Altcoin

Trump’s Defi Order Sparks CRV’s Surge – Start of a Bullish Run?

Credit : ambcrypto.com

- CRV noticed an enormous 24-hour enhance after the brand new legislative order of Trump that grants Defi Belongings Independence

- Spotmarkt traders are their publicity to persevering with to extend actively

Within the final 24 hours, Curve Dao [CRV] has seen an vital assembly after the newest legislative order of Trump, one which protects the decentralized funds (Defi) and associated property.

Shopping for sentiment has since continued to strengthen, whereby spot market merchants collected a substantial quantity. Nevertheless, there’s a probably drop of earnings earlier than a persistent rally up.

How does the invoice of President Trump CRV affect?

On April 10, the president of the USA, Donald Trump, signed The very first crypto invoice within the legislation, safety of Defi.

This new legislation has been set to forestall the Digital Belongings SALE and Exchanges rule of the Inner Income Service (IRS) to not be adopted by legislation. This invoice, also referred to as the Defi-broker rule, would preserve each retention and non-guardianship companies to submit reviews to the IRS at intervals.

Consultant Mike Carey of the Home Methods and Means committee said:

“The Defi -broker -rule unnecessarily hinded the American innovation, infringed the privateness of on a regular basis Individuals, and would overwhelm the IRS with an overflow of recent archives that doesn’t have the infrastructure to deal with through the tax season.”

After the information, Defi -Tokens responded positively. CRV, the native token of the curve, led the load. It rose by 19% and pushed his month-to-month revenue to 48%.

That’s the reason Ambcrypto analyzed the market to find out how contributors can reply and whether or not the rally might be maintained or not.

Merchants accumulate CRV and watch a rally of just about $ 2

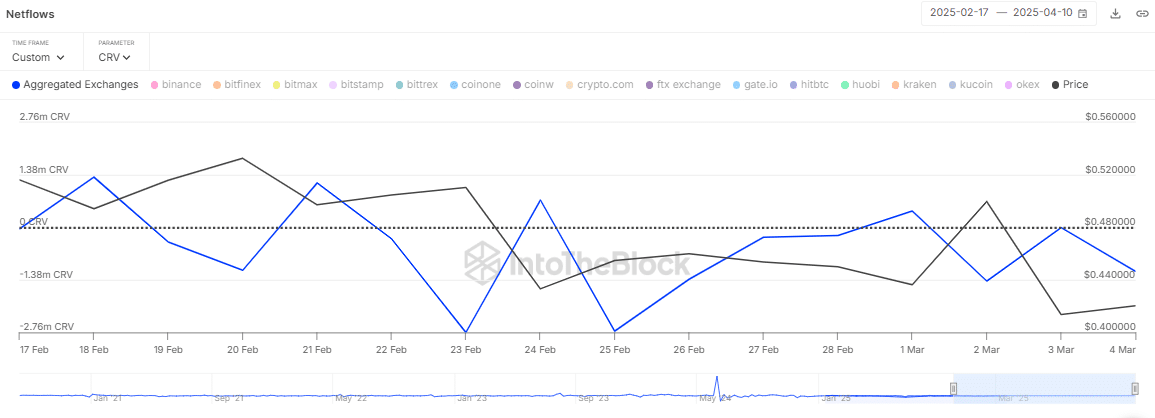

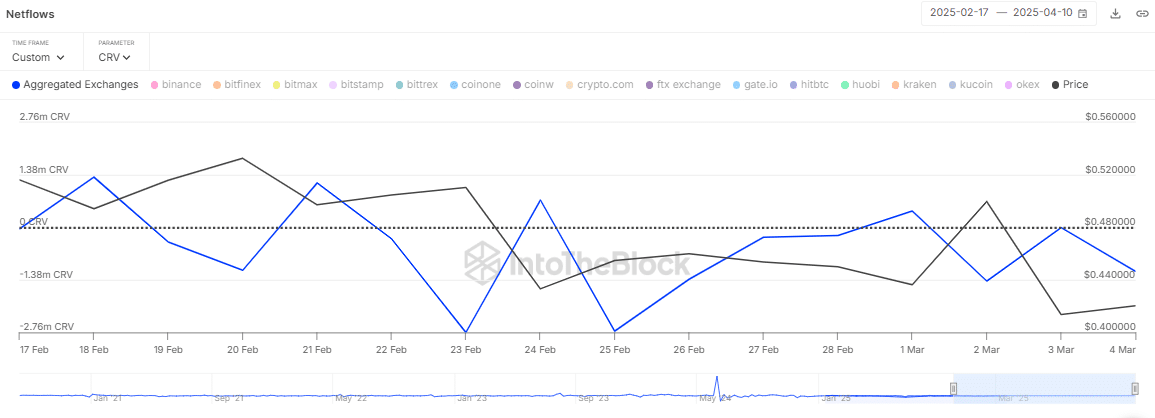

After the replace, merchants on the spot market collected 1.15 million CRV, price round $ 667,000, as indicated by the Alternate Netflows.

