Altcoin

Trump’s route map up to $ 32 – so is how the memecoin can reach that level!

Credit : ambcrypto.com

- Spot merchants have been actively accumulating, with the identical correspondence with the rise in market rate of interest

- Binance -derivatives merchants are additionally on the transfer

Within the final 24 hours, Trump has fallen by 3.25% within the charts. As a result of identical, the month-to-month value efficiency additionally decreased by 32.62%. Regardless of this Bearish sentiment, nevertheless, the market might be able to put together for a big assembly. Particularly as a result of accumulation statistics throughout the board floor.

Based on Ambcrypto’s findings, Spot merchants have just lately bought persistently. And this has led to Trump having to comply with in a bullish sample. Nonetheless, to have this materialized, it should overcome a serious impediment.

Spot and Binance merchants may make the most of Trump traders

On the spot market there was a constant accumulation pattern as a result of merchants proceed to purchase Trump.

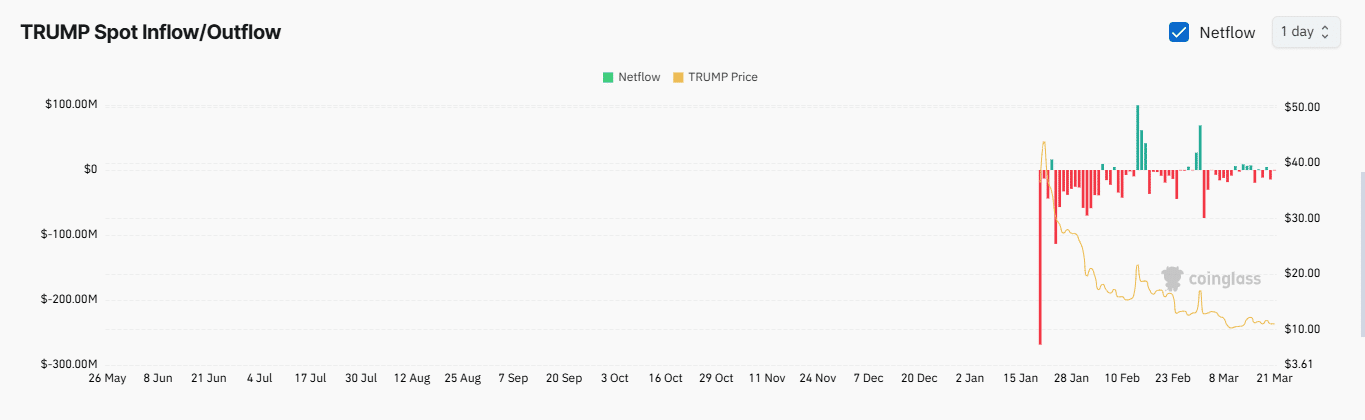

Coinglass’s Trade Netflows, who purchase or promote an energetic one on the spot market, referred to this. Since March 16, a complete of $ 41.92 million has been bought from Trump because the curiosity of the patrons is elevated.

An vital buy corresponding to this, and not using a constructive value dump, may point out market members who’re at the moment shopping for with a reduction – in any other case often known as accumulation.

Supply: Coinglass

Though this accumulation emphasised the sentiment of the broader market, Binance merchants appear to steer the Golf on the Derivatenmarkt. The lengthy -diving ratio that compares the shopping for and promoting of quantity to find out the market route emphasised that the market is within the buy part.

The lengthy -diving ratio signifies shopping for as quickly because it has a lecture above 1. The additional it goes up, the bullish the market is. On the time of writing, Binance merchants had a lecture of three.95. This implied that these derivatives merchants have completely different lengthy positions on the energetic, which may result in a value pump.

A necessity for warning

Sure market statistics, nevertheless, hinted, particularly since Trump may nonetheless fall farther from the time degree of the press.

