Analysis

Traders Alert! Tron (TRX) Set for 10% Price Surge, Here’s Why

Credit : coinpedia.org

After a sustained worth decline of over 12% in latest days, Tron (TRX) is now poised for an upside rally as worth motion and on-chain metrics point out bullishness. After breaking a robust resistance degree at $0.145, the value rose greater than 16% and by no means retested.

Tron profitable breakout retest

With the latest market decline, it has efficiently retested its breakout space and is now experiencing upward motion with a robust day by day candle.

On the time of writing, TRX is buying and selling across the $0.151 degree and has skilled a worth improve of over 3% within the final 24 hours. In the meantime, buying and selling quantity has fallen by 17% over the identical interval. This drop in buying and selling quantity could possibly be as a result of extremely risky market and bearish sentiment.

Tron Worth Prediction

Based on professional technical evaluation, not like the key cryptocurrencies, TRX seems bullish and is buying and selling above the 200 Exponential Transferring Common (EMA) in a time-frame of 4 instances, indicating an uptrend. Furthermore, the formation of a doji candle at assist degree and the 200 EMA additional signifies bullishness.

TRX has efficiently damaged out of a descending trendline and is presently going through a minor resistance degree close to $0.152. Primarily based on the historic worth momentum, if TRX closes a candle above this resistance degree, there’s a excessive likelihood that it may rise by 10% to the $0.167 degree.

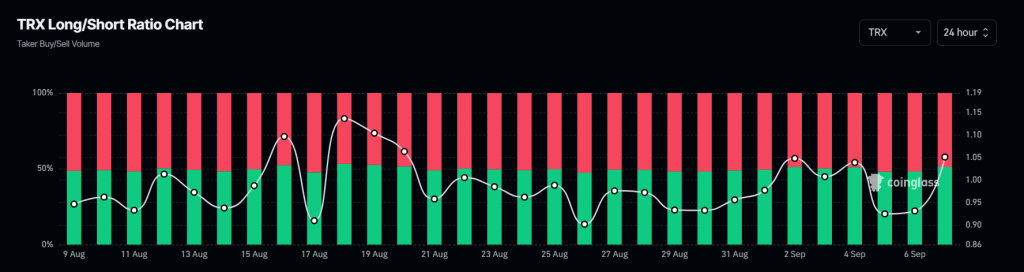

Bullish statistics within the chain

CoinGlass’s TRX Lengthy/Quick ratio signifies bullish sentiment. Based on the information, the ratio presently stands at 1.0509, indicating bullish sentiment (a price above 1 signifies this). In the meantime, 51.24% of merchants maintain lengthy positions, whereas 48.7% maintain brief positions.

However, TRX’s open interest is up 8% within the final 24 hours, indicating the build-up of extra lengthy positions throughout this era. The mix of the bullish lengthy/brief ratio and rising open curiosity indicators a robust shopping for alternative. Merchants usually mix this knowledge as they construct lengthy/brief positions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now