerce increased.

Supply: buying and selling view

What’s subsequent for NEAR?

On the weekly chart, NEAR appeared to commerce inside a symmetrical triangle sample: a consolidation section by which the value narrows between outlined assist and resistance ranges as shopping for exercise steadily will increase. Traditionally, such a sample usually precedes a major upside breakout.

Nevertheless, continued promoting stress may push NEAR in direction of the $4,625 assist stage, or probably decrease, in direction of the bottom of the symmetrical channel.

Supply: buying and selling view

This decline would possible mark the ultimate leg of the continued downtrend earlier than a rebound, with property anticipated to rise again to not less than $10 on the charts.

On this context, the continued downturn could possibly be a harbinger of a serious value swing within the close to future.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024