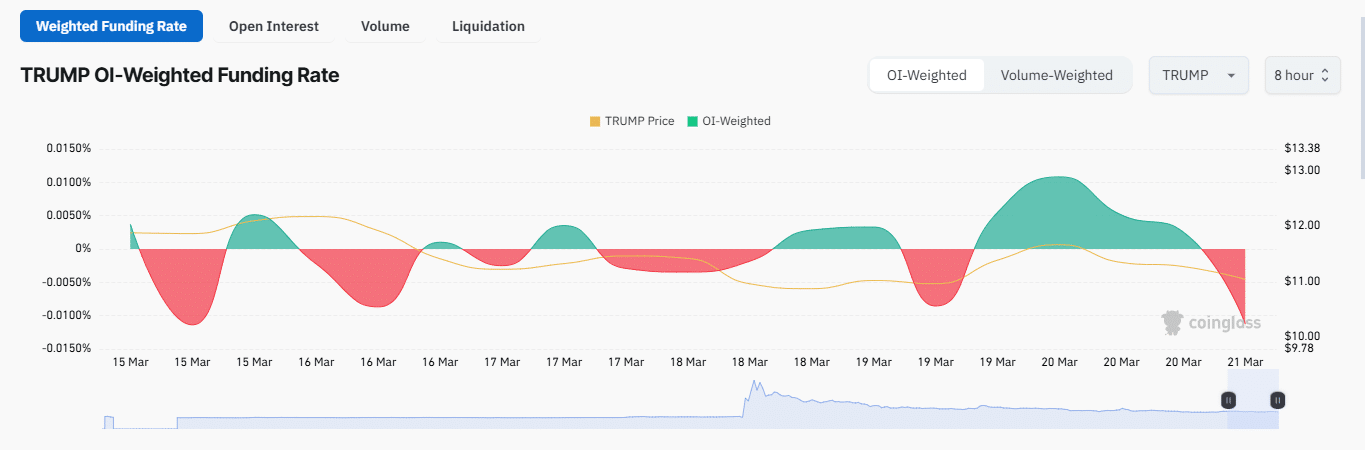

On the time of the press, the open curiosity -weighted financing share had a unfavourable studying of -0.0112%. This metric supplies perception into market sentiment primarily based on the exercise of derivatives merchants. With such a unfavourable studying, Trump may most likely decrease developments within the charts.

Supply: Coinglass

This potential motion will be supported by the general long-to-go ratio, with the identical at the moment decrease than 1 with a lecture of 0.9128. This indicated that there are extra troubled gross sales contracts in the marketplace, which may drive the value of Trump even decrease.

Ambcrypto additionally found that Trump remains to be sustaining his bullish part. And an additional decline might be a part of the market accumulation course of.

Market in an accumulation part

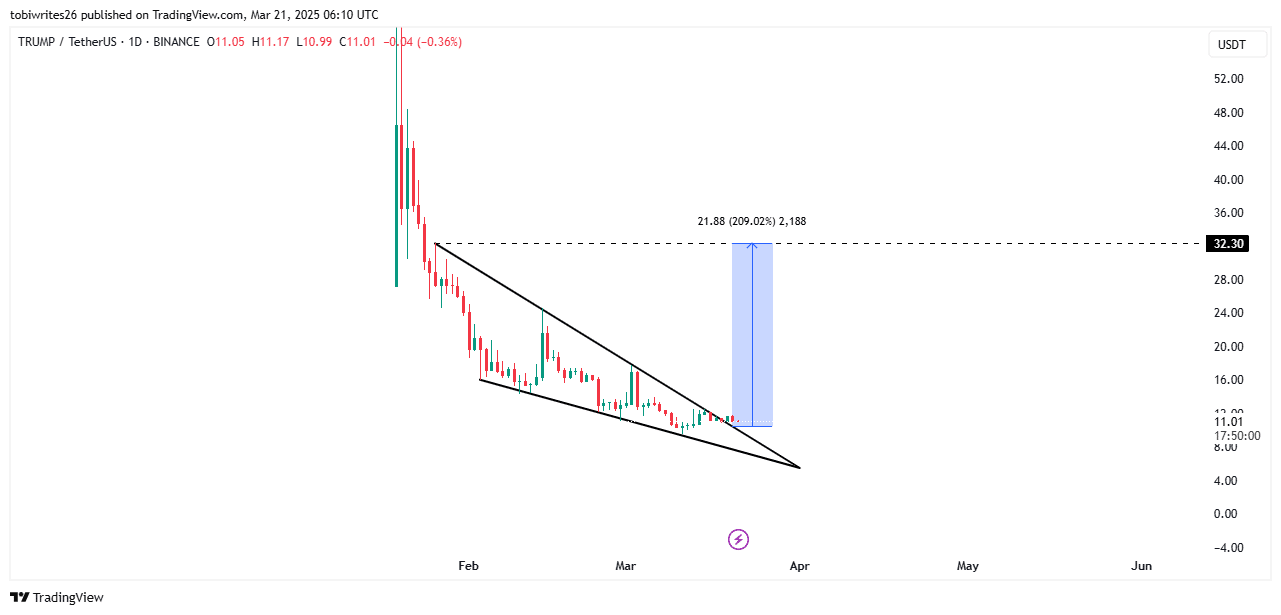

Within the charts, Trump has traded in a bullish accumulation sample that is called the falling triangle. When an asset acts inside this construction, it signifies that a market trally is in your palms and that it will probably ignite shortly.

On the time of writing, Trump appeared to have introduced this sample considerably, on the best way to utilizing the resistance as a foundation for a rally. If that occurred, Trump might be able to collect as much as $ 32.30.

Supply: TradingView

If the downward pattern extends, this might imply that spot merchants stay all in favour of shopping for at decrease ranges. And the buildup would proceed with the large rally to the objective of $ 32.30.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024