Blockchain

TVL on Kraken’s L2 Ink Surges 3,800% in Less Than Two Weeks

Credit : cryptonews.net

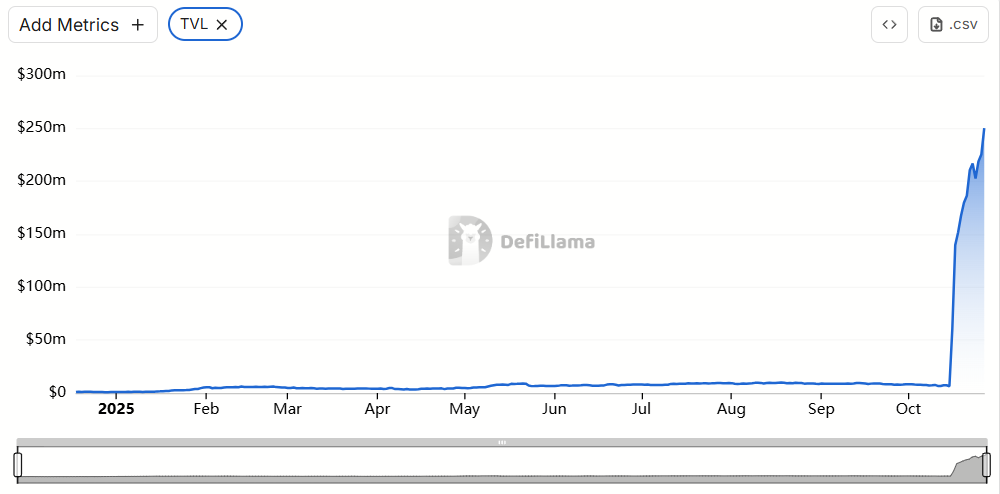

Ink, a Layer 2 (L2) blockchain launched by US crypto alternate Kraken in December 2024, noticed its complete worth locked (TVL) improve by virtually 3,800% in lower than two weeks, from $6.42 million on October 15 to virtually $249 million on the time of writing.

Ink TVL. Supply: DefiLlama

Nevertheless, information from DefiLlama reveals that of the 30 protocols deployed on Ink, greater than 97% of this sharp improve got here from a single product, Tydro, a non-custodial lending protocol constructed by the Ink Basis, as a white label occasion of open-source DeFi big Aave.

The Ink Basis introduced the launch of Tydro on October 15, calling the protocol Ink’s “native liquidity layer” and revealing that it will even be built-in instantly into Kraken.

The information additional means that the spike in TVL adopted shortly after Tydro’s launch and was amplified by a nine-digit stablecoin coin of USDT0, a cross-chain model of USDT.

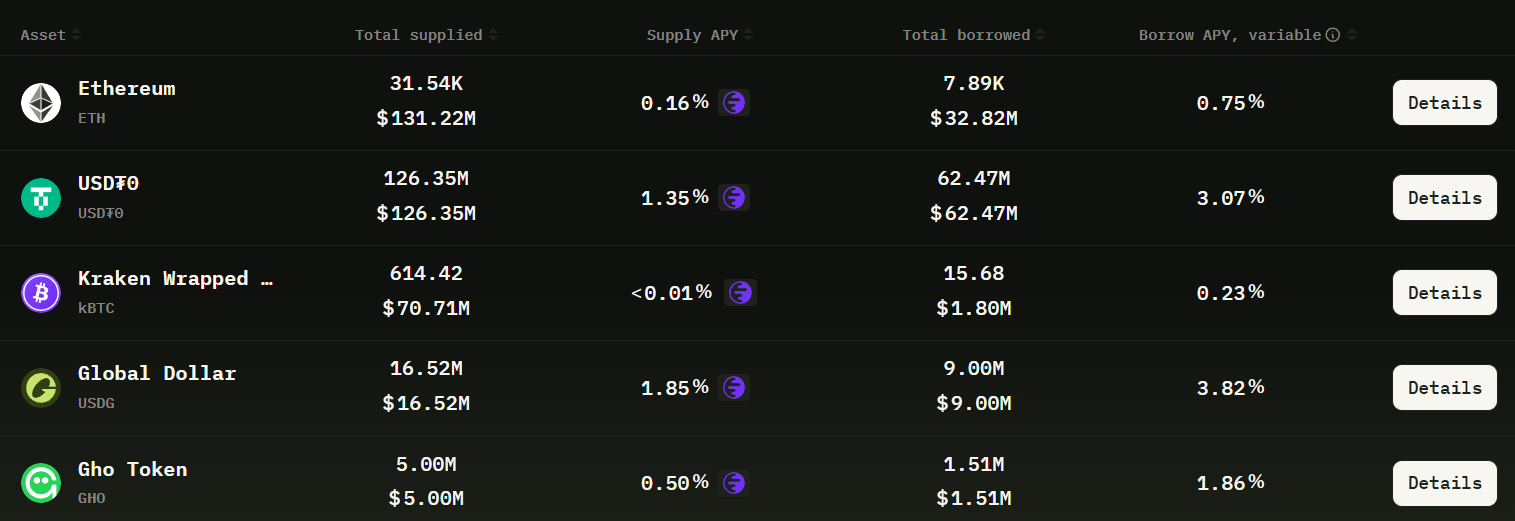

Markets on Tydro. Supply: Tydro

On the time of writing, Tydro’s complete market dimension of deployed property is over $350 million, together with $108 million in borrowed property and $243.55 million in provide.