This buy might be the long run, particularly as a result of this cohort of merchants moved the CRV to non-public portfolios.

Supply: Intotheblock

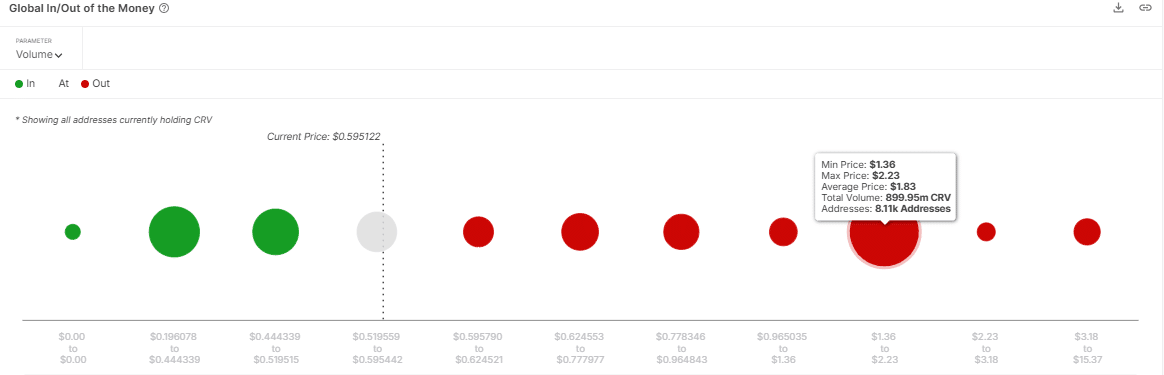

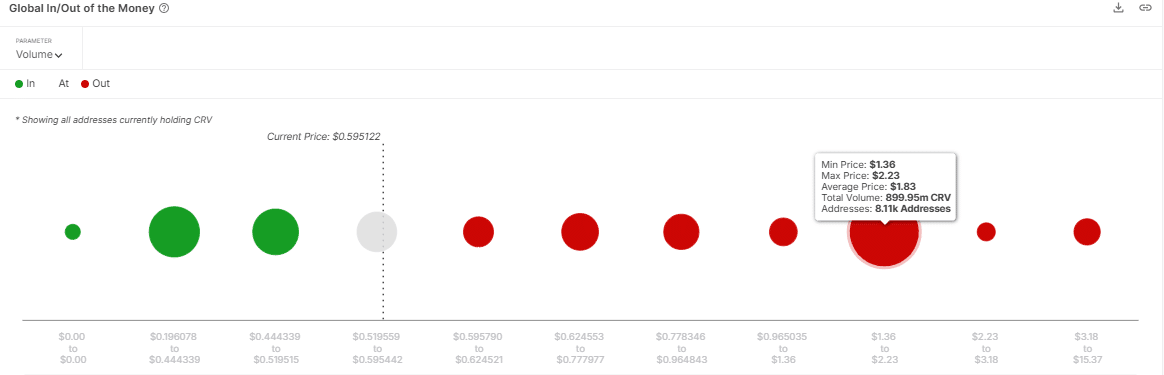

The in/out of the cash round value (omap) -indicator revealed minimal resistance to the bow, giving us extra room for progress.

On the time of writing, the omap didn’t emphasize robust resistance to $ 1.83. At that stage there might be round 899.95 million CRV gross sales orders.

If shopping for strain persists, CRV may climb to this resistance zone.

Which means that if shopping for sentiment in the marketplace continues to climb, CRV can register a value on the stage of $ 1.83.