The best providing APY on the protocol, presently 1.84%, just isn’t supplied on USDT0 however on USDG, a stablecoin issued by regulated fintech Paxos and backed by a consortium together with Kraken, Robinhood, Anchorage Digital, Bullish and Galaxy Digital.

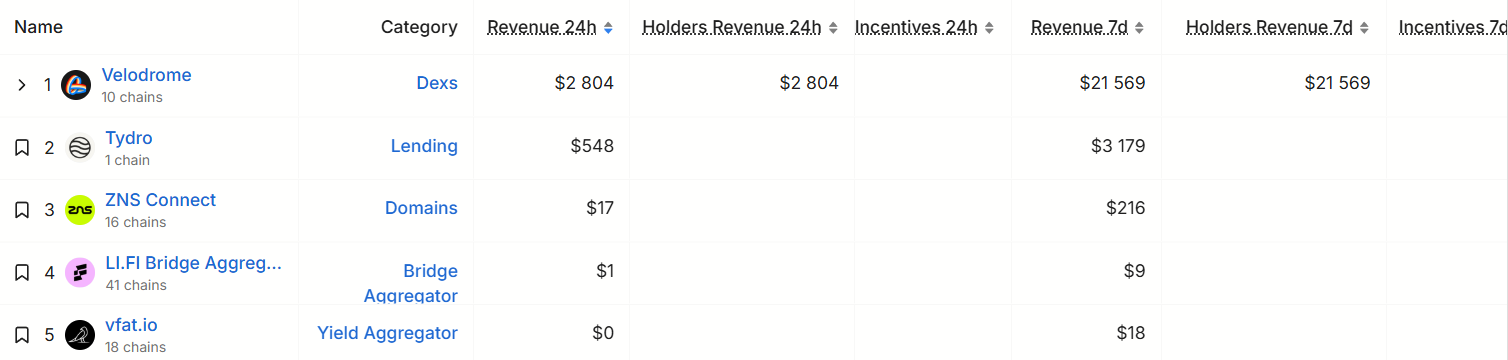

Ink protocols based mostly on weekly turnover. Supply: DefiLlama

In consequence, Tydro, which presently solely helps 5 markets – ETH, USDT0, USDG, KBTC and GHO – turned the second largest protocol on Ink when it comes to weekly income, producing $3,179 since launch, subsequent to Velodrome, a decentralized cryptocurrency alternate, which has over $21,000 in weekly income.

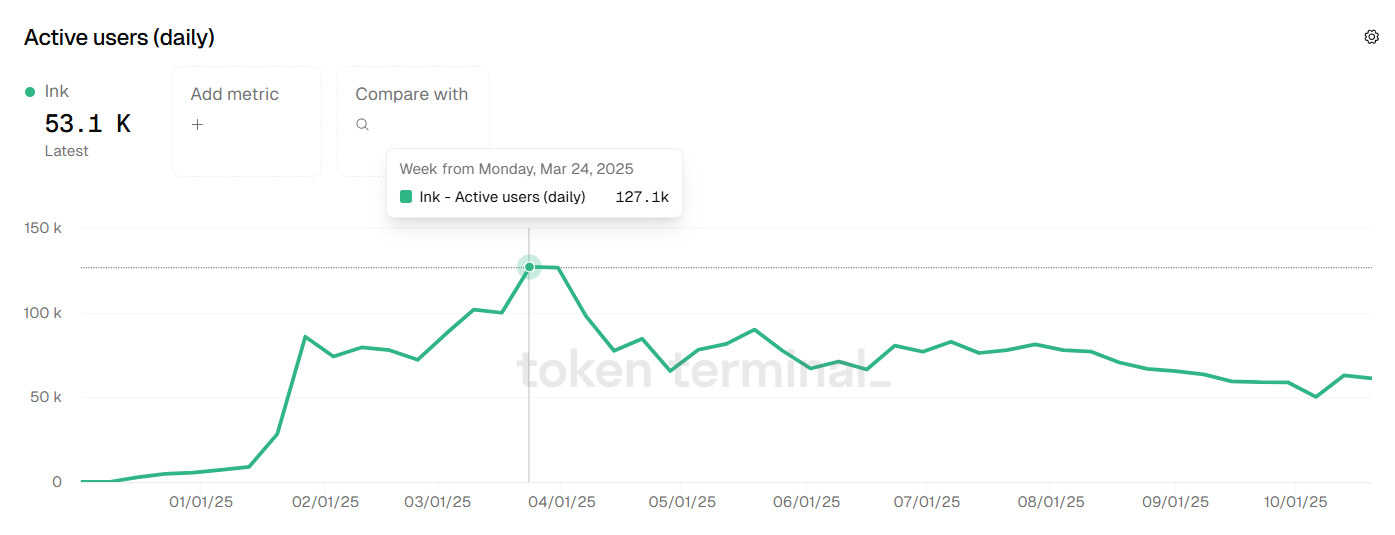

Each day lively customers on Ink. Supply: Token terminal

Regardless of the parabolic TVL growth, community exercise on Ink, which is constructed on Optimism’s Superchain, is trending downward. The variety of every day lively addresses has steadily declined from a peak of 127,100 customers on March 24 to about 60,300 up to now week, a drop of greater than 50%, in keeping with information from Token Terminal. The decline in person exercise has additionally translated into declining community revenues, which have just lately fallen to lower than $500 in every day charges, with complete revenues of $11,600 up to now month.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024