Supply: Intotheblock

A drop for an extra push

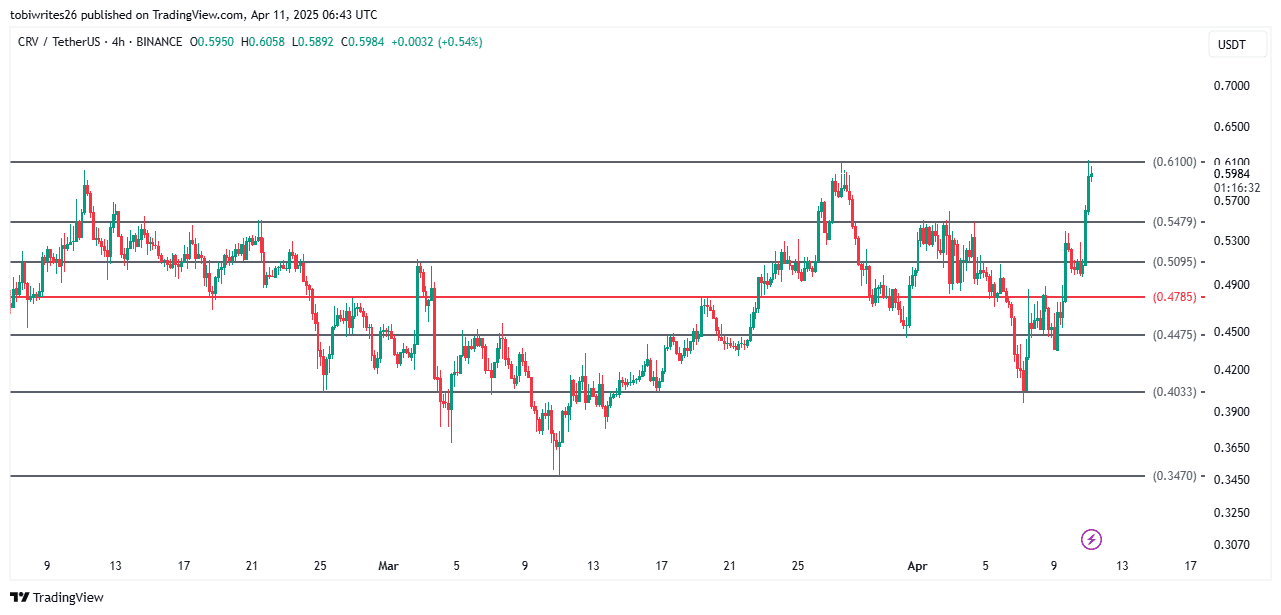

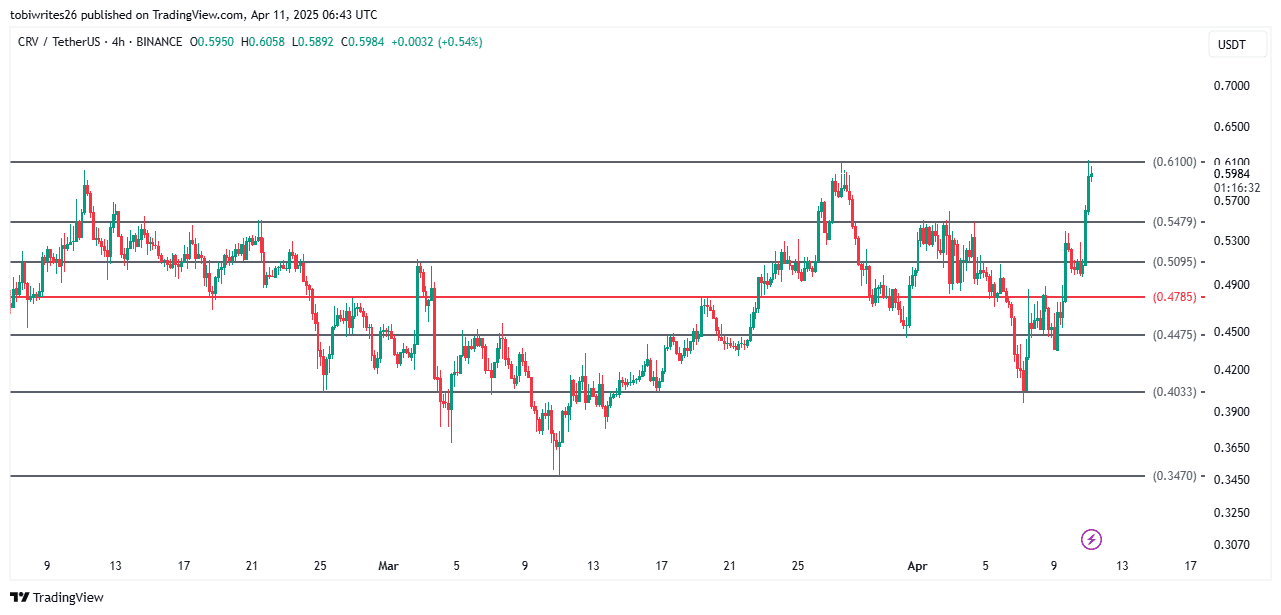

CRV may witness a value cooldown for a persistent market trally. On the time of writing, it acted in an vital resistance stage at $ 0.61 – a stage that beforehand compelled the value decrease the final time that the energetic stage reached this stage.

It’s unlikely that this drop is vital, particularly in view of the prevailing bullish sentiment. It’s anticipated that three ranges will act as assist to actively push it additional – $ 0.549, $ 0.509 or $ 0.478, relying in the marketplace momentum.

Supply: TradingView

The gross sales strain additionally appeared to construct on the derivatives market. The OI-weighted financing pace has additionally turned negatively an indication of a stroll in brief exercise.

CRV’s latest rally mirrored renewed belief, particularly on the again of the laws of the White Home laws.

Though a brief dip can occur quickly, robust accumulation and minimal resistance have had some room to run.